AQA Specification focus:

‘They should also be aware that many banks are engaged in both investment banking and commercial banking activities and that this may increase systemic risk.’

Universal banking combines both commercial and investment banking activities within a single institution, but this integrated structure can increase systemic risk and financial instability across interconnected markets.

Universal Banking

Universal banking refers to a model in which a single financial institution undertakes both commercial banking (deposit-taking and lending) and investment banking (securities trading, underwriting, advisory services).

Universal Banking: A banking structure where one institution offers both commercial and investment banking services.

This approach allows banks to diversify income streams and expand influence in financial markets. However, it also introduces complexities that may magnify vulnerabilities in the wider economy.

Functions of Universal Banks

Universal banks typically engage in:

Deposit-taking and lending to households and firms.

Issuing and underwriting securities for governments and corporations.

Advisory services on mergers, acquisitions, and restructuring.

Foreign exchange trading and derivatives dealing.

Asset management and wealth services for institutional and private clients.

These activities integrate traditional retail functions with sophisticated capital market operations.

Advantages of Universal Banking

Economies of Scope

By combining diverse services, banks can spread costs, cross-sell products, and increase efficiency. Customers may benefit from a “one-stop shop” for financial needs.

Diversification of Risk

Banks with multiple revenue streams can offset downturns in one area with gains in another. For example, retail lending profits may balance trading losses.

Stronger Competitive Position

Universal banks often command significant resources, international reach, and brand reputation, enabling them to dominate both domestic and global markets.

Systemic Risk

Systemic risk arises when the failure of one financial institution, or distress within a part of the financial system, spreads across the economy and threatens overall stability.

Systemic Risk: The risk that distress in one financial institution or market will spread through interconnected systems, leading to widespread economic disruption.

Universal banks, by engaging in both commercial and investment activities, may amplify such risks.

This diagram from Bank Al-Maghrib maps the interrelationships between different types of risks that contribute to systemic risk. It includes extra elements such as real estate and macroeconomic risks, beyond the AQA syllabus. Source

Sources of Systemic Risk in Universal Banking

Interconnectedness

Universal banks link retail depositors, corporate borrowers, and global capital markets.

Problems in one area (e.g., investment losses) can quickly impact lending capacity to households and firms.

Size and Market Power

Large universal banks are often considered “too big to fail”, leading governments to intervene with costly bailouts in crises.

This reliance encourages risk-taking behaviour.

Complexity of Operations

Overlapping services make it difficult for regulators to monitor risks.

Losses in derivatives trading may be hidden within balance sheets.

Contagion Effects

Failure of one universal bank can spread panic across markets, affecting confidence in the entire financial system.

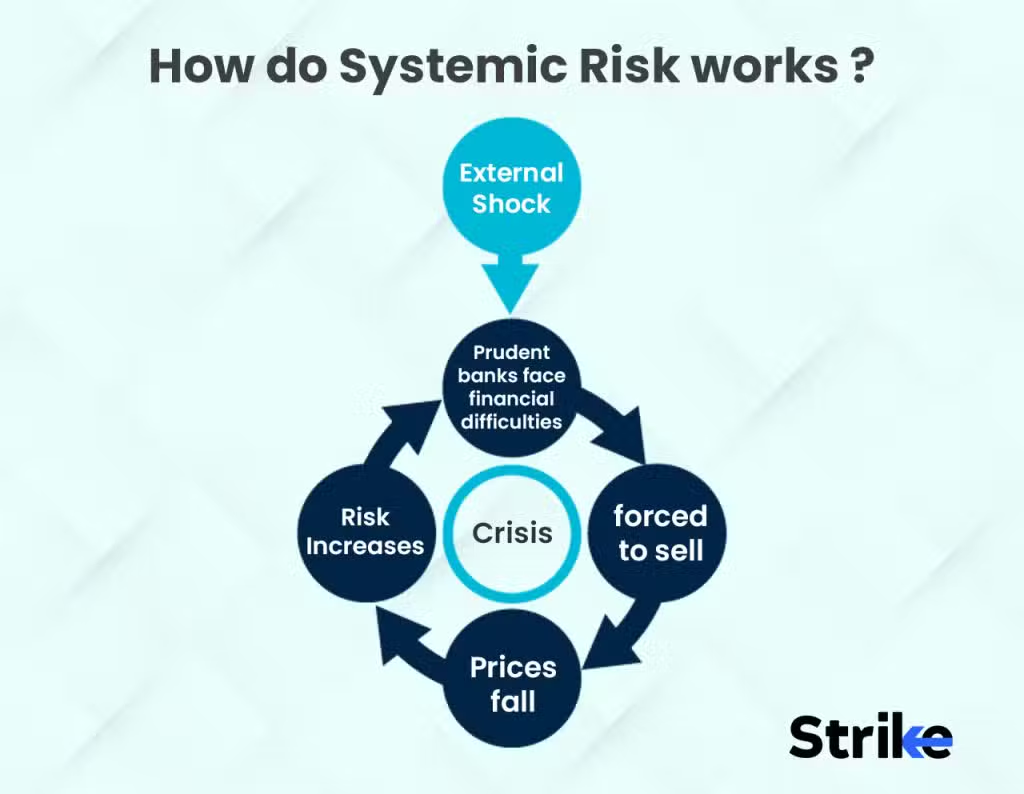

This flowchart from Strike Money outlines how systemic risk develops, beginning with external shocks and culminating in crisis. It includes references to external shocks not emphasised in the syllabus. Source

The 2008 Financial Crisis Example

During the Global Financial Crisis (2007–2009), universal banks played a central role in spreading systemic risk:

Their involvement in complex financial products (e.g., mortgage-backed securities) transmitted losses widely.

Retail customers and businesses faced credit shortages when banks absorbed heavy trading losses.

Government bailouts highlighted the systemic importance of universal institutions.

This crisis reinforced the dangers of combining risky investment activities with essential retail banking services.

Regulatory Concerns

Moral Hazard

If banks expect state support in crises, they may engage in riskier activities, confident that taxpayers will absorb potential losses.

Moral Hazard: A situation where a party takes greater risks because they do not bear the full consequences of failure.

Systemic Risk Oversight

UK regulators, such as the Bank of England and the Financial Policy Committee (FPC), monitor large banks to identify systemic vulnerabilities. Capital and liquidity requirements are imposed to limit excessive risk-taking.

Measures to Reduce Systemic Risk

Ring-fencing: Separating retail banking from investment banking to protect depositors.

Capital Adequacy Ratios: Ensuring banks maintain sufficient equity buffers.

Liquidity Coverage Ratios: Requiring banks to hold highly liquid assets to cover short-term obligations.

Stress Testing: Simulating adverse economic scenarios to assess resilience.

International Coordination: Global agreements such as Basel III set common standards to prevent systemic shocks.

These measures aim to balance the efficiency benefits of universal banking with the need to safeguard financial stability.

Key Evaluation Points

Universal banking creates efficiency and service advantages but at the cost of higher systemic risk.

The failure of a universal bank has greater potential to destabilise the real economy than a smaller, specialised institution.

Regulatory frameworks continue to evolve, seeking to manage risks without stifling financial innovation.

FAQ

A universal bank combines both commercial and investment services, while a specialised bank focuses on only one function.

For example, a retail bank focuses on deposits and loans, while an investment bank deals mainly with securities, underwriting, and corporate finance.

Universal banks may provide convenience and efficiency but are exposed to broader risks due to their wider scope of operations.

The collapse of a universal bank threatens both retail customers and capital markets simultaneously.

Retail customers risk losing access to deposits and credit.

Financial markets may face disruption in securities trading and investment flows.

This dual threat makes intervention more likely, as governments seek to prevent widespread economic instability.

When the same institution provides both lending and investment services, conflicts of interest may arise.

For instance, a bank might:

Recommend securities it has itself underwritten.

Prioritise investment clients over retail depositors.

These conflicts can damage trust and increase regulatory scrutiny.

Large universal banks often dominate markets due to their size and resources.

This dominance can reduce competition by crowding out smaller firms. However, universal banks may also lower costs for consumers by spreading risk and achieving economies of scope.

The balance between market power and efficiency is a major concern for policymakers.

Beyond the UK, regulators worldwide have introduced reforms:

In the USA, the Glass–Steagall Act (repealed in 1999) once separated commercial and investment banking.

The EU has explored structural reforms to ring-fence retail operations.

Global agreements such as Basel III aim to strengthen capital buffers and liquidity requirements.

These measures reflect global recognition of the risks posed by universal banking models.

Practice Questions

Define the term systemic risk in the context of universal banking. (2 marks)

Award 1 mark for identifying that systemic risk refers to risk spreading through the financial system.

Award 1 mark for recognising that this can cause widespread disruption to the real economy or multiple institutions.

Explain how universal banking can increase systemic risk within the financial system. (6 marks)

1 mark for identifying that universal banks combine commercial and investment banking activities.

1 mark for explaining interconnectedness (e.g., linking depositors, borrowers, and global markets).

1 mark for recognising the role of complexity and difficulty of regulation.

1 mark for mentioning the “too big to fail” problem and reliance on government bailouts.

1 mark for describing contagion effects if a universal bank collapses.

1 mark for any clear evaluative point (e.g., despite risks, universal banking may diversify revenue and provide efficiency benefits).