AQA Specification focus:

‘How exchange rates are determined in freely floating exchange rate systems.’

Floating exchange rates are determined by the forces of supply and demand in the foreign exchange market, without direct government intervention, influencing trade, investment, and economic stability worldwide.

The Foreign Exchange Market

The foreign exchange market (forex) is where currencies are traded internationally. In a floating exchange rate system, the value of a currency is determined by the interaction of buyers and sellers without a fixed government-set price.

Supply and Demand Dynamics

The exchange rate is essentially the price of one currency in terms of another. Just like any other market, the exchange rate is determined by:

Demand for a currency (when foreign buyers want domestic goods, services, or assets).

Supply of a currency (when domestic consumers or firms want foreign goods, services, or assets).

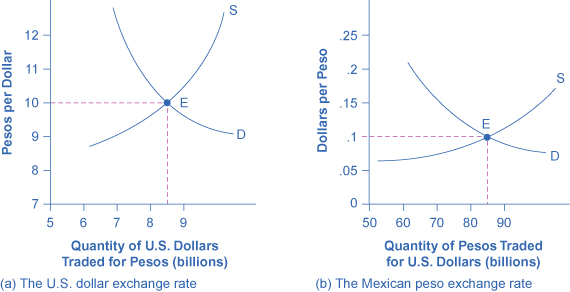

This diagram depicts the equilibrium exchange rate between the U.S. dollar and the Mexican peso, determined by the intersection of the demand and supply curves in the foreign exchange market. The equilibrium point reflects the exchange rate where the quantity of currency demanded equals the quantity supplied. Source

Key Determinants of Currency Demand

A currency appreciates when demand for it rises relative to supply. The main influences include:

Exports of goods and services: Higher foreign demand for a country’s exports increases demand for its currency.

Foreign direct investment (FDI): Inflows of investment from abroad create additional demand for the domestic currency.

Interest rate differentials: Higher domestic interest rates relative to abroad attract “hot money” flows, increasing currency demand.

Speculation: If investors expect a currency to appreciate, they will buy it now, driving up demand.

Confidence and stability: Political or economic stability encourages investment, increasing demand for the currency.

Key Determinants of Currency Supply

A currency depreciates when its supply in forex markets rises relative to demand. Key influences include:

Imports of goods and services: Increased domestic spending on imports leads to more supply of the domestic currency in exchange for foreign currencies.

Outward investment: Domestic firms investing abroad must convert into foreign currencies, increasing supply.

Relative interest rates: Lower interest rates than abroad encourage capital outflows, increasing the supply of the domestic currency.

Speculation: If depreciation is expected, investors sell the currency, raising its supply on markets.

The Role of Market Equilibrium

Equilibrium Exchange Rate

The exchange rate stabilises at the point where currency demand equals currency supply. This equilibrium fluctuates constantly as trade flows, investment, and speculation shift.

Equilibrium Exchange Rate: The rate at which the quantity of a currency demanded equals the quantity supplied in the foreign exchange market.

Currency Appreciation and Depreciation

Appreciation

Occurs when demand increases or supply decreases.

Example: Strong export growth or higher interest rates may push up demand, raising the value of the currency.

Depreciation

Occurs when demand falls or supply increases.

Example: A rise in imports or lower investor confidence may increase supply, reducing currency value.

Currency Appreciation: An increase in the value of a currency relative to another in a floating exchange rate system.

Advantages of Floating Exchange Rates

Floating exchange rate systems provide several potential benefits:

Automatic adjustment: Imbalances in the balance of payments adjust automatically. A current account deficit leads to depreciation, boosting exports and reducing imports.

Monetary policy independence: Governments can set domestic interest rates without being tied to maintaining a fixed exchange rate.

Shock absorption: Exchange rates can act as a buffer against external shocks (e.g., commodity price fluctuations).

Disadvantages of Floating Exchange Rates

Despite advantages, floating systems also have drawbacks:

Volatility: Exchange rates may fluctuate sharply due to speculation, destabilising trade and investment.

Imported inflation: A sudden depreciation increases import prices, raising inflationary pressures.

Uncertainty: Firms engaged in international trade may face uncertainty over future costs and revenues, discouraging investment.

Interaction with Macroeconomic Variables

Inflation

Higher domestic inflation reduces export competitiveness, decreasing demand for the currency.

Inflation also raises demand for foreign goods, increasing currency supply, leading to depreciation.

Growth

Strong economic growth can attract investment, increasing demand for the currency.

However, it may also raise imports, boosting currency supply and offsetting appreciation pressures.

Employment

Exchange rate shifts affect employment via trade balances. A weaker currency supports export industries, while a stronger one benefits importers but may hurt domestic producers.

Speculative and Short-Term Capital Flows

Speculators play a critical role in floating exchange rate determination. They often react quickly to new information, causing rapid shifts in supply and demand.

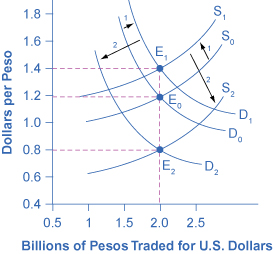

This diagram illustrates how expectations about future exchange rates can simultaneously shift the demand and supply curves for a currency, resulting in an immediate change in the equilibrium exchange rate. Such shifts highlight the impact of investor sentiment and speculation on currency values. Source

Hot money: Short-term flows of capital seeking the highest returns in global markets.

Bandwagon effects: Investors may buy or sell currency simply because others are doing so, amplifying volatility.

Hot Money: Short-term capital flows into and out of financial markets seeking maximum short-term returns, highly sensitive to interest rate changes.

No Direct Government Intervention

In a purely floating system, governments do not set or maintain exchange rate targets. However, in practice, some “managed floating” exists, where authorities occasionally intervene through:

Verbal intervention (statements influencing expectations).

Direct market operations (buying or selling currency reserves).

Even so, the core principle remains: exchange rates are primarily market-determined by supply and demand forces.

FAQ

Short-term volatility is often caused by speculative activity, where traders quickly respond to news such as interest rate changes or political events.

Other drivers include:

Sudden shifts in global investor confidence.

Unexpected economic data releases (e.g., inflation figures).

Central bank announcements, even if they do not involve direct intervention.

These factors can move exchange rates within hours or even minutes.

When a currency depreciates, exports become cheaper abroad, boosting competitiveness, while imports become more expensive, reducing domestic reliance on foreign goods.

Conversely, appreciation makes imports cheaper and exports less competitive. This automatic adjustment can stabilise trade imbalances but creates uncertainty for businesses dependent on predictable international prices.

Floating exchange rates give governments greater freedom in using monetary policy. They can raise or lower interest rates to manage inflation or unemployment without worrying about defending a fixed rate.

They also act as shock absorbers: for example, if commodity prices fall, depreciation can partially offset the impact by boosting exports.

Speculators buy or sell currencies based on expected future changes. If investors believe a currency will rise, they purchase more, pushing it up further.

This can create a bandwagon effect, where collective speculation magnifies movements beyond what trade or investment flows justify, leading to significant volatility.

The main risk is volatility. Frequent swings in currency value can deter long-term investment and complicate planning for exporters and importers.

Additionally, sudden depreciation can fuel imported inflation, raising the price of essential goods such as food and energy.

Governments may still intervene occasionally to calm markets, creating a “managed float” rather than a completely free-floating system.

Practice Questions

Define what is meant by a floating exchange rate system. (2 marks)

1 mark for stating that exchange rates are determined by supply and demand in the foreign exchange market.

1 mark for noting that there is no direct government intervention to fix or peg the exchange rate.

Explain how an increase in domestic interest rates could influence the value of a country’s currency in a floating exchange rate system. (6 marks)

1 mark for recognising that higher interest rates attract foreign capital inflows.

1 mark for explaining that investors seek higher returns, increasing demand for the domestic currency.

1 mark for stating that this increased demand causes the currency to appreciate.

1 mark for linking appreciation to reduced import prices or more expensive exports.

1 mark for mentioning the role of speculation in amplifying currency appreciation.

1 mark for overall coherence and logical economic reasoning.