AQA Specification focus:

‘The consequences of investment flows between countries.’

Introduction

Investment flows shape economies by influencing productivity, employment, balance of payments, and growth. Understanding their consequences is vital for evaluating international economic interdependence.

Understanding Investment Flows

Types of Investment Flows

Investment flows refer to the movement of capital across borders, typically in the form of Foreign Direct Investment (FDI) or Portfolio Investment. These flows are recorded in the financial account of the balance of payments.

Foreign Direct Investment (FDI): Long-term capital investment by a firm in another country, often involving management control, production facilities, or subsidiaries.

Portfolio Investment: Cross-border investment in financial assets such as shares or bonds, without control over the enterprise.

FDI is usually more stable and long-term, while portfolio flows are often more speculative and volatile.

Positive Consequences of Investment Flows

Benefits for Host Countries

When investment flows into a country, it can generate significant advantages:

Capital inflows increase the availability of funds for investment in infrastructure, industry, and services.

Technology transfer occurs when multinational corporations bring advanced methods, equipment, and managerial expertise.

Employment creation results from new businesses and expansion of industries.

Increased productivity stems from exposure to new techniques and greater efficiency.

Export growth can be stimulated if foreign firms produce goods for international markets.

Technology Transfer: The process by which foreign investors introduce new skills, processes, and innovations into the host economy.

FDI often plays a central role in enhancing the long-run aggregate supply (LRAS) of a host country by improving productive capacity.

Benefits for Source Countries

Countries investing abroad also experience advantages:

Higher returns on capital when overseas markets provide better growth opportunities.

Diversification of risk by spreading investment across multiple economies.

Market access as firms gain entry into new consumer bases.

Resource acquisition when firms invest in countries rich in natural resources.

These benefits can increase competitiveness and profitability of domestic firms.

Negative Consequences of Investment Flows

Risks for Host Countries

While investment inflows provide opportunities, they may also carry drawbacks:

Profit repatriation reduces the benefits for the host economy as foreign firms send profits back to their home countries.

Dependency on foreign capital may limit domestic control over industries.

Crowding out of local firms if multinationals dominate markets and outcompete domestic producers.

Cultural and political influence may increase, as foreign investors exert pressure on local policies.

Balance of payments vulnerability if large outflows occur during economic downturns.

Profit Repatriation: The process where foreign-owned businesses transfer their earnings back to the home country of the investor.

These risks are particularly relevant for developing economies reliant on external capital.

Risks for Source Countries

Investors’ home countries also face potential issues:

Capital flight if large volumes of investment leave domestic markets, reducing funds available for home industries.

Job losses when firms relocate production abroad to exploit lower costs.

Vulnerability to global shocks if portfolio investments are exposed to instability in foreign economies.

For example, rapid withdrawal of capital during a crisis can amplify global financial instability.

Macroeconomic Consequences

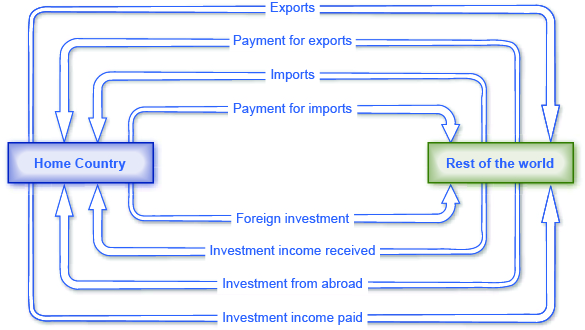

Effects on the Balance of Payments

Investment flows directly impact a country’s external accounts:

The Balance of Payments diagram demonstrates the double-entry accounting method, showing how exports and imports of goods and services correspond with financial inflows and outflows, including investment flows. Source

FDI inflows appear as credits on the financial account.

FDI outflows appear as debits.

Portfolio investments affect the balance more volatilely, depending on investor confidence.

A high level of inflows may finance a current account deficit, but outflows can worsen external imbalances.

Effects on Growth and Employment

Inflows of FDI support economic growth by expanding productive capacity and raising aggregate demand.

Job creation in host countries boosts household income and consumption.

Outflows of capital can reduce domestic investment opportunities in the source economy, potentially leading to unemployment.

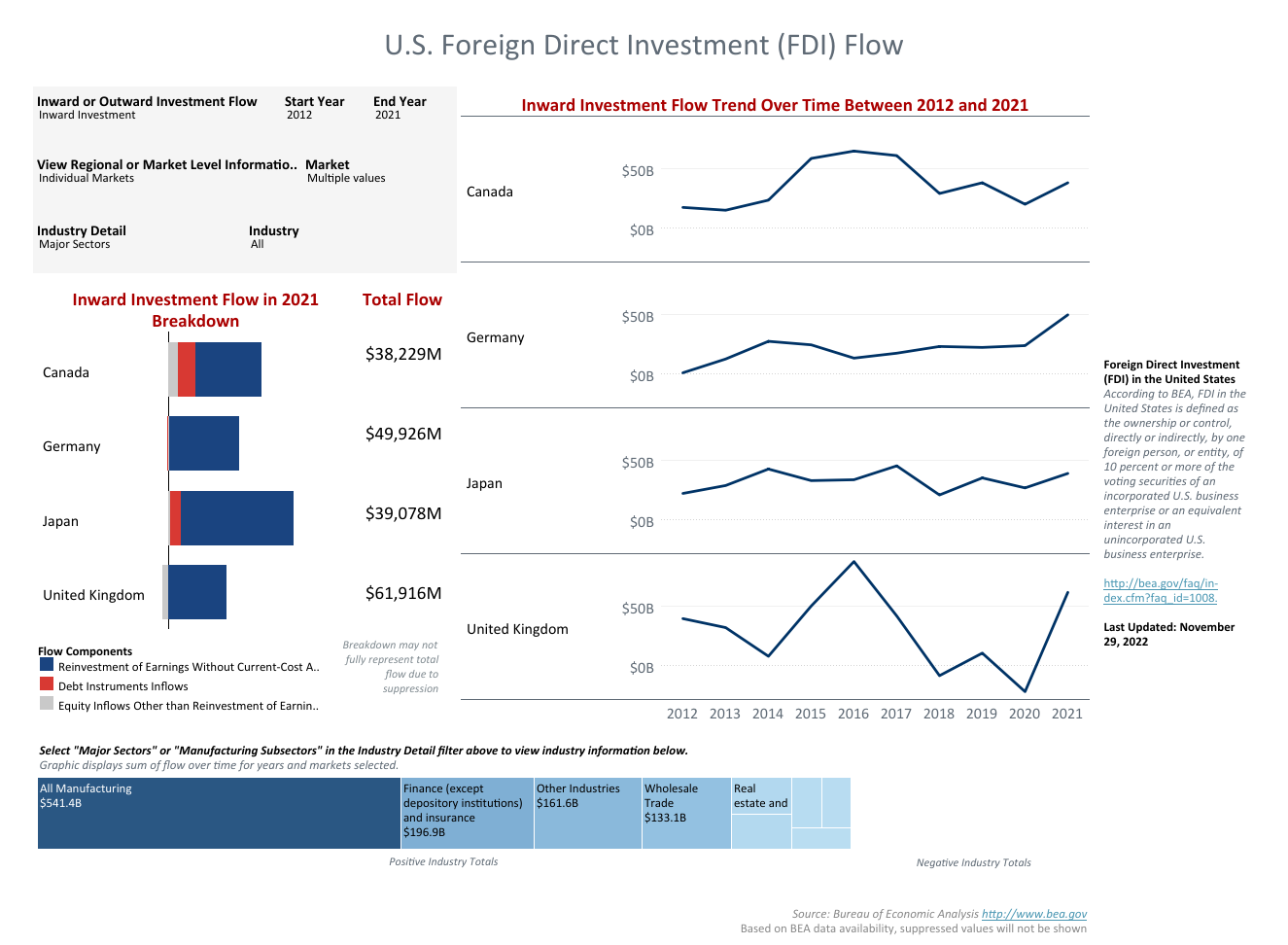

Effects on Exchange Rates

Investment flows influence currency markets:

The Foreign Direct Investment flow diagram illustrates the directional movement of capital between countries, highlighting how FDI inflows and outflows are recorded in the financial account and their impact on exchange rates. Source

Capital inflows increase demand for a country’s currency, leading to appreciation.

Capital outflows reduce demand, leading to depreciation.

Exchange Rate (ER) = Demand for Currency / Supply of Currency

ER↑ (appreciation) when demand increases

ER↓ (depreciation) when supply increases

Volatile portfolio flows can lead to rapid fluctuations in exchange rates, causing instability in trade and investment planning.

Consequences for Developed and Developing Economies

Developed Economies

Source countries often benefit from higher returns abroad, but may suffer deindustrialisation as firms shift production overseas.

Host countries that are developed benefit from FDI in high-tech industries and research, but face concerns about foreign control of strategic sectors.

Developing Economies

Host countries gain essential capital, technology, and jobs, which support growth and development.

However, they may become dependent on foreign investors, face exploitation of resources, and struggle with unstable portfolio inflows.

Developing nations are more vulnerable to sudden stops — abrupt reversals of capital inflows that destabilise their economies.

Sudden Stop: An abrupt halt in capital inflows that leads to financial instability, often triggering currency depreciation and economic crisis.

FAQ

Short-term flows, often portfolio investments, can be highly volatile and are influenced by changes in interest rates and investor confidence. These can leave economies vulnerable to sudden withdrawals.

Long-term flows, such as FDI, tend to be more stable, tied to physical investment and job creation, and therefore more beneficial for long-term growth and development.

Investment inflows may reduce inequality by creating employment opportunities and raising incomes, particularly in urban areas.

However, they can also increase inequality if high-paying jobs are concentrated in certain industries, or if foreign firms mainly benefit skilled workers and marginalise low-skilled labour.

Developing economies typically have:

Less diversified industries

Weaker financial systems

Limited reserves to stabilise their currency

This means when investment flows reverse suddenly, they experience sharper currency depreciations, capital shortages, and greater instability compared to developed economies.

Investor confidence affects whether capital flows into or out of a country.

Factors influencing confidence include:

Political stability

Consistent economic policy

Low inflation and sustainable debt levels

If confidence declines, portfolio investors in particular may quickly withdraw funds, causing financial instability.

Yes, governments often adjust policy to attract or retain foreign investors.

This may involve:

Offering tax incentives or subsidies

Relaxing labour or environmental regulations

Signing trade agreements to reassure investors

While this can encourage growth, it may also limit government control over social and environmental priorities.

Practice Questions

Define Foreign Direct Investment (FDI) and explain how it differs from portfolio investment. (3 marks)

1 mark for a correct definition of FDI: long-term investment by a firm in another country involving management control or physical presence (e.g. subsidiaries, factories).

1 mark for identifying that portfolio investment involves financial assets such as shares or bonds without management control.

1 mark for clearly contrasting the two (e.g. FDI is long-term and involves control, portfolio is short-term and does not involve control).

Explain two potential consequences of large inflows of foreign direct investment (FDI) for a developing economy. (6 marks)

Up to 3 marks for each well-explained consequence.

Consequences could include:

Employment creation (1 mark) with explanation of how jobs raise income and consumption (1–2 marks).

Technology transfer (1 mark) with explanation of improved productivity and skills in host economy (1–2 marks).

Increased capital and infrastructure investment (1 mark) with explanation of long-run growth potential (1–2 marks).

Profit repatriation risk (1 mark) with explanation of reduced domestic benefits (1–2 marks).

Maximum 6 marks overall.

Application to developing economies (e.g. dependence on foreign capital, vulnerability to sudden stops) can gain credit within the explanation marks.