AQA Specification focus:

‘Students should be able to assess the view that the price mechanism is an impersonal method of allocating resources.’

Introduction

In market economies, the price mechanism allocates resources without central planning. Its impersonal nature raises questions about fairness, efficiency, and social consequences.

Understanding the Price Mechanism

The Role of Prices

The price mechanism refers to the way changes in prices influence the allocation of resources. Prices act as signals to buyers and sellers, directing their decisions.

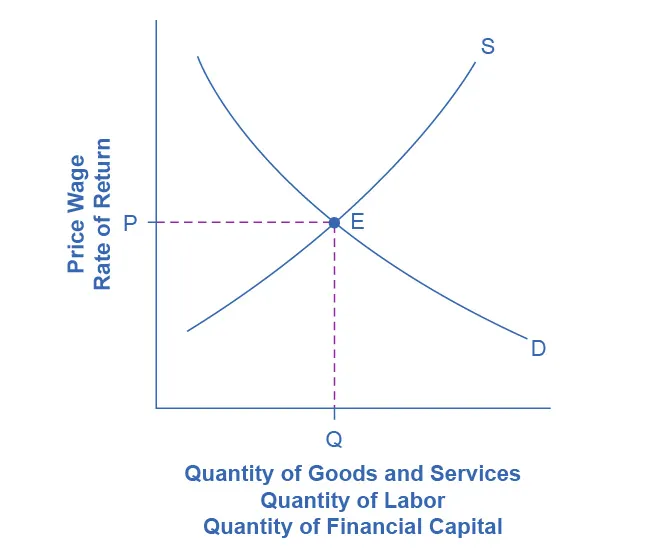

Standard supply and demand curves intersect at equilibrium E, where quantity demanded equals quantity supplied. The diagram shows how a single market price communicates information impersonally to buyers and sellers. Source

Price Mechanism: The system where the interaction of demand and supply determines prices, which then allocate resources in an economy.

The mechanism works without direct communication between producers and consumers, instead relying on impersonal market forces.

Impersonality Defined

The term impersonal refers to decisions being made by market forces rather than by individuals or government officials. Resource allocation is determined by willingness and ability to pay, not by personal relationships or subjective judgments.

The Case for Impersonality

Efficiency and Objectivity

Supporters of the impersonal nature of the price mechanism argue that it brings several advantages:

Objectivity: Allocation decisions are based on price signals, not favouritism or discrimination.

Decentralisation: Millions of decisions are coordinated automatically, without the need for central authority.

Responsiveness: Prices adjust quickly to shifts in supply and demand, reallocating resources efficiently.

Incentives: Sellers are encouraged to produce goods where demand is strongest, ensuring resources flow to high-value uses.

Example in Action

A sudden shortage of oil raises prices. This signals producers to extract more and consumers to reduce consumption.

The adjustment happens automatically, without government commands or subjective choices.

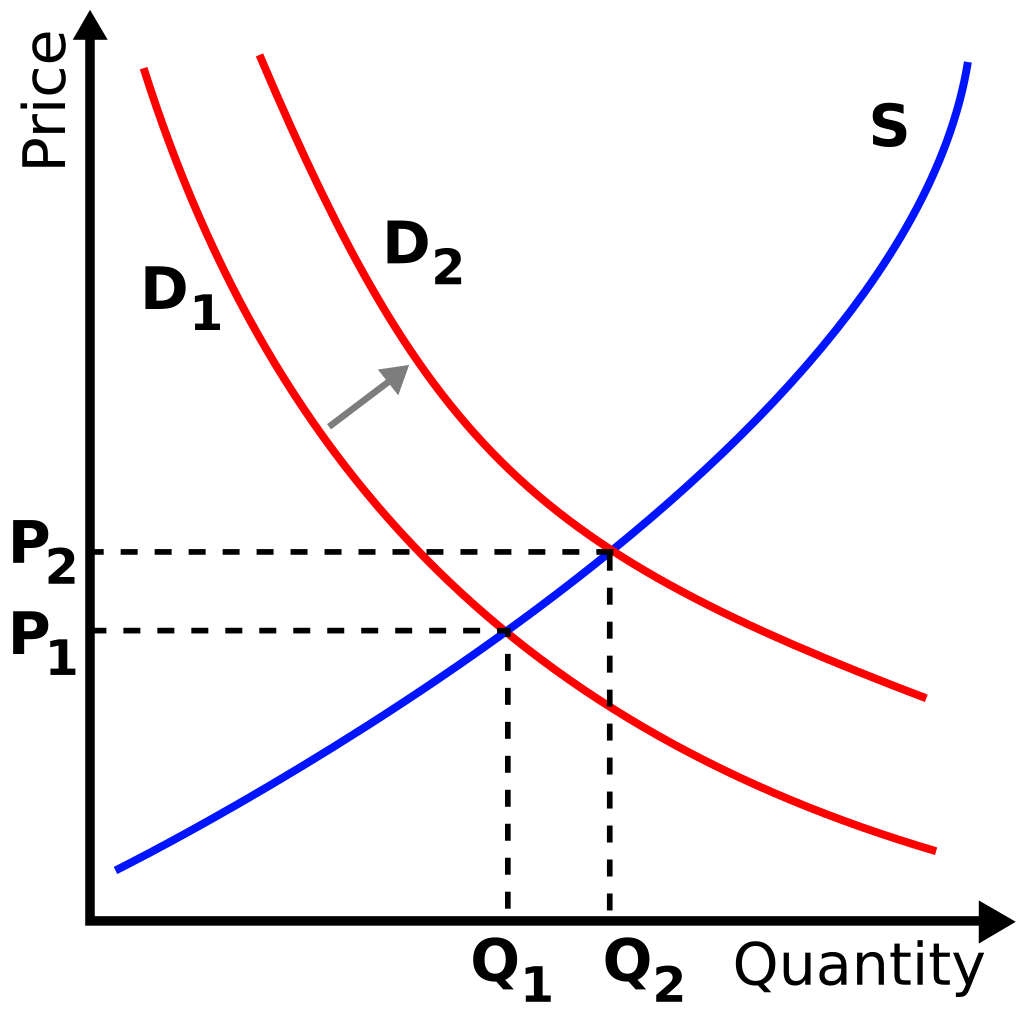

A rightward demand shift raises the equilibrium price and quantity, signalling producers to allocate more resources to this market. The adjustment is coordinated by prices rather than personal discretion. Source

Criticisms of Impersonality

Inequality and Exclusion

The impersonal nature of the price mechanism also has drawbacks:

Ability to Pay: Only those with sufficient income can express demand, leaving poorer groups excluded.

Inequality: Allocation may favour wealthy consumers, intensifying social divisions.

No Consideration of Merit: Essential services may not go to those most in need, but rather to those able to afford them.

Lack of Ethical Consideration

Markets treat all transactions as equivalent exchanges of value, ignoring ethical or social priorities. For example:

Healthcare delivered purely through markets may exclude vulnerable groups.

Housing markets may price out essential workers in urban areas.

Market Failure: When the price mechanism leads to a misallocation of resources and fails to achieve economic efficiency or fairness.

The impersonality of markets can therefore lead to outcomes many societies consider unacceptable.

Balancing Impersonality with Social Goals

Role of Government Intervention

Where the price mechanism fails, governments often intervene to soften the harshness of impersonality:

Subsidies for merit goods like education and healthcare.

Price controls to ensure affordability of essentials.

Regulation to prevent exploitation by monopolies.

Redistribution through taxes and transfers to reduce inequality.

Sensitive Areas

The impersonal nature of markets may be unsuitable for certain sectors. For instance:

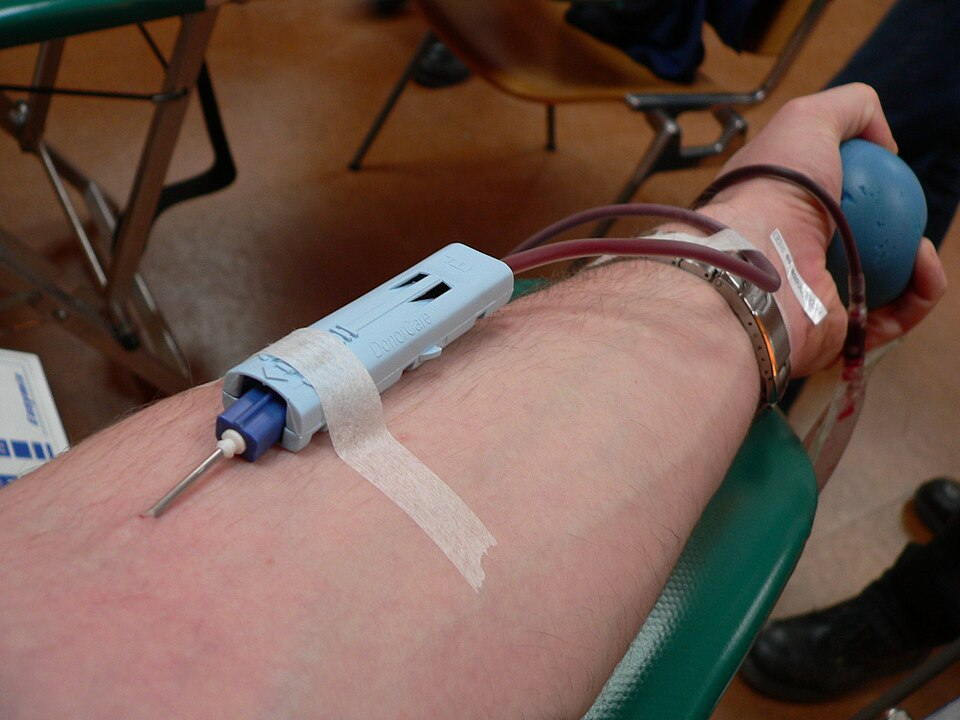

Blood donation markets could commodify human life and undermine altruism.

Education markets risk favouring wealthy families and reducing social mobility.

Photograph of a voluntary blood donation in progress, showing needle, tubing, and collection equipment. It supports the discussion of whether introducing market pricing into sensitive activities can alter motivations and social norms. Source

Evaluating the Impersonal Nature

Advantages of Impersonality

Promotes efficiency by focusing on consumer sovereignty.

Prevents bias and discrimination in resource allocation.

Supports innovation and growth, as producers respond to market signals.

Disadvantages of Impersonality

Risks inequality and exclusion of disadvantaged groups.

May overlook social welfare and ethical concerns.

Can result in market failure, requiring corrective intervention.

Balanced Perspective

The price mechanism is indeed impersonal, and this impersonality can be both a strength and a weakness. Economists and policymakers must weigh efficiency against fairness when judging its role in different areas of the economy.

FAQ

The price mechanism is impersonal because it relies solely on price signals generated by supply and demand. These signals operate without reference to individual circumstances or social considerations.

In contrast, government planning involves conscious decisions made by policymakers who may consider fairness, equity, or need. The market system treats all consumers and producers equally in the sense that only willingness and ability to pay determine outcomes.

No, impersonality should not be confused with fairness. Although decisions are free from personal bias, outcomes may disproportionately favour those with higher incomes.

For example:

Luxury goods may be readily available for wealthy consumers.

Essential services may be inaccessible to those who cannot pay.

This shows that while the process is neutral, the results may reflect existing inequalities in society.

Impersonality reinforces consumer sovereignty by ensuring that producers respond to market demand rather than individual preferences of decision-makers.

Consumers collectively determine what is produced by choosing where to spend their money. Producers react to price changes, adjusting output accordingly. This process ensures that resources flow to goods with the strongest demand signals.

Yes, impersonality can diminish the influence of ethics. Markets treat all goods and services as commodities, regardless of social or moral value.

This means that sensitive areas such as healthcare, education, or organ donation may be allocated based only on price, ignoring broader ethical considerations. Such situations often prompt calls for regulation or government intervention.

Impersonality encourages firms to innovate as a way to respond to price signals and consumer demand. Since producers are motivated by profit, they invest in efficiency and new technologies to stay competitive.

The absence of subjective or biased decision-making also means that innovative firms are rewarded directly through consumer purchases. This cycle supports both long-term growth and dynamic market efficiency.

Practice Questions

Define what is meant by the term impersonal in the context of the price mechanism. (2 marks)

1 mark for stating that allocation decisions are made by market forces/prices rather than individuals or government.

1 mark for recognising that allocation depends on willingness and ability to pay, not personal relationships or subjective judgement.

Assess the view that the impersonal nature of the price mechanism leads to both advantages and disadvantages in allocating resources. (6 marks)

1–2 marks: Identification of advantages (e.g. objectivity, efficiency, responsiveness, avoidance of bias).

1–2 marks: Identification of disadvantages (e.g. inequality, exclusion of poorer groups, neglect of ethical/social priorities).

1 mark: Use of appropriate terminology (e.g. efficiency, inequality, market failure).

1 mark: Analysis/evaluation that recognises balance, e.g. impersonality can enhance efficiency but may reduce fairness, leading to calls for government intervention.