AQA Specification focus:

‘The difference between a commercial bank and an investment bank.’

Introduction

Banks form the backbone of modern economies, but commercial banks and investment banks perform very different roles. Understanding their differences is vital for A-Level Economics.

Commercial Banks

Core Purpose

Commercial banks are financial institutions that primarily deal with accepting deposits and providing loans to households, businesses, and governments. Their activities are focused on the wider economy and personal finance.

This diagram illustrates the fundamental differences between commercial and investment banks, highlighting their distinct roles in the financial system. Source

Commercial Bank: A financial institution that accepts deposits from the public, offers current and savings accounts, and provides loans to individuals and businesses.

Key Functions

Commercial banks act as intermediaries between savers and borrowers. Their services include:

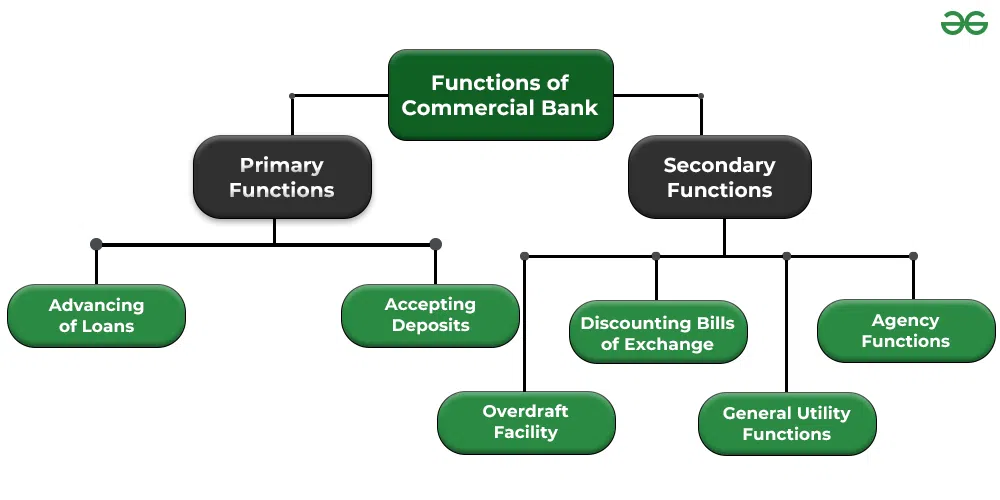

This flowchart categorises the essential functions of commercial banks, emphasising their role in deposit acceptance and loan provision. Source

Accepting deposits – savings accounts, current accounts, and time deposits.

Providing credit – personal loans, business loans, mortgages, and overdrafts.

Payment services – cheque clearing, debit and credit card transactions, and electronic transfers.

Liquidity provision – ensuring customers can access funds when needed.

Safeguarding money – offering secure storage and protection for deposits.

Customers

Households – using banks for saving, borrowing, and transactions.

Firms – needing short-term working capital loans or long-term investment funding.

Government – often using banks for issuing treasury bills or facilitating tax collection.

Investment Banks

Core Purpose

Investment banks operate in financial markets to provide specialist services for large corporations, governments, and institutional investors. Unlike commercial banks, they do not focus on everyday retail banking.

Investment Bank: A financial institution that specialises in underwriting securities, facilitating mergers and acquisitions, and engaging in trading and investment activities.

Key Functions

Investment banks are crucial in the world of high finance. Their roles include:

Underwriting – guaranteeing the sale of new securities such as shares or bonds.

Advisory services – advising on mergers, acquisitions, and corporate restructuring.

Proprietary trading – buying and selling securities with the bank’s own capital for profit.

Asset management – managing investment portfolios for clients such as pension funds.

Market making – buying and selling financial instruments to provide liquidity in markets.

Customers

Large corporations – requiring access to capital markets and strategic advice.

Governments – issuing sovereign bonds and privatisation advisory services.

Institutional investors – such as hedge funds and pension funds needing asset management.

Differences Between Commercial and Investment Banks

Primary Activities

Commercial banks focus on the general public, facilitating deposits, lending, and payments.

Investment banks concentrate on complex financial services for large-scale clients.

Sources of Revenue

Commercial banks earn money from interest charged on loans and fees for services.

Investment banks generate revenue from advisory fees, underwriting commissions, and trading profits.

Risk Profile

Commercial banks are generally lower risk as they deal with retail deposits and regulated lending.

Investment banks face higher risks due to speculative trading and exposure to volatile markets.

Regulation

Commercial banks are heavily regulated to protect depositors and ensure systemic stability. Investment banks are also regulated, but their risks often arise in more complex financial products and international markets.

Interconnectedness and Universal Banking

Some institutions engage in both commercial and investment banking, known as universal banking. This model allows banks to provide a wide range of services but can also increase systemic risk, as failures in one division (e.g., risky trading losses) may threaten the stability of traditional banking functions such as deposit protection.

Importance to the Economy

Role of Commercial Banks

Provide essential services to individuals and small businesses.

Facilitate economic activity by enabling saving and borrowing.

Support monetary policy transmission via lending behaviour.

Role of Investment Banks

Enable firms and governments to raise capital efficiently.

Provide expertise in global financial markets.

Contribute to economic growth by supporting large-scale investments and restructuring.

Summary of Key Distinctions

Commercial banks = retail-focused, deposit-taking, loan-making.

Investment banks = corporate-focused, securities, advisory, and trading.

Their roles complement each other, but their differences in function, revenue sources, and risk make it essential to distinguish between them.

FAQ

Commercial banks are frequently called retail banks because they primarily serve individual consumers and small businesses. Their activities are similar to retail transactions, with many small-scale deposits and loans.

In contrast, investment banks work on large-scale corporate and government finance, which makes their operations more “wholesale” in nature.

During the crisis, investment banks were hit hardest due to their reliance on complex financial products like mortgage-backed securities.

Commercial banks, although affected, were more protected because their core activities—deposit-taking and traditional lending—were less speculative.

Universal banks combine commercial and investment banking functions.

This increases systemic risk because:

Losses from risky investment activities can undermine retail deposit security.

Failures can spread quickly across the financial system, amplifying instability.

Commercial banks are more tightly regulated due to their direct role in holding consumer deposits.

Investment banks face regulation too, but the focus is on capital markets activity, risk management, and transparency in securities markets.

Investment banks employ specialists in:

Securities trading

Corporate finance advisory

Risk modelling and derivatives

Commercial banks instead rely more on expertise in retail lending, customer service, and local credit assessment.

Practice Questions

State one key function of a commercial bank and one key function of an investment bank. (2 marks)

1 mark for identifying a correct function of a commercial bank (e.g., accepting deposits, providing loans, offering payment services).

1 mark for identifying a correct function of an investment bank (e.g., underwriting securities, providing advice on mergers and acquisitions, proprietary trading).

(Max 2 marks)

Explain two differences between commercial banks and investment banks. (6 marks)

Up to 2 marks for each valid difference identified (e.g., purpose, customers, revenue sources, risk profile).

Up to 1 additional mark for clear development/explanation of each difference.

Examples may be credited if they enhance explanation but are not required.

Indicative content:

Commercial banks focus on the general public, providing services such as deposit-taking and loans, whereas investment banks serve corporations, governments, and institutional investors.

Commercial banks mainly earn revenue from interest on loans and service fees, whereas investment banks earn from advisory fees, underwriting, and trading activities.

(Max 6 marks)