AQA Specification focus:

‘Students should be able to evaluate the case for and against government intervention in particular markets and to assess the relative merits of different methods of intervention.’

Government intervention addresses market failure but can create distortions and inefficiencies. Evaluating methods involves balancing efficiency, equity, feasibility, and unintended consequences in determining their overall effectiveness.

Methods of Government Intervention

Indirect Taxation

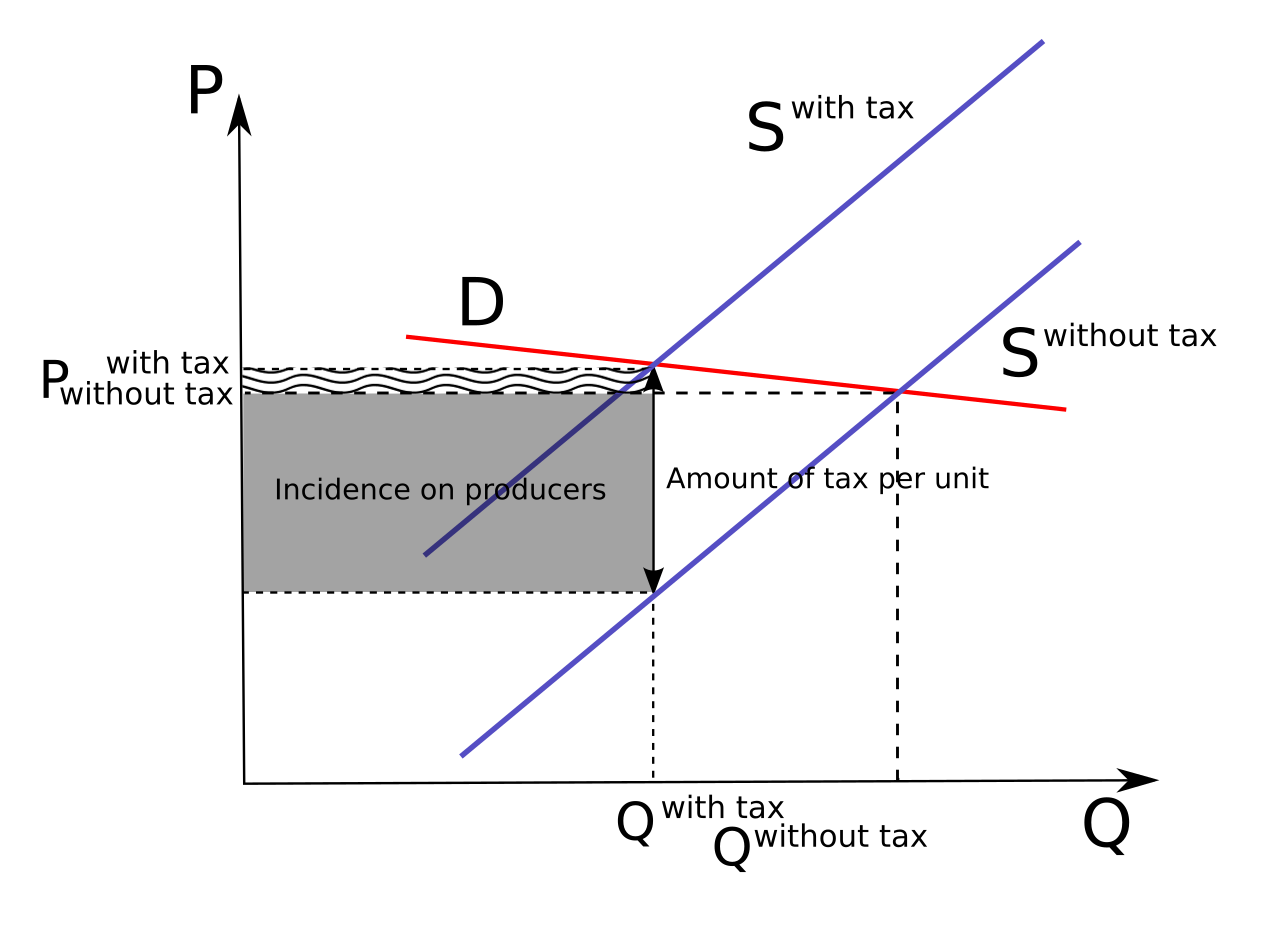

Indirect taxes are levied on goods and services, often used to reduce consumption of demerit goods or internalise negative externalities.

Example: duties on tobacco, alcohol, and petrol.

Taxes increase costs for producers, shifting the supply curve upwards, reducing output and consumption.

Tax Incidence Diagram (Producer Burden). This diagram demonstrates how the burden of a per-unit tax is distributed between producers and consumers when demand is elastic and supply is inelastic. The greater share of the tax burden falls on producers due to their limited ability to pass the tax onto consumers. Source

Merits:

Discourages harmful consumption.

Generates government revenue.

Internalises external costs.

Drawbacks:

Can be regressive, disproportionately affecting low-income groups.

Risk of tax evasion or smuggling.

May cause inflationary pressure.

Subsidies

Subsidies are payments from the government to producers or consumers to encourage production or consumption of merit goods.

Merits:

Increases consumption of socially beneficial goods (e.g. education, renewable energy).

Supports emerging industries and innovation.

Reduces inequality by improving access.

Drawbacks:

Opportunity cost for government spending.

Risk of inefficiency if firms become reliant on subsidies.

Potential misallocation if subsidies are politically motivated.

Price Controls

Price controls include maximum prices (price ceilings) and minimum prices (price floors).

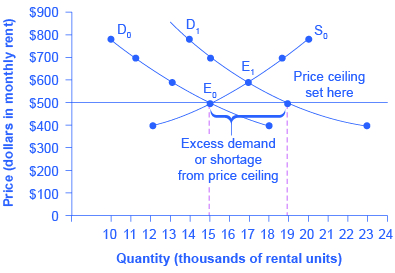

Maximum prices: set below equilibrium to make goods affordable (e.g. rent controls).

Minimum prices: set above equilibrium to support producers (e.g. minimum wage, agricultural guarantees).

Merits:

Protects consumers from exploitation.

Ensures fair wages or farmer income.

Drawbacks:

Maximum prices can cause shortages and black markets.

Price Ceiling Example – Rent Control. This photograph depicts a store displaying a price ceiling notice, illustrating government-imposed maximum prices intended to make goods more affordable. However, such controls can lead to shortages and the emergence of black markets, as suppliers may reduce quantity supplied. Source

Minimum prices can create surpluses and inefficiency.

State Provision

State provision means goods and services directly supplied by the government, often in healthcare, education, or defence.

Merits:

Guarantees access regardless of income.

Addresses under-provision of merit and public goods.

Promotes equality of opportunity.

Drawbacks:

Expensive for taxpayers.

Risk of bureaucratic inefficiency and waste.

Limited consumer choice compared to market provision.

Regulation

Regulation involves government rules to control economic activity, such as safety standards, pollution limits, or advertising restrictions.

Merits:

Corrects market failure directly.

Protects consumers and environment.

Can be flexible if well designed.

Drawbacks:

Enforcement is costly and complex.

May create red tape, discouraging business activity.

Risk of regulatory capture where industries influence regulators.

Property Rights and Pollution Permits

Property rights ensure individuals or firms have legal control over resources, reducing overuse.

Pollution permits allow firms a limited right to pollute, tradable in markets.

Merits:

Encourages efficient resource use.

Market-based solution that incentivises firms to cut emissions.

Generates revenue if permits are auctioned.

Drawbacks:

Difficult to assign and enforce property rights.

Firms may relocate to countries with looser regulation (carbon leakage).

Permit systems require strong monitoring.

Criteria for Evaluation

Efficiency

Does the intervention improve allocative efficiency by moving output closer to the socially optimal level?

Risk of government failure if policies distort incentives.

Equity

Does it reduce inequalities in access to goods and services?

Taxation may worsen equity, while state provision and subsidies may improve it.

Administrative Feasibility

Simplicity and cost of implementation are crucial.

Direct provision and regulation often involve high administrative burdens.

Unintended Consequences

Black markets from price controls.

Overproduction under minimum prices.

Dependency on subsidies.

Balancing Market and Government Roles

Markets are efficient in many areas but prone to failure in others. Government intervention is justified when the benefits of correcting failure outweigh risks of inefficiency. The key challenge is choosing the appropriate mix of intervention tools tailored to each market’s characteristics.

FAQ

The effectiveness of subsidies depends on how well they are targeted and the size of the financial support provided.

Subsidies are more effective if:

They are directed at goods with clear positive externalities, such as vaccines.

The government sets the subsidy high enough to significantly reduce prices and increase demand.

There is accurate information to avoid misallocation.

If subsidies are too small, poorly targeted, or create dependency, their impact is limited.

A price ceiling set below the equilibrium price creates excess demand because consumers want more than producers are willing to supply at that lower price.

This shortage incentivises unofficial markets where sellers charge higher prices to those willing to pay. Black markets undermine the policy’s purpose, as access is determined by willingness or ability to pay rather than affordability.

Pollution permits allocate a legal allowance to emit a set amount of pollutants. Firms that reduce emissions below their allowance can sell unused permits, generating profit.

Firms that exceed their allowance must buy additional permits, creating a financial incentive to cut emissions. This market-based approach links costs to environmental impact while rewarding efficiency.

When the government directly provides goods or services, the money spent has an alternative use.

For example, increased spending on healthcare provision could mean fewer resources for education or infrastructure. The opportunity cost reflects the trade-off governments face when choosing which areas of intervention to prioritise.

Regulation can change firm behaviour in ways policymakers did not anticipate.

Strict environmental rules may encourage firms to relocate production overseas.

Complex rules can increase compliance costs, discouraging small business growth.

Overregulation risks regulatory capture, where firms influence regulators to create favourable rules.

These outcomes can weaken the intended benefits of regulation.

Practice Questions

Define government failure and explain why it may occur when attempting to correct market failure. (3 marks)

1 mark for a clear definition: Government failure occurs when government intervention leads to a misallocation of resources or a worsening of economic outcomes.

1 mark for identifying a possible cause (e.g. inadequate information, administrative costs, or unintended consequences).

1 mark for an example or brief explanation of how intervention may distort incentives (e.g. subsidies creating inefficiency, or price controls causing shortages).

Evaluate the merits and drawbacks of using subsidies as a method of government intervention to correct market failure. (6 marks)

1–2 marks: Basic explanation of subsidies (financial support from the government to encourage production or consumption of merit goods).

1–2 marks: Identification of merits (e.g. encourages consumption of socially beneficial goods, supports innovation, reduces inequality).

1–2 marks: Identification of drawbacks (e.g. high opportunity cost, inefficiency if firms become reliant, potential misallocation).

1–2 marks: Some evaluation or balanced judgement, e.g. considering effectiveness depends on correct targeting, size of subsidy, or whether benefits outweigh costs.

Maximum 6 marks: full, balanced explanation with merits, drawbacks, and some evaluative comment.