AQA Specification focus:

‘Students should be aware that there are other institutions that operate in financial markets but they do not need to know about their activities or their functions.’

Introduction

In addition to commercial and investment banks, a range of other financial institutions play key roles in the economy. Understanding their existence broadens awareness of how modern financial systems operate.

Other Financial Institutions in Financial Markets

Overview

The financial system is not solely made up of banks. It is supported by a variety of non-bank financial institutions that channel funds, provide liquidity, and support investment and risk management. While the specification only requires awareness, knowing the main categories enhances appreciation of how financial markets function.

Insurance Companies

Role in Financial Markets

Insurance companies pool risk from individuals and firms, offering protection against unexpected losses. They also act as institutional investors by placing premiums into financial markets.

Insurance Company: A financial institution that provides risk management by offering policies in exchange for premiums and invests collected funds in financial assets.

Insurance companies therefore serve both a protective and an investment role, helping to stabilise households and businesses while supporting capital markets.

Pension Funds

Long-Term Investment

Pension funds collect contributions from employees and employers, which are then invested to provide retirement income. They are among the largest institutional investors in global markets.

Pension Fund: A pool of savings accumulated during an individual’s working life, invested by fund managers to provide income after retirement.

Because pension liabilities are long term, these funds often invest heavily in equities, bonds, and property, influencing both financial market stability and economic growth.

Mutual Funds and Unit Trusts

Collective Investment

Mutual funds (also called unit trusts in the UK) pool money from many investors to purchase a diversified portfolio of assets. They reduce risk for individuals by offering professional fund management.

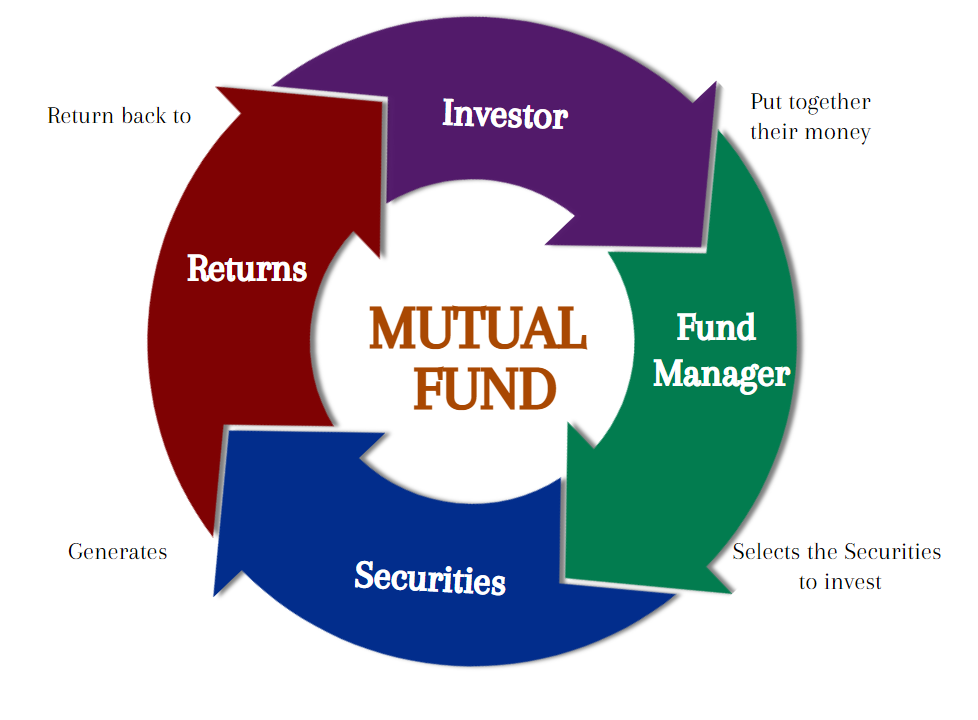

This diagram depicts the operational flow of a mutual fund, showing how investors' pooled money is managed by fund managers to invest in various securities, thereby providing diversification and professional management. Source

Mutual Fund / Unit Trust: An investment vehicle where money from many investors is combined and managed collectively to buy a diversified set of securities.

This provides liquidity and accessibility for small investors who otherwise could not participate directly in capital markets.

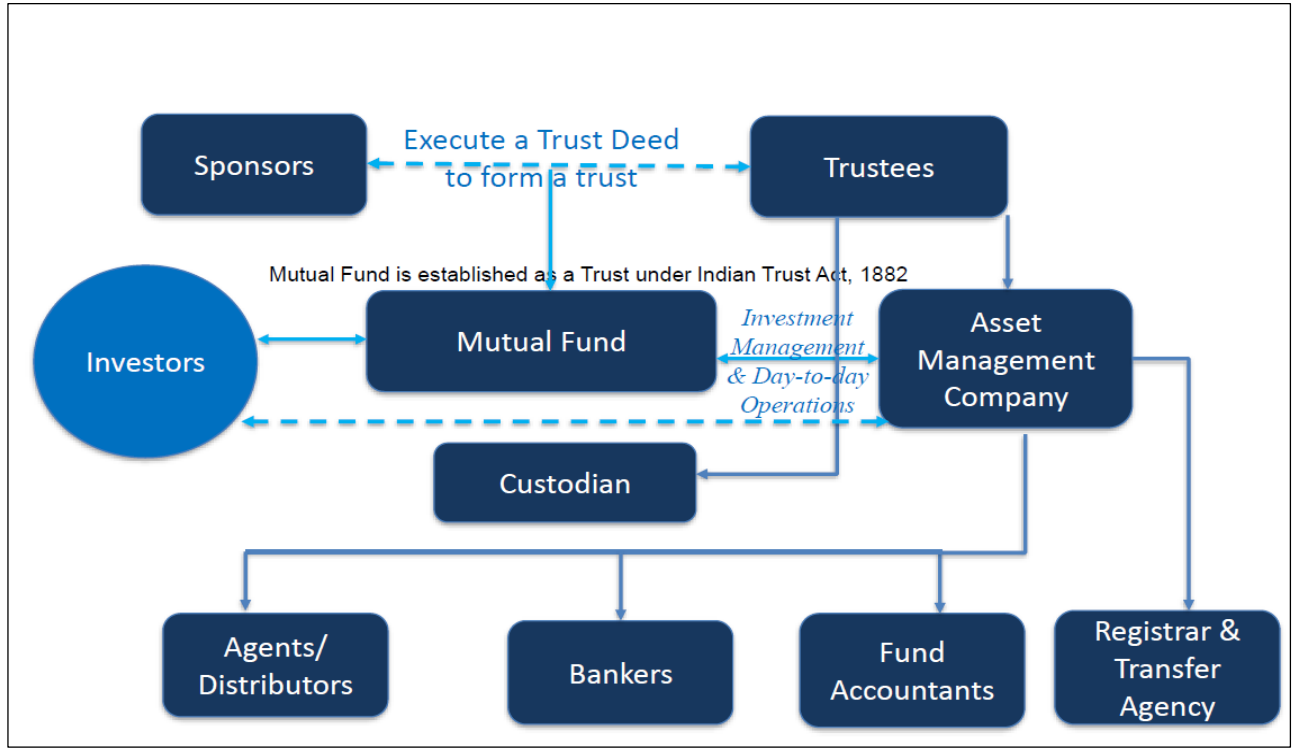

This flowchart illustrates the organisational structure of a mutual fund, outlining the roles of various entities such as sponsors, trustees, and asset management companies in managing and overseeing the fund's operations. Source

Hedge Funds

High-Risk Investment Strategies

Hedge funds are private investment partnerships that use a wide range of strategies, often including leverage and derivatives, to seek high returns.

Hedge Fund: A pooled investment fund that employs high-risk, sophisticated strategies to achieve above-average returns, usually open only to wealthy investors and institutions.

They are less regulated than mutual funds, which can contribute to systemic risk if strategies fail, but they also add to market efficiency by exploiting mispricing.

Private Equity Firms

Financing Business Growth

Private equity firms raise funds from investors to acquire, restructure, and sell companies. Their involvement often focuses on improving efficiency and profitability before selling the business at a higher value.

Private Equity Firm: An investment institution that provides capital directly to companies, typically through buyouts, with the aim of generating high long-term returns.

This form of finance differs from public stock markets, as it is illiquid and long term, but it plays a significant role in business innovation and restructuring.

Building Societies

Member-Owned Institutions

Building societies are mutual organisations, originally established to provide mortgages and savings accounts for their members. Unlike banks, they are owned by their members rather than shareholders.

Building Society: A financial institution owned by its members, providing savings and mortgage lending services.

While many have demutualised to become banks, building societies remain a distinctive part of the UK’s financial system.

Credit Unions

Community-Based Finance

Credit unions are not-for-profit cooperatives that provide savings and loans to their members, often with lower interest rates than commercial banks.

Credit Union: A member-owned cooperative financial institution that offers savings and loans services, typically focused on community benefit rather than profit maximisation.

They are especially significant in supporting financial inclusion for households underserved by mainstream banks.

Investment Trusts

Closed-End Funds

Investment trusts are companies that issue a fixed number of shares and use the proceeds to invest in a portfolio of securities. Unlike mutual funds, their shares are traded on the stock exchange.

Investment Trust: A closed-end company that invests in a portfolio of assets, with its shares traded publicly on stock exchanges.

Their prices can differ from the value of underlying assets due to supply and demand in the market.

Development Banks

Supporting Long-Term Projects

Development banks provide finance for large-scale infrastructure, housing, or industrial projects. In the UK context, examples include government-supported institutions that encourage long-term investment in the economy.

Development Bank: A state-supported or specialised financial institution that provides long-term finance for projects aimed at economic development.

They often focus on projects with social or economic benefits that private banks might consider too risky.

Key Points for Awareness

Insurance companies provide risk management and investment.

Pension funds are major institutional investors shaping long-term markets.

Mutual funds/unit trusts allow collective investment with diversification.

Hedge funds employ high-risk strategies with potential systemic impact.

Private equity firms finance and restructure businesses.

Building societies and credit unions are member-owned alternatives to banks.

Investment trusts offer closed-end, exchange-traded investment vehicles.

Development banks promote long-term projects for national growth.

FAQ

Non-bank institutions expand the variety of financial services available.

Banks mainly provide short- and medium-term lending. Other institutions:

Pension funds supply long-term capital for infrastructure and businesses.

Insurance companies spread risk and invest premiums into wider markets.

Mutual funds and unit trusts make investing accessible to smaller investors.

This diversity reduces reliance on banks and helps stabilise the financial system.

Hedge funds are less regulated than mutual funds, often targeting high-net-worth individuals and institutions.

They use strategies involving leverage, derivatives, and short selling, which regulators typically monitor lightly.

Mutual funds, however, are designed for the general public, with stricter rules on transparency, risk limits, and investor protection.

This regulatory gap means hedge funds can generate higher returns but also pose greater systemic risks.

Building societies are larger institutions focused on mortgages and savings. They often serve national markets and manage significant funds.

Credit unions are smaller, community-based cooperatives. Their priority is affordable loans and financial inclusion for members.

Both are member-owned, but credit unions usually restrict membership to a specific group, while building societies are open to broader public access.

Pension funds have long-term obligations to pay retirement benefits.

Equities provide potential for higher returns over decades.

Bonds deliver steady interest payments and long-term security.

Keeping large amounts in cash would not match inflation or provide sufficient growth, making it unsustainable for long-term pension commitments.

Development banks focus on projects that generate social and economic benefits, such as housing, energy, or infrastructure, even if short-term profits are limited.

Private equity firms seek high returns by restructuring and selling businesses, prioritising profitability and efficiency.

Thus, development banks emphasise public goals, while private equity firms are driven primarily by private investment returns.

Practice Questions

Identify two examples of financial institutions other than commercial and investment banks. (2 marks)

1 mark for each correct example, up to 2 marks.

Acceptable answers include: insurance companies, pension funds, mutual funds/unit trusts, hedge funds, private equity firms, building societies, credit unions, investment trusts, development banks.

Do not award credit for answers naming commercial or investment banks.

Explain the role of pension funds and insurance companies in financial markets. (6 marks)

Up to 3 marks for knowledge and understanding:

Pension funds: pool contributions, invest in long-term assets, provide retirement income (1–2 marks depending on detail).

Insurance companies: manage risk by pooling premiums, invest collected funds in financial markets (1–2 marks depending on detail).

Up to 2 marks for application: clear link to how these institutions influence financial markets, e.g. through large-scale investment in equities, bonds, and property.

1 mark for analysis: recognition that their activities affect both market stability and long-term economic growth.

Maximum 6 marks.