AQA Specification focus:

‘Consumer Prices and Retail Prices Indices (CPI/RPI)’

Measuring price changes through indices like the Consumer Prices Index (CPI) and Retail Prices Index (RPI) is essential for tracking inflation, informing policy, and guiding economic decision-making.

Price Indices and Inflation Measurement

A price index is a statistical measure that tracks changes in the price level of a basket of goods and services over time. It provides a way to measure inflation, the sustained rise in the general price level of goods and services in an economy.

Inflation: The sustained increase in the general price level of goods and services in an economy over a period of time.

Without reliable price indices, it would be difficult for governments, firms, or households to understand how living costs are evolving.

Consumer Prices Index (CPI)

The Consumer Prices Index (CPI) is the UK government’s preferred measure of inflation. It is used for setting inflation targets, wage negotiations, and as a key macroeconomic indicator.

Compiled by the Office for National Statistics (ONS).

Based on the expenditure patterns of an average household.

Uses a basket of goods and services, updated annually to reflect changing spending habits.

Employs a geometric mean to better reflect consumer substitution between goods.

CPI: A measure of inflation that tracks the weighted average of prices for a basket of goods and services purchased by an average household.

CPI excludes certain housing costs such as mortgage interest payments, which makes it narrower in scope than RPI.

Retail Prices Index (RPI)

The Retail Prices Index (RPI) is an older measure of inflation, still used for some wage negotiations, index-linked pensions, and student loan interest calculations.

Includes housing costs such as mortgage interest payments and council tax.

Uses the arithmetic mean, which often results in a higher reported inflation rate than CPI.

Less frequently used in government policy but remains significant in certain contracts and financial arrangements.

RPI: A measure of inflation that tracks changes in the cost of a representative basket of goods and services, including housing costs like mortgage payments.

The continued use of RPI, despite official preference for CPI, reflects its embedded role in older financial agreements.

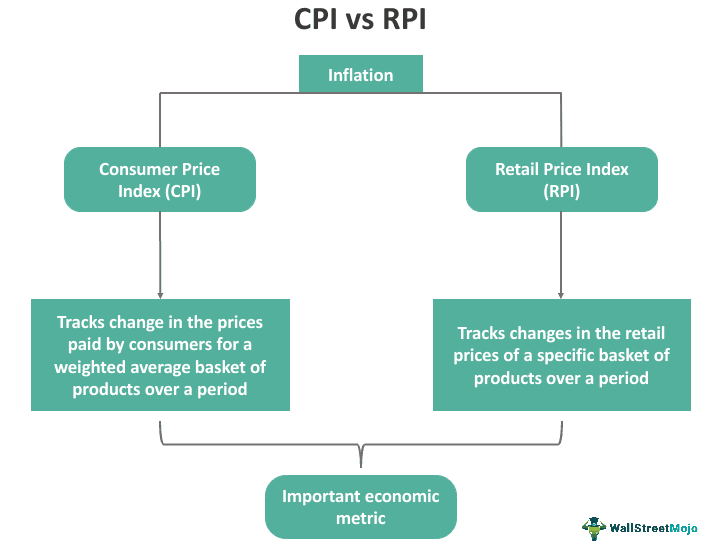

Differences between CPI and RPI

Although both indices aim to measure changes in the general price level, they differ in coverage and methodology:

Coverage of goods and services

CPI excludes most housing costs.

RPI includes housing-related expenses.

Population coverage

CPI excludes the top 4% of earners and pensioner households mainly dependent on state benefits.

RPI excludes high-income households and pensioner households entirely.

Calculation method

CPI uses the geometric mean.

RPI uses the arithmetic mean.

These differences mean RPI generally reports a higher inflation rate than CPI.

This diagram contrasts the Consumer Prices Index (CPI) and Retail Prices Index (RPI), highlighting differences in coverage, calculation methods, and population scope. Note that the image includes information on CPIH, which is not required by the syllabus. Source

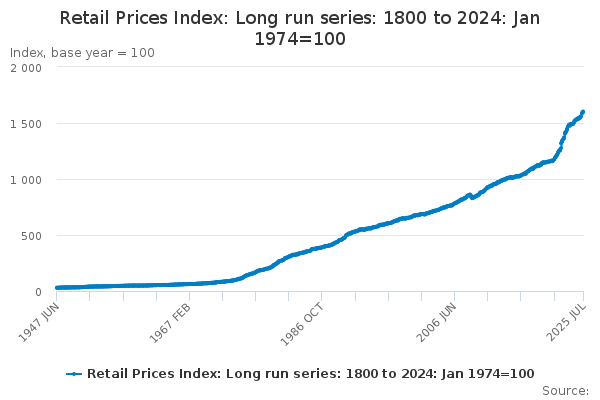

This graph depicts the long-term trends in the Retail Prices Index, highlighting periods of significant inflation and deflation. The image includes data up to 2024, which may be beyond the syllabus scope. Source

Construction of Price Indices

Both CPI and RPI are constructed using index number techniques:

Base Year

A specific year is chosen as the base year, with the index set to 100.

Changes in prices are then expressed relative to this base.

Weights

Each good or service in the basket is assigned a weight, reflecting its share in average household expenditure.

Items with higher expenditure shares (e.g. housing, transport) have greater influence on the index.

Process

Select basket of goods and services.

Collect price data from outlets nationwide.

Apply expenditure weights to calculate weighted averages.

Compute the index relative to the base year.

This methodology ensures the index reflects both changes in prices and consumer spending habits.

Importance of CPI and RPI in Policy and Economics

Price indices play a central role in economic management:

Monetary policy: The Bank of England targets inflation using CPI, influencing interest rate decisions.

Fiscal policy: Government spending and benefits are often adjusted in line with inflation measures.

Wages and contracts: Employers and trade unions use indices to negotiate wage increases.

Pensions and loans: Some financial products are index-linked to RPI.

Indexation: The adjustment of income, payments, or financial contracts in line with a price index to preserve purchasing power.

By anchoring expectations, these indices help stabilise the economy.

Criticisms and Limitations

While CPI and RPI are widely used, both face criticism:

Basket limitations: May not reflect spending patterns of all households, especially low-income groups.

Substitution bias: CPI’s geometric mean addresses substitution, but RPI does not.

Housing costs: Exclusion of mortgage payments in CPI makes it less reflective of housing pressures.

Comparability: CPI is aligned with international standards (HICP), making cross-country comparisons easier than with RPI.

Despite limitations, these indices remain crucial tools for measuring and understanding inflation in the UK.

FAQ

CPI is internationally comparable as it follows the standards set by the EU’s Harmonised Index of Consumer Prices (HICP). This consistency allows comparisons with other economies.

CPI’s use of the geometric mean is considered more accurate as it reflects consumer substitution behaviour when relative prices change. In contrast, RPI tends to overstate inflation.

The basket is updated annually to reflect changing consumer habits. For example, items like streaming subscriptions may be added while outdated products are removed.

This ensures the indices remain relevant and accurately represent current household spending patterns.

Weights reflect the proportion of household expenditure on each category of goods or services.

Higher weights are assigned to essentials like housing and transport.

Lower weights are given to less common expenditures.

This system ensures that items making up a larger share of spending have greater influence on the index.

RPI includes housing costs such as mortgage interest payments and council tax, which can rise faster than other prices.

It also uses the arithmetic mean, which does not account for substitution effects, leading to a higher overall figure than CPI.

CPI influences national economic policy, such as interest rate changes by the Bank of England, which impacts borrowing costs and savings.

RPI, while less used in policy, directly affects households through index-linked pensions, student loan interest, and some wage agreements, making it significant in personal finances.

Practice Questions

Define the Consumer Prices Index (CPI). (2 marks)

1 mark for identifying CPI as a measure of inflation or a price index.

1 mark for stating it is based on a weighted basket of goods and services purchased by an average household.

Explain two differences between the Consumer Prices Index (CPI) and the Retail Prices Index (RPI). (6 marks)

Up to 2 marks for each valid difference (max 4 marks). Examples:

CPI excludes housing costs such as mortgage interest payments, whereas RPI includes them.

CPI uses the geometric mean, RPI uses the arithmetic mean.

CPI is the UK’s target inflation measure, RPI is mainly used in pensions and some contracts.

Up to 2 marks for development, such as:

Explaining why using the geometric mean in CPI reflects consumer substitution behaviour.

Stating that RPI typically reports a higher inflation rate because of its methodology and inclusion of housing costs.

(Total 6 marks)