AQA Specification focus:

‘measures of unemployment, productivity and the balance of payments on current account.’

Labour market and productivity indicators are vital for measuring macroeconomic performance, revealing the efficiency of employment, resource allocation, and competitiveness in domestic and global contexts.

Labour Market Indicators

Labour market indicators provide insights into the overall employment situation, the efficiency of labour use, and potential pressures on the economy.

Unemployment

Unemployment is one of the key labour market indicators. It represents the proportion of people in the labour force who are actively seeking but unable to find work.

Unemployment: The situation in which individuals who are willing and able to work at the current wage rate are unable to find employment.

Different measures of unemployment provide varied perspectives on the labour market:

Claimant Count: Measures those claiming unemployment-related benefits.

Labour Force Survey (LFS): An International Labour Organisation (ILO) compliant survey that counts anyone without a job, available to start within two weeks, and actively seeking work.

The LFS often produces higher unemployment figures than the claimant count because not all unemployed individuals qualify for benefits.

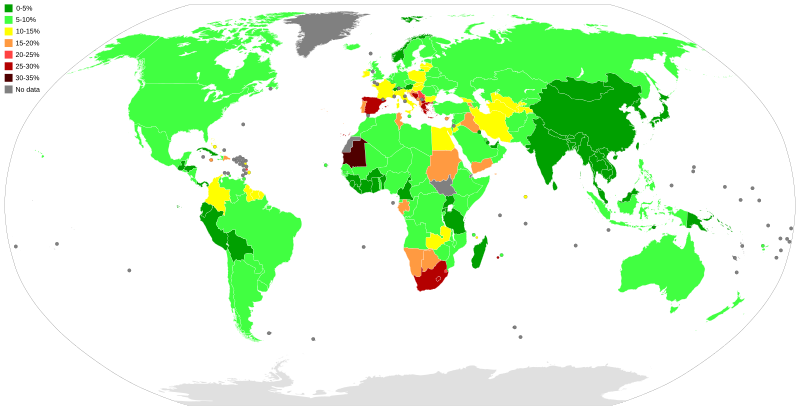

This map displays the unemployment rates by country as reported by the International Labour Organization in 2013. It offers a comparative view of global unemployment trends, highlighting regional disparities. Note: The data is from 2013 and may not reflect current statistics. Source

Employment Rate

The employment rate shows the percentage of the working-age population that is currently in work. This indicator complements unemployment figures to provide a fuller picture of the labour market.

Participation Rate

The participation rate measures the proportion of the working-age population that is economically active (employed or actively seeking work). A falling participation rate may conceal weaknesses in the labour market despite falling unemployment.

Types of Unemployment

Understanding the different types of unemployment helps to diagnose structural issues in the economy:

Cyclical unemployment: Caused by downturns in the business cycle.

Structural unemployment: Results from mismatches between workers’ skills and job opportunities.

Frictional unemployment: Short-term unemployment occurring when people move between jobs.

Seasonal unemployment: Occurs in industries with seasonal demand (e.g. tourism, agriculture).

Each type has distinct policy implications, making them important for government intervention strategies.

Productivity Indicators

Labour Productivity

Labour productivity is one of the most significant measures of economic efficiency.

Labour Productivity: Output per worker or output per hour worked, used to assess how effectively labour is utilised.

Higher productivity generally leads to higher living standards, as more output can be produced with the same inputs, enabling real wage growth and economic expansion.

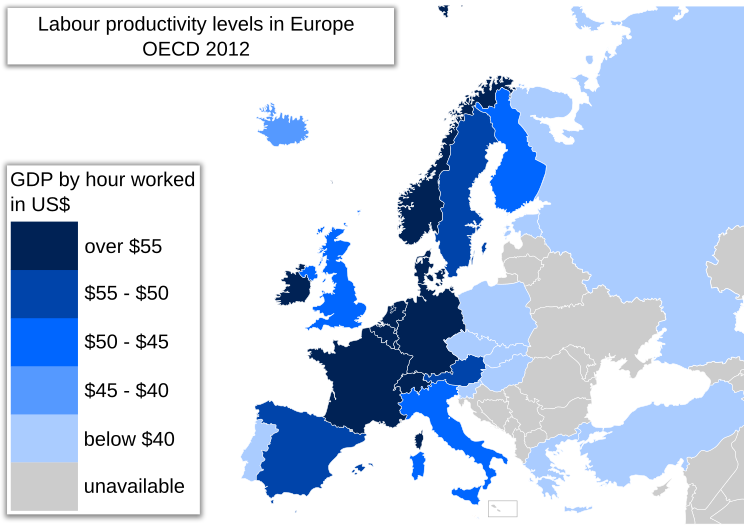

The chart presents labour productivity levels in Europe, measured as GDP per hour worked, based on OECD data from 2007. It highlights variations in productivity among European nations. Note: The data is from 2007 and may not reflect current statistics. Source

Labour Productivity = Total Output ÷ Number of Workers (or Hours Worked)

Output: Measured as real GDP or industry-specific output.

Workers: The total number of people employed, or hours worked for a more precise measure.

Multifactor Productivity

In addition to labour productivity, economists often consider multifactor productivity (MFP), which measures output relative to combined inputs such as labour and capital. MFP provides a broader picture of efficiency improvements, particularly through innovation or better management practices.

Importance of Productivity Indicators

Productivity growth is vital because it:

Enhances international competitiveness by lowering unit costs.

Supports sustainable economic growth without inflationary pressures.

Influences wages and living standards, as productivity increases allow real wage growth.

Helps to manage public finances, as higher output generates more tax revenue.

Balance of Payments on Current Account

The specification also links labour market and productivity indicators to the balance of payments on current account. This indicator records all transactions of goods, services, investment income, and transfers between residents of a country and the rest of the world.

Balance of Payments on Current Account: A measure of trade in goods and services, investment income, and transfers between a country and its trading partners.

Current Account Components

The current account consists of four main elements:

Trade in goods: Exports and imports of physical products.

Trade in services: Exports and imports of intangible items (e.g. financial services, tourism).

Primary income: Income from overseas investments minus payments to foreign investors.

Secondary income: Transfers such as remittances, aid, or EU contributions.

Link with Labour Market and Productivity

The current account position often reflects labour market and productivity performance:

High productivity enhances competitiveness, supporting export growth and reducing deficits.

Weak productivity growth may cause reliance on imports, leading to current account deficits.

Unemployment levels affect consumption patterns, influencing the demand for imports.

Interrelationships between Indicators

Labour market, productivity, and current account measures are interconnected:

Rising unemployment reduces tax revenue and increases welfare payments, straining public finances.

Productivity growth lowers production costs, improving international competitiveness and supporting current account balance.

A persistent current account deficit can signal structural issues in productivity or competitiveness, affecting labour market outcomes.

Policy Relevance

Governments and policymakers use these indicators to guide economic policy:

Monetary policy: Interest rate adjustments depend on unemployment levels and productivity growth.

Fiscal policy: Taxation and spending decisions are influenced by labour market conditions.

Supply-side policies: Education, training, and investment in technology aim to improve productivity and reduce structural unemployment.

Labour market and productivity indicators therefore provide a framework for assessing the overall health and efficiency of an economy, ensuring policies target both stability and long-term growth.

FAQ

The claimant count only includes those eligible and claiming unemployment-related benefits, while the Labour Force Survey measures anyone actively seeking work regardless of benefit status.

This means the claimant count often underestimates unemployment, as not all unemployed individuals qualify for benefits. The LFS is internationally comparable, aligning with ILO standards, making it a more widely used indicator in policy and analysis.

Measuring productivity per hour accounts for variations in working patterns, such as part-time and overtime work.

If productivity were measured solely per worker, it could misrepresent efficiency where working hours differ significantly. Using output per hour gives a more precise indicator of efficiency and international competitiveness.

Cyclical unemployment rises during economic downturns, leading to increased government spending on welfare benefits.

At the same time, tax revenues fall due to reduced incomes and lower consumer spending. This combination can widen budget deficits and limit the government’s ability to fund other economic priorities.

MFP considers multiple inputs such as capital, labour, and technology, making data collection and calculation more complex.

Unlike labour productivity, which uses straightforward measures of output and employment, MFP requires detailed estimates of how inputs combine. This makes it more useful for long-term growth studies but less practical for short-term policy decisions.

Higher productivity allows firms to produce more output with the same input, lowering unit costs.

If firms pass these gains to workers, real wages can rise without causing inflation. However, this depends on bargaining power, labour market conditions, and whether firms retain profits for investment rather than raising wages.

Practice Questions

Define labour productivity. (2 marks)

1 mark for recognising productivity relates to output relative to inputs.

1 mark for stating specifically that it is output per worker or output per hour worked.

Explain how an increase in labour productivity could affect the balance of payments on the current account. (6 marks)

1 mark: Identifies that higher productivity lowers unit costs of production.

1 mark: Explains that lower costs can improve international competitiveness.

1 mark: Identifies potential for increased exports.

1 mark: Explains that higher exports improve the current account balance.

1 mark: Identifies potential for reduced imports due to stronger domestic supply.

1 mark: Explains that both higher exports and reduced imports could reduce a current account deficit or create a surplus.