AQA Specification focus:

‘Advantages and disadvantages for a country of joining a currency union, eg the eurozone.’

Introduction

Joining a currency union such as the Eurozone creates deep economic integration between member countries. It brings advantages of stability and trade but also imposes significant constraints.

What is a Currency Union?

A currency union occurs when a group of countries adopt a single currency, managed by a shared central authority, eliminating individual monetary policies.

Currency Union: An agreement between two or more countries to share a common currency and monetary policy, often coordinated by a central bank.

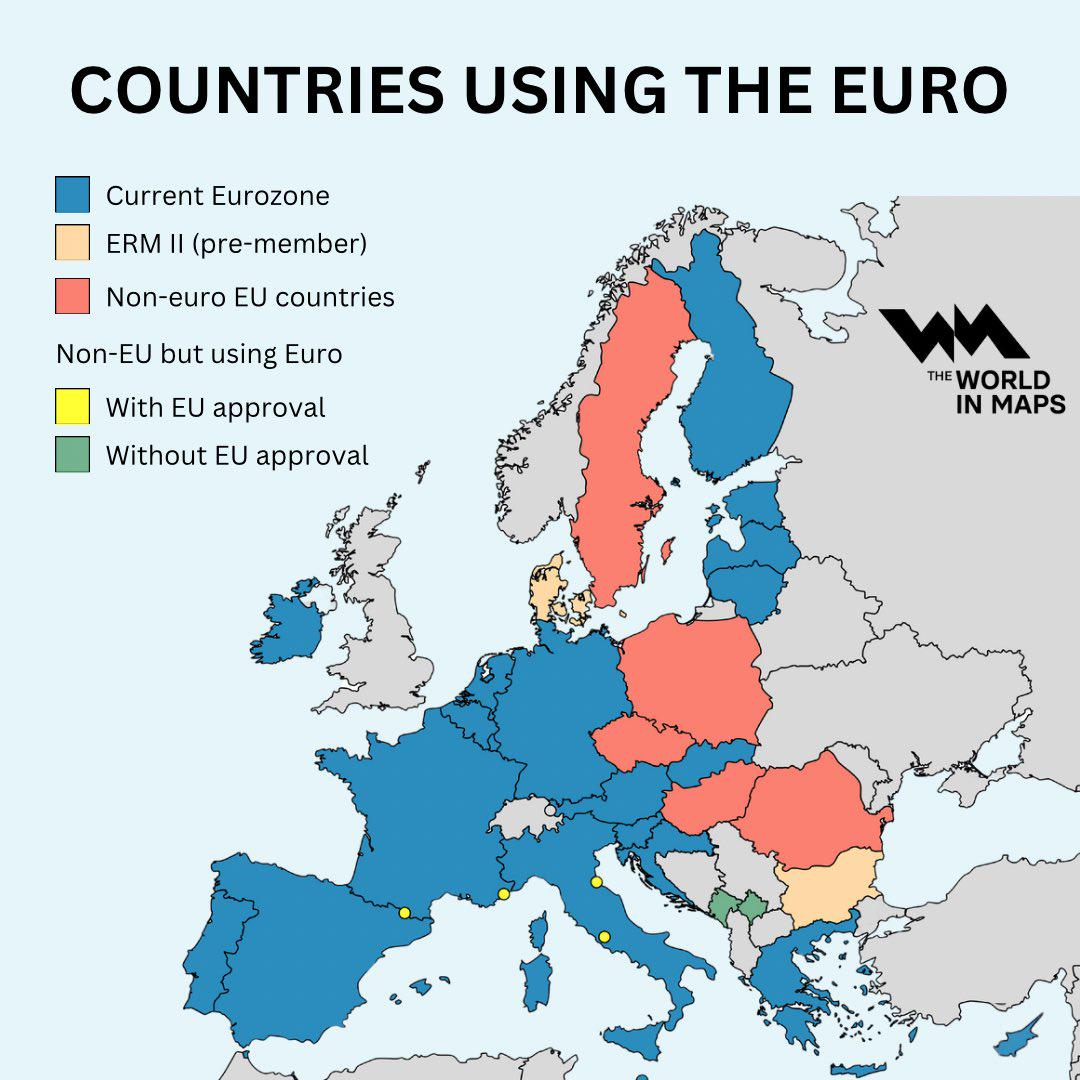

In Europe, the key example is the Eurozone, where 20 EU countries use the euro, overseen by the European Central Bank (ECB).

This map illustrates the 20 European Union countries that have adopted the euro as their official currency, forming the Eurozone. It provides a clear visual representation of the geographical scope of the currency union, highlighting the extent of economic integration among these nations. Source

Advantages of Joining a Currency Union

1. Elimination of Exchange Rate Uncertainty

No need to exchange currencies within the union.

Greater confidence for businesses engaging in cross-border trade and investment.

Reduces transaction costs for tourists, firms, and banks.

2. Increased Trade and Investment

Encourages intra-union trade by simplifying pricing.

Multinational firms benefit from a larger, integrated market.

Attracts foreign direct investment (FDI), as investors face fewer currency risks.

3. Price Transparency and Competition

Consumers can easily compare prices across borders.

Encourages competition, helping to lower prices and increase efficiency.

Limits firms’ ability to exploit currency fluctuations.

4. Lower Inflation and Credibility

The ECB’s monetary policy prioritises price stability.

Helps countries with historically high inflation anchor expectations.

Increases credibility of monetary policy compared to weaker domestic central banks.

5. Lower Interest Rates

Countries with weaker financial reputations benefit from association with stronger members.

Borrowing costs may fall due to shared stability and reduced risk premia.

Encourages investment and consumption, boosting economic activity.

6. Political and Economic Integration

Strengthens European integration, fostering cooperation beyond economics.

Enhances bargaining power in international negotiations (e.g., trade deals).

Disadvantages of Joining a Currency Union

1. Loss of Independent Monetary Policy

Countries cannot set interest rates or control money supply.

Monetary policy is centralised at the ECB, which sets a one-size-fits-all policy.

May not suit countries facing unique domestic economic conditions.

2. Loss of Exchange Rate Flexibility

Countries cannot devalue their currency to restore competitiveness during recessions.

Internal devaluation (wage cuts, austerity) becomes the only adjustment method, which can worsen unemployment.

Internal Devaluation: Reducing domestic costs (e.g., wages, public spending) to restore competitiveness instead of lowering the exchange rate.

This was evident during the Eurozone debt crisis (e.g., Greece, Spain, Portugal).

3. Fiscal Constraints

Members are bound by fiscal rules such as the Stability and Growth Pact (limits on budget deficits and debt).

Restricts government spending flexibility in times of crisis.

Countries may struggle to stimulate growth through expansionary fiscal policy.

4. Economic Divergence

Economies within the Eurozone are highly varied (Germany vs Greece).

A single monetary policy may benefit stronger economies while harming weaker ones.

Regional imbalances can widen, increasing tensions between members.

5. Risk of Financial Contagion

Problems in one country can spill over to others.

Debt crises in weaker members may reduce confidence in the entire union.

Bailout mechanisms create moral hazard, as struggling states may rely on stronger members for support.

6. Costs of Transition

Joining requires meeting strict convergence criteria (inflation, deficit, debt, interest rates, exchange stability).

Requires overhaul of systems (banking, payment, contracts).

National symbols and control over currency are lost, which may reduce public support.

The Eurozone Example

The Eurozone demonstrates both benefits and challenges:

Benefits realised:

Increased trade flows between members.

Enhanced price transparency.

Lower transaction costs.

Greater political unity within the EU.

Challenges faced:

Sovereign debt crises in Greece and other periphery nations highlighted structural weaknesses.

Austerity policies created economic and social strain.

Lack of fiscal union (shared taxation and spending) limited the ability to respond to asymmetric shocks.

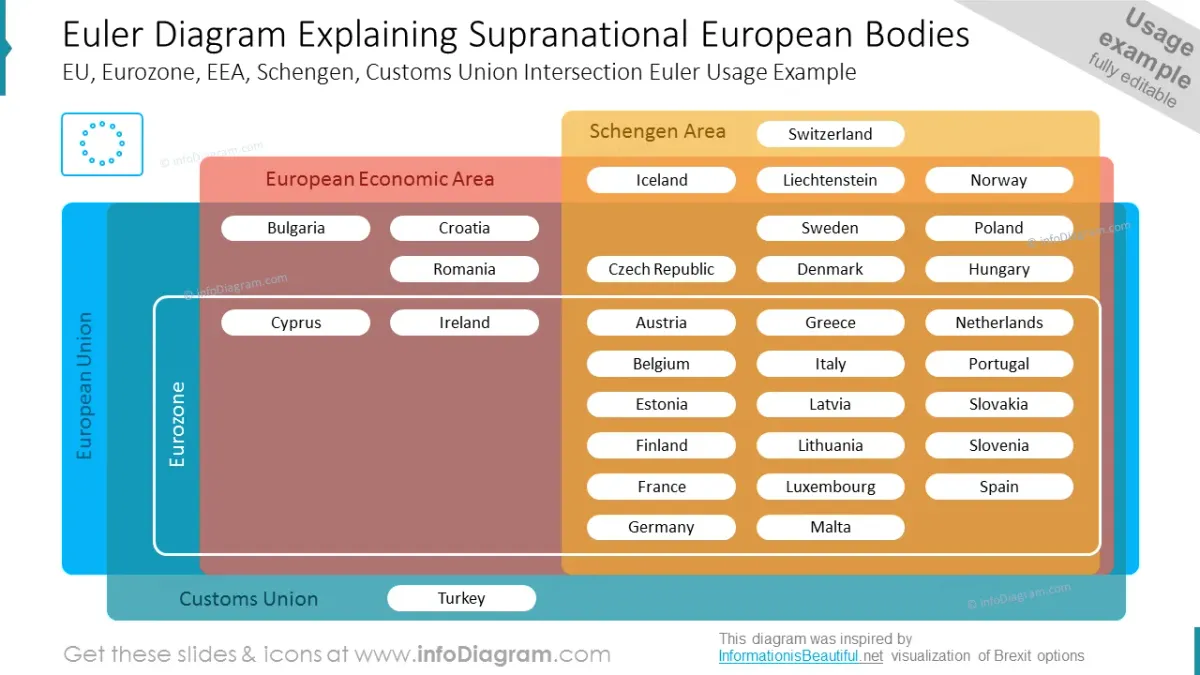

This Euler diagram depicts the overlapping memberships of European countries in various cooperation groups, such as the EU, Eurozone, EEA, and Schengen Area. It aids in understanding the complex relationships and distinctions between these entities, highlighting the Eurozone's role within the broader framework of European integration. Source

Evaluation Points

Optimum Currency Area (OCA) Theory

Economist Robert Mundell’s OCA theory helps assess suitability:

A currency union works best when member states have:

Labour mobility.

Capital mobility.

Similar business cycles.

Fiscal transfers to help struggling regions.

Optimum Currency Area: A geographic region where sharing a common currency is economically efficient due to similar economic structures and integrated markets.

The Eurozone lacks strong fiscal transfers and labour mobility compared to, for example, the United States.

Trade-Offs

Gains: Stability, integration, investment.

Costs: Policy constraints, risk of divergence.

Suitability depends on economic structure, fiscal discipline, and political commitment.

FAQ

To adopt the euro, countries must meet the Maastricht convergence criteria. These include:

Inflation rate close to the best-performing EU states.

Government budget deficit not exceeding 3% of GDP.

National debt below 60% of GDP or falling towards it.

Stable exchange rates for at least two years within the ERM II system.

Long-term interest rates aligned with low-inflation EU members.

These rules are intended to ensure stability before entering the currency union.

Some countries prefer to retain control over their own monetary policy and exchange rate flexibility.

Others fear the fiscal rules, which restrict government borrowing and spending.

Additionally, public opinion and political considerations often play a major role. For example, the UK opted out to maintain sovereignty over economic decisions.

The ECB sets a single interest rate and monetary policy aimed at price stability across the Eurozone.

It faces challenges because member states have diverse economies. A policy that suits Germany’s strong economy may not suit Greece’s weaker one.

The ECB uses tools like open market operations and setting reserve requirements, but it cannot adjust policy to fit individual countries.

Countries such as Greece, Spain, and Portugal experienced severe debt problems after 2008.

Because they were in a currency union, they could not devalue their currency or use independent monetary policy to recover.

Instead, they relied on bailouts from EU institutions and the IMF, often in exchange for austerity measures. This revealed the risks of joining without strong fiscal discipline.

Membership imposes restrictions through agreements like the Stability and Growth Pact.

Budget deficits should not exceed 3% of GDP.

Public debt should not exceed 60% of GDP.

These limits restrict governments from using expansionary fiscal policy freely during downturns.

Although exceptions exist, they highlight the trade-off between stability within the union and domestic policy flexibility.

Practice Questions

Define a currency union and give one example. (2 marks)

1 mark for a correct definition: e.g. “A currency union is when two or more countries share a common currency and monetary policy.”

1 mark for a correct example: e.g. Eurozone.

Explain two advantages and two disadvantages for a country of joining a currency union such as the Eurozone. (6 marks)

Up to 2 marks for each well-explained advantage (max 4 marks). Examples:

Elimination of exchange rate uncertainty → increases trade and investment. (1 mark for identification, 1 mark for explanation).

Price transparency → easier comparison of prices across countries, fostering competition. (1+1).

Up to 2 marks for each well-explained disadvantage (max 4 marks). Examples:

Loss of independent monetary policy → cannot set interest rates to suit domestic conditions. (1+1).

Loss of exchange rate flexibility → cannot devalue currency to restore competitiveness. (1+1).

Maximum 6 marks in total. Students can gain full marks with two well-developed advantages and two well-developed disadvantages.