AQA Specification focus:

‘Students should be able to use a diagram to illustrate the effects of imposing a tariff on imports.’

Introduction

Tariffs are a crucial tool in international trade policy. They affect domestic markets, government revenue, and global trade relations, making them essential for A-Level Economics students.

Understanding Tariffs

A tariff is a tax imposed on imported goods, usually as a percentage of the import’s value. It raises the price of foreign products, influencing both consumers and producers.

Tariff: A tax levied by a government on imported goods to restrict imports, protect domestic industries, or raise revenue.

Tariffs are one of the most common forms of protectionism, designed to shield domestic producers from international competition. By making imports more expensive, they aim to encourage the consumption of domestically produced goods.

The Tariff Diagram: Key Features

When studying tariffs, the standard supply and demand diagram is used to illustrate their effects. It compares the market equilibrium without trade, with free trade, and with a tariff imposed.

Without Trade

Domestic equilibrium occurs where domestic supply equals domestic demand.

The equilibrium price and output are determined internally.

With Free Trade

World supply is assumed to be perfectly elastic at the world price, which is lower than the domestic equilibrium price.

Consumers can buy imports at this cheaper price.

Domestic producers supply less, while the shortfall is made up through imports.

With a Tariff

The government imposes a tariff, raising the import price above the world price.

Imports fall as consumers reduce demand due to higher prices.

Domestic producers expand supply because they are now more competitive.

The result is higher domestic production, lower imports, and reduced consumer welfare.

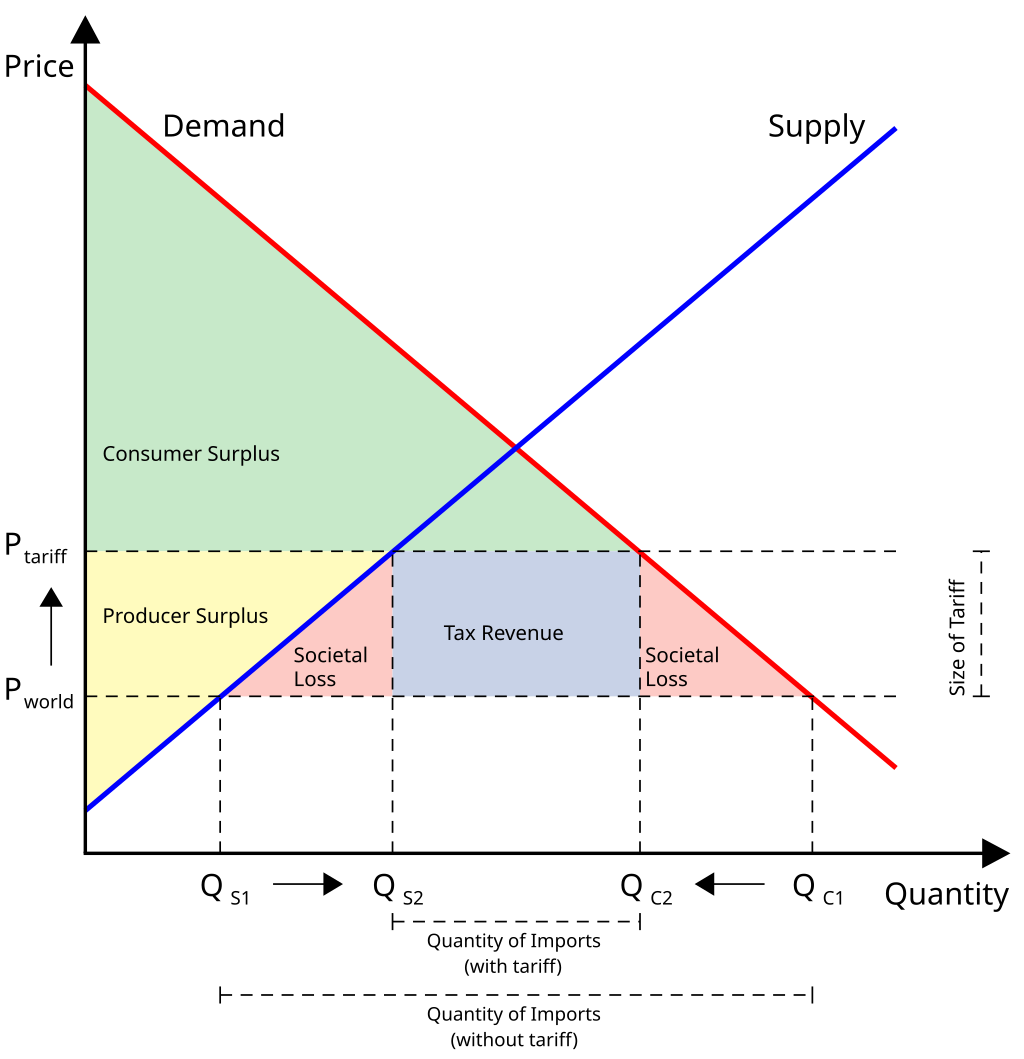

This diagram depicts the market effects of an import tariff, highlighting shifts in supply and demand curves, and areas representing consumer surplus, producer surplus, government revenue, and deadweight loss. Source

Diagram Analysis Step by Step

In the tariff diagram, the following elements are crucial:

World Price (Pw): The lower price at which imports are available without tariffs.

Tariff Price (Pw + T): The world price plus the tariff, raising the cost of imports.

Domestic Supply Expansion: Producers increase output in response to the higher price.

Reduced Imports: The gap between demand and domestic supply shrinks as fewer imports are demanded.

Government Revenue: Collected from the tariff, represented by a rectangular area on the diagram.

Welfare Effects

Consumer Surplus: Falls, as consumers pay higher prices and buy fewer goods.

Producer Surplus: Rises, as domestic producers sell more at a higher price.

Government Revenue: Gains tariff revenue from remaining imports.

Deadweight Loss: Overall welfare falls due to inefficiencies, shown by two triangular areas of lost surplus.

Deadweight Loss: A loss of economic efficiency that occurs when equilibrium output is reduced due to distortions such as tariffs or taxes.

These losses occur because some mutually beneficial trades between consumers and foreign producers no longer take place.

Reasons for Imposing Tariffs

Governments may impose tariffs for several reasons:

Protecting infant industries: Allowing new domestic industries to grow without being overwhelmed by foreign competition.

Safeguarding jobs: Preventing unemployment in key industries threatened by cheaper imports.

Reducing trade deficits: Limiting imports to correct imbalances in the balance of payments.

Retaliation: Responding to unfair trade practices or protectionist policies by other countries.

Revenue generation: Especially in less-developed economies where tariffs contribute significantly to government income.

Short-Run vs Long-Run Effects

Short-run: Tariffs can protect jobs, raise revenue, and support industries.

Long-run: They may reduce efficiency, provoke retaliation, and limit the benefits of international trade such as lower prices and greater consumer choice.

Tariff Effects on Stakeholders

Consumers

Face higher prices and reduced choice.

Experience a significant fall in welfare due to reduced consumer surplus.

Producers

Benefit from increased market share and higher revenues.

Inefficient producers may survive due to lack of competition.

Government

Gains tariff revenue, which can be used for public spending.

May face retaliation, reducing exports in other sectors.

Global Economy

Trade tensions and retaliatory tariffs may escalate.

Global efficiency is reduced as resources are misallocated.

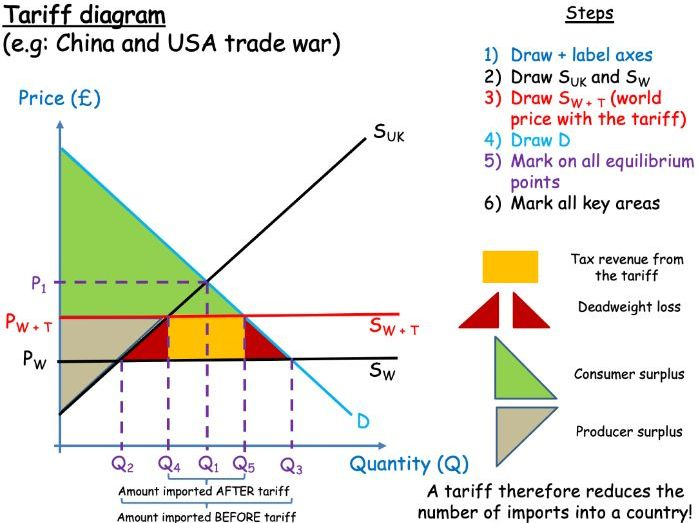

This diagram offers a step-by-step guide to drawing a tariff diagram, highlighting areas representing tax revenue, deadweight loss, and changes in consumer and producer surplus. Source

Linking Tariffs to AQA Specification

The AQA specification requires students to use a diagram to illustrate the effects of imposing a tariff on imports. This involves:

Accurately labelling supply, demand, world price, and tariff price.

Identifying the changes in consumer surplus, producer surplus, government revenue, and deadweight loss.

Explaining the welfare effects clearly in relation to the diagram.

Key Takeaways for Students

Tariffs raise import prices and reduce imports.

Domestic producers gain, consumers lose, and governments earn revenue.

Welfare losses occur due to inefficiency and reduced trade.

The diagram is central to understanding these effects and is a high-frequency exam focus.

FAQ

Government revenue from a tariff depends on:

The size of the tariff imposed.

The price elasticity of demand for the imported good. If demand is elastic, imports fall significantly, reducing revenue. If inelastic, revenue is higher.

The volume of imports before and after the tariff.

The ability of foreign exporters to absorb part of the tariff, which may lessen the price rise and affect demand.

Deadweight loss arises because tariffs reduce the total number of mutually beneficial trades.

Some consumers who would have bought at the world price no longer purchase at the higher tariff price, while domestic resources are reallocated inefficiently to less competitive producers.

This means both consumer welfare and overall economic efficiency are reduced, even though domestic producers and the government gain.

Tariffs can shift income from consumers to producers.

Consumers lose as they face higher prices.

Domestic producers benefit from increased sales and profits.

Workers in protected industries may see more secure employment.

However, the poorest households are often most affected, as they spend a larger proportion of income on goods that may now cost more.

Tariffs may fail if:

The domestic industry cannot scale up production quickly enough to replace imports.

Foreign producers lower their prices to maintain market share.

Consumers continue to prefer imported goods due to higher quality or brand loyalty.

Retaliation by trading partners reduces demand for the country’s exports, offsetting any protectionist gains.

Tariffs often lead to tension between countries.

Trading partners may view tariffs as unfair barriers to free trade and retaliate with their own tariffs.

This can escalate into trade disputes or even trade wars, reducing global economic efficiency and harming international cooperation.

In contrast, removing tariffs can strengthen diplomatic and economic relationships by fostering openness and trust.

Practice Questions

Define a tariff and explain its immediate effect on the price of imported goods. (2 marks)

1 mark for defining a tariff as a tax on imported goods.

1 mark for explaining that it raises the price of imports in the domestic market.

Using a supply and demand diagram, explain the impact of a tariff on consumer surplus, producer surplus, and government revenue. (6 marks)

1 mark for correctly stating that consumer surplus falls due to higher prices and lower consumption.

1 mark for correctly stating that producer surplus rises as domestic producers expand output at the higher price.

1 mark for recognising that government revenue increases from tariff income.

1 mark for reference to reduced imports as a result of the tariff.

1 mark for identifying deadweight loss (welfare loss) due to inefficiency.

1 mark for clear and accurate use of a supply and demand diagram with correct labelling (Pw, Pw+T, quantities, surplus areas).