AQA Specification focus:

‘The concepts of inflation, deflation and disinflation.’

Introduction

Inflation, deflation, and disinflation are central to understanding price stability and economic performance. Each describes a different movement in the general price level over time.

Inflation

Definition and Concept

Inflation: A sustained rise in the general price level of goods and services in an economy over a period of time.

Inflation reduces the purchasing power of money because more money is required to buy the same amount of goods or services.

Causes of Inflation

Demand-pull inflation: Caused by excessive growth in aggregate demand (AD).

Cost-push inflation: Triggered by rising production costs (e.g. wages, oil prices).

Built-in inflation: Resulting from a wage–price spiral where higher wages lead to higher prices and vice versa.

Measurement

Inflation in the UK is primarily measured by indices such as:

Consumer Prices Index (CPI)

Retail Prices Index (RPI)

These track changes in the average price of a “basket” of goods and services.

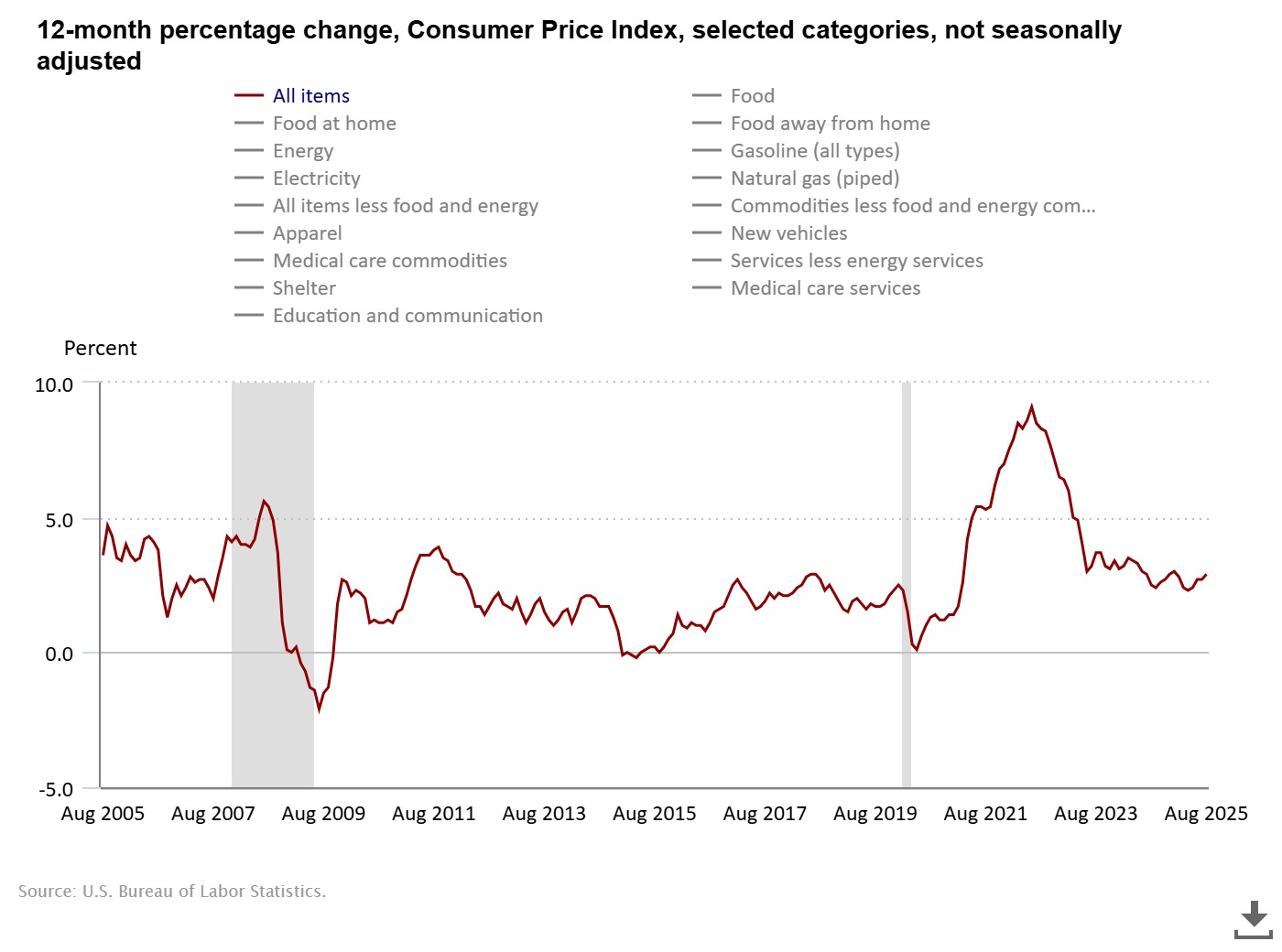

The graph depicts the Consumer Price Index (CPI) over time, illustrating how the general price level of goods and services changes, which is a primary measure of inflation. Source

Deflation

Definition and Concept

Deflation: A sustained fall in the general price level of goods and services in an economy over a period of time.

Deflation is less common but potentially more damaging than inflation. It is usually linked to severe downturns in economic activity.

Characteristics of Deflation

Falling aggregate demand (AD) often drives deflation, especially during recessions.

Consumers may delay spending in expectation of lower future prices, reducing demand further.

Firms may reduce investment due to shrinking revenues.

Risks of Deflation

Can create a deflationary spiral, where falling prices reduce profits, leading to job losses, reduced demand, and further price falls.

Increases the real value of debt, making repayment more difficult.

Disinflation

Definition and Concept

Disinflation: A fall in the rate of inflation, meaning prices are still rising but at a slower pace.

Disinflation is not the same as deflation. Instead, it signals a slowdown in price growth, often due to contractionary policies or weakening demand.

This diagram illustrates the distinction between disinflation and deflation. Disinflation refers to a decrease in the rate of inflation, where prices continue to rise but at a slower pace, whereas deflation indicates a decline in the general price level. Source

Key Features

Prices continue to rise, but inflationary pressure eases.

Often occurs when governments or central banks tighten monetary policy.

Indicates progress towards price stability without the dangers of falling prices.

Comparing Inflation, Deflation and Disinflation

Inflation

General price level rising.

Reduces the real value of money.

Can benefit debtors but harm savers.

Deflation

General price level falling.

Reduces spending and investment.

Can worsen recessions.

Disinflation

Prices still rising, but growth slows.

Seen as less disruptive than deflation.

Suggests a controlled reduction in inflationary pressure.

Importance in Economic Performance

Effects of Inflation

Moderate inflation (e.g. 2% in the UK) is often seen as desirable, encouraging spending and investment.

Hyperinflation severely disrupts economies, eroding confidence in money.

Effects of Deflation

Often associated with high unemployment and low growth.

Reduces consumer and business confidence.

Effects of Disinflation

Seen as a policy success when reducing high inflation.

Helps economies transition to stable growth without the risks of deflation.

Policy Responses

To Control Inflation

Monetary policy: Raising interest rates to reduce borrowing and demand.

Fiscal policy: Reducing government spending or raising taxes to cool AD.

To Prevent Deflation

Expansionary monetary policy: Cutting interest rates or using quantitative easing to increase liquidity.

Fiscal stimulus: Government spending to boost AD.

To Manage Disinflation

Central banks may use careful adjustments to ensure inflation slows but does not slip into deflation.

Key Takeaways

Inflation: Rising general price level.

Deflation: Falling general price level.

Disinflation: Slowing rate of inflation.

These three concepts are critical to evaluating how economies function, the risks they face, and the effectiveness of macroeconomic policies.

FAQ

Anticipated inflation occurs when households and firms expect price rises and can plan accordingly, such as by negotiating wage increases. This reduces its disruptive effects.

Unanticipated inflation takes people by surprise, distorting contracts and redistributing income unfairly, often hurting savers while benefiting borrowers.

Mild deflation can occur due to productivity improvements, meaning lower prices alongside strong output and employment. In this context, spending and investment may remain stable.

Severe deflation, however, is linked to falling demand, reduced profits, job losses, and can lead to a deflationary spiral.

Disinflation slows the rise of prices, which reduces the erosion of the real value of government debt. This makes it relatively more expensive for governments to repay debt.

It also limits the scope for governments to rely on “inflating away” debt, increasing the importance of sound fiscal planning.

Central banks act to avoid prolonged deflation through:

Lowering interest rates to stimulate borrowing and spending

Engaging in quantitative easing to boost liquidity

Signalling long-term inflation targets to anchor expectations

These measures aim to maintain stability and encourage demand.

Disinflation signals that high inflation is being brought under control without pushing the economy into falling prices.

It helps preserve consumer confidence while allowing central banks to move closer to their inflation target, supporting long-term economic stability.

Practice Questions

Define the term deflation. (2 marks)

1 mark for stating that deflation is a fall in the general price level.

1 additional mark for specifying that this fall must be sustained over a period of time.

Explain two possible consequences of disinflation for an economy. (6 marks)

Up to 3 marks for each consequence (maximum of 2 consequences credited).

Award 1 mark for identification of a valid consequence (e.g. slower growth in consumer spending, reduced inflationary pressure, improved international competitiveness, or reduced pressure on monetary policy).

Award 1–2 additional marks for clear explanation and development of how this consequence arises (e.g. slower growth in consumer spending due to households expecting smaller price rises, therefore delaying purchases; improved international competitiveness as domestic prices rise more slowly compared to trading partners, boosting exports).

Maximum 6 marks in total.