AQA Specification focus:

‘Students should be able to apply economic models to assess the role of markets and the government in a variety of situations. Students should be able to explain, analyse and evaluate the strengths and weaknesses of the market economy and the role of government within it.’

Introduction

Understanding the interaction between markets and government intervention is central to A-Level Economics. This subtopic explores how economic models can be applied to evaluate efficiency, welfare, and policy effectiveness.

The Market Economy and Its Strengths

Market Allocation through the Price Mechanism

In a market economy, the price mechanism allocates resources through the rationing, signalling, and incentive functions of prices. These functions ensure that scarce resources are distributed to their most valued uses without central direction.

Efficiency gains: Competition among firms can drive productive and allocative efficiency.

Consumer sovereignty: Consumer preferences dictate production decisions, influencing what, how, and for whom goods and services are produced.

Innovation: Profit motives stimulate technological progress and new product development.

Allocative Efficiency: Achieved when resources are distributed such that no one can be made better off without making someone else worse off.

Allocative efficiency provides a benchmark for evaluating market outcomes, although in practice it may not always be achieved due to distortions.

Weaknesses of Market Allocation

Sources of Market Failure

Markets may misallocate resources due to externalities, public goods, asymmetric information, monopoly power, and factor immobility. These lead to welfare losses compared to the socially optimal allocation.

Negative externalities (e.g., pollution) create overproduction.

Positive externalities (e.g., education) result in underproduction.

Public goods suffer from the free-rider problem.

Information gaps distort decision-making for both producers and consumers.

Market Failure: Occurs whenever the free market fails to allocate resources efficiently, leading to a net welfare loss.

While markets may fail, this does not guarantee government intervention will succeed in correcting outcomes.

The Role of Government Intervention

Policy Instruments

Governments intervene in markets using a variety of tools:

Indirect taxes to internalise negative externalities.

Subsidies to encourage production or consumption of merit goods.

Price controls (maximum or minimum prices) to protect consumers or producers.

State provision of essential goods and services.

Regulation to correct information gaps or prevent abuse of monopoly power.

These methods can be modelled using supply and demand diagrams to show shifts in equilibrium and changes in welfare.

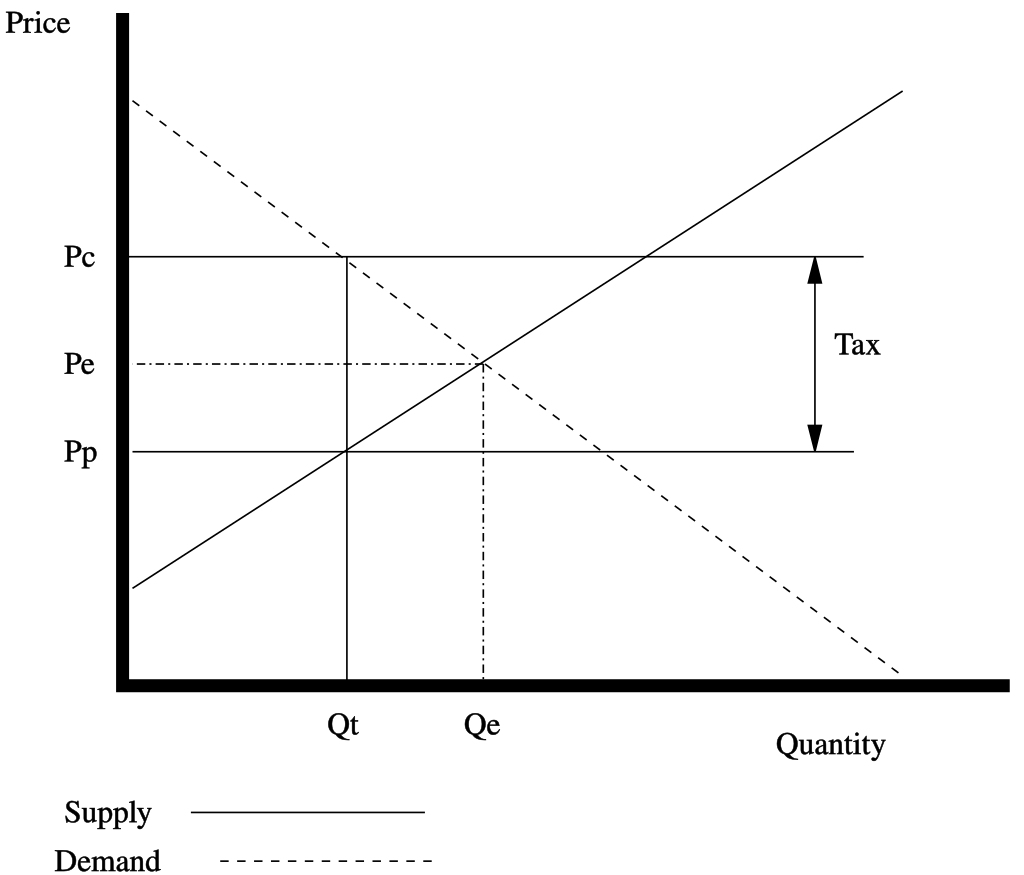

The Tax Supply and Demand Diagram illustrates how a per-unit tax shifts the supply curve upward, leading to a higher equilibrium price and reduced quantity, demonstrating the economic effects of taxation. Source

Evaluating Government Effectiveness

The success of intervention depends on several factors:

Information accuracy: Governments need reliable data to design effective policies.

Administrative feasibility: Policies must be practical to implement and enforce.

Unintended consequences: Price ceilings may create shortages, while subsidies may encourage inefficiency.

Opportunity cost: Public funds used for intervention could have alternative uses.

Applying Economic Models

Supply and Demand Framework

Economic models such as supply and demand analysis help illustrate the effects of both market outcomes and interventions:

A tax on a negative externality shifts the supply curve leftwards, reducing output to the socially optimal level.

A subsidy for a merit good shifts demand rightwards, raising consumption closer to the socially optimal level.

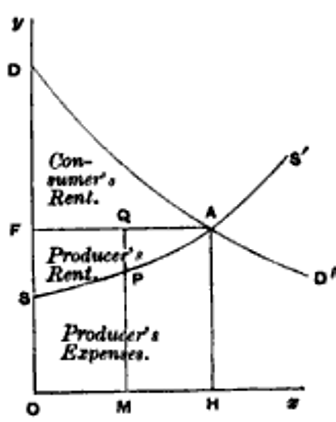

Marshall's Supply and Demand Graph demonstrates the equilibrium point where market supply equals demand, highlighting how prices and quantities are determined in a free market. This diagram serves as a fundamental model for analyzing market mechanisms. Source

Welfare Analysis

Welfare economics provides tools to assess gains and losses from market and government activity:

Consumer surplus: Benefit consumers receive from paying less than they are willing to pay.

Producer surplus: Benefit producers receive from selling at a price above minimum acceptable levels.

Deadweight loss: The net welfare loss from misallocation of resources due to either market failure or poor intervention.

Deadweight Loss: The loss of total economic welfare that occurs when equilibrium is not achieved or is distorted by market failure or intervention.

Deadweight loss diagrams are frequently used in exam answers to assess the impact of both markets and governments.

Evaluating Markets versus Government

Strengths of Market Allocation

Encourages innovation and efficiency.

Reflects consumer preferences quickly through price signals.

Minimises bureaucracy compared to state planning.

Weaknesses of Market Allocation

Prone to externalities and inequality.

Ignores non-market values (e.g., environmental protection, equity).

Fails to provide public goods.

Strengths of Government Intervention

Can address distributional concerns through taxation and transfers.

Provides essential public and merit goods.

Corrects externalities and protects vulnerable groups.

Weaknesses of Government Intervention

Government failure: Intervention may misallocate resources or worsen inefficiency.

Risk of regulatory capture by powerful industries.

High administrative costs and delays in policy implementation.

Government Failure: When government intervention in the economy leads to a misallocation of resources and a net welfare loss.

Thus, both market and government mechanisms must be evaluated relative to their ability to improve overall welfare.

Comparative Evaluation

Students should develop the ability to apply economic models (such as welfare diagrams and cost-benefit frameworks) to:

Compare market outcomes versus government intervention in different contexts.

Evaluate the relative merits and drawbacks of each system.

Recognise that neither markets nor governments are perfect, but both play crucial roles in resource allocation within a mixed economy.

FAQ

The most common models are supply and demand diagrams, often adapted to show shifts caused by government policies such as taxes or subsidies.

Welfare diagrams are also used, focusing on consumer and producer surplus and deadweight loss. These models make it easier to compare the efficiency and distributional impacts of markets versus interventions.

Cost–benefit analysis (CBA) weighs the social costs and benefits of different policies against market outcomes.

If benefits exceed costs, government action may improve welfare.

If costs outweigh benefits, it suggests intervention could cause government failure.

CBA is particularly useful when externalities are present, but outcomes depend on the accuracy of information.

A mixed economy combines market forces with government intervention. It recognises that while markets efficiently allocate many resources, governments address failures and equity concerns.

The extent of government involvement varies between countries, but the key is balance: too much reliance on markets risks inequality, while excessive intervention risks inefficiency.

Several factors shape effectiveness:

Quality of information: Poor data can cause both market and government failures.

Administrative capacity: Governments need resources to enforce regulation.

Cultural values: Societies place different emphasis on equity versus efficiency.

Scale of the issue: National problems (e.g., pollution) may require more government action than localised market failures.

Markets usually adjust quickly through price signals, while government policies often face delays.

Time lags arise because:

Policy design and approval take time.

Implementation and enforcement require administrative processes.

Effects may not be visible until long after intervention.

These lags can reduce the effectiveness of policies compared to the immediacy of market adjustments.

Practice Questions

Define government failure and give one example of how it may occur in practice. (3 marks)

1 mark for a correct definition of government failure: When government intervention leads to a misallocation of resources and a net welfare loss.

1 mark for identifying a valid example, e.g., subsidies encouraging inefficiency, price controls causing shortages, or regulatory capture.

1 mark for explaining how the example leads to inefficiency or welfare loss.

Using an economic model, explain how a subsidy for a merit good can improve resource allocation and assess one potential drawback of this intervention. (6 marks)

Up to 2 marks for correctly identifying and explaining a merit good (goods with positive externalities in consumption).

Up to 2 marks for use of an economic model, e.g., supply and demand diagram showing a rightward shift in demand (or effective demand) due to the subsidy.

1 mark for explaining how this leads to increased consumption closer to the socially optimal level (improved allocative efficiency).

1 mark for identifying and briefly evaluating a drawback of subsidies, e.g., opportunity cost for government spending, risk of inefficiency, or difficulty in targeting.