AQA Specification focus:

‘The main functions of a commercial bank.’

Commercial banks are essential institutions in modern economies, performing a range of functions that support individuals, businesses, and governments. Their operations are vital for maintaining liquidity, providing financial intermediation, and facilitating payments. Understanding these functions helps explain how commercial banks contribute to economic stability and growth.

Core Functions of Commercial Banks

Commercial banks carry out several key functions that allow them to serve households, firms, and the wider economy. These functions are interconnected and directly influence how money flows through the financial system.

Accepting Deposits

One of the most fundamental functions of commercial banks is accepting deposits from customers. These deposits provide banks with a significant source of funding.

Deposit: Money placed into a bank account, which can be withdrawn on demand or after a fixed term, depending on the account type.

Current accounts allow customers to access funds at any time, often with facilities such as debit cards and overdrafts.

Savings accounts typically pay interest, rewarding individuals for leaving money deposited over time.

Fixed-term deposits involve customers agreeing to leave money in the bank for a set period in return for higher interest.

Deposits are central to a bank’s ability to lend and invest, linking them to other core functions.

Providing Loans

Banks transform deposits into loans, enabling borrowing by households, businesses, and governments. This process is a major driver of economic activity.

Loan: A sum of money borrowed from a bank that must be repaid with interest, usually over a specified period.

Loans may be short-term (such as overdrafts and working capital finance) or long-term (such as mortgages or business investment loans). Through lending, banks promote consumption, business expansion, and investment.

Creating Credit

A distinctive function of commercial banks is credit creation. When banks issue loans, they effectively create new purchasing power in the economy.

A bank issues a loan by crediting the borrower’s account with a deposit.

This newly created deposit can then circulate in the economy as money.

Although subject to regulation, credit creation expands the effective money supply.

Credit creation is significant for monetary policy, as it directly influences aggregate demand and investment.

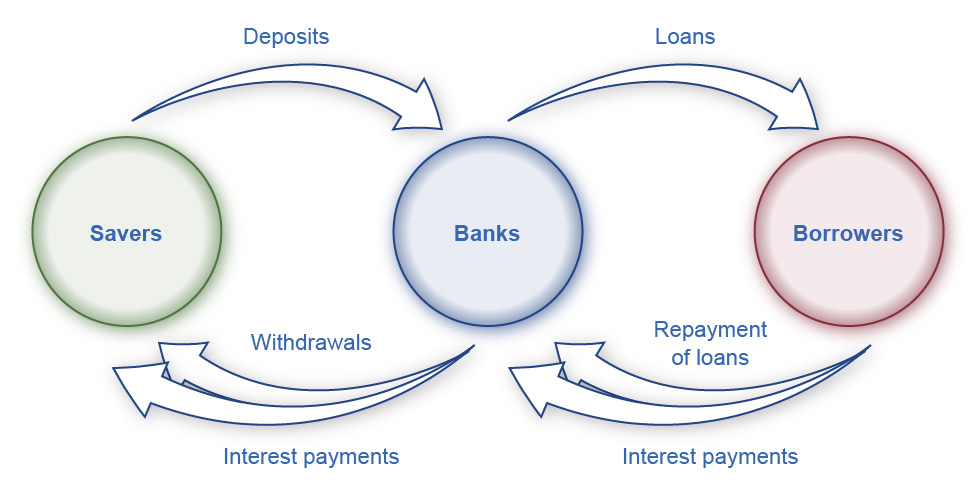

This diagram demonstrates the process by which banks accept deposits from savers and provide loans to borrowers, highlighting their role in credit creation and monetary policy transmission. The image includes additional details on the money multiplier effect, which, while informative, is not required by the AQA syllabus. Source

Facilitating Payments

Commercial banks make modern economies operational by providing secure and efficient payment systems. These include:

Cheque clearing and electronic funds transfers.

Debit and credit card services.

Online and mobile banking systems.

By enabling the smooth transfer of funds between individuals and businesses, banks reduce transaction costs and enhance economic efficiency.

Investment Services

Beyond deposit-taking and lending, banks often provide investment services to individuals and firms. These may include:

Selling financial products, such as insurance or pension funds.

Offering advisory services on savings and investments.

Managing assets on behalf of clients.

Such services help customers grow wealth and plan for the future.

Safekeeping of Valuables

Historically and still today, banks act as a trusted place for safekeeping valuables. Customers may deposit important documents, securities, or other assets with banks for protection against theft or loss.

Acting as Financial Intermediaries

Commercial banks are key financial intermediaries, channelling funds from savers (depositors) to borrowers (firms, households, governments). This intermediation function reduces the risks and transaction costs associated with direct lending and borrowing.

Financial Intermediary: An institution that connects lenders and borrowers by collecting funds from savers and lending them to those in need of finance.

By pooling savings, banks spread risk and make lending safer and more efficient.

Providing Liquidity

A central role of banks is ensuring liquidity for depositors, meaning funds are accessible when needed. While much of the money is lent out, banks maintain reserves and access to short-term borrowing facilities to ensure they can meet withdrawal demands.

This balance between liquidity provision and profitability is a recurring theme in bank operations.

Foreign Exchange Transactions

Many commercial banks also deal in foreign exchange services. These allow individuals and businesses to convert currencies for travel, trade, or investment. Banks make profits through exchange rate margins and fees, while supporting international trade and global investment.

Supporting Government and Monetary Policy

Commercial banks interact with central banks and governments, playing a role in the implementation of monetary policy. For example:

They transmit changes in the bank rate to borrowing and saving decisions.

They may purchase government bonds, providing funding for public spending.

They adjust lending in response to central bank reserve requirements.

Through these functions, commercial banks are vital in influencing aggregate demand and stabilising the economy.

Summary of Functions

Commercial banks fulfil a wide variety of roles, which can be grouped into several categories:

Accepting deposits from individuals and organisations.

Providing loans to support consumption and investment.

Creating credit, thereby expanding the money supply.

Facilitating payments to ensure smooth economic transactions.

Offering investment services and wealth management.

Safekeeping valuables for customers.

Acting as financial intermediaries, reducing risk and transaction costs.

Providing liquidity to depositors.

Conducting foreign exchange services, aiding international trade.

Supporting monetary policy transmission through their lending and borrowing decisions.

Through these diverse yet interconnected functions, commercial banks underpin the stability and efficiency of modern economies, aligning with the AQA specification’s focus on their main functions.

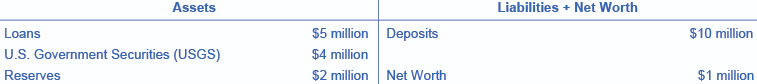

The balance sheet illustrates the structure of a commercial bank's financial position, detailing assets such as loans and reserves, and liabilities including customer deposits. The image also includes information on bank capital and regulatory capital ratios, which are not specified in the AQA syllabus but offer additional context. Source

FAQ

Commercial banks pay interest on deposits to attract savings from households and firms. These savings provide banks with funds they can then lend to borrowers.

The rate of interest offered depends on factors such as the type of deposit account, the bank’s funding needs, and overall market interest rates. Higher interest rates encourage savers to keep money in the bank, supporting credit creation.

Banks face a trade-off between keeping funds liquid for withdrawals and lending money for profit.

Holding too much cash improves liquidity but reduces profitability.

Lending more increases profit but can risk liquidity shortages.

To manage this, banks maintain reserves and diversify lending while also using interbank markets to borrow if needed.

Credit creation can be restricted by several factors:

Central bank regulations on reserve requirements.

A lack of demand for loans during economic downturns.

Banks’ cautious lending policies when risk levels are high.

These limitations help maintain financial stability but can reduce the availability of credit for businesses and consumers.

The main risk is default, where borrowers fail to repay.

Consumer loans may face income shocks or unemployment risk.

Business loans may fail due to poor investment returns.

Housing loans may be affected by falling property values.

Banks manage these risks through credit checks, requiring collateral, and charging interest rates that reflect the level of risk.

Commercial banks provide essential funding for investment and consumption, which fuels economic growth.

Businesses use loans to expand operations and create jobs.

Households borrow for housing, education, and durable goods, increasing demand.

By channelling savings into productive investments, banks improve resource allocation.

This intermediation role ensures that capital flows to where it generates the greatest economic benefit.

Practice Questions

State two main functions of a commercial bank. (2 marks)

1 mark for each valid function, up to 2 marks.

Acceptable answers include:

Accepting deposits

Providing loans

Creating credit

Facilitating payments

Providing liquidity

Acting as a financial intermediary

Safekeeping valuables

Offering investment services

Conducting foreign exchange services

Explain how commercial banks act as financial intermediaries and why this function is important for the wider economy. (6 marks)

Up to 2 marks for explaining the process of financial intermediation (e.g., banks collect deposits from savers and lend to borrowers).

Up to 2 marks for linking this to reduced risks/transaction costs (e.g., pooling savings spreads risk, making lending safer and more efficient).

Up to 2 marks for explaining the importance to the wider economy (e.g., promotes investment, supports economic growth, ensures efficient allocation of resources).

Maximum 6 marks available.

Award marks for clear explanation, use of economic terminology, and accurate links to the role of commercial banks.