AQA Specification focus:

‘Students will not be required to calculate the credit multiplier.’

Introduction

In AQA A-Level Economics, students learn how banks create credit and the role of the financial system in the economy. However, while understanding these mechanisms is important, the AQA specification explicitly states that students will not be required to calculate the credit multiplier. Instead, the focus is on conceptual understanding of how the process works, its implications for money supply, and why it matters for monetary policy and financial stability.

Understanding the Credit Multiplier

What the Credit Multiplier Represents

The credit multiplier is a concept used in banking and monetary economics to show how an initial deposit in the banking system can lead to a greater final increase in the total money supply. This is linked to the process of banks lending out a portion of deposits while holding a fraction as reserves.

Credit Multiplier: A measure of the maximum potential increase in the money supply resulting from an injection of reserves into the banking system, given a required reserve ratio.

Although this definition helps students grasp the idea, the AQA specification clarifies that no numerical calculations of this multiplier will be assessed in exams.

Why Calculations Are Excluded from Assessment

Specification Guidance

The exclusion of calculations indicates that AQA prioritises theoretical comprehension over mathematical derivation in this subtopic. Students should be able to:

Explain how banks create credit by lending out deposits.

Recognise that lending is limited by liquidity needs and reserve requirements.

Understand the broader economic significance of credit creation.

Emphasis on Understanding, Not Maths

Excluding calculations ensures that the emphasis remains on explaining processes, links to aggregate demand, and financial stability rather than focusing on algebra or ratios.

How Banks Create Credit Without the Multiplier

The Core Banking Process

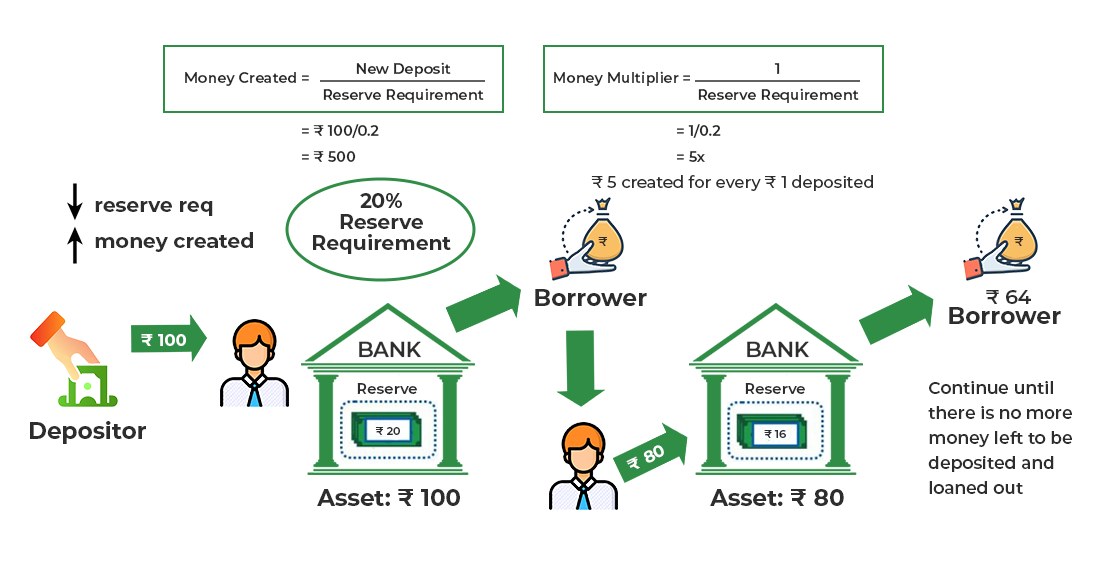

Commercial banks expand credit through a cycle:

A customer deposits money in a bank.

The bank holds a proportion of this deposit as reserves to meet withdrawal demands.

The remaining balance is loaned to another customer.

This diagram illustrates the process of credit creation by commercial banks, showing how initial deposits lead to multiple rounds of lending and re-depositing, expanding the money supply. Source

That loan becomes a deposit in the banking system when spent and redeposited.

The process continues, multiplying the volume of deposits in the system.

This process explains why the banking sector can increase the money supply beyond the initial deposits made, even without needing to calculate the credit multiplier numerically.

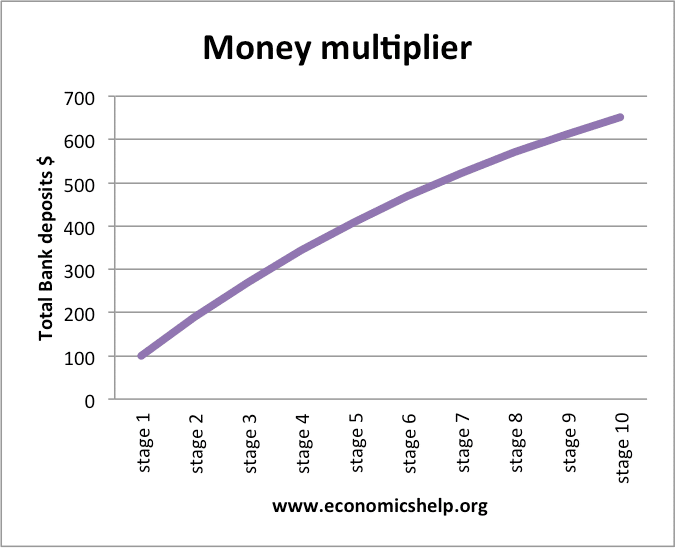

This graph depicts the theoretical money multiplier effect, illustrating how changes in the reserve ratio influence the potential expansion of the money supply through fractional reserve banking. Source

Conceptual Insights Students Must Retain

Credit Creation and Aggregate Demand

Understanding credit creation is essential for linking banking behaviour to the wider economy:

Increased lending → boosts consumption and investment.

Greater money supply → potential upward pressure on inflation.

Restricted lending → reduces economic activity, lowering inflationary pressures.

Constraints on Credit Creation

Even without formal calculations, students must know the real-world limitations on how much credit banks can generate:

Liquidity requirements: Banks must keep sufficient reserves.

Profitability motives: Banks balance lending with risks and returns.

Regulation: Capital adequacy ratios and supervisory rules limit excessive lending.

Market confidence: Public trust in banks influences deposits and withdrawals.

Exam Implications for Students

What You Need to Know

For exam purposes, focus on:

The concept of how lending and deposits expand the money supply.

The relationship between banking activity and macroeconomic variables (growth, inflation, unemployment).

The limitations of credit creation in practice.

What You Do Not Need to Do

Students will not be required to:

Perform calculations of the multiplier.

Memorise or manipulate the multiplier formula.

Produce numerical examples of credit expansion.

Instead, use clear verbal explanations and logical reasoning to demonstrate understanding.

Broader Relevance of the Credit Multiplier

Links to Monetary Policy

While no calculations are needed, the idea of the multiplier underpins why central banks, like the Bank of England, regulate money supply:

Changes in interest rates affect how much lending occurs.

Reserve requirements and regulation help prevent overexpansion of credit.

Policy tools like quantitative easing also influence bank lending capacity.

Real-World Context

Historical financial crises highlight the risks of unchecked credit expansion. Understanding the credit multiplier conceptually equips students to see why prudential regulation and monetary control are essential.

Key Takeaways

No credit multiplier calculations will appear in AQA exams.

Focus on the conceptual process: how banks create credit and its economic effects.

Be aware of constraints: reserves, regulations, and risk management.

Link the concept to monetary policy and macroeconomic objectives.

FAQ

The credit multiplier is a central concept in monetary economics and helps explain how banks expand the money supply.

AQA includes it to ensure students understand the underlying theory of credit creation, while avoiding the complexity of numerical calculations. This keeps the focus on economic reasoning rather than mathematical skills.

There are no marks for showing calculations, since they are outside the scope of assessment.

However, demonstrating the concept clearly in words, such as explaining how deposits can generate further lending, is rewarded. Attempting unnecessary calculations may waste valuable exam time.

During crises, banks may restrict lending due to concerns over liquidity or solvency.

This reduces the multiplier effect, as fewer loans mean fewer redeposits. The process can reverse, shrinking the money supply and deepening economic downturns.

The multiplier assumes banks lend out every pound not held as reserves.

In reality, credit creation is limited by:

Regulatory requirements

Market confidence

Bank profitability goals

This means the actual increase in money supply is often lower than the theoretical multiplier suggests.

Different countries impose varying reserve requirements and regulatory controls.

In systems with higher required reserves, the multiplier effect is smaller.

In looser systems, credit can expand more rapidly, but systemic risk may increase.

This variation highlights why credit expansion differs between economies.

Practice Questions

Explain why AQA A-Level Economics students are not required to calculate the credit multiplier in examinations. (2 marks)

1 mark for recognising that the AQA specification states calculations of the credit multiplier are excluded.

1 mark for explaining that the emphasis is on conceptual understanding rather than mathematical derivation.

Discuss the importance of understanding the concept of the credit multiplier for explaining how banks create credit, even though students are not required to calculate it. (6 marks)

1 mark for defining the credit multiplier (concept of deposit expansion through fractional reserve banking).

1 mark for explaining that banks create credit by lending out deposits while keeping reserves.

1 mark for linking credit creation to an increase in the money supply.

1 mark for identifying how this can influence aggregate demand (consumption, investment).

1 mark for recognising limitations (e.g. liquidity requirements, regulation, risk management).

1 mark for linking the understanding to monetary policy and financial stability (e.g. why central banks regulate).