AQA Specification focus:

‘The implications for the global economy of a major economy or economies with imbalances deciding to take corrective action.’

When large economies implement corrective action to address balance of payments imbalances, the effects are not confined domestically; they generate profound global implications across trade, investment, and growth.

Understanding Corrective Action

Corrective action refers to the policies governments employ to address persistent balance of payments imbalances, such as large current account deficits or surpluses. These measures can include:

Expenditure-switching policies (e.g., tariffs, subsidies, exchange rate adjustments).

Expenditure-reducing policies (e.g., fiscal austerity, tighter monetary policy).

These policies aim to realign domestic demand and competitiveness but inevitably transmit effects internationally due to the interconnected nature of the global economy.

Transmission Mechanisms of Global Impact

Trade Effects

When a large economy takes corrective action, changes ripple outward via trade channels:

Reduced imports caused by austerity measures or currency depreciation lower export demand for trading partners.

Increased exports from a weaker exchange rate can disadvantage other exporters in global markets, heightening competition.

Protectionist policies like tariffs or quotas can trigger retaliatory measures, leading to a trade war dynamic.

Investment Flows

Corrective action alters the pattern of global capital flows:

Higher domestic interest rates (from tighter monetary policy) attract foreign portfolio investment, strengthening the currency but reducing capital availability elsewhere.

Lower demand within the correcting economy reduces foreign direct investment (FDI) opportunities, impacting developing economies reliant on external funding.

Implications for Developed Economies

For developed countries, corrective action by a major partner such as the United States, China, or the EU has significant spillover consequences:

Export-dependent economies face falling demand if the corrective economy reduces imports.

Financial markets become more volatile as capital reallocates in response to interest rate and exchange rate shifts.

Policy coordination challenges emerge, especially within currency unions or trade blocs, where unilateral corrective action can disrupt wider macroeconomic stability.

Implications for Developing Economies

Developing economies often face greater vulnerability:

Falling commodity demand from a major correcting economy lowers export revenues, leading to slower growth.

Volatile exchange rates result from global capital movements, creating instability in fragile financial systems.

Aid and remittances may decline if expatriates in correcting economies experience reduced incomes.

Foreign Direct Investment (FDI): Investment made by a firm or individual in one country into business interests located in another country, typically by acquiring assets or establishing operations.

Protectionism and Retaliation

Corrective actions involving protectionist measures can spark global tension:

Countries facing reduced market access may retaliate with their own tariffs.

This leads to a cycle of escalating protectionism, undermining the efficiency of global trade.

The World Trade Organisation (WTO) often plays a role in mediating disputes, but enforcement can be slow and politically constrained.

Effects on Global Growth

Corrective action by large economies can influence worldwide growth patterns:

Negative multiplier effects emerge if global demand contracts, as one country’s reduced spending lowers output abroad.

Conversely, successful rebalancing may create long-term stability, fostering healthier global growth if sustainable trade patterns are restored.

Growth in emerging markets may become subdued if global supply chains face disruption.

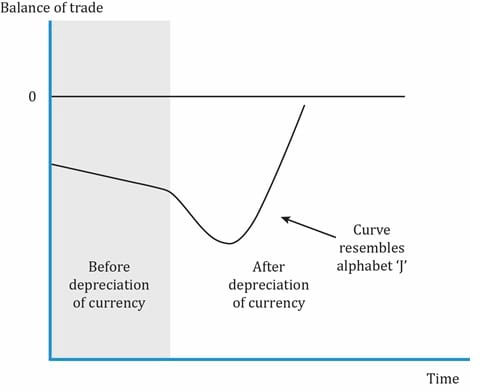

This chart illustrates the J-curve effect: after a depreciation, the trade balance worsens in the short run but improves over time as exports expand and imports contract. Source

Exchange Rate Adjustments

Exchange rate policies are a frequent form of corrective action:

Currency depreciation boosts competitiveness of exports but harms trade partners’ market shares.

Currency appreciation in other economies may reduce their export competitiveness, widening their own imbalances.

Currency unions face unique challenges since member states cannot unilaterally devalue, increasing reliance on fiscal measures.

Expenditure-Switching Policies: Policies designed to encourage domestic consumers to buy home-produced goods instead of imports, or to increase exports relative to imports.

Global Financial Stability

Corrective action has far-reaching financial implications:

Interest rate rises in major economies, such as the US Federal Reserve tightening policy, can trigger capital flight from emerging markets.

Exchange rate volatility can disrupt international investment planning, raising risk premiums and reducing cross-border flows.

Contagion effects may arise, where instability in one region spreads to others through financial linkages.

Policy Coordination and International Institutions

Because of these wide-ranging global effects, corrective action often requires coordination:

Institutions like the International Monetary Fund (IMF) support countries in addressing imbalances while mitigating global harm.

G20 summits provide a forum for coordination between major economies, though cooperation depends on political will.

Without coordination, corrective action risks generating beggar-thy-neighbour policies, where one country’s gains come at others’ expense.

Key Risks and Long-Term Outcomes

The global implications can be both stabilising and destabilising:

Risks: protectionism, slower global growth, heightened volatility, trade conflicts.

Benefits: sustainable trade balances, stronger global institutions, greater macroeconomic resilience.

Thus, corrective action by a major economy has consequences extending far beyond its borders, shaping the trajectory of the global economy itself.

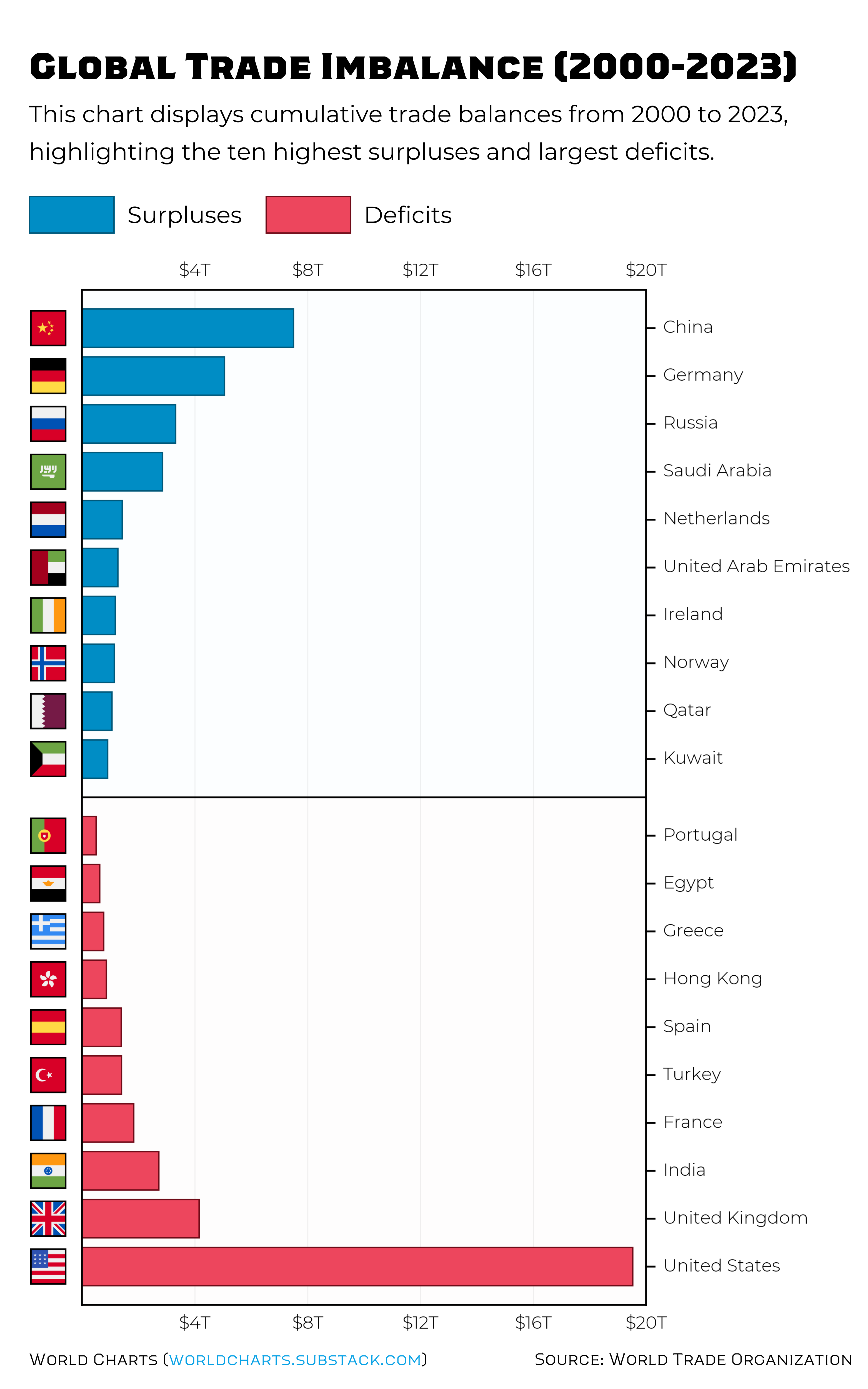

This infographic outlines the causes and consequences of global trade imbalances. It highlights how mismatches between imports and exports can destabilise economies, affecting markets and international relations worldwide. Source

FAQ

The J-curve effect describes how a depreciation may initially worsen a country's trade balance before improving it. Contracts and price rigidities delay the positive effect of cheaper exports.

Globally, this matters because in the short run trading partners may experience falling demand, while in the long run competitiveness shifts. The transition period can create uncertainty in international markets.

When a large economy adjusts through measures such as currency depreciation or tariffs, others may respond to protect their own competitiveness.

Retaliatory tariffs can escalate trade tensions.

Countries with pegged currencies may intervene to avoid large swings.

Regional trading blocs may pressure members to coordinate policies.

This chain reaction shows how corrective action rarely stays confined to one country.

Developing economies are highly dependent on trade with larger economies and often rely on commodity exports.

If a major economy reduces demand for imports, commodity prices may fall, reducing export revenues. Capital flight can also occur if global investors shift funds to safer developed markets.

These combined effects can weaken growth, worsen debt burdens, and destabilise exchange rates in less resilient economies.

Global investors react quickly to corrective measures, especially when interest rates or exchange rates are involved.

Higher interest rates in one economy can cause capital inflows there and outflows elsewhere.

Exchange rate shifts can reprice international investments, altering returns.

Increased uncertainty raises risk premiums, making borrowing costlier globally.

Thus, financial contagion can spread well beyond the correcting economy.

Institutions such as the IMF and WTO help mitigate negative spillovers.

The IMF provides emergency lending or guidance to countries affected by global capital movements. The WTO resolves disputes arising from protectionist corrective measures.

By offering forums for dialogue and rules to follow, these institutions aim to reduce instability and promote cooperative solutions when corrective actions impact global trade and finance.

Practice Questions

Define the term expenditure-switching policy and explain briefly how it might correct a balance of payments deficit. (2 marks)

1 mark for definition: Expenditure-switching policies encourage consumers to switch spending from imports to domestically produced goods (e.g., tariffs, subsidies, currency depreciation).

1 mark for explanation: They reduce imports or increase exports, thereby improving the current account balance.

Analyse the possible global implications if a major economy adopts corrective action through a significant depreciation of its currency. (6 marks)

1 mark: Identification that depreciation makes exports cheaper and imports more expensive.

1 mark: Explanation that this can improve the correcting country’s current account balance.

1 mark: Recognition that trade partners may face reduced export competitiveness.

1 mark: Explanation that this can lead to retaliation or protectionist measures.

1 mark: Identification that developing economies reliant on exports to the major economy may suffer from falling demand.

1 mark: Explanation that global trade tensions or instability could result, potentially slowing worldwide growth.