AQA Specification focus:

‘The rationing, incentive and signalling functions of prices in allocating resources and coordinating the decisions of buyers and sellers in a market economy.’

The price mechanism is central to market economies, performing key roles in allocating scarce resources efficiently. Its functions—rationing, incentive and signalling—shape producer behaviour and consumer decisions.

The Price Mechanism in Market Economies

The price mechanism refers to the system through which prices adjust to balance demand and supply in markets. It coordinates economic activity without the need for central planning. Prices act as signals, incentives, and rationing devices, ensuring resources move towards their most valued uses.

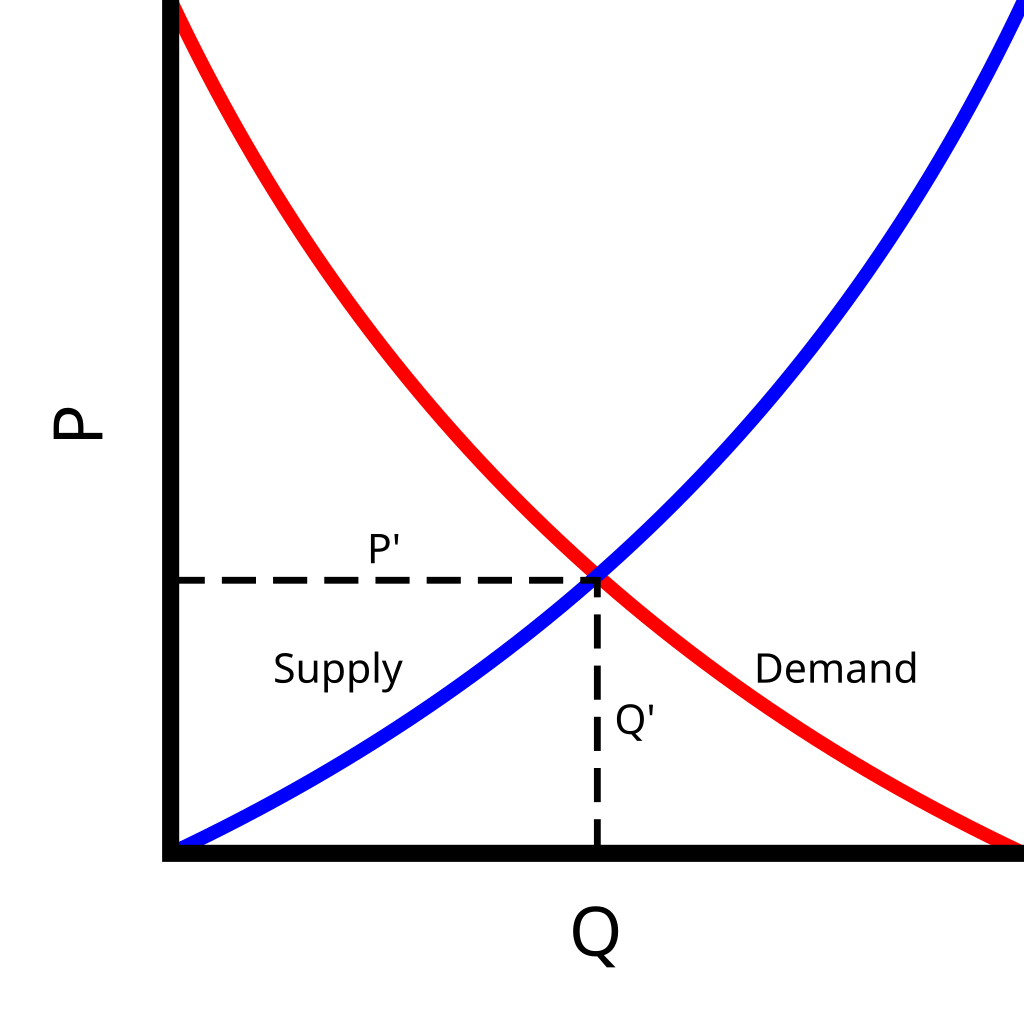

A standard supply–demand diagram showing the downward-sloping D curve and upward-sloping S curve meeting at market equilibrium. The equilibrium price and quantity coordinate buyers’ and sellers’ decisions without central direction. This figure underpins how prices both signal conditions and incentivise responses while rationing scarce goods. Source

The Rationing Function of Prices

Concept

The rationing function ensures that limited resources are distributed among competing uses. When demand exceeds supply, higher prices restrict access, prioritising those willing and able to pay.

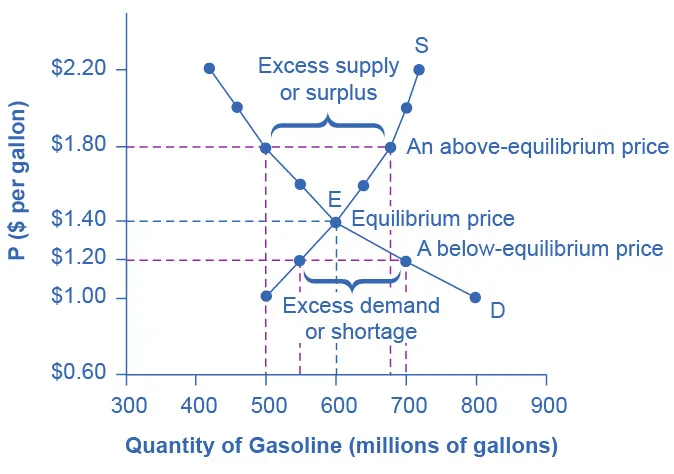

“Figure 3.4 Demand and Supply for Gasoline” depicts equilibrium where D and S intersect, plus dashed horizontal lines illustrating shortage below equilibrium and surplus above. The shortage area directly supports the rationing role: low prices create excess demand until price rises. (Includes surplus detail beyond the syllabus focus, retained to clarify the full adjustment story.) Source

Rationing Function: The role of prices in limiting demand for scarce goods and services, ensuring allocation among competing buyers.

Mechanism

When demand rises, prices increase.

Higher prices reduce quantity demanded.

Only consumers with the greatest willingness and ability to pay purchase the good.

This prevents shortages by equating demand with supply.

Importance

Ensures scarce resources are not overused.

Prevents persistent excess demand.

Encourages consumers to consider alternatives.

The Incentive Function of Prices

Concept

The incentive function motivates economic agents to alter behaviour. Higher prices encourage producers to increase output, while lower prices discourage production but incentivise consumer demand.

Incentive Function: The role of prices in motivating producers and consumers to change their behaviour in response to changes in supply and demand.

Mechanism

A rise in price signals potential profits, encouraging firms to expand output.

Falling prices reduce profitability, leading firms to cut supply.

Consumers respond by altering consumption patterns, switching towards cheaper substitutes when relative prices change.

Importance

Guides producers towards goods with high consumer demand.

Promotes efficiency by rewarding firms that adapt quickly.

Encourages innovation and cost-saving to maintain competitiveness.

The Signalling Function of Prices

Concept

The signalling function communicates information about market conditions. Price changes transmit signals between buyers and sellers, guiding decisions about what to produce, how to produce, and for whom.

Signalling Function: The role of prices in transmitting information about shifts in demand and supply to consumers and producers.

Mechanism

Rising prices signal stronger demand or reduced supply.

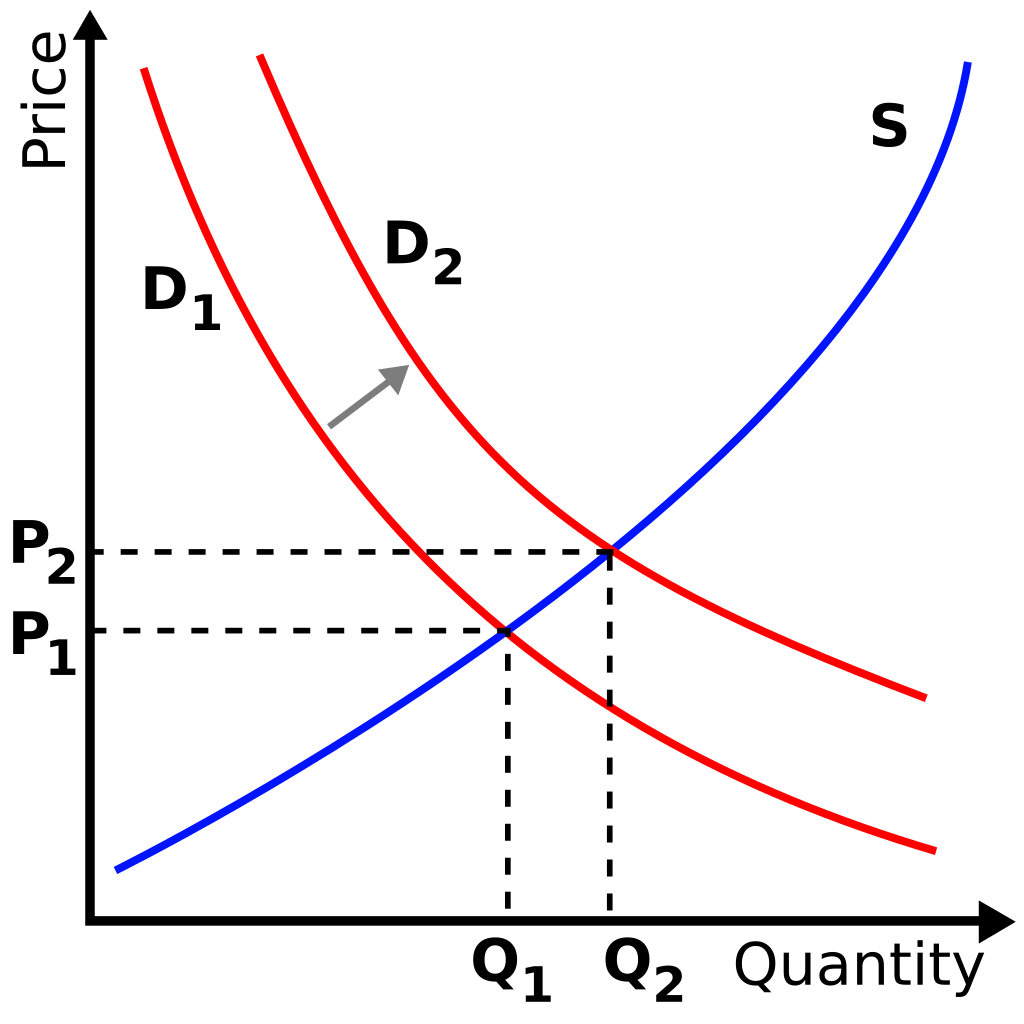

The diagram shows the demand curve shifting from D to the right, increasing the equilibrium price and quantity. A higher price signals stronger demand and incentivises producers to expand output. Labels are minimal and align with A-Level graphical conventions. Source

Falling prices indicate weaker demand or oversupply.

Firms use these signals to allocate resources efficiently.

Consumers interpret price movements to guide spending choices.

Importance

Reduces the need for centralised control.

Provides constant, real-time feedback to markets.

Ensures responsiveness to changing consumer preferences and resource availability.

Coordination of Decisions

The three functions—rationing, incentive, and signalling—work together to coordinate decisions in a decentralised market economy.

Rationing prevents overconsumption of scarce goods.

Incentives drive changes in production and consumption.

Signals allow buyers and sellers to respond to evolving conditions.

This coordination addresses the fundamental economic problem: deciding what to produce, how to produce, and for whom resources are allocated.

Strengths of the Price Mechanism

Operates without direct government involvement.

Encourages innovation and efficiency.

Provides flexibility in response to shocks (e.g. changes in demand or supply).

Offers consumers choice and variety.

Limitations of the Price Mechanism

Assumes perfect information, which is rarely present.

May fail in cases of market failure (e.g. externalities, public goods).

Can lead to inequalities in access when rationing excludes low-income groups.

Sensitive to short-term fluctuations, which may discourage long-term planning.

Summary of Functions

Rationing: Allocates scarce goods by limiting demand through higher prices.

Incentives: Motivate producers and consumers to respond to price changes.

Signals: Convey information to coordinate actions across the economy.

FAQ

When shortages occur, higher prices ration scarce goods by excluding some buyers. Consumers then make choices based on priorities, substituting alternatives or reducing consumption.

This process ensures demand falls until it matches the limited supply, showing how rationing links directly to consumer decision-making under scarcity.

Higher prices signal potential profit, encouraging firms to invest in new technology or production methods to capture demand.

Innovation helps lower costs.

It can create entirely new products or markets.

Long-term, this enhances efficiency and competitiveness.

Thus, the incentive function supports both short-term output decisions and longer-term growth through innovation.

Prices provide continuous information about consumer preferences and resource availability.

This allows firms and households to adapt behaviour without government instruction. For example, a price rise in renewable energy signals growing demand, prompting more investment in that sector.

Yes, rationing works by price, so those with higher incomes are more likely to access scarce goods.

This creates unequal outcomes in areas like housing or healthcare if left solely to market forces. Policymakers often intervene to reduce these disparities.

Though distinct, the rationing, incentive and signalling functions work together.

Signalling informs buyers and sellers about conditions.

Incentives motivate them to respond to these signals.

Rationing ensures scarce goods are allocated efficiently.

Together, they coordinate economic activity and determine the what, how, and for whom of production.

Practice Questions

Define the signalling function of prices in a market economy. (2 marks)

1 mark for identifying that the signalling function communicates information to buyers and sellers.

1 mark for stating that changes in price indicate shifts in demand or supply, guiding economic decisions.

Explain how the rationing and incentive functions of prices help to allocate scarce resources in a market economy. (6 marks)

Up to 2 marks for explaining the rationing function (higher prices restrict demand, scarce goods allocated to those willing/able to pay).

Up to 2 marks for explaining the incentive function (higher prices motivate producers to increase output, lower prices encourage consumers to buy more).

Up to 2 marks for linking both functions to resource allocation (ensuring resources move to where they are most valued, preventing overuse).