AQA Specification focus:

‘The use of indirect taxation, subsidies, price controls, state provision and regulation, the extension of property rights and pollution permits to correct market failure.’

Introduction

Government policy instruments aim to address market failure by influencing incentives, prices, and behaviour. They ensure resources are better allocated, improving efficiency and welfare outcomes.

Indirect Taxation

Indirect taxation involves levying taxes on goods and services, rather than directly on income. These can correct negative externalities by internalising external costs.

Indirect Tax: A tax imposed on expenditure, paid by producers but often passed onto consumers through higher prices.

Used to discourage harmful activities such as smoking or excessive alcohol consumption.

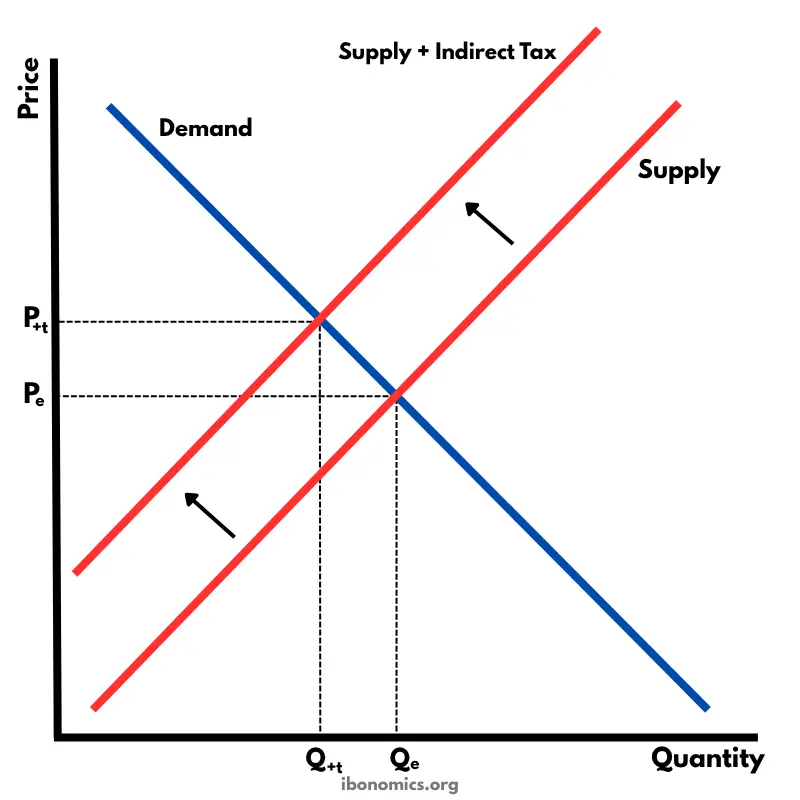

This diagram demonstrates how an indirect tax shifts the supply curve upward, leading to higher prices for consumers and reduced quantity traded, thereby addressing negative externalities. The image includes detailed labels for supply and demand curves, equilibrium points, and price effects. Source

Shifts supply curve upwards, increasing price and reducing quantity consumed.

Effective if demand is price elastic, less so if demand is inelastic (e.g., petrol).

Generates government revenue which can be reinvested in public services.

Subsidies

Subsidies involve payments from the government to producers or consumers to encourage the production or consumption of goods with positive externalities.

Subsidy: A financial grant provided by the government to reduce production costs and encourage increased supply or consumption of a good.

Examples include subsidies for renewable energy or education.

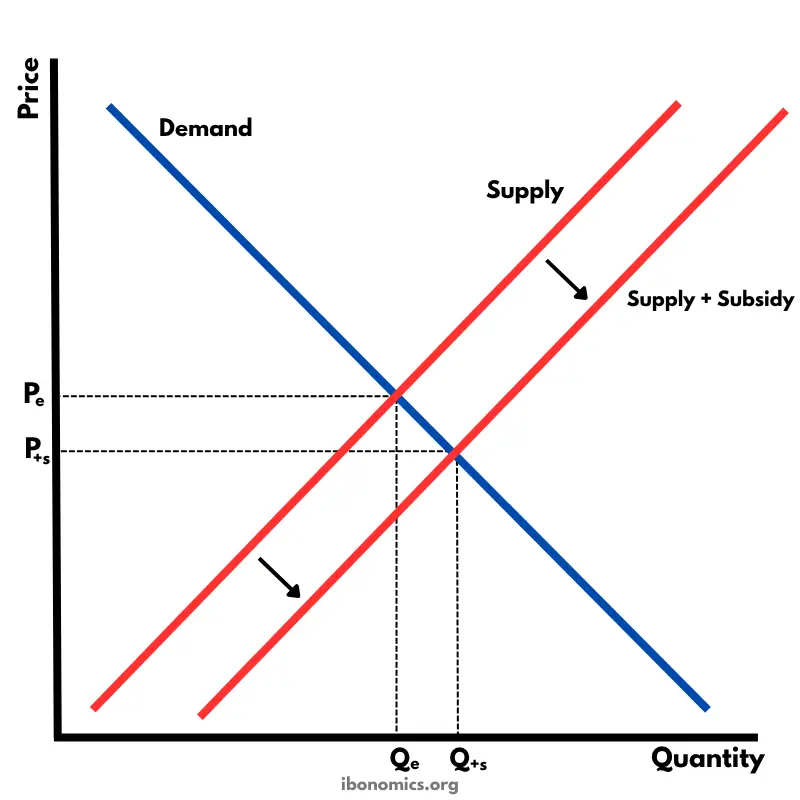

Shifts supply curve downward, reducing price and increasing output.

The diagram illustrates how a subsidy shifts the supply curve downward, decreasing the price for consumers and increasing the quantity supplied, thereby encouraging the production and consumption of goods with positive externalities. Source

Can lead to over-subsidisation or dependency if poorly targeted.

Opportunity cost exists, as subsidies require government spending that could be used elsewhere.

Price Controls

Price controls are direct interventions where the government sets a maximum or minimum legal price.

Maximum Prices (Price Ceilings)

Set below equilibrium to prevent excessive pricing, e.g., rent controls.

Protect consumers but may cause shortages and black markets.

Minimum Prices (Price Floors)

Set above equilibrium to guarantee income, e.g., minimum wage or alcohol pricing.

Supports producers but may cause excess supply (e.g., agricultural surpluses).

State Provision

State provision occurs when the government directly supplies goods and services, ensuring access regardless of income.

Typical in healthcare, education, and defence, which are often public goods or merit goods.

Overcomes under-provision caused by imperfect information or lack of profit motive.

Can ensure universal access but risks inefficiency and high costs if mismanaged.

Regulation

Regulation involves the government setting rules to influence economic behaviour.

Regulation: Legal rules imposed by the government to control the behaviour of firms and consumers in order to correct market failure.

Examples include pollution caps, smoking bans, and safety standards.

Provides certainty and protects consumers but may be costly to monitor and enforce.

Risks regulatory capture, where regulators serve the interests of firms rather than the public.

Property Rights

The absence of property rights often causes market failure, especially with environmental resources.

Property Rights: The legal ownership and control over resources, determining how they can be used, transferred, or sold.

Clear rights prevent the overuse of common resources, e.g., fisheries, forests.

Encourages responsible stewardship and investment.

However, difficult to assign in some cases, especially with global issues like climate change.

Pollution Permits

Tradable pollution permits are a market-based solution to reduce negative externalities by limiting emissions.

Pollution Permits: Government-issued allowances giving firms the right to emit a certain level of pollution, which can be traded between firms.

Cap overall pollution, creating scarcity and giving firms incentives to reduce emissions.

Efficient firms sell permits; less efficient firms buy them, minimising total costs.

Example: EU Emissions Trading Scheme.

Effectiveness depends on correct cap setting and monitoring compliance.

Evaluation of Policy Instruments

Each policy instrument has advantages and drawbacks:

Indirect taxes discourage harmful consumption but may be regressive.

Subsidies promote beneficial goods but carry opportunity costs.

Price controls protect groups but distort market signals.

State provision ensures access but risks inefficiency.

Regulation sets clear rules but is costly to enforce.

Property rights incentivise conservation but are complex to assign.

Pollution permits encourage efficiency but depend on accurate caps.

Governments often use a combination of instruments to address different aspects of market failure, balancing efficiency, equity, and practicality.

FAQ

If demand is price inelastic, consumption falls only slightly when prices rise, so the tax may not significantly reduce harmful behaviour.

For goods with elastic demand, a tax has a larger impact on quantity consumed, making it more effective in reducing negative externalities.

Governments often tax inelastic goods like petrol because they raise stable revenue, even if consumption reduction is limited.

A subsidy reduces costs for private firms or consumers, encouraging more supply or demand while markets still operate.

State provision bypasses the market, with the government directly providing the good or service.

Subsidy: Involves private sector delivery.

State provision: Involves public sector delivery, ensuring universal access.

Maximum prices can create shortages, leading to waiting lists or black markets.

Minimum prices may cause surpluses, resulting in wasted resources or government purchase of excess supply.

Both distort price signals, discouraging efficient allocation and innovation in the long run.

By assigning ownership, individuals or firms gain responsibility and incentives to manage resources sustainably.

Without property rights, resources like fisheries or forests are overused because no one bears the full cost.

Clear, enforceable property rights encourage conservation, investment, and efficient use.

They allow flexibility: firms can choose whether to cut emissions or buy permits.

Create incentives for innovation, as reducing emissions lowers costs.

Market trading ensures pollution reduction occurs at lowest overall cost.

Direct regulation, by contrast, imposes uniform limits and may not account for differences in firm efficiency.

Practice Questions

Define what is meant by an indirect tax and explain how it can be used to correct market failure. (2 marks)

1 mark for correctly defining an indirect tax (a tax on expenditure, levied on goods/services, collected by producers but passed on to consumers through higher prices).

1 mark for explaining its corrective function (internalises external costs/reduces consumption of goods with negative externalities).

Explain how subsidies and pollution permits can be used by governments to correct market failure. (6 marks)

Up to 2 marks for explaining subsidies:

Government payments to producers/consumers (1 mark).

Encourages production/consumption of goods with positive externalities (1 mark).

Up to 2 marks for explaining pollution permits:

Tradable allowances to emit a certain level of pollution (1 mark).

Provides incentives to reduce emissions/creates a cap on pollution (1 mark).

Up to 2 additional marks for clarity and development:

Clear explanation of how both measures correct misallocation of resources (1 mark).

Relevant real-world example or link to efficiency/welfare improvement (1 mark).