AQA Specification focus:

‘How changes in other economies can affect inflation in the UK.’

Economic relationships across countries have become increasingly interconnected, making external influences a crucial determinant of UK inflation dynamics. These influences operate through trade, capital flows, commodity markets, and currency movements. Understanding them is essential for analysing inflationary pressures in an open economy like the UK.

External Influences on UK Inflation

Globalisation and Price Transmission

The UK economy is highly open, importing both finished goods and raw materials. When prices change abroad, these can quickly feed into UK domestic prices. For example:

Rising input costs abroad increase import prices.

Lower production costs in other economies can reduce UK consumer prices.

Exchange rate fluctuations amplify or reduce the effect of global price movements.

World Demand and Inflationary Pressure

Changes in aggregate demand in other economies can directly affect the UK:

Strong growth in major economies such as the US, EU, or China increases demand for UK exports. This may boost UK output and incomes, creating demand-pull inflation.

Conversely, global recessions reduce export demand, lowering UK growth and possibly creating disinflationary pressure.

Demand-pull inflation: A rise in the general price level caused by increases in aggregate demand exceeding aggregate supply.

Commodity Prices and Imported Inflation

The UK is a net importer of essential commodities such as oil, natural gas, and many foodstuffs. Global price shifts feed directly into the UK inflation rate.

Higher oil prices raise transport and production costs, contributing to cost-push inflation.

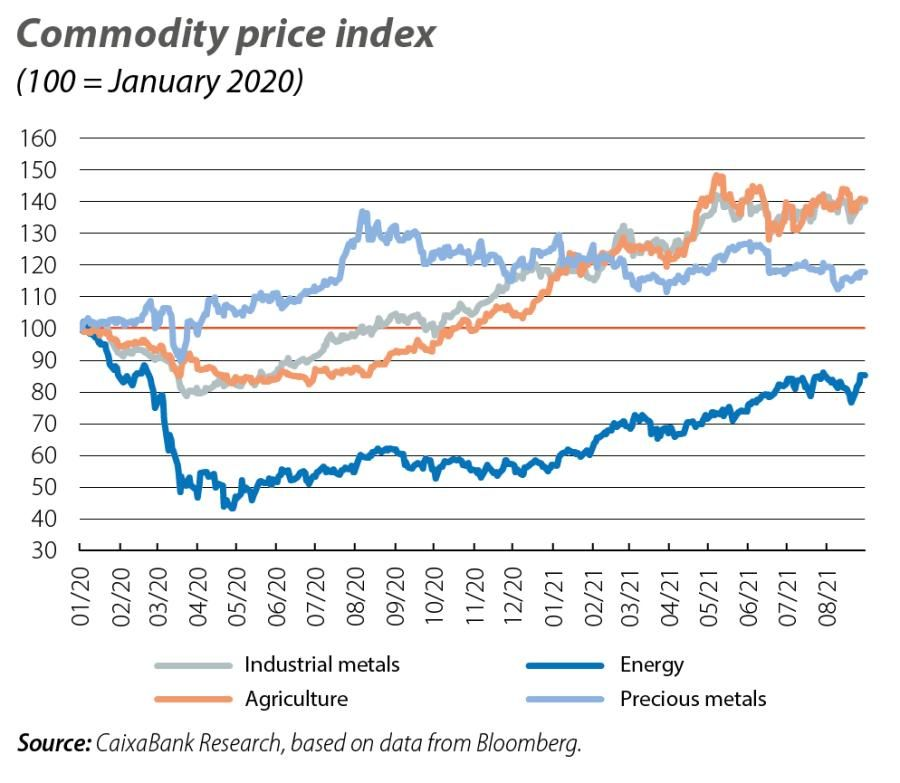

The graph displays the Commodity Price Index from January 2020, highlighting significant increases in energy and industrial metal prices. These price surges contribute to cost-push inflation in the UK by raising production costs. Source

Falling commodity prices ease inflationary pressures by lowering input costs.

Cost-push inflation: A rise in the general price level caused by increases in the costs of production, such as wages or raw materials.

These influences can be intensified by exchange rate changes, since commodities are typically priced in US dollars.

Exchange Rates and International Competitiveness

External economic developments often affect the sterling exchange rate, which alters inflation in two key ways:

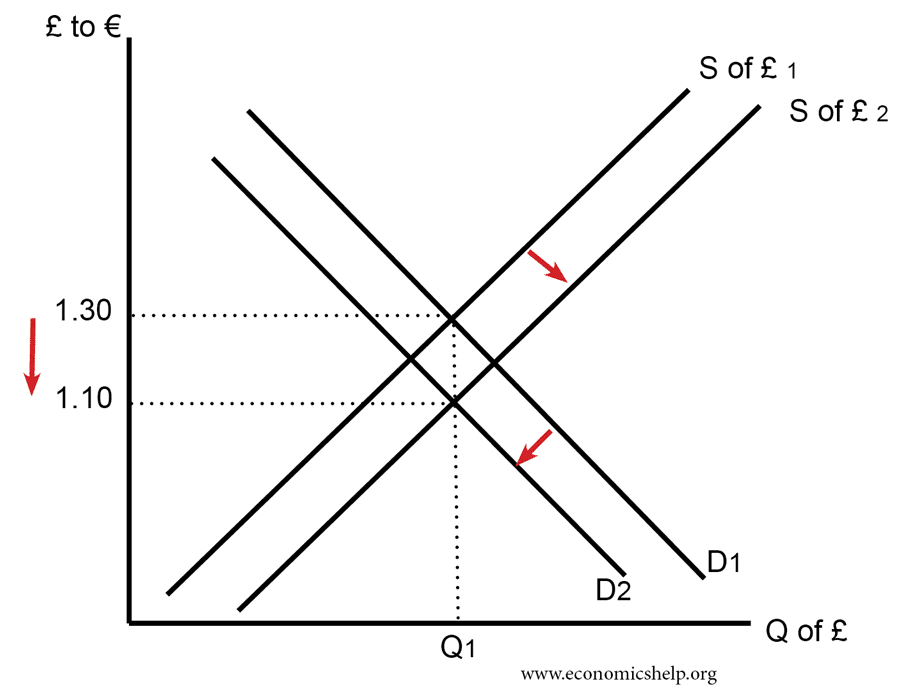

A depreciation of sterling increases the domestic price of imports, raising inflation.

The diagram illustrates the feedback loop between higher domestic inflation and currency depreciation, leading to increased import prices and contributing to imported inflation in the UK. Source

An appreciation of sterling makes imports cheaper, dampening inflation.

Exchange rate shifts often reflect broader global conditions, such as foreign interest rate changes, investor confidence, or capital movements.

Global Supply Chain Disruptions

Modern economies rely on complex, integrated supply chains. External shocks — such as natural disasters, geopolitical conflict, or pandemics — disrupt production and distribution globally. For the UK, this leads to:

Shortages of goods (e.g., semiconductors, food, energy).

Rising costs from delays and scarcity.

Volatility in inflation as firms pass these costs onto consumers.

Imported Wages and Labour Costs

Labour cost changes abroad, especially in countries that supply UK goods, can feed into UK prices. For example:

Wage growth in low-cost manufacturing countries increases export prices, feeding into UK inflation.

Technological progress abroad lowering labour costs can reduce import prices, easing inflation.

Monetary Policy and Global Spillovers

Monetary policies in major economies affect global interest rates, investment flows, and ultimately inflation in the UK.

If the US Federal Reserve raises interest rates, capital may flow out of the UK, weakening sterling and raising imported inflation.

Conversely, expansionary monetary policy abroad can lower borrowing costs globally, stimulating demand and potentially contributing to UK inflationary pressure.

Financial Market and Asset Price Channels

Global financial markets transmit inflationary influences quickly:

Rising global asset prices (e.g., housing or equities) increase wealth effects and consumption, stimulating demand in the UK.

Falling asset prices abroad can reduce confidence, curbing UK spending and dampening inflation.

External Shocks and Uncertainty

Sudden global shocks can alter inflation trajectories significantly:

Oil price shocks from geopolitical tensions can cause sharp cost-push inflation.

Global recessions may reduce inflation by weakening demand.

Financial crises can trigger currency depreciation, fuelling imported inflation.

Summary of Key External Influences on UK Inflation

External influences are multifaceted, but the major channels are:

World demand and export markets (affecting demand-pull inflation).

Commodity price changes (feeding into cost-push inflation).

Exchange rate fluctuations (altering import/export price levels).

Supply chain disruptions (increasing scarcity and costs).

Global monetary policies (shaping capital flows and sterling value).

Financial and asset market changes (impacting spending and confidence).

Together, these external forces illustrate how UK inflation cannot be analysed in isolation, but instead must be understood within the wider framework of the global economy.

FAQ

Emerging market growth often increases demand for raw materials, raising global commodity prices and creating cost-push inflation in the UK.

By contrast, growth in advanced economies like the EU or US tends to increase demand for UK exports, generating demand-pull inflation. Both effects can occur simultaneously, but the channel of transmission differs.

The UK imports a large share of its consumer goods, energy, and raw materials. This high import dependency means fluctuations in sterling quickly alter domestic prices.

Less open economies, producing more goods domestically, are less sensitive to external exchange rate shocks, making imported inflation a smaller concern.

When major economies like the US raise interest rates:

Investors may shift capital away from the UK, weakening sterling.

A weaker pound increases import prices, adding to inflation.

Lower global rates can strengthen sterling or encourage capital inflows, easing imported inflation.

Supply chain disruptions not only raise production costs but also reduce product availability.

This scarcity can shift demand towards substitutes, increasing prices in unrelated sectors. For example, a shortage of semiconductors raises electronics costs but can also push demand onto alternative products, spreading inflationary pressure.

A financial crisis can weaken sterling, fuelling imported inflation through higher prices of foreign goods.

At the same time, falling asset values and reduced confidence can suppress consumption and investment, lowering demand and creating deflationary pressure.

The overall effect depends on which influence is stronger at the time.

Practice Questions

Explain how an increase in global commodity prices could lead to higher inflation in the UK. (2 marks)

1 mark for identifying that higher commodity prices increase production/transport costs.

1 mark for linking this to cost-push inflation in the UK.

Discuss how changes in exchange rates, influenced by global economic conditions, can affect the rate of inflation in the UK. (6 marks)

Up to 2 marks for explaining how a depreciation of sterling raises import prices and contributes to imported inflation.

Up to 2 marks for explaining how an appreciation of sterling lowers import prices and reduces inflationary pressure.

Up to 1 mark for linking exchange rate movements to global factors (e.g., interest rate changes abroad, global investor confidence).

Up to 1 mark for clear analysis that both effects depend on the degree of import dependence and pass-through to UK consumer prices.