AQA Specification focus:

‘The existence of market failure, in its various forms, provides an argument for government intervention in markets.’

Introduction

Markets do not always achieve efficient outcomes, and government intervention is often justified when resource allocation is distorted. Understanding market failure highlights why policy action may be necessary.

Understanding Market Failure

Definition of Market Failure

Market Failure: Occurs whenever the free market leads to a misallocation of resources, producing outcomes that are inefficient or inequitable.

In other words, markets can either fail to exist (complete failure) or fail to deliver optimal outcomes despite functioning (partial failure).

Why Intervention Is Necessary

Governments intervene when market forces alone cannot achieve efficiency or fairness. Intervention aims to correct distortions and improve economic welfare.

Key reasons include:

Correcting externalities (e.g. pollution or vaccination benefits).

Addressing the under-provision of public goods such as defence.

Reducing inequality from skewed income and wealth distribution.

Tackling imperfect information that distorts consumer and producer decisions.

Controlling market power where monopolies exploit consumers.

Externalities and Intervention

Positive Externalities

When third parties benefit from consumption or production without paying, markets tend to under-provide such goods. Examples include education and healthcare.

Negative Externalities

Costs imposed on others, such as air pollution, lead to over-production. Left uncorrected, this reduces overall efficiency.

Externality: A side-effect of consumption or production that affects third parties and is not reflected in market prices.

Government intervention—via subsidies, taxes, or regulation—aims to align private costs/benefits with social costs/benefits.

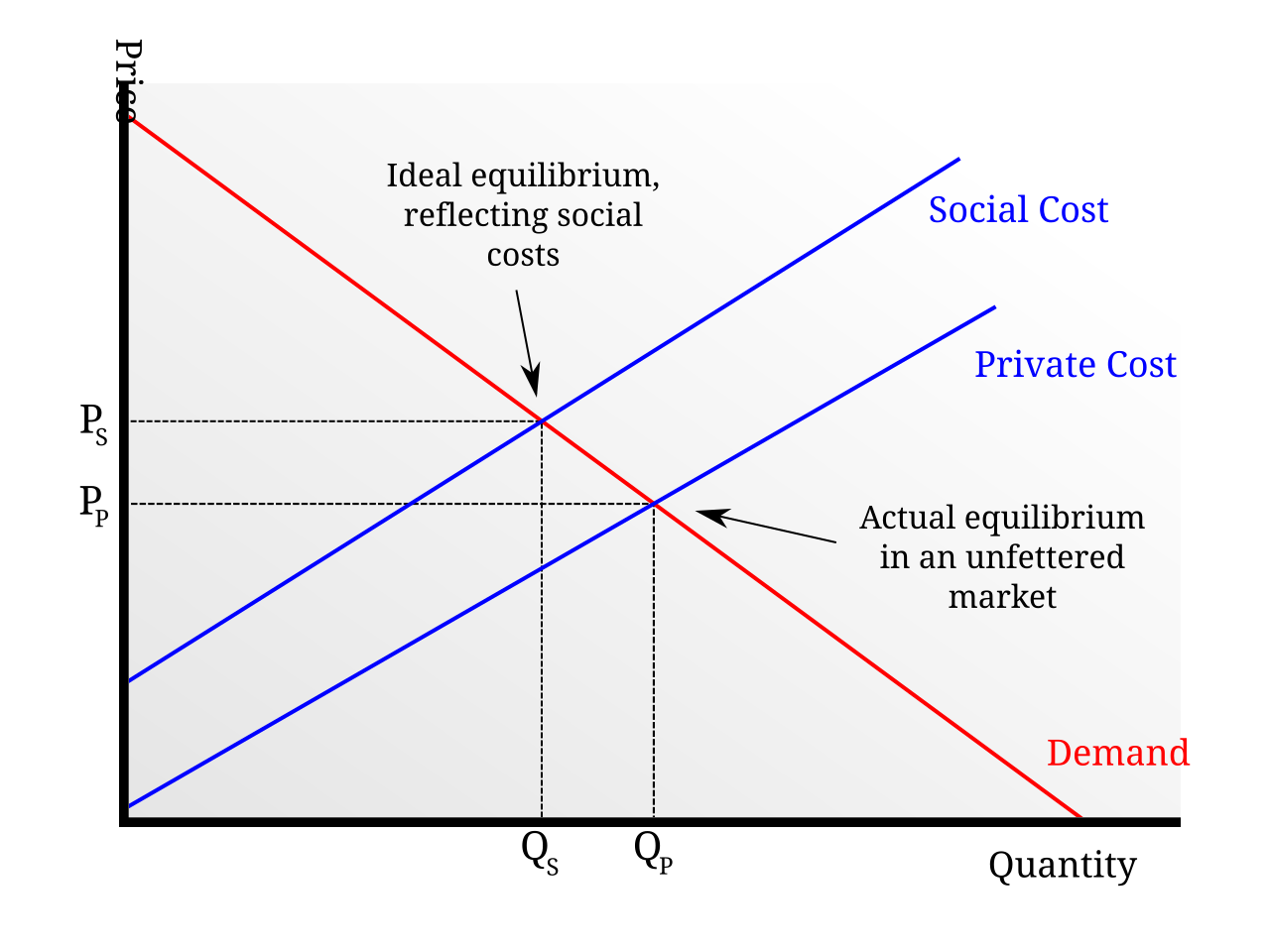

A labelled diagram showing a negative production externality where MSC exceeds MPC, causing over-production and welfare loss. This illustrates why taxation or regulation can correct the inefficiency. Source

Public Goods and Intervention

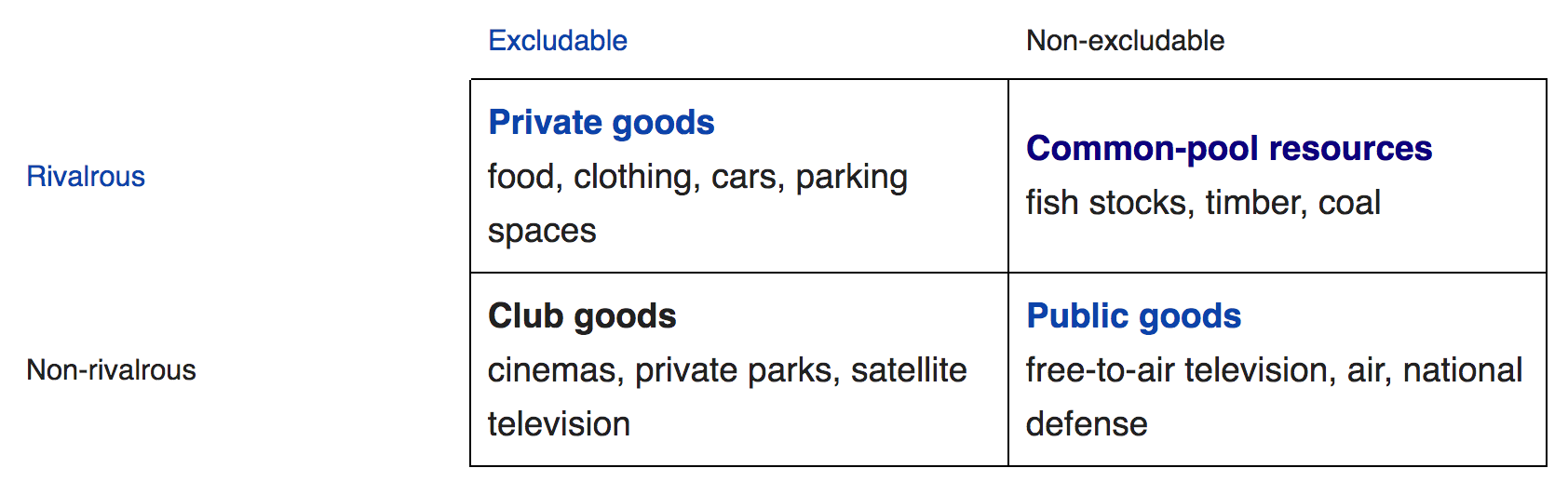

Public goods are non-rival (one person’s use does not reduce availability) and non-excludable (people cannot be prevented from using them). Examples include national defence and street lighting.

A quadrant diagram classifying goods by excludability and rivalry. Public goods are shown as non-rival and non-excludable, creating the free-rider problem. Other categories (club and common goods) are included for context. Source

Markets fail to supply these because of the free-rider problem, where individuals benefit without paying. Governments must intervene directly through public provision or funding.

Merit and Demerit Goods

Governments intervene to correct misjudgements by consumers.

Merit goods (e.g. education, museums) are under-consumed because individuals underestimate their benefits.

Demerit goods (e.g. tobacco, alcohol) are over-consumed as people ignore long-term social costs.

Intervention can take the form of subsidies, regulation, or advertising campaigns for merit goods, and taxation, bans, or age restrictions for demerit goods.

Market Power and Intervention

Unregulated markets can produce monopolistic outcomes where firms restrict output and raise prices. This leads to allocative inefficiency and consumer exploitation.

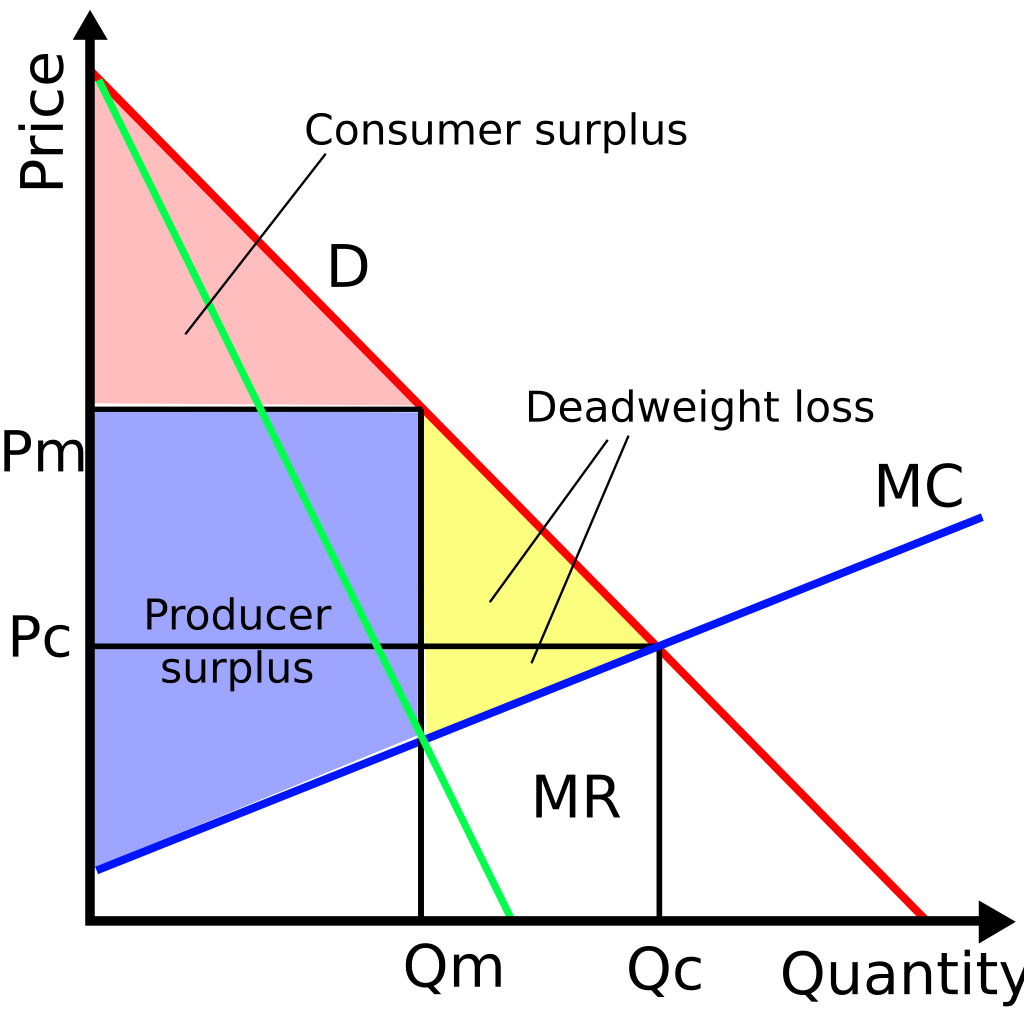

A monopoly diagram showing reduced output, higher prices, and deadweight loss compared with competitive equilibrium. This demonstrates how market power causes inefficiency and why regulation is justified. Source

Government actions include:

Competition policy to prevent abuse of monopoly power.

Price controls or regulation in natural monopolies.

Encouraging market entry to promote innovation and efficiency.

Imperfect Information and Intervention

Markets assume participants make informed decisions, but information gaps distort outcomes:

Consumers may not know long-term health risks of smoking.

Producers may hide environmental costs.

Imperfect Information: A situation where economic agents do not possess full or accurate knowledge, leading to suboptimal decisions.

Government can intervene by enforcing labelling laws, quality standards, or information campaigns to ensure more efficient choices.

Equity and Redistribution

Markets allocate resources according to purchasing power, not necessarily according to need. This creates inequality in income and wealth distribution.

Governments intervene through:

Progressive taxation to redistribute wealth.

Welfare benefits and transfers to reduce poverty.

Provision of essential services (healthcare, education) to promote equality of opportunity.

Policy Tools for Intervention

Government intervention can take many forms, including:

Indirect taxation to discourage harmful consumption.

Subsidies to encourage beneficial activities.

State provision of essential services.

Regulation and legal frameworks to control behaviour.

Pollution permits and property rights extension to manage environmental issues.

These tools aim to realign private and social outcomes, improving efficiency and fairness.

Evaluating the Rationale for Intervention

While the existence of market failure provides the rationale for intervention, the success of government action depends on:

Accuracy of identifying the source of failure.

Effectiveness of policy instruments used.

Balance between efficiency and equity objectives.

Risks of government failure (where intervention worsens outcomes).

Ultimately, intervention is justified when it improves economic welfare beyond what unregulated markets can achieve.

FAQ

Market failure reduces efficiency by preventing resources from being allocated to their most valued uses. This means total welfare (consumer and producer surplus) is lower than it could be.

It can also lead to equity concerns, as some groups may bear disproportionate costs (e.g. from pollution) while others benefit without contributing (e.g. free riders).

Externalities: Use of taxes or subsidies to internalise costs/benefits.

Public goods: Direct provision funded by taxation.

Information gaps: Regulation, labelling, and awareness campaigns.

Monopoly power: Competition policy and price regulation.

The form of intervention depends on the source of inefficiency.

Policymakers often balance efficiency with equity.

For instance, even if a market functions efficiently, intervention may still occur if outcomes are considered unfair. Judgements on issues such as healthcare access or environmental protection influence how governments act.

Yes, failure to intervene can entrench inefficiencies.

External costs may worsen (e.g. unchecked emissions).

Public goods may remain severely under-provided.

Inequalities may grow if redistribution is absent.

This can reduce long-term growth and damage living standards.

Yes, as technology, social values, and economic structures evolve, so does the case for intervention.

For example:

Advances in broadcasting technology made once-public goods (like TV) excludable.

Shifts in social concern, such as climate change, have increased the perceived need for regulation.

The rationale is not fixed; it adapts to context.

Practice Questions

Define market failure and explain briefly why it provides a rationale for government intervention. (2 marks)

1 mark for a correct definition of market failure: misallocation of resources by the free market.

1 mark for linking market failure to the need for government intervention (e.g. correcting inefficiency, improving welfare).

Explain how the existence of public goods and negative externalities provides a rationale for government intervention in markets. (6 marks)

Up to 2 marks for explaining why public goods are non-rival and non-excludable, leading to the free-rider problem and under-provision.

Up to 2 marks for explaining negative externalities (costs imposed on third parties not reflected in market prices) and how they cause over-production.

Up to 2 marks for showing the link between these failures and the rationale for government intervention (e.g. state provision, taxation, regulation).

Maximum 6 marks. Partial credit for incomplete or vague explanations.