AQA Specification focus:

‘The advantages and disadvantages of the price mechanism and of extending its use into new areas of activity.’

The price mechanism plays a central role in allocating resources in market economies, but its strengths and limitations must be assessed carefully, especially when applied in sensitive contexts.

The Nature of the Price Mechanism

The price mechanism is the process by which market prices adjust to allocate resources, coordinating the decisions of buyers and sellers without central planning.

Price Mechanism: The system in a market economy where prices adjust to balance demand and supply, guiding resource allocation through the rationing, incentive and signalling functions.

Through shifts in demand and supply, prices communicate information, reward or penalise behaviours, and balance scarce resources.

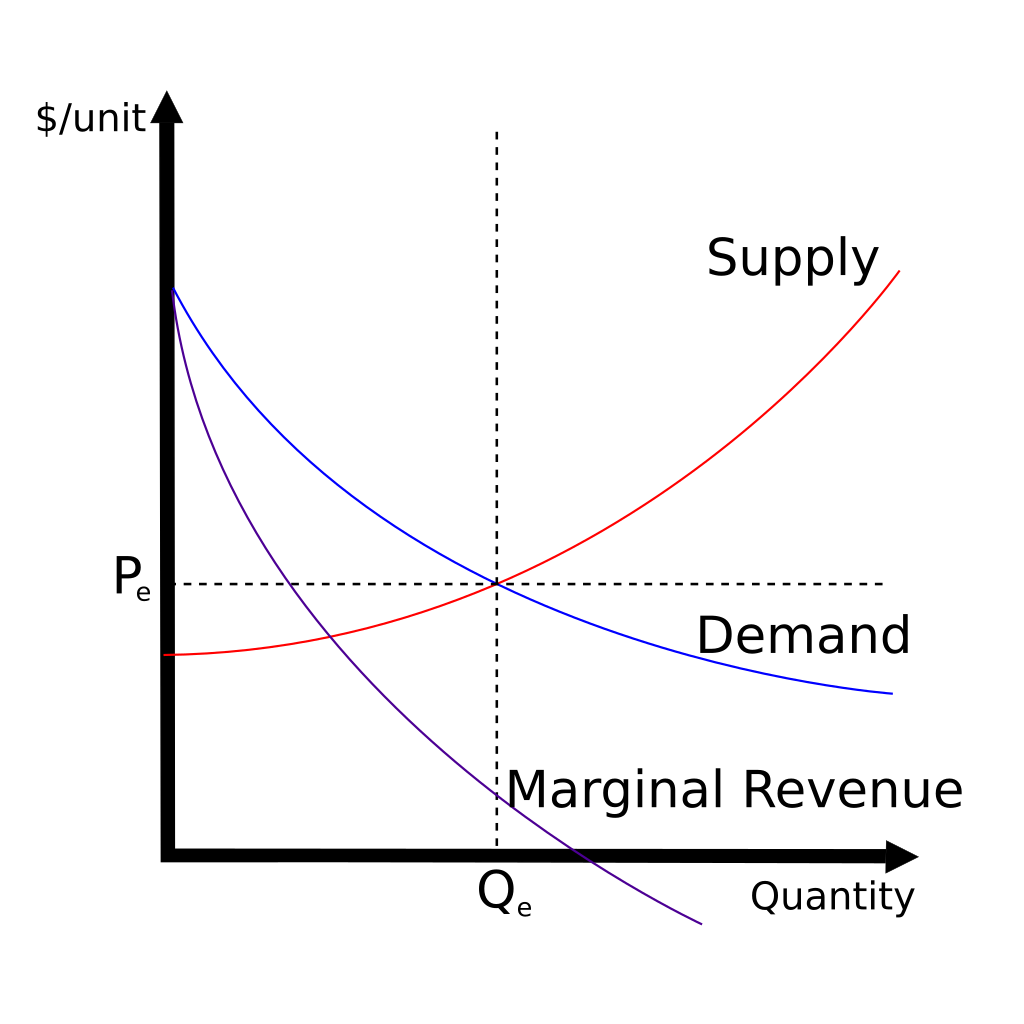

A simple supply and demand diagram showing equilibrium price and quantity, illustrating how the price mechanism balances demand and supply without central direction. Source

Advantages of the Price Mechanism

Efficiency in Resource Allocation

Automatic adjustment: Prices adjust quickly to changes in demand and supply without external intervention.

No administrative cost: Unlike government allocation, the mechanism does not require bureaucracy or central planning.

Dynamic responsiveness: Markets adapt to shocks such as sudden resource scarcity or surges in consumer demand.

Consumer Sovereignty

Consumers, through spending choices, direct production.

Resources are allocated towards goods and services most valued by society.

Producers respond to profit incentives, focusing on efficiency and innovation.

Innovation and Productivity

Profit incentives encourage firms to innovate to reduce costs or improve quality.

Competition fosters efficiency, leading to lower prices and greater choice.

Firms that meet consumer demands are rewarded, while inefficient firms exit the market.

Decentralisation of Decision-Making

Decisions are dispersed across millions of buyers and sellers, reducing reliance on centralised authority.

This decentralisation reduces the risk of systemic errors and encourages experimentation.

Disadvantages of the Price Mechanism

Inequality of Outcomes

Income inequality arises because purchasing power determines access to resources.

Essential goods may be inaccessible to lower-income households, leading to social exclusion.

Without redistribution, vulnerable groups may lack basic provisions such as healthcare or education.

Public Goods and Market Failure

The mechanism cannot efficiently allocate public goods, which are non-rival and non-excludable.

The free-rider problem prevents provision of socially valuable goods like national defence.

Markets may underprovide merit goods, leading to long-term social inefficiencies.

Externalities and Misallocation

Prices may fail to reflect external costs or benefits.

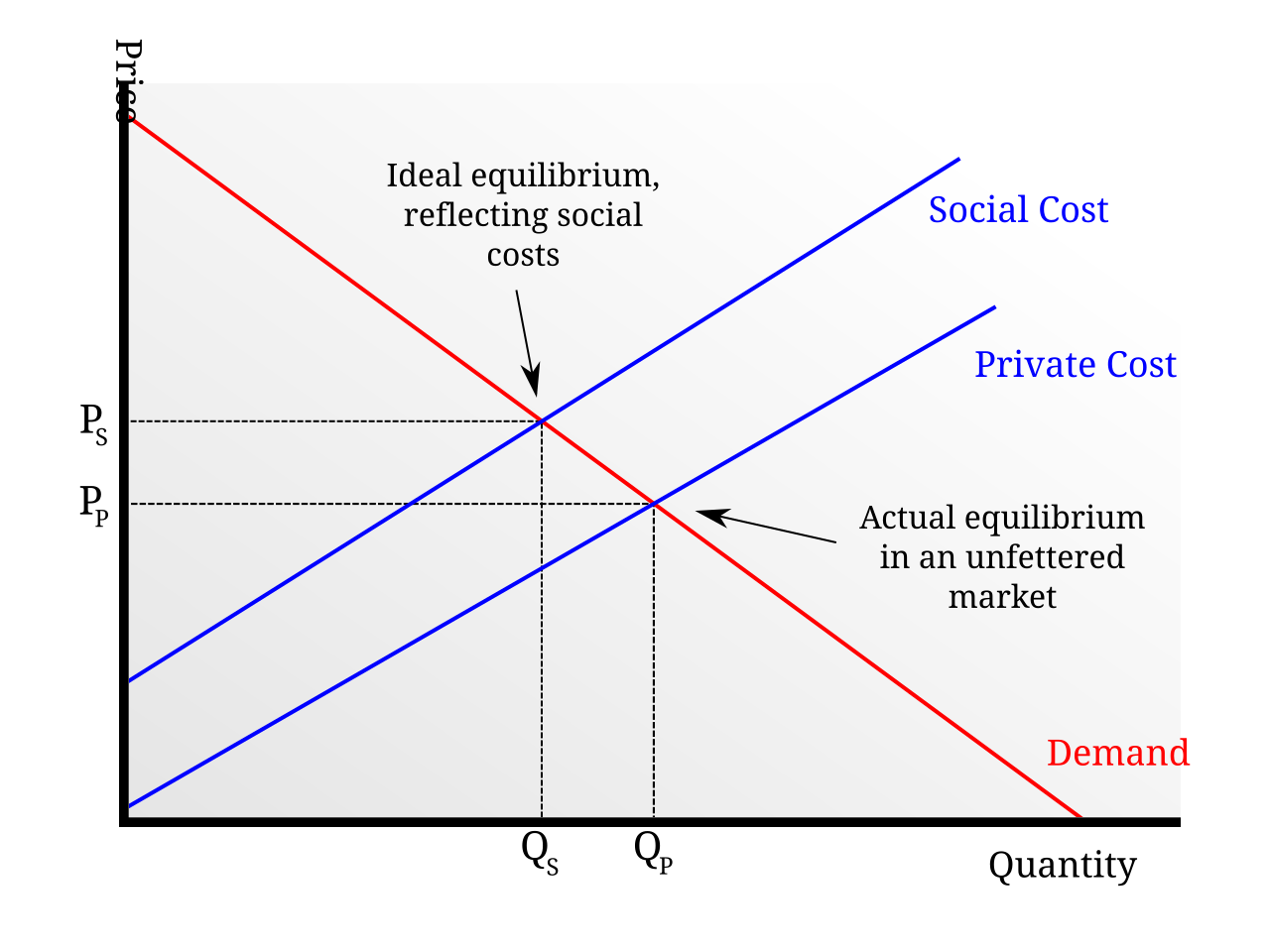

Diagram of a negative externality showing the divergence between private and social curves and the resulting welfare loss from over-consumption relative to the social optimum. Source

For instance, negative externalities (pollution) lead to overproduction, while positive externalities (education, vaccination) result in underproduction.

This misallocation harms both efficiency and welfare.

Information Failure

The mechanism assumes perfect information, but in reality, consumers and producers often lack accurate knowledge.

Asymmetric information (where one party knows more than the other) distorts efficient decision-making.

For example, consumers may over-consume demerit goods such as tobacco if unaware of health risks.

Market Power and Monopoly

When firms acquire monopoly power, they can restrict output and raise prices, undermining efficiency.

A monopoly diagram showing higher prices, reduced output, and deadweight loss. It illustrates how monopoly power distorts the price mechanism and reduces total welfare. Source

Market dominance may reduce innovation and harm consumers.

Prices no longer reflect the true balance of demand and supply but rather the strategic behaviour of powerful firms.

Extending the Price Mechanism into New Areas

Potential Advantages

Applying the mechanism can increase efficiency in traditionally non-market areas such as healthcare or education.

Competition and choice may drive innovation and reduce costs.

For governments, market-based solutions may lower the burden of funding public services.

Risks and Disadvantages

Introducing markets into sensitive areas can distort incentives.

For example, creating a market for blood donations may reduce altruistic supply if individuals demand payment.

Markets in education or healthcare may increase inequality, as those with higher incomes secure better services.

Social values may be undermined when human activities are commodified.

Evaluation of Use in Sensitive Areas

When considering whether to extend markets, economists assess the balance between efficiency and equity:

Efficiency gains must be weighed against the risk of inequality.

The nature of the good (public, private, or merit) determines whether markets can function effectively.

Ethical considerations also matter: society may reject the idea of applying market incentives in areas with strong moral or cultural significance.

Key Points Recap for Students

The advantages of the price mechanism include efficiency, consumer sovereignty, innovation, and decentralised decision-making.

The disadvantages involve inequality, externalities, information failure, and monopoly power.

Extending the mechanism into new fields may improve efficiency but can threaten equity and alter the social meaning of certain activities.

FAQ

The price mechanism relies on the forces of demand and supply to determine prices, whereas government allocation involves central decision-making about what is produced and how it is distributed.

Markets are decentralised, meaning millions of decisions are made by buyers and sellers without central oversight. This can be quicker and less costly than government planning. However, unlike the government, the price mechanism does not directly account for equity or wider social goals.

When prices rise, they signal to producers that demand is strong or supply is scarce. When prices fall, they signal weaker demand or excess supply.

These signals guide firms on where to invest resources and which products to reduce or expand. This constant adjustment ensures resources flow towards their most valued uses, provided markets are competitive and information is reliable.

In sensitive areas such as healthcare, education, or organ donation, introducing prices can change the way people view these goods.

Placing a monetary value may undermine intrinsic motivations like altruism. For instance, creating a market for blood donations risks reducing voluntary supply, as donors may perceive the act as transactional rather than moral.

Yes, efficiency and inequality can coexist. The mechanism ensures scarce resources are allocated to those who value them most, but value is expressed through willingness and ability to pay.

Wealthier households may gain access to higher-quality goods and services.

Poorer households may be priced out of essential resources.

This highlights the trade-off policymakers face between efficient allocation and fair distribution.

Technology improves access to information, reducing information failure and making consumer decisions more efficient. Online platforms, for instance, allow instant price comparisons.

However, technology can also strengthen monopoly power through network effects, as seen with digital giants. This means while some disadvantages shrink, others may intensify, altering the balance of pros and cons in modern markets.

Practice Questions

State two advantages of the price mechanism in allocating resources. (2 marks)

1 mark for each valid advantage (any two required):

Automatic adjustment of prices to changes in demand and supply (1 mark)

Encourages efficiency and innovation due to profit incentives (1 mark)

Promotes consumer sovereignty as spending directs production (1 mark)

Decentralisation of decision-making (1 mark)

(Max 2 marks)

Explain two disadvantages of relying on the price mechanism to allocate resources, using examples to support your answer. (6 marks)

Identification of a disadvantage (1 mark each, max 2).

Development of explanation for each disadvantage (up to 2 marks each).

Use of relevant example for each disadvantage (1 mark each).

Indicative content:

Inequality of outcomes: purchasing power determines access to resources; for example, healthcare may be inaccessible to low-income households.

Externalities and misallocation: prices do not reflect external costs or benefits; for example, pollution leads to overproduction of harmful goods.

Information failure: consumers may over-consume demerit goods like tobacco if unaware of risks.

Monopoly power: firms can restrict output and raise prices, reducing efficiency.

Award up to 3 marks per disadvantage (identification + development + example).

(Max 6 marks)