AQA Specification focus:

‘Demand-pull and cost-push influences on the price level.’

Economic growth, unemployment, and inflation are interlinked, but understanding demand-pull and cost-push inflation is essential to see how price levels are influenced.

Demand-Pull Inflation

Demand-pull inflation arises when aggregate demand (AD) in the economy grows faster than aggregate supply (AS). This excess demand places upward pressure on prices.

Demand-Pull Inflation: A sustained rise in the general price level caused by increases in aggregate demand exceeding the economy’s productive capacity.

Causes of Demand-Pull Inflation

Factors that can increase aggregate demand include:

Higher consumer spending: driven by rising disposable incomes, lower taxation, or greater consumer confidence.

Increased investment: when firms expand capacity due to higher profits or easier access to credit.

Government expenditure: expansionary fiscal policy can stimulate demand.

Export growth: a weaker exchange rate or higher foreign demand increases net exports.

When AD shifts rightward beyond full employment output, the economy faces demand-pull inflation.

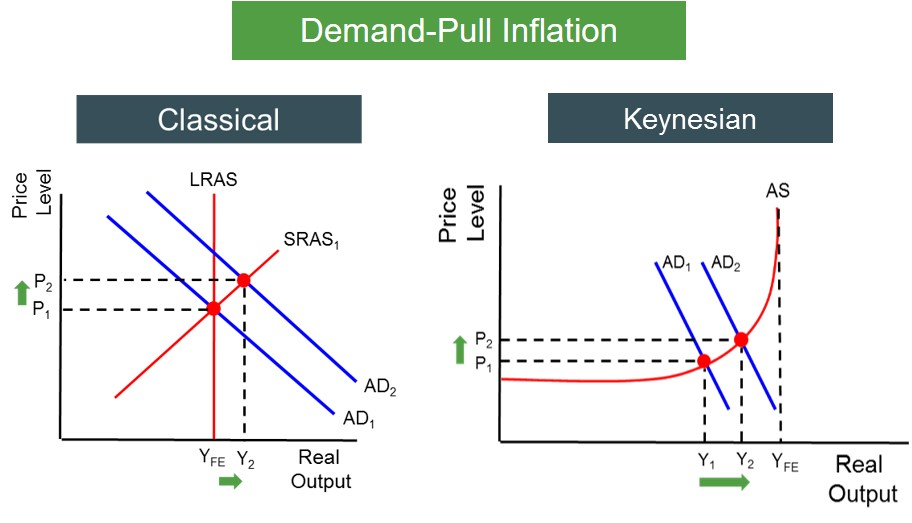

This diagram shows a rightward shift in the aggregate demand curve from AD1 to AD2, leading to an increase in the price level from P1 to P2, illustrating demand-pull inflation. Source

Characteristics of Demand-Pull Inflation

Typically associated with booms in the economic cycle.

May be short-lived if supply adjusts, but persistent if demand continually outpaces supply.

Often linked with positive output gaps (when actual GDP exceeds potential GDP).

Cost-Push Inflation

Cost-push inflation occurs when firms experience rising costs of production, leading them to increase prices to maintain profit margins.

Cost-Push Inflation: A rise in the general price level caused by higher production costs passed onto consumers in the form of increased prices.

Causes of Cost-Push Inflation

Rising wages: if wage growth exceeds productivity, unit labour costs rise.

Higher raw material prices: especially oil, gas, and food, which have widespread effects.

Depreciation of the currency: increases import costs, raising input prices.

Supply-side shocks: such as natural disasters or geopolitical conflicts disrupting production.

Characteristics of Cost-Push Inflation

Can occur independently of demand levels, even in stagnant economies.

Creates a negative supply shock, shifting AS leftwards.

May coexist with rising unemployment — leading to stagflation (inflation plus stagnant growth).

Comparing Demand-Pull and Cost-Push

Key Distinctions

Source: demand-pull stems from excess demand; cost-push from rising costs.

Impact on output: demand-pull usually increases real output and employment before inflationary pressure sets in; cost-push can reduce output while raising prices.

Policy response: demand-pull may require contractionary monetary or fiscal policy; cost-push may demand supply-side policies or temporary tolerance of higher inflation.

Interaction Between the Two

Inflation is rarely driven solely by one type:

Demand-pull inflation can trigger higher wages, reinforcing cost-push effects.

Cost-push shocks can reduce real incomes, prompting government stimulus that reignites demand-pull pressures.

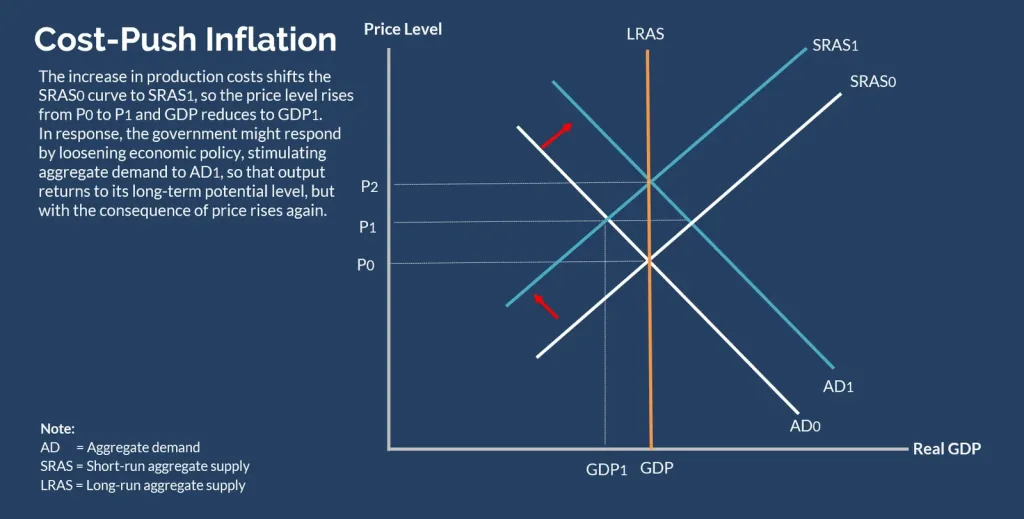

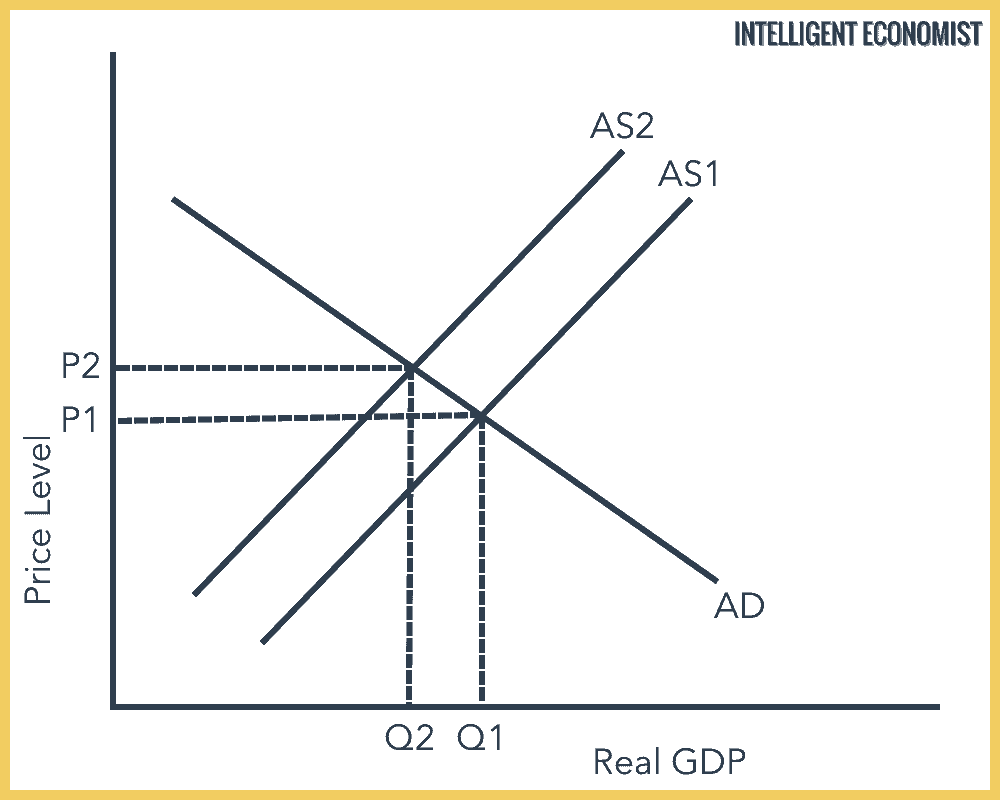

This diagram compares demand-pull and cost-push inflation within the AD/AS model, illustrating how each type affects the price level and output differently. Source

Demand-Pull in the AD/AS Model

When aggregate demand shifts rightward (AD1 → AD2) beyond the economy’s long-run productive capacity (LRAS), the price level rises (P1 → P2). This illustrates demand-pull inflation.

Cost-Push in the AD/AS Model

When short-run aggregate supply shifts leftward (SRAS1 → SRAS2), the price level rises (P1 → P2) while output falls (Y1 → Y2). This illustrates cost-push inflation.

This diagram illustrates cost-push inflation, where an increase in production costs shifts the SRAS curve leftward from SRAS1 to SRAS2, resulting in a higher price level from P1 to P2 and a decrease in output from Y1 to Y2. Source

Evaluation Points

Students should be able to evaluate:

Relative importance of causes: Is inflation mainly demand-driven or cost-driven at a given time?

Short vs long run: Cost-push shocks may fade, while persistent demand-pull requires sustained policy action.

Impact on policy trade-offs: Tackling demand-pull risks slowing growth, while tackling cost-push may worsen unemployment.

Policy Implications

Demand-Pull Inflation:

Use contractionary monetary policy (higher interest rates) to curb spending.

Reduce fiscal stimulus to ease demand pressures.

Cost-Push Inflation:

Promote supply-side reforms (improving productivity, reducing bottlenecks).

Temporary government subsidies or tax relief to shield producers and consumers.

Exam Relevance

Students should demonstrate understanding of:

The distinct causes of inflation under the AQA specification focus.

The ability to apply AD/AS diagrams to show demand-pull and cost-push processes.

The capacity to link real-world examples such as oil price shocks or rapid growth in emerging markets.

FAQ

Wage-price spirals occur when workers demand higher wages to keep up with rising prices, and firms then raise prices further to cover higher wage costs.

This feedback loop sustains inflation even without additional demand, making cost-push inflation persistent and harder to control.

A positive output gap arises when actual GDP exceeds potential GDP.

Firms operate beyond sustainable capacity.

Resources, such as labour, are over-utilised.

Prices rise as firms bid up wages and input costs.

This condition commonly underpins demand-pull inflation.

Yes, they often overlap.

For instance, rapid growth (demand-pull) may increase wages, raising production costs (cost-push). Similarly, a supply shock can reduce output, prompting governments to stimulate demand, combining both pressures.

Demand-pull inflation can usually be managed with contractionary policies like raising interest rates.

Cost-push inflation is trickier because reducing demand does not resolve supply shocks. It risks worsening unemployment and slowing growth, creating a policy dilemma.

If households and firms expect higher prices, their behaviour reinforces inflation.

In demand-pull, consumers spend more now to avoid future price rises.

In cost-push, firms pre-emptively raise prices to protect margins.

In both cases, expectations can make inflation self-fulfilling.

Practice Questions

Define cost-push inflation. (2 marks)

1 mark for stating that cost-push inflation is caused by rising costs of production.

1 mark for explaining that these higher costs are passed on to consumers in the form of higher prices.

Using an AD/AS diagram, explain how demand-pull inflation differs from cost-push inflation. (6 marks)

Up to 2 marks for correctly describing demand-pull inflation as being caused by an outward shift of aggregate demand.

Up to 2 marks for correctly describing cost-push inflation as being caused by a leftward shift of short-run aggregate supply.

1 mark for recognising the difference in economic effects: demand-pull usually raises output and employment initially, while cost-push can reduce output.

1 mark for accurate use of an AD/AS diagram with labels showing price level and output changes.