AQA Specification focus:

‘The reasons for changes in the pattern of trade between the UK and the rest of the world.’

The UK’s trade patterns have changed significantly over recent decades due to structural economic shifts, globalisation, policy changes, and evolving comparative advantages influencing trade flows.

Historical context of UK trade

The UK historically traded mainly with the Commonwealth, exporting manufactured goods and importing raw materials. Over time, trade shifted towards Europe and more recently towards emerging economies. The decline of heavy industry and the rise of services have been central to these changes.

Structural economic change

The UK economy has experienced deindustrialisation, reducing reliance on traditional manufacturing exports such as coal, steel, and textiles. Instead, growth in the service sector — particularly financial, business, and professional services — has reshaped trade.

Decline of primary and secondary industries reduced exports of goods.

Expansion of tertiary and quaternary sectors increased exports of services.

The UK is now a net exporter of services, while it imports more manufactured goods.

Deindustrialisation: The long-term decline of manufacturing industries and associated employment within an economy, often replaced by service-based activity.

Globalisation and emerging markets

Globalisation has integrated economies worldwide, enabling shifts in production and consumption patterns. The UK’s trade links increasingly reflect global value chains.

Increased imports from China and India due to lower production costs.

Greater exports to emerging markets such as Asia and Latin America as incomes rise abroad.

Offshoring of UK-based manufacturing to low-cost economies.

Globalisation: The increasing interconnectedness and interdependence of economies worldwide through trade, investment, technology, and cultural exchange.

UK membership of the European Union

Joining the European Economic Community (EEC) in 1973 transformed UK trade patterns.

Tariff-free trade within the Single European Market boosted intra-EU trade.

Harmonisation of regulations and standards encouraged integration with EU economies.

By the 1990s, the EU became the UK’s largest trading partner.

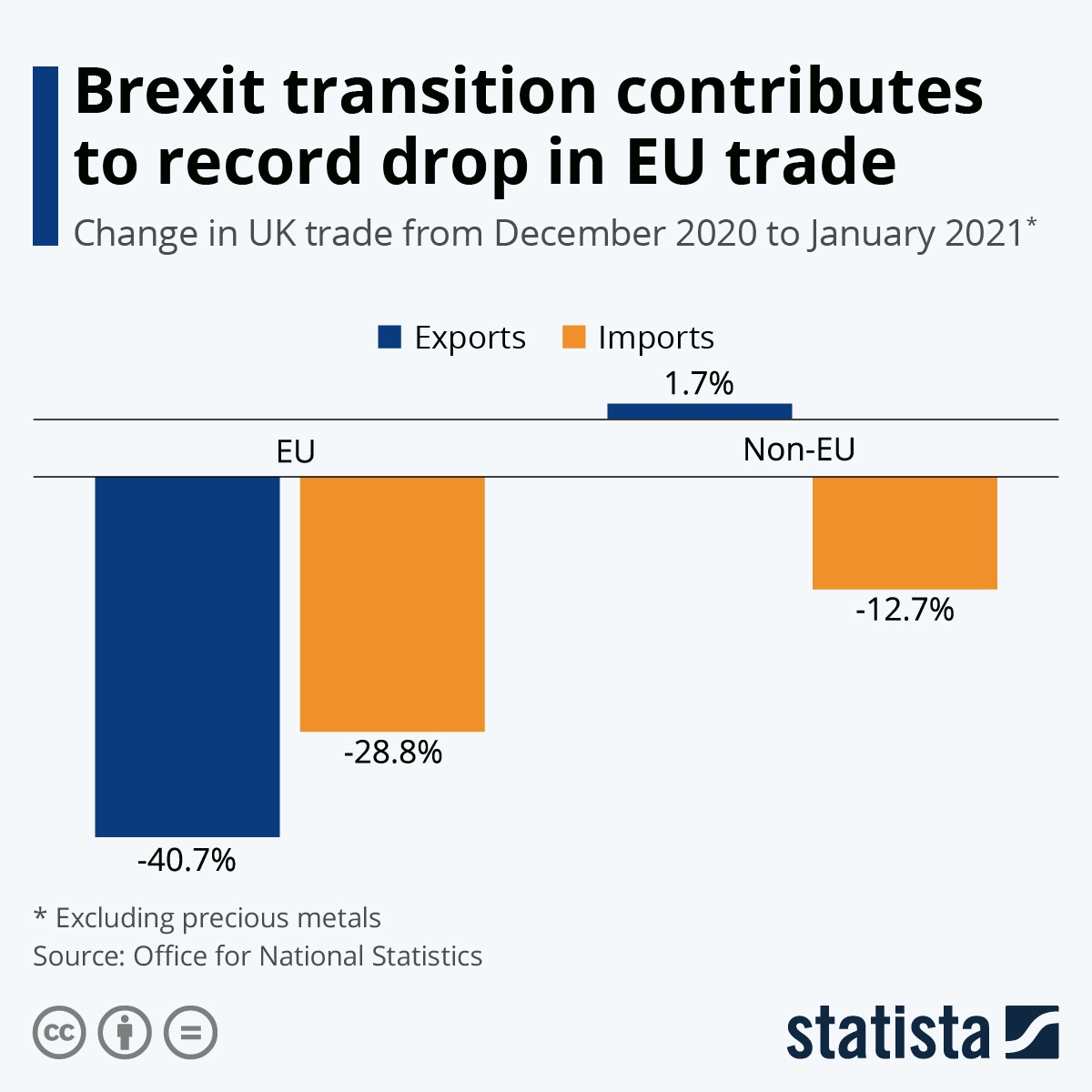

Brexit in 2020 altered these links:

Increased non-tariff barriers (customs checks, regulatory divergence).

Incentivised the UK to seek new trade deals outside Europe, such as with Australia and Japan.

This chart depicts the sharp decline in UK trade with the EU post-Brexit, emphasising the challenges posed by new trade barriers and the need for the UK to seek new trading partners. Source

Comparative advantage and specialisation

Shifts in the UK’s comparative advantage have changed its trade composition.

Declining competitiveness in manufacturing meant a move away from mass-produced goods.

Rising comparative advantage in high-value services, pharmaceuticals, and creative industries.

Heavy dependence on imports for consumer goods and intermediate inputs.

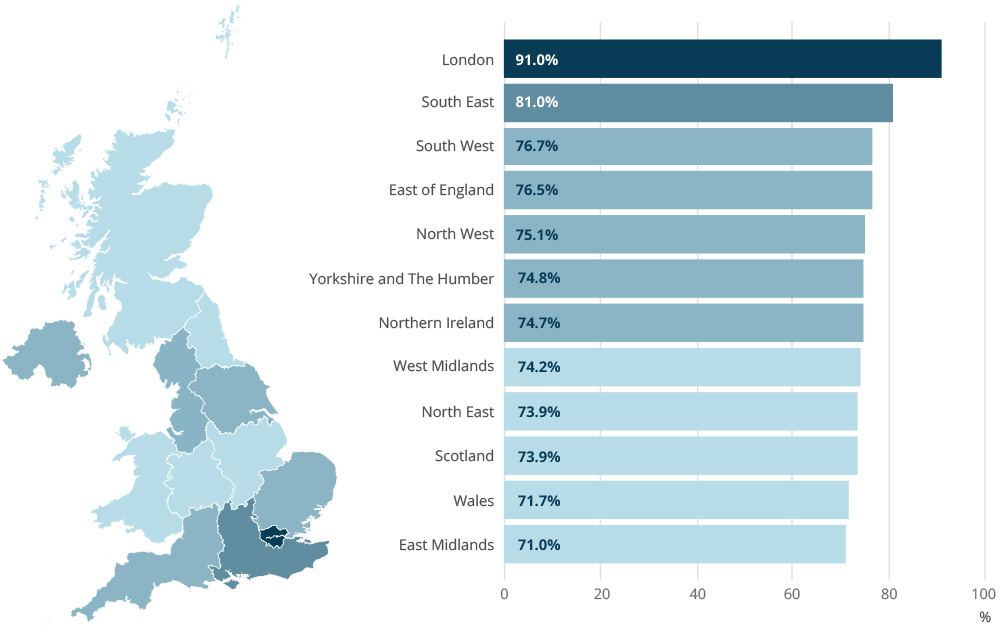

This infographic highlights the UK's dependence on the service sector, illustrating its growing importance in the nation's export profile and economic structure. Source

Comparative Advantage: The ability of a country to produce a good or service at a lower opportunity cost compared with other nations.

Technological change

Advances in information and communications technology have supported the UK’s service exports, particularly in finance, education, and digital services.

Growth of fintech and digital platforms facilitated cross-border trade in services.

E-commerce enabled global distribution of UK goods and services.

Exchange rate fluctuations

Changes in the value of sterling influence UK trade competitiveness.

A depreciated pound makes UK exports cheaper abroad but imports more expensive.

An appreciated pound increases import purchasing power but reduces export competitiveness.

Real Exchange Rate (RER) = Nominal Exchange Rate × (Domestic Price Level / Foreign Price Level)

Nominal Exchange Rate = Rate at which one currency exchanges for another

Price Level = General level of prices in each country

Foreign direct investment and trade links

The UK has attracted significant foreign direct investment (FDI), particularly in sectors like finance, automotive, and technology.

Multinational corporations shape trade flows by locating production in the UK.

Foreign-owned firms (e.g., Japanese car manufacturers) export from the UK to Europe and beyond.

Policy and trade agreements

Government trade policy influences UK trade patterns:

Past reliance on EU single market arrangements.

Current emphasis on bilateral and multilateral trade deals outside the EU.

Membership of the World Trade Organisation (WTO) ensuring rules-based trade.

Changing consumer preferences

Shifts in UK consumer demand also reshape imports:

Rising demand for electronics, fashion, and consumer goods sourced globally.

Growth in ethical and sustainable trade altering the types of imports.

Increased demand for specialised food and drink imports reflecting diverse consumer tastes.

Summary of key reasons for changes in UK trade patterns

Structural change: shift from goods to services.

Globalisation: stronger ties with emerging economies.

EU membership and Brexit: institutional factors shaping access.

Comparative advantage shifts: rise of services, decline of manufacturing.

Technological change: enabling service trade.

Exchange rate movements: altering competitiveness.

FDI and multinational corporations: influencing trade flows.

Government policies and trade deals: redirecting trade partners.

Consumer preferences: diversifying import demand.

FAQ

The decline of traditional industries such as coal, steel, and textiles has reduced the UK’s export share of manufactured goods.

This process, known as deindustrialisation, has led the UK to import more manufactured goods from low-cost economies like China, while increasingly specialising in high-value services such as finance, law, and education.

The result is a shift in the UK’s trade balance, with services exports growing in importance and goods imports rising.

UK consumers demand a greater variety of goods, including electronics, fast fashion, and speciality foods.

Rising incomes have supported greater spending on luxury imports.

Diverse cultural influences have boosted demand for international cuisine and products.

Ethical and sustainable sourcing has increased demand for fair-trade and environmentally friendly imports.

These evolving tastes have diversified UK imports and strengthened trade with a wider range of countries.

The UK has a strong comparative advantage in high-value services. London is a global financial hub, while the country also leads in legal, educational, and creative industries.

Technological advances in communications allow services to be delivered internationally. Demand for English-speaking expertise also strengthens global demand for UK-based service exports.

This shift explains why the UK consistently records a surplus in services trade.

When sterling depreciates, UK exports become cheaper abroad, benefiting foreign buyers. Conversely, imports become more expensive, reducing demand for overseas goods.

A weaker pound can therefore improve the UK’s current account by boosting exports and reducing imports.

However, key partners such as the EU may experience reduced export revenue if UK consumers cut back on imports.

These changes alter the relative importance of different partners in UK trade.

Foreign direct investment (FDI) brings overseas firms into the UK, shaping export and import activity.

For example, Japanese car companies such as Nissan export vehicles produced in the UK to European and global markets.

FDI also boosts the UK’s participation in global supply chains, as foreign-owned firms often import intermediate goods and export final products, altering both the scale and direction of UK trade.

Practice Questions

Identify two reasons why the pattern of UK trade has changed in recent decades. (2 marks)

1 mark for identifying structural change (e.g., shift from manufacturing to services).

1 mark for identifying globalisation/emerging markets (e.g., increased trade with Asia due to lower costs or rising incomes).

(Max 2 marks)

Explain how Brexit has influenced the pattern of UK trade with the European Union and with non-EU countries. (6 marks)

1–2 marks: Basic reference to Brexit leading to changes in trading arrangements.

3–4 marks: Clear explanation of non-tariff barriers (e.g., customs checks, regulatory divergence) affecting EU trade.

5–6 marks: Developed explanation showing how this has encouraged the UK to pursue new trade agreements with non-EU countries (e.g., Australia, Japan), demonstrating understanding of shifting trade patterns.

(Max 6 marks)