AQA Specification focus:

‘The factors that influence a country’s current account balance such as productivity, inflation and the exchange rate.’

Introduction

The current account balance reflects trade in goods and services alongside income flows. It is influenced by several key factors shaping competitiveness and international economic performance.

Understanding the Current Account Balance

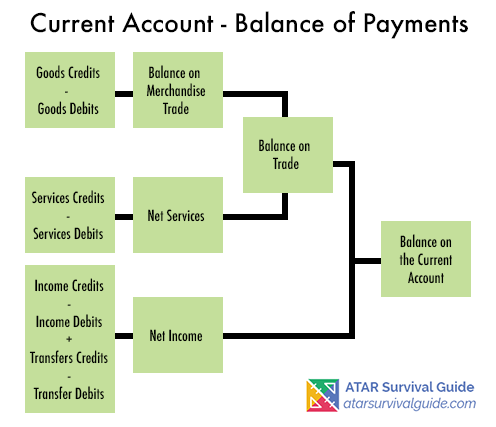

The current account is a major component of the balance of payments, recording the net trade in goods and services, primary income (e.g., investment earnings), and secondary income (e.g., aid, remittances). A country’s balance can show either:

This diagram outlines the components of the balance of payments, with a focus on the current account. It shows how trade in goods, services, income, and transfers contribute to a country's overall balance of payments. Source

Surplus: exports exceed imports plus net income outflows.

Deficit: imports and net outflows exceed exports and inflows.

The determinants of this balance link directly to macroeconomic performance.

Productivity

Role of Productivity

Productivity is the output per unit of input, such as labour productivity (output per worker per hour). It is crucial in shaping export competitiveness.

Higher productivity reduces unit labour costs, improving price competitiveness internationally.

Countries with strong productivity growth tend to export more, strengthening the current account.

Low productivity growth raises costs, making imports relatively cheaper, worsening the balance.

Structural Productivity Differences

Advanced economies often lead in capital-intensive, high-technology industries, maintaining strong export markets.

Developing economies may rely on low-cost labour exports but struggle if global wages rise faster than productivity.

Inflation

Relative Inflation Rates

Inflation is the sustained rise in the general price level. Its effect on the current account depends on relative rates compared to trading partners.

If domestic inflation is higher than foreign inflation, exports become less competitive, reducing demand abroad.

If inflation is lower than trading partners, exports become relatively cheaper, improving the current account.

Short-Term vs Long-Term Impacts

Short-term: sudden inflationary spikes may quickly erode export competitiveness.

Long-term: persistent inflationary gaps lead to structural current account deficits, requiring corrective policies.

Exchange Rate

Floating Exchange Rates

Under a floating exchange rate system, the value of a currency is determined by supply and demand.

Depreciation (fall in currency value): exports become cheaper, imports more expensive, improving the current account (depending on elasticities).

Appreciation (rise in currency value): exports become more expensive, imports cheaper, worsening the current account.

Marshall-Lerner Condition: (PEDx + PEDm) > 1

PEDx = Price elasticity of demand for exports

PEDm = Price elasticity of demand for imports

The condition states that a depreciation will only improve the balance if demand for exports and imports is sufficiently elastic.

J-Curve Effect

The J-curve effect explains why following depreciation, the current account may worsen before improving. Contracts and habits keep demand inelastic in the short run, but adjustment occurs over time.

Domestic Economic Growth

Strong domestic growth increases consumer demand, often leading to higher imports.

In booming economies, import expenditure rises faster than export revenues, creating current account deficits.

In recessions, import demand falls, sometimes narrowing the deficit or creating a surplus.

This cyclical pattern highlights the close link between growth and external balances.

Competitiveness and Non-Price Factors

Quality and Innovation

Beyond costs and prices, the quality of goods and services, branding, and after-sales support influence demand. High-quality exports can sustain sales even if relatively expensive.

Trade Agreements and Market Access

Membership of customs unions or trade blocs enhances export access, supporting the current account.

Protectionist barriers abroad restrict exports, worsening balances.

Investment Flows and Income

The current account includes primary income from overseas investments.

Strong foreign direct investment (FDI) earnings abroad support surpluses.

High payments to foreign investors worsen the balance.

Secondary income (such as foreign aid and worker remittances) also influences flows, though often less significantly.

Government Policy

Fiscal and Monetary Policy

Expansionary policies that boost consumption often raise imports, worsening the current account.

Contractionary policies can reduce import spending but may also slow export industries.

Supply-Side Policy

Policies improving productivity, infrastructure, or education can enhance competitiveness, improving export performance and stabilising the current account.

Global Economic Conditions

World Demand

Global recessions reduce demand for exports, while booms strengthen them. For instance, falling global commodity prices harm commodity exporters’ current accounts.

Relative Growth Rates

If a country’s trading partners grow faster, their increased demand benefits the exporter’s balance. Conversely, weak partner growth reduces export opportunities.

Summary of Determinants

Key influences on the current account balance include:

Productivity: determines unit labour costs and competitiveness.

Inflation: relative price changes affect trade flows.

Exchange rates: depreciation/appreciation shapes competitiveness (via the Marshall-Lerner condition and J-curve).

Domestic growth: influences import demand.

Competitiveness factors: quality, innovation, and trade access.

Investment income: net flows from FDI and portfolio assets.

Policy and global context: fiscal, monetary, supply-side policy, and global demand shifts.

FAQ

If wages in one country rise faster than productivity, unit labour costs increase. This makes exports less competitive internationally.

Meanwhile, if trading partners maintain lower wage growth relative to productivity, their exports become more attractive. This often leads to a shift in trade flows, worsening the current account for the higher-cost country.

Commodity prices are highly sensitive to global demand and supply shocks. A sudden fall in prices reduces export revenues significantly, even if export volumes remain stable.

Because commodities form a large share of many developing countries’ exports, fluctuations can create instability in their current account balances.

Yes, subsidies to domestic industries lower production costs. This can make exports cheaper, supporting an improvement in the current account.

However, subsidies may also distort competition, sometimes prompting retaliatory measures from trading partners, which could offset any gains.

Non-price factors such as branding, quality, and cultural preferences influence demand for imports and exports.

For example, strong consumer demand for foreign luxury goods may increase imports, worsening the current account, even if domestic alternatives exist at lower prices.

An ageing population may reduce overall productivity and increase reliance on imported healthcare products and services.

By contrast, younger populations with a growing labour force may enhance productivity and competitiveness, strengthening exports and supporting a healthier current account balance.

Practice Questions

Explain how a fall in a country’s productivity is likely to affect its current account balance. (2 marks)

1 mark for recognising that lower productivity raises unit labour costs/reduces competitiveness.

1 mark for explaining that this is likely to reduce exports and/or increase imports, worsening the current account.

Discuss how changes in the exchange rate can influence a country’s current account balance. (6 marks)

Up to 2 marks for explaining the effect of depreciation (exports cheaper, imports more expensive, potential improvement in current account).

Up to 2 marks for explaining the effect of appreciation (exports more expensive, imports cheaper, potential worsening of current account).

1 mark for reference to the Marshall-Lerner condition (the impact depends on the price elasticity of demand for exports and imports).

1 mark for reference to the J-curve effect (short-term worsening before long-term improvement after depreciation).