AQA Specification focus:

‘The conditions necessary for price discrimination.’

Introduction

Price discrimination occurs when a firm charges different prices for the same good or service to different consumers, not due to cost differences, but market conditions.

Understanding Price Discrimination

Price discrimination is a pricing strategy where a seller charges varying prices for the same product to different customers. The differences are not based on production costs but on the ability and willingness of consumers to pay. It is a central concept in monopoly and imperfect competition analysis.

Price Discrimination: The practice of selling the same product to different consumers at different prices, not justified by cost differences.

Price discrimination allows firms to capture more consumer surplus and convert it into producer surplus. This can affect both efficiency and welfare depending on the context.

Key Conditions for Price Discrimination

For price discrimination to be possible, three necessary conditions must be satisfied.

1. Market Power

The firm must have some degree of monopoly power, meaning it is a price maker rather than a price taker. This allows the firm to set different prices without losing all of its customers.

Perfectly competitive markets cannot sustain price discrimination because identical goods and perfect knowledge prevent price variation.

Monopolies and oligopolies are better positioned to discriminate because they can influence pricing strategies.

2. Ability to Segment the Market

The firm must be able to separate consumers into distinct groups based on their price elasticity of demand.

Price elasticity of demand (PED) measures how responsive demand is to changes in price.

Price Elasticity of Demand (PED): A measure of how much the quantity demanded of a good responds to a change in its price, calculated as percentage change in quantity demanded divided by percentage change in price.

Different consumer groups will have varying PED:

Inelastic demand (e.g., business travellers for flights): Firms can charge higher prices.

Elastic demand (e.g., students, off-peak train travellers): Firms charge lower prices to increase sales.

Segmentation can be based on:

Age (student vs adult prices)

Time (peak vs off-peak travel)

Geography (domestic vs overseas markets)

Income levels (luxury vs budget versions)

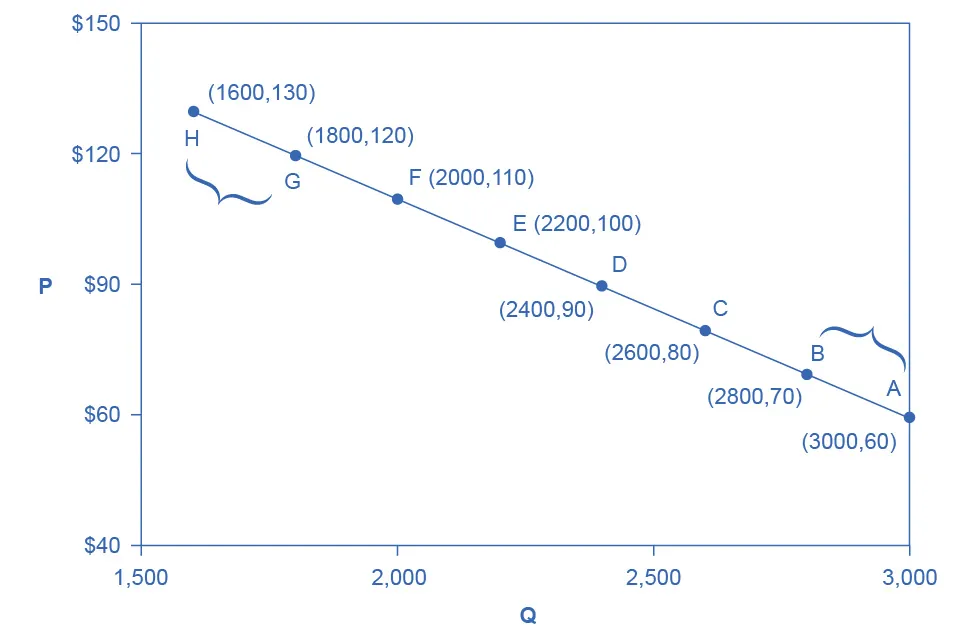

Price elasticity of demand shown on a standard demand curve with labelled points. It highlights differences in responsiveness to price, supporting market segmentation by elasticity. The page also discusses midpoint calculations, which go beyond the syllabus focus here. Source

3. Prevention of Arbitrage (No Resale)

The firm must prevent or limit resale between groups, otherwise consumers who purchase at the lower price could resell to those facing higher prices.

Airlines prevent arbitrage by requiring photo ID matching the ticket name.

Services like cinema tickets enforce age-based segmentation by checking identification.

Software licensing may differ between regions but cannot easily be traded across markets.

Types of Price Discrimination

Though the syllabus highlights conditions, understanding the types helps clarify why the conditions matter.

First-Degree (Perfect) Price Discrimination

Each consumer pays the maximum they are willing to pay.

Requires full knowledge of consumer preferences, rarely achievable in practice.

Second-Degree Price Discrimination

Prices vary according to the quantity consumed or the product version chosen.

Examples include bulk discounts, electricity tariffs, or premium features.

Third-Degree Price Discrimination

Consumers are grouped into distinct markets with different elasticities of demand.

Examples include student discounts, peak vs off-peak pricing, or regional price variations.

The key condition underpinning all these types is effective market segmentation.

Why Firms Use Price Discrimination

Firms pursue price discrimination to:

Increase profits by capturing consumer surplus.

Improve market coverage by selling to price-sensitive groups.

Potentially increase efficiency, as more consumers are served compared with single pricing.

However, these objectives are only achievable if the three fundamental conditions are met.

Diagrammatic Context

In A-Level analysis, students should be comfortable illustrating price discrimination with demand and marginal revenue curves.

A firm divides the market into sub-markets with different elasticities.

By setting different prices, the firm maximises profit in each segment.

Profit Maximisation Rule: MR = MC

MR = Marginal Revenue (additional revenue from selling one more unit)

MC = Marginal Cost (additional cost from producing one more unit)

This rule applies to each sub-market separately under third-degree price discrimination.

Diagram of third-degree price discrimination: the total market is divided into two sub-markets with distinct demand and MR curves. Profit is maximised by setting output where MR = MC in each segment. The figure focuses on segmentation by elasticity and the MR=MC rule central to the AQA specification. Source

Evaluation of the Conditions

Meeting all three conditions is not always straightforward:

Market power can be challenged by new entrants or regulation.

Segmentation may be costly or imperfect (e.g., consumers switching identities online).

Arbitrage prevention is more difficult in the digital age, where resale and cross-border price comparisons are easier.

Despite these challenges, many real-world markets—such as transport, telecommunications, and software—demonstrate that the conditions can be met, enabling firms to price discriminate effectively.

FAQ

Legal price discrimination occurs when firms adjust prices according to demand and willingness to pay without breaking consumer protection laws, such as student discounts.

Illegal price discrimination arises when it involves unfair or anti-competitive practices, for example, charging different prices based on race or gender, or collusion between firms to fix discriminatory pricing.

Digital platforms collect data on consumer behaviour, allowing firms to identify willingness to pay more precisely.

Examples include:

Personalised pricing through cookies and browsing history.

Dynamic pricing in ride-sharing apps and online ticketing.

Regional pricing for digital goods like software or streaming services.

In a single-price market, consumers benefit from paying below their maximum willingness to pay.

Price discrimination captures more of this surplus by charging closer to each consumer’s maximum. As a result, consumer surplus decreases while producer surplus rises, altering welfare distribution.

Industries with high fixed costs and low marginal costs often rely on price discrimination. Examples include:

Airlines and railways (peak vs off-peak tickets).

Utilities (different tariff structures).

Digital markets (region-specific subscription pricing).

These industries typically have strong market power and the ability to prevent resale.

Price discrimination is more effective when markets can be segmented by demand elasticity.

Inelastic demand: higher prices can be charged without losing significant sales.

Elastic demand: lower prices increase sales volumes and revenue.

The greater the difference in elasticity across segments, the more profitable price discrimination becomes.

Practice Questions

State two conditions that must be satisfied for a firm to be able to practise price discrimination. (2 marks)

1 mark for each correct condition, up to a maximum of 2 marks.

The firm must have some degree of monopoly power / be a price maker (1).

The firm must be able to segment the market into distinct groups with different elasticities of demand (1).

The firm must prevent or limit resale/arbitrage between consumer groups (1).

Explain why the ability to prevent arbitrage (resale) is important for a firm practising price discrimination. Use examples in your answer. (6 marks)

Knowledge (up to 2 marks):

Correctly explains arbitrage as resale of goods from low-price markets to high-price markets (1).

States that preventing arbitrage ensures that different consumer groups can be charged different prices (1).

Application (up to 2 marks):

Example of prevention such as ID checks for student discounts, non-transferable airline tickets, or regional software licensing (1).

Explains how these methods stop low-price consumers from reselling to high-price groups (1).

Analysis (up to 2 marks):

Explains that if arbitrage occurs, price discrimination breaks down because consumers in high-price segments will switch to cheaper resold goods (1).

Links prevention of arbitrage to maintaining higher profits and sustaining different pricing strategies across markets (1).

(Maximum 6 marks available; quality of written communication assessed implicitly.)