AQA Specification focus:

‘The advantages and disadvantages of fixed and floating exchange rate systems.’

Exchange rate systems shape how currencies interact in global markets, influencing trade, investment, and economic stability. Each system—fixed or floating—offers distinct benefits and drawbacks.

Exchange Rate Systems Overview

An exchange rate system refers to the way in which the value of a country’s currency is determined relative to other currencies. Two main types exist: fixed exchange rates and floating exchange rates.

Fixed Exchange Rate System: A system where the value of a currency is officially tied (pegged) to another currency, a basket of currencies, or a commodity such as gold.

A government or central bank maintains this fixed rate through interventions, such as buying or selling currency or adjusting interest rates.

Floating Exchange Rate System: A system where the value of a currency is determined by market forces of supply and demand without direct government or central bank intervention.

In practice, many countries adopt a managed float, where authorities intervene occasionally to influence the rate.

Advantages of Fixed Exchange Rates

Fixed systems create predictability in international transactions and investment. They are often adopted to encourage stability and control inflation.

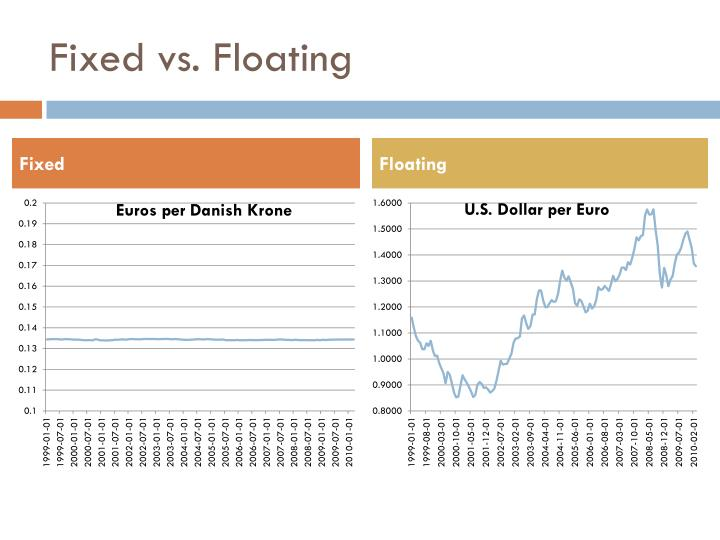

This diagram contrasts fixed and floating exchange rate systems, highlighting key differences such as government intervention, exchange rate stability, and market-driven fluctuations. It illustrates the core concepts discussed in the study notes. Source

Stability and Confidence

Provides certainty for exporters and importers, as exchange rate risks are minimised.

Encourages foreign direct investment (FDI), as investors face less currency volatility.

Supports government credibility, signalling a commitment to monetary stability.

Inflation Control

Pegging to a low-inflation currency can act as an anchor, restricting excessive money supply growth.

Reduces the likelihood of imported inflation when exchange rates remain constant.

Reduced Speculation

Limits currency speculation since traders cannot easily profit from expected fluctuations.

Protects against destabilising short-term capital flows.

Discipline on Governments

Forces governments to maintain sound economic policies to defend the peg.

Prevents over-expansionary fiscal or monetary policies that could undermine stability.

Disadvantages of Fixed Exchange Rates

While stable, fixed systems carry risks and costs, particularly for long-term flexibility and autonomy in policy.

Loss of Monetary Policy Autonomy

Governments cannot freely adjust interest rates to target domestic macroeconomic objectives, such as unemployment or growth.

Policies become constrained by the need to defend the peg.

Risk of Balance of Payments Problems

If the currency is overvalued, exports become less competitive, causing trade deficits.

Reserves of foreign currency may run out if continual intervention is needed.

Vulnerability to Speculative Attacks

If markets doubt the sustainability of the peg, speculative selling can trigger currency crises.

Governments may be forced into sharp devaluations, damaging credibility.

Cost of Intervention

Maintaining the peg requires significant reserves of foreign currency.

Opportunity costs arise when reserves could otherwise support domestic investment.

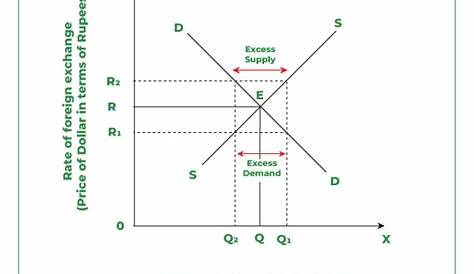

The diagram depicts the supply and demand curves for foreign exchange in a fixed exchange rate system, illustrating how government intervention can influence the exchange rate to maintain a desired level. Source

Advantages of Floating Exchange Rates

Floating systems allow market forces to determine exchange values, giving governments greater freedom in domestic policy.

Automatic Adjustment

Exchange rates adjust naturally to reflect trade imbalances.

A current account deficit leads to depreciation, improving export competitiveness and reducing imports.

Independent Monetary Policy

Governments can focus on domestic policy goals such as controlling inflation or stimulating growth.

Interest rates can be adjusted without defending a currency peg.

Absorption of External Shocks

Floating currencies can depreciate during global downturns, softening negative effects on exports.

Provides flexibility during crises compared to rigid fixed systems.

Lower Reserve Requirements

No need to maintain large foreign exchange reserves for defending a peg.

Resources can be redirected to investment and development.

Disadvantages of Floating Exchange Rates

Floating systems, while flexible, introduce uncertainty and potential instability into international markets.

Exchange Rate Volatility

Exchange rates fluctuate frequently, creating uncertainty for trade and investment.

Can deter businesses from engaging in long-term international contracts.

Inflationary Risks

Depreciation raises the price of imports, causing imported inflation.

Countries reliant on imports, particularly developing economies, face heightened vulnerability.

Speculative Fluctuations

Markets can cause excessive short-term volatility unrelated to economic fundamentals.

Unpredictable swings may harm confidence and increase risks for global investors.

Lack of Discipline

Without the constraint of a peg, governments may adopt expansionary monetary policies irresponsibly.

Risk of devaluation spirals if markets lose confidence in policy decisions.

Comparative Evaluation

The choice between fixed and floating exchange rate systems depends on economic context, policy objectives, and structural features of the economy.

Fixed systems benefit smaller or developing countries reliant on external trade stability, but at the cost of policy independence.

Floating systems favour larger, diversified economies that value autonomy and flexibility but can tolerate volatility.

Ultimately, both systems offer distinct advantages and disadvantages, and many nations operate with hybrid arrangements, such as managed floats, to balance stability with flexibility.

FAQ

The choice depends on the country’s size, openness to trade, and policy priorities. Smaller economies often prefer fixed systems for stability in trade.

Larger, diversified economies benefit from floating rates as they allow greater flexibility in monetary policy and automatic adjustment to global shocks.

Fixed systems require governments to hold large reserves of foreign currency to defend the peg.

If markets lose confidence in the peg, speculative attacks can force devaluation, making it unsustainable.

Uncertainty in floating systems can discourage long-term investment due to unpredictable returns.

However, they can attract short-term capital flows from investors seeking to profit from currency movements.

Speculation relies on expected fluctuations in exchange rates.

In fixed systems, the government actively intervenes to prevent such fluctuations.

This reduces profit opportunities for speculators, limiting destabilising movements in the currency.

Yes, if the fixed rate is set at an unrealistic level, it may lead to crises.

A floating system, though variable, reflects market conditions and can avoid sudden sharp adjustments caused by defending unsustainable pegs.

Practice Questions

Define a fixed exchange rate system. (2 marks)

1 mark for identifying that the exchange rate is tied/pegged to another currency, basket of currencies, or commodity.

1 mark for stating that the government or central bank intervenes to maintain this fixed value.

Explain two disadvantages of a floating exchange rate system for an economy. (6 marks)

Up to 3 marks for each disadvantage explained (maximum of 6 marks).

1 mark for identifying the disadvantage.

1 additional mark for explaining how it arises.

1 further mark for linking it to an economic consequence.

Examples:

Volatility: Floating exchange rates fluctuate frequently (1 mark). This creates uncertainty for exporters and importers (1 mark). It may reduce investment and trade (1 mark).

Imported inflation: Depreciation of the currency raises the price of imports (1 mark). This can increase domestic inflation (1 mark). Higher inflation may reduce real incomes and purchasing power (1 mark).