AQA Specification focus:

‘The nature of protectionist policies, such as: tariffs, quotas and export subsidies.’

Protectionism refers to measures taken by governments to restrict international trade. By limiting imports or artificially supporting exports, states aim to protect domestic industries, maintain employment, and control trade balances.

Understanding Protectionism

Protectionism occurs when governments intervene in international trade to shield domestic industries from foreign competition. While it can provide short-term advantages, it often leads to inefficiencies and retaliation. The three main forms highlighted in the specification are tariffs, quotas, and export subsidies.

Tariff: A tax imposed on imported goods, raising their price to reduce demand for imports and protect domestic producers.

Quota: A legal limit on the quantity of a particular good that can be imported into a country, directly restricting supply.

Export Subsidy: A payment made by a government to domestic producers to encourage exports by reducing their costs, making their goods more competitive abroad.

Tariffs

Tariffs are the most widely used form of protectionism. By increasing the price of imported goods, tariffs aim to encourage consumers to switch to domestically produced alternatives.

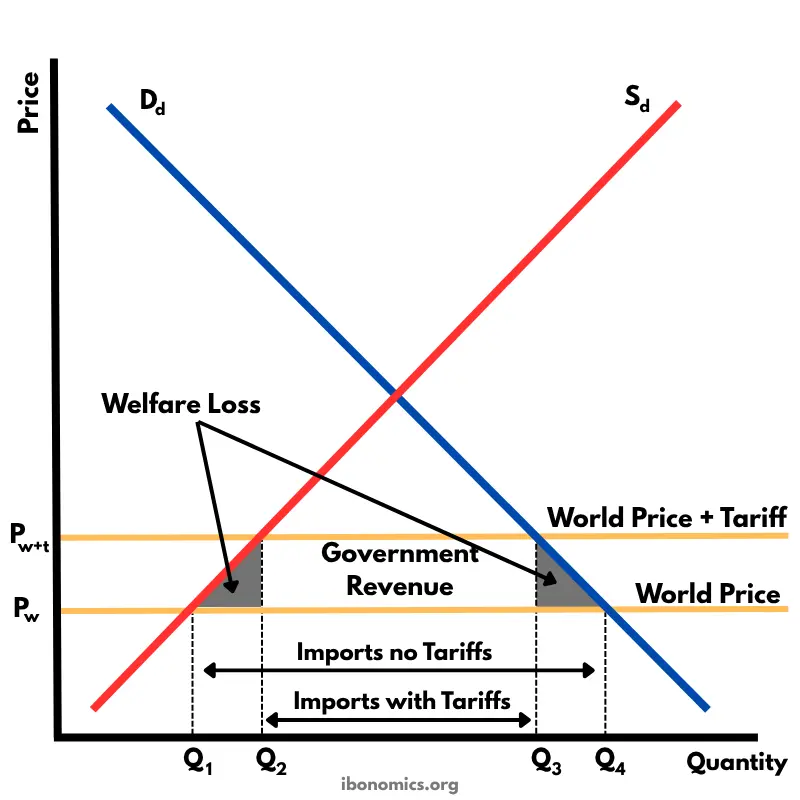

This diagram demonstrates the effects of imposing a tariff on imported goods, highlighting changes in price, quantity, and the distribution of economic welfare among consumers, producers, and the government. Source

Key effects of tariffs:

Domestic industries face less competition, potentially boosting output and employment.

Consumers pay higher prices, reducing consumer surplus.

Government revenue increases from tariff collections.

Foreign exporters experience reduced demand for their products.

However, tariffs can provoke retaliation from trading partners, reducing overall trade and leading to inefficiency.

Quotas

Quotas directly restrict the quantity of imports, rather than raising their price. Unlike tariffs, they do not generate government revenue but still protect domestic producers by limiting competition.

Implications of quotas:

Domestic supply fills the gap left by restricted imports.

Prices of imported goods may rise due to scarcity.

Foreign producers may lobby for export licences, sometimes creating corruption or inefficiency.

Consumers face reduced choice and higher costs.

Export Subsidies

Export subsidies work in the opposite direction to tariffs and quotas. Instead of discouraging imports, they encourage exports by making domestic goods cheaper abroad.

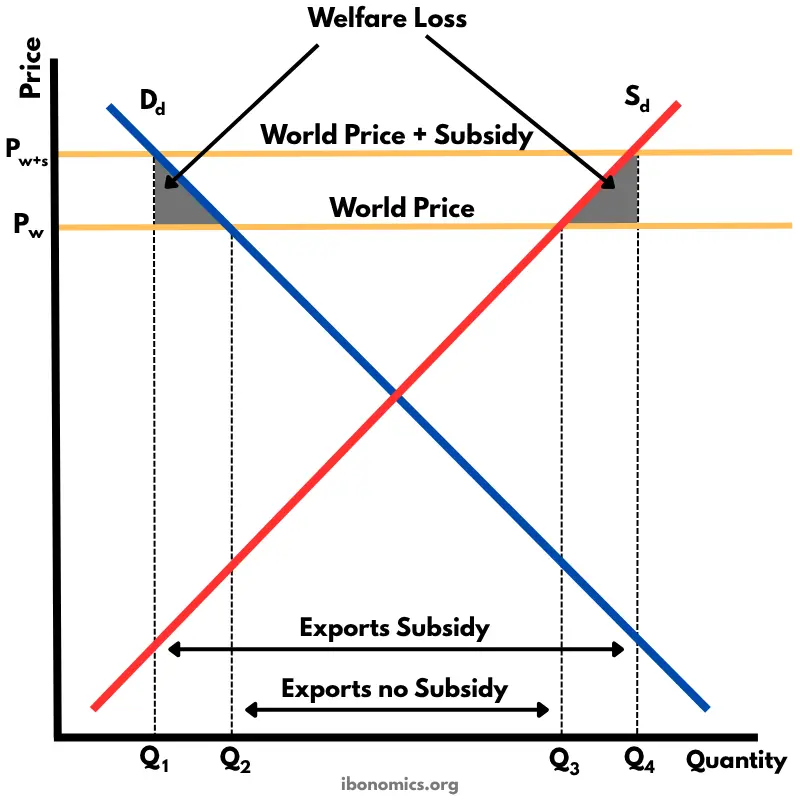

The diagram illustrates the impact of an export subsidy on domestic prices, production, and consumption, highlighting the resulting welfare losses and the redistribution of economic surplus. Source

Consequences of subsidies:

Domestic firms gain competitiveness in foreign markets.

Government expenditure increases, with taxpayers funding subsidies.

International markets may face distortions, leading to accusations of unfair trade practices.

Consumers abroad benefit from cheaper imports, while domestic taxpayers bear the cost.

Broader Economic Implications of Protectionism

Protectionist measures have wider economic effects beyond individual policies.

Effects on Efficiency

Protectionism often reduces allocative efficiency by shielding inefficient domestic producers. It prevents the global economy from achieving comparative advantage, where each country specialises in what it produces most efficiently.

Effects on Prices and Consumers

Consumers usually face higher prices and reduced choice due to restrictions. In the long run, this may slow innovation as domestic firms face less competition.

Effects on Employment

Protectionism may protect jobs in vulnerable industries, but retaliation or reduced efficiency can cause losses in other sectors. For example, restricting imports of steel may help steelworkers but raise costs for industries relying on steel inputs.

Effects on Government Finances

Tariffs generate revenue.

Quotas provide no direct income.

Subsidies increase government spending.

The overall fiscal effect depends on the mix of policies.

Effects on International Relations

Protectionist policies can damage relations between trading partners. Countries affected by tariffs, quotas, or subsidies may introduce retaliatory measures, escalating into trade wars. Such conflicts reduce global trade volumes and harm economic growth.

Why Governments Use Protectionism

Despite negative consequences, governments adopt protectionist measures for several reasons:

Infant industry protection: Supporting emerging industries until they become competitive.

Strategic industries: Protecting industries vital for national security, such as defence or energy.

Employment protection: Preventing job losses in declining industries.

Balance of payments support: Reducing imports to improve the current account balance.

Political reasons: Responding to pressure groups or public opinion.

Case-Specific Consequences

Developed economies: Often use protectionism to safeguard high-value industries or maintain employment.

Developing economies: May protect domestic markets from being flooded by imports, though subsidies can strain limited government budgets.

Interaction with the WTO

The World Trade Organisation (WTO) plays an important role in limiting unfair trade practices. Many subsidies and excessive tariffs are challenged through its dispute resolution system. This demonstrates how protectionism, while legal under certain circumstances, is increasingly regulated in the global economy.

Summary of Key Points on Protectionism

Tariffs

Raise import prices.

Protect domestic firms.

Generate government revenue.

Quotas

Limit import quantity.

Protect domestic industries.

Restrict consumer choice.

Subsidies

Encourage exports.

Increase government spending.

Distort international competition.

FAQ

In the short run, tariffs shield domestic firms from competition, but in the long run they can reduce incentives for innovation and efficiency.

Firms may become reliant on protection rather than improving productivity. This can weaken their international competitiveness once tariffs are removed or reduced.

Quotas place a fixed legal limit on imports, which means supply cannot expand even if consumers are willing to pay higher prices.

Unlike tariffs, where demand can still be met at higher costs, quotas directly prevent access to additional goods. This often leads to more severe shortages and distortions in consumer choice.

Export subsidies can distort global trade by lowering prices for subsidised goods in international markets.

This may harm foreign producers unable to compete.

Trade disputes may arise, often brought before the WTO.

Countries facing subsidised exports may retaliate with tariffs or quotas.

Protectionist policies often benefit producers at the expense of consumers.

Producers gain through higher prices or guaranteed market share.

Consumers face higher costs and less choice, disproportionately affecting lower-income households.

Government subsidy spending may divert resources away from public services.

Governments may adopt a mix of protectionist tools to achieve multiple objectives.

Tariffs raise revenue while restricting imports.

Quotas ensure a firm cap on foreign goods.

Subsidies strengthen exports and support domestic jobs.

This combination allows policymakers to balance fiscal, political, and economic goals.

Practice Questions

Define a tariff and explain its main purpose in the context of protectionism. (2 marks)

1 mark for a correct definition: A tariff is a tax imposed on imported goods.

1 mark for explaining the purpose: To raise the price of imports and protect domestic industries.

Discuss the likely effects of imposing quotas on imported goods in terms of consumers, domestic producers, and government finances. (6 marks)

Up to 2 marks for explaining the impact on consumers: Higher prices, reduced choice.

Up to 2 marks for explaining the impact on domestic producers: Less foreign competition, potential increase in output and jobs.

Up to 2 marks for explaining the impact on government finances: No tariff revenue generated, possible administrative costs.

Maximum 6 marks overall; responses should show balance and cover at least two different stakeholders for full credit.