AQA Specification focus:

‘Students should have a detailed knowledge of the structure of the current account of the balance of payments but only need a general appreciation of the other sections of the balance of payments account. Students should appreciate the difference between foreign direct investment (FDI) and portfolio investment.’

Introduction

Understanding the balance of payments is central to analysing a country’s international economic position. Students must know the current account structure in detail and distinguish between FDI and portfolio investment.

The Balance of Payments

Overall Structure

The balance of payments (BoP) is a record of all economic transactions between residents of a country and the rest of the world over a given period. It is divided into three main sections:

Current account

Capital account

Financial account

The AQA specification requires detailed knowledge of the current account, but only a general awareness of the other two.

The Current Account

The current account measures the flow of goods, services, income, and transfers between the domestic economy and overseas.

Current Account: A record of a nation’s transactions in goods, services, income, and current transfers with the rest of the world.

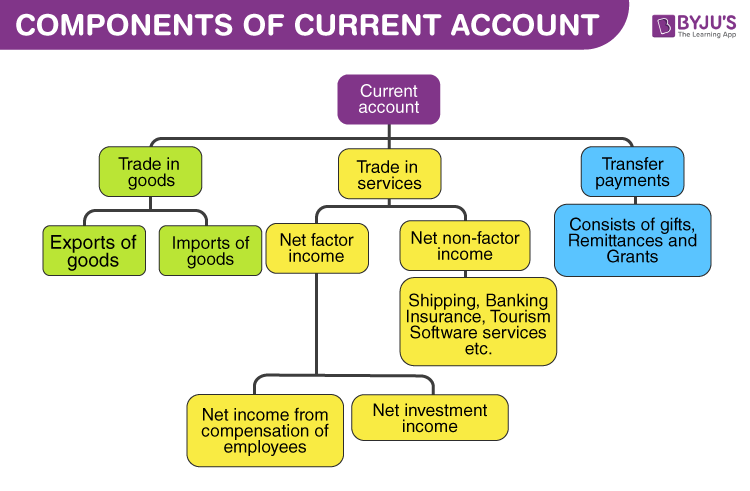

The four components of the current account are:

Trade in goods – Exports and imports of physical products.

Trade in services – Includes banking, tourism, insurance, and education.

Primary income – Returns on investment abroad, such as profits, interest, and dividends.

Secondary income – Transfers such as aid, remittances, and EU contributions (when applicable).

This diagram illustrates the components of the Balance of Payments, emphasising the current account's role in recording trade in goods, services, income, and transfers. It provides a visual representation of how FDI and portfolio investment transactions are integrated into the financial account. Source

A surplus occurs when inflows exceed outflows, while a deficit arises when outflows are greater.

The Capital and Financial Accounts (General Appreciation)

Although detailed understanding is not required for the AQA syllabus, students should be aware of the following:

Capital account – Minor flows, such as debt forgiveness, transfers of non-produced, non-financial assets.

Financial account – Records cross-border investment flows, divided into:

Foreign Direct Investment (FDI)

Portfolio Investment

Other investment (loans, deposits, currency holdings)

Reserve assets (foreign currency reserves held by central banks)

Foreign Direct Investment (FDI)

Definition and Characteristics

Foreign Direct Investment (FDI): Cross-border investment by a firm or individual to acquire lasting interest and control in a foreign enterprise, typically involving at least 10% ownership.

This diagram contrasts Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI), outlining distinctions in investment objectives, control, and liquidity. It aids in understanding the fundamental differences between these two forms of international investment. Source

Key features of FDI:

Establishing new business operations abroad (greenfield investment).

Acquiring existing firms or assets (mergers and acquisitions).

Long-term commitment, involving control over operations and decision-making.

Often accompanied by technology transfer, expertise, and management practices.

FDI can significantly affect a country’s balance of payments and economic development.

Motivations for FDI

Common reasons firms engage in FDI:

Access to new markets to expand sales.

Resource-seeking investment, e.g., securing raw materials.

Efficiency-seeking investment, e.g., exploiting lower labour costs.

Strategic asset-seeking, such as acquiring brands or technology.

Impacts of FDI

FDI can benefit both host countries and investors:

Brings in capital, creating jobs and stimulating growth.

Increases productivity through technology and knowledge transfer.

Enhances integration into the global economy.

However, possible drawbacks include:

Profit repatriation back to the investor’s home country.

Potential dominance by foreign firms over domestic industries.

Exposure to global financial volatility.

Portfolio Investment

Definition and Characteristics

Portfolio Investment: Cross-border investment in financial assets such as shares, bonds, or other securities, without gaining significant control over the enterprise.

Key features of portfolio investment:

Shorter-term focus compared to FDI.

Involves buying equities, government bonds, or corporate debt.

No managerial control, only financial returns expected.

Highly liquid and mobile, moving quickly across borders.

Motivations for Portfolio Investment

Diversification of risk by spreading investments internationally.

Higher returns than domestic markets may offer.

Speculative opportunities from exchange rate fluctuations.

Attractive interest rates or favourable bond yields abroad.

Impacts of Portfolio Investment

Advantages:

Provides capital inflows that can finance investment and government borrowing.

Enhances liquidity in domestic financial markets.

May strengthen exchange rates when inflows are strong.

Risks:

Can be volatile, with large inflows and outflows creating instability.

Sudden withdrawals may trigger financial crises.

Less stable contribution to long-term growth than FDI.

Key Distinction Between FDI and Portfolio Investment

FDI differs from portfolio investment mainly in terms of control, duration, and stability:

FDI implies long-term involvement and control over a foreign enterprise.

Portfolio investment is more short-term, involving passive financial holdings.

FDI is generally more stable, while portfolio flows can reverse suddenly.

Balance of Payments and Investment Flows

Relationship with Current Account

The balance of payments ensures that all flows are recorded. If a country has a current account deficit, it must be financed by capital and financial account surpluses. This makes FDI and portfolio inflows crucial to sustaining deficits.

Implications for Policy

Governments may prefer FDI over portfolio flows, as FDI tends to be more stable and supportive of long-term development. Policies often aim to attract FDI through:

Tax incentives

Improved infrastructure

Stable macroeconomic environment

Meanwhile, portfolio investment is harder to control but can be influenced by monetary policy and financial regulation.

FAQ

The 10% threshold is used internationally to distinguish FDI from portfolio investment. Ownership of at least 10% in a foreign enterprise indicates a lasting interest and some degree of control over management decisions. Anything below this threshold is generally classified as portfolio investment, since the investor is unlikely to influence day-to-day operations.

FDI is tied to long-term projects such as factories, infrastructure, or acquisitions. These require significant capital and cannot be withdrawn quickly without large costs.

By contrast, portfolio investment can be shifted across countries almost instantly, as it involves liquid financial assets. This makes portfolio flows far more sensitive to global economic conditions and investor sentiment.

Multinationals often use FDI as a strategy to:

Establish production facilities in new markets (greenfield investment).

Acquire local firms to gain market share.

Access raw materials or skilled labour.

Benefit from favourable tax or regulatory environments.

This allows them to integrate operations internationally and strengthen global supply chains.

Heavy reliance on FDI can create vulnerabilities, such as:

Dependence on foreign firms for jobs and technology.

Risk of domestic industries being overshadowed.

Profits being repatriated abroad rather than reinvested locally.

Political influence exerted by powerful multinationals.

Governments often balance attracting FDI with ensuring that benefits are shared domestically.

Large inflows of portfolio investment increase demand for the domestic currency, strengthening the exchange rate.

However, sudden outflows can reverse this effect, leading to sharp depreciations. This volatility can make it harder for governments and businesses to plan trade and investment strategies, and may affect inflation if import prices rise quickly after depreciation.

Practice Questions

Define Foreign Direct Investment (FDI) and explain how it differs from portfolio investment. (2 marks)

1 mark for a correct definition of FDI: e.g., cross-border investment involving at least 10% ownership and control of a foreign enterprise.

1 mark for clear distinction: portfolio investment involves financial assets without control or management influence.

Discuss the potential advantages and disadvantages for a developing country of relying on Foreign Direct Investment (FDI) compared to portfolio investment. (6 marks)

Up to 2 marks: Identification of advantages of FDI, such as technology transfer, job creation, long-term capital inflows.

Up to 2 marks: Identification of disadvantages of FDI, e.g., profit repatriation, foreign dominance.

Up to 1 mark: Identification of advantages of portfolio investment, e.g., increased liquidity, access to capital markets.

Up to 1 mark: Identification of disadvantages of portfolio investment, e.g., volatility of inflows, risk of sudden capital flight.

Reward balance and application to a developing country context for full marks.