AQA Specification focus:

‘The consequences of inflation for both individuals and the performance of the economy.’

Introduction

Inflation, the sustained rise in the general price level, has wide-ranging consequences. It affects individuals, businesses, governments, and the overall performance of an economy in complex ways.

Consequences of Inflation for Individuals

Reduced Purchasing Power

When inflation rises, the real value of money falls. This means that households can buy fewer goods and services with the same nominal income.

People on fixed incomes (e.g., pensioners or those with fixed-wage contracts) suffer most, as their income does not rise in line with prices.

Savers may see the real value of savings eroded, particularly if interest rates are lower than the rate of inflation.

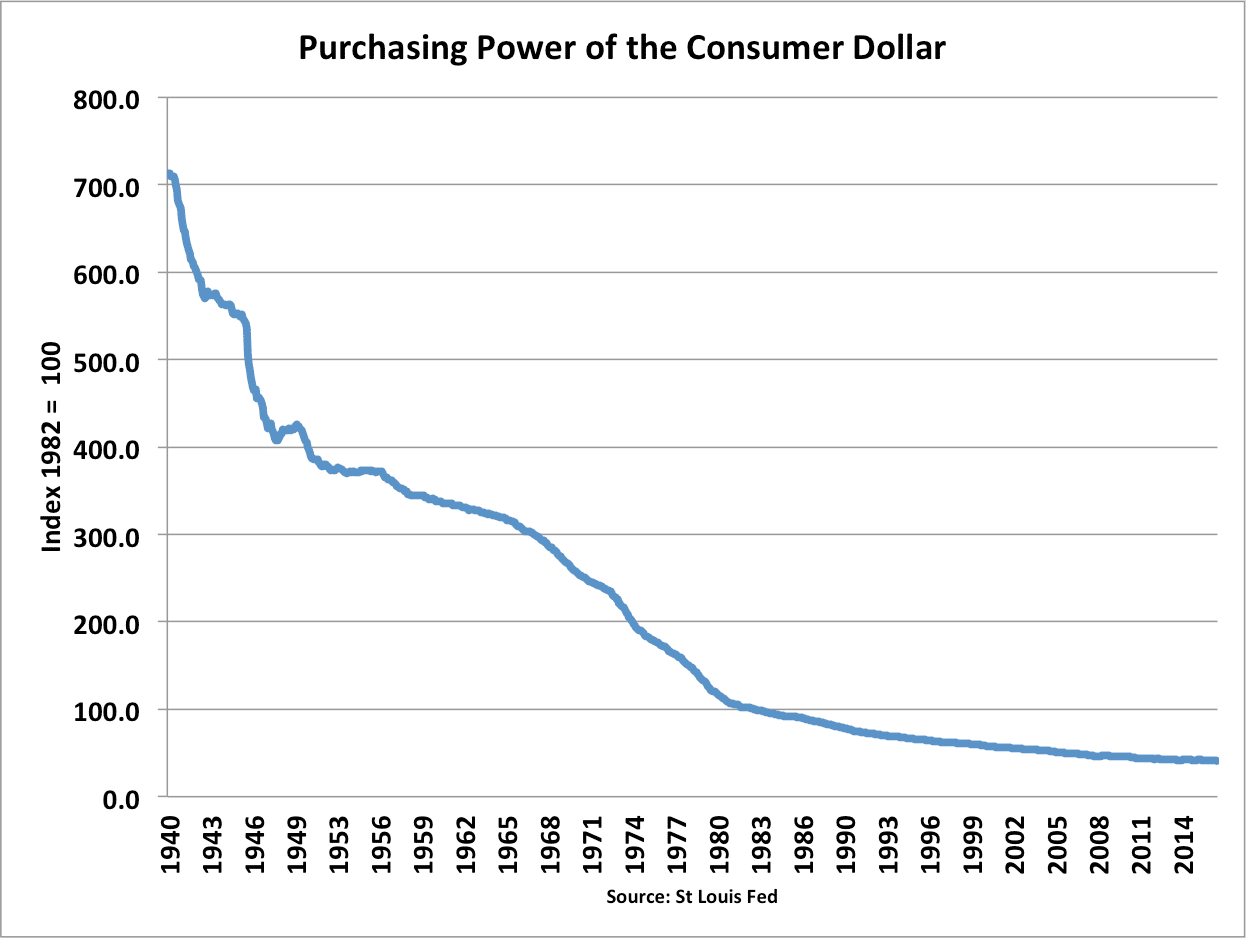

The graph illustrates the decline in the purchasing power of the US dollar from 1940 to 1996, emphasizing the impact of inflation on the value of savings over time. Source

Real income: Income adjusted for the effects of inflation, showing the actual purchasing power of money.

Impact on Borrowers and Lenders

Inflation redistributes income between borrowers and lenders:

Borrowers benefit if inflation is higher than expected, as they repay loans with money that is worth less in real terms.

Lenders lose out if interest payments do not keep up with inflation, reducing the real return on lending.

Menu Costs and Shoe-Leather Costs

Frequent price changes cause menu costs (the cost of physically changing prices) for firms, which are ultimately passed on to consumers.

Consumers may also face shoe-leather costs, such as time and effort spent managing money more actively in a high-inflation environment.

Consequences of Inflation for the Economy

Loss of International Competitiveness

If domestic inflation is higher than that of trading partners:

UK exports become less competitive abroad.

Imports become relatively cheaper, worsening the balance of payments on current account.

This may contribute to a trade deficit and weaken the currency over time.

Distortion of Price Signals

Inflation can obscure changes in relative prices:

Producers may struggle to distinguish between genuine demand increases and general price rises.

This leads to misallocation of resources and reduced efficiency in the economy.

Uncertainty and Investment

High and unpredictable inflation generates uncertainty:

Firms find it harder to forecast costs and revenues.

This discourages long-term investment, reducing the economy’s future growth potential.

Effects on Employment and Growth

Short-Run Trade-Offs

Moderate demand-pull inflation may stimulate growth and reduce unemployment in the short run, as firms expand production to meet rising demand.

However, persistent inflation can lead to wage-price spirals, where rising wages push costs and prices even higher.

Wage-price spiral: A situation where rising wages increase production costs, leading firms to raise prices, which then prompts further wage demands.

Long-Run Consequences

If inflation remains unchecked:

The central bank may tighten monetary policy, raising interest rates.

Higher borrowing costs reduce aggregate demand, slowing growth and potentially increasing unemployment.

Government and Fiscal Implications

Fiscal Drag

Inflation causes fiscal drag, where individuals are pushed into higher tax brackets despite no real increase in purchasing power. This boosts tax revenues but reduces disposable income.

Real Value of Debt

Governments benefit if inflation reduces the real value of existing public debt, making repayments less costly in real terms. However, persistent inflation may increase borrowing costs if investors demand higher interest rates.

Distributional Effects

Winners and Losers

Inflation does not affect all groups equally:

Winners: Borrowers, workers with strong unions able to negotiate wage increases.

Losers: Savers, fixed-income households, and those unable to secure higher wages.

Income Inequality

Uneven impacts of inflation may widen income inequality, as vulnerable groups are disproportionately affected.

Hyperinflation as an Extreme Case

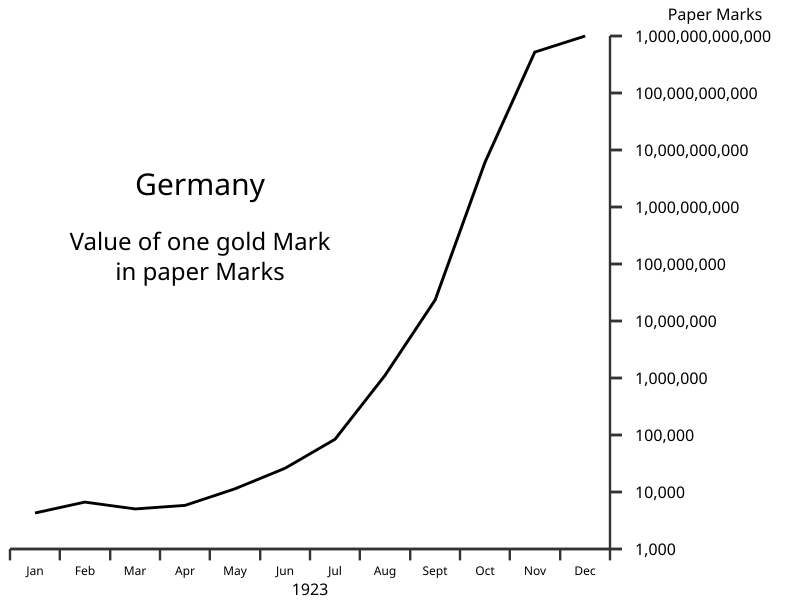

Although rare in advanced economies, hyperinflation shows the extreme consequences of inflation:

Collapse in confidence in money.

Shift to alternative currencies or barter systems.

Severe economic dislocation and loss of living standards.

The chart shows the steep decline in the value of the German Papiermark during the 1923 hyperinflation, exemplifying the severe effects of uncontrolled inflation on a currency's value. Source

Hyperinflation: Extremely rapid and out-of-control price increases, often exceeding 50% per month.

Key Macroeconomic Risks

Reduced investment due to uncertainty.

Balance of payments problems from loss of competitiveness.

Higher unemployment if corrective policies contract demand.

Reduced growth potential if long-term planning and resource allocation are disrupted.

FAQ

Unanticipated inflation creates greater uncertainty because households and firms cannot plan effectively. This often leads to misallocation of resources and reduced investment.

Anticipated inflation, by contrast, allows wage agreements and interest rates to adjust in advance, reducing some of the negative effects. However, even anticipated inflation still involves menu costs and distortions in tax brackets.

Inflation tends to affect low-income households more severely because they spend a larger share of their income on essentials, such as food and energy, which may rise quickly in price.

Meanwhile, wealthier households may own assets, such as property or shares, that often rise in value with inflation, protecting their purchasing power. This difference increases income and wealth inequality.

If people expect inflation to continue, they may adjust behaviour in ways that reinforce it.

Workers may demand higher wages in anticipation of rising prices.

Firms may raise prices more aggressively, assuming costs will increase.

Savers and investors may switch to assets seen as “inflation-proof,” affecting financial markets.

These expectations can intensify wage-price spirals and reduce confidence in money.

Sustained inflation can discourage long-term investment, as businesses find it difficult to predict costs and future revenues. This undermines capital formation, reducing potential growth.

Moreover, high inflation may force governments and central banks to prioritise stability over investment-friendly policies, slowing productivity improvements and damaging competitiveness.

When a country has higher inflation than its trading partners, exports become less competitive, as foreign buyers face higher relative prices.

At the same time, imports become more attractive to domestic consumers, as they may be cheaper compared with home-produced goods.

This can worsen the balance of payments, lead to currency depreciation, and create pressure for policy adjustments to restore competitiveness.

Practice Questions

Define the term real income and explain why it may fall during periods of inflation. (2 marks)

1 mark for correct definition of real income: income adjusted for the effects of inflation, showing the actual purchasing power of money.

1 mark for explaining that during inflation, if nominal income does not rise at the same rate as prices, real income falls.

Analyse two consequences of high inflation for savers and borrowers. (6 marks)

1–2 marks: Identification of a relevant consequence for savers (e.g., erosion of the real value of savings if interest rates are below inflation).

1–2 marks: Identification of a relevant consequence for borrowers (e.g., borrowers benefit as debts are repaid in money worth less in real terms).

1–2 marks: Development of analysis showing why these consequences occur, with clear economic reasoning (e.g., link between interest rates, purchasing power, and inflationary expectations).

Maximum 6 marks for clear and accurate analysis of both groups with developed explanation.