AQA Specification focus:

‘the balance of payments on current account.’

Introduction

The current account is a crucial measure of a country’s international economic performance, reflecting trade in goods and services, investment incomes, and transfers with the rest of the world.

Understanding the Current Account

The current account is part of a nation’s balance of payments, which records all financial transactions between residents of a country and the rest of the world. It provides a comprehensive snapshot of the nation’s economic interactions.

Components of the Current Account

The current account consists of four key elements:

Trade in goods: Exports and imports of physical items such as cars, machinery, food, and raw materials.

Trade in services: Transactions involving intangible goods, for example financial services, education, and tourism.

Primary income (investment income): Earnings from foreign investments, such as interest, dividends, and profits earned abroad, minus similar payments to overseas investors.

Secondary income (transfers): Non-commercial transfers such as remittances, foreign aid, and EU contributions.

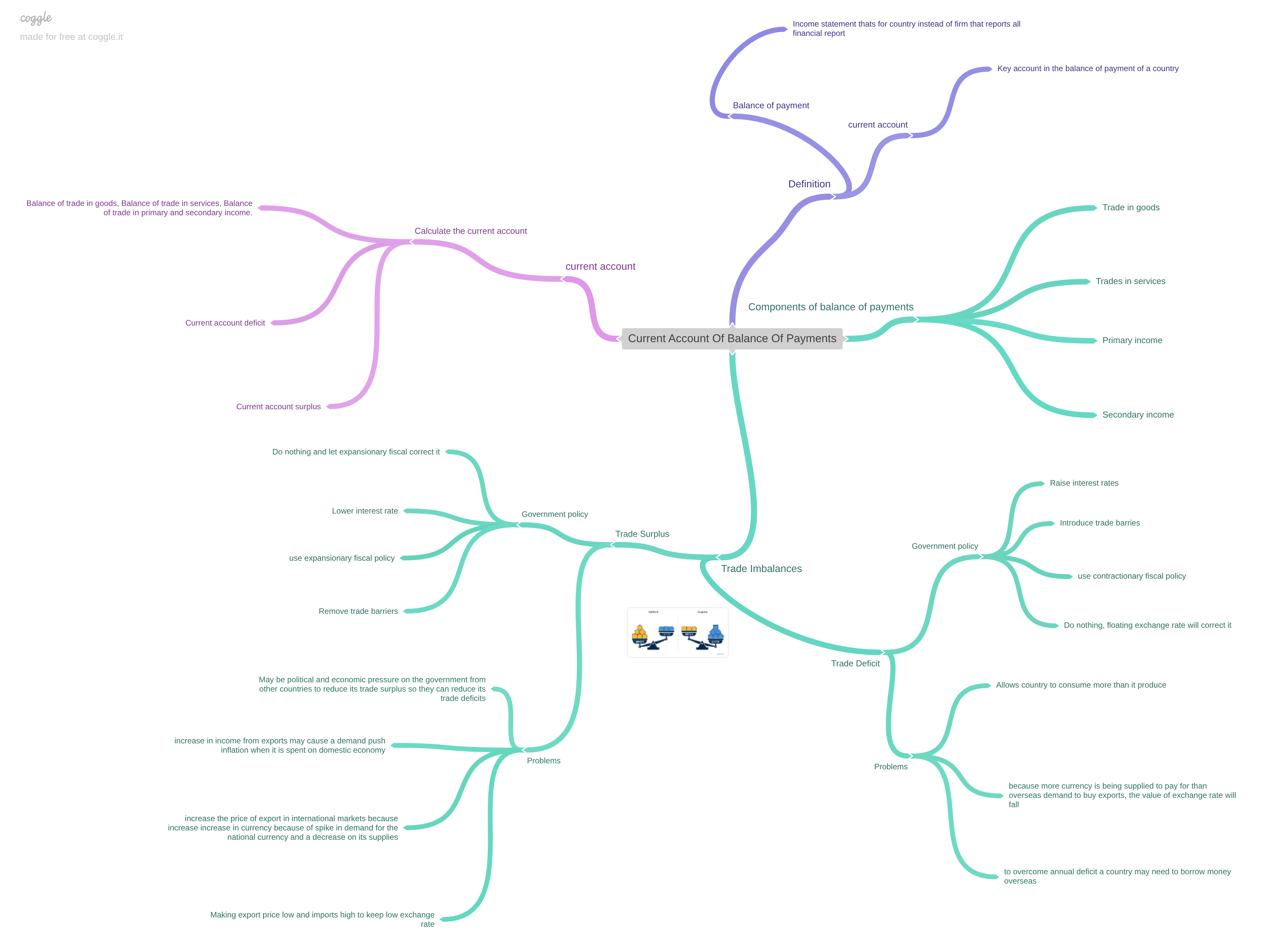

This diagram illustrates the four primary components of the current account: trade in goods, trade in services, primary income, and secondary income. It provides a clear visual representation of how each component contributes to the overall current account balance. Source

Current Account: A record of a nation’s trade in goods and services, primary income, and secondary income with the rest of the world.

The overall current account balance is calculated as the sum of these components, showing whether a country runs a current account surplus or a current account deficit.

Measuring the Current Account

The balance on the current account is expressed as:

Current Account Balance = (Exports of Goods + Exports of Services + Primary Incomes + Secondary Incomes) – (Imports of Goods + Imports of Services + Outflows of Incomes + Transfers Abroad)

Exports/Imports = Value of trade in goods and services (£)

Primary Incomes = Investment earnings and payments (£)

Secondary Incomes = Transfers such as remittances or aid (£)

If exports and inflows exceed imports and outflows, there is a surplus; the opposite results in a deficit.

Causes of Current Account Surpluses and Deficits

The position of a country’s current account can be influenced by many factors:

Competitiveness: High productivity and competitive industries boost exports.

Exchange rates: A strong currency makes exports expensive and imports cheap, leading to deficits; a weak currency has the reverse effect.

Economic growth: Rapid domestic growth often increases demand for imports, widening deficits.

Relative inflation: Higher inflation than trading partners reduces export competitiveness.

Resource endowment: Natural resources can create persistent surpluses through commodity exports.

Structural factors: Long-term patterns, such as reliance on low-value exports or high import dependency.

Implications of Current Account Balances

Surpluses

Indicate strong export performance or high levels of foreign income.

Provide extra foreign currency reserves.

Can create tensions, as trading partners with deficits may push for adjustments.

Deficits

Suggest that a country is consuming more than it produces internationally.

May require financing through borrowing or drawing on reserves.

Persistent deficits can weaken confidence in the currency and reduce investment attractiveness.

Current Account Deficit: A situation where a country’s imports of goods, services, and income exceed its exports and inflows.

Policy Responses to Current Account Imbalances

Governments and central banks may adopt measures to address imbalances:

Exchange rate adjustments: Devaluation or depreciation can boost export competitiveness.

Demand management policies: Tightening monetary or fiscal policy to reduce import demand.

Supply-side policies: Enhancing productivity and competitiveness of domestic industries.

Protectionist measures: Tariffs or quotas (though restricted by international agreements).

These policies often create trade-offs with other macroeconomic objectives such as growth, inflation, and employment.

Current Account in the UK Context

The UK has historically run a current account deficit, driven by:

High demand for imported consumer goods.

Declines in manufacturing competitiveness.

Reliance on service exports, particularly financial services, which offset but do not eliminate the goods deficit.

Significant income outflows to foreign investors.

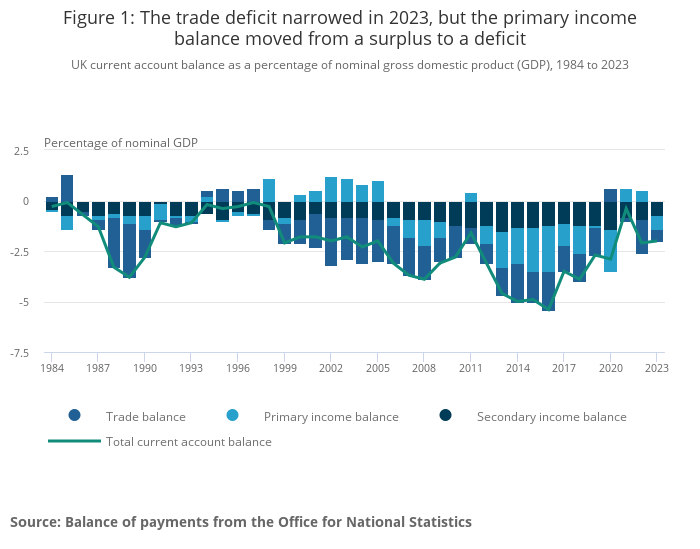

This chart depicts the UK's current account balance as a percentage of GDP from 1984 to 2023. It illustrates the fluctuations between surpluses and deficits, offering insights into the country's external economic position over time. Source

Importance for Economic Performance

The sustainability of a current account position depends on:

The size of the deficit relative to GDP.

How it is financed (e.g., through foreign investment inflows).

Confidence of international markets in the country’s economic stability.

Link to Other Macroeconomic Objectives

The current account interacts closely with the main objectives of government economic policy:

Economic growth: Strong growth may widen deficits due to imports.

Price stability: A weaker exchange rate to improve the current account can increase import prices, fuelling inflation.

Unemployment: Export industries supported by a competitive current account help sustain employment.

Balance of payments stability: The current account is central to maintaining sustainable international trade and investment flows.

In practice, governments must carefully manage these trade-offs to maintain both domestic and external stability.

FAQ

The current account records trade in goods, services, investment income, and transfers.

The capital and financial accounts deal with flows of assets and liabilities, such as foreign direct investment, portfolio investment, and changes in foreign exchange reserves.

The key difference is that the current account focuses on day-to-day international transactions, while the capital and financial accounts focus on cross-border flows of money for investment purposes.

Goods are more sensitive to exchange rate movements, commodity prices, and consumer demand shifts.

Services, such as education, tourism, and financial services, are less reliant on physical trade logistics and can remain more stable.

Additionally, goods trade depends heavily on global supply chains and transportation costs, which can fluctuate significantly with global economic conditions.

Remittances are recorded as secondary income within the current account.

They are funds sent home by individuals working abroad and can significantly improve the current account position of countries reliant on them.

For example, developing economies often experience reduced deficits or even surpluses when remittances form a large share of their inflows.

A strong currency makes exports more expensive in foreign markets, reducing demand for them.

It also lowers the cost of imports, leading to greater demand for foreign goods and services.

Combined, these effects tend to reduce inflows and increase outflows, thereby widening the current account deficit.

Developed economies often hold large overseas investments that generate dividends, profits, and interest.

These earnings count as primary income inflows and can partially offset trade deficits.

However, if foreign investors own many assets within the country, significant outflows of investment income may outweigh inflows, worsening the current account position.

Practice Questions

Define a current account deficit. (2 marks)

1 mark for stating that imports of goods, services, and income exceed exports and inflows.

1 mark for recognising that this results in more money leaving the economy than entering.

Explain two possible causes of a persistent current account deficit in a country such as the UK. (6 marks)

Up to 3 marks for each cause, max 6 marks in total.

Identification of a cause (1 mark each).

Clear explanation of the mechanism by which the cause leads to a deficit (1–2 marks each).

Possible causes include:

Strong domestic demand for imports due to rising incomes.

Loss of international competitiveness (e.g., higher relative inflation, productivity issues).

An overvalued exchange rate making exports expensive and imports cheap.

Structural reliance on imported goods and raw materials.