AP Syllabus focus:

‘The Articles lacked an executive branch to enforce laws, including taxation; this weakened national authority and limited the government’s ability to raise revenue.’

The Articles of Confederation created a national government that could debate and request, but not reliably execute.

Engrossed (official) text of the Articles of Confederation, presented as a primary-source document. Using the original text reinforces that the national government’s design choices—including the absence of an independent executive—were written into the founding framework rather than merely accidental or temporary. This is a useful anchor image when discussing why Congress could deliberate but struggled to execute policy consistently. Source

Without an executive, Congress struggled to enforce laws, collect funds, and build the administrative capacity needed for national governance.

Core Problem: No Executive to “Carry Out” National Decisions

Under the Articles of Confederation, the national government consisted mainly of a unicameral Congress. There was no separate national officer or branch tasked with implementing congressional decisions across the states.

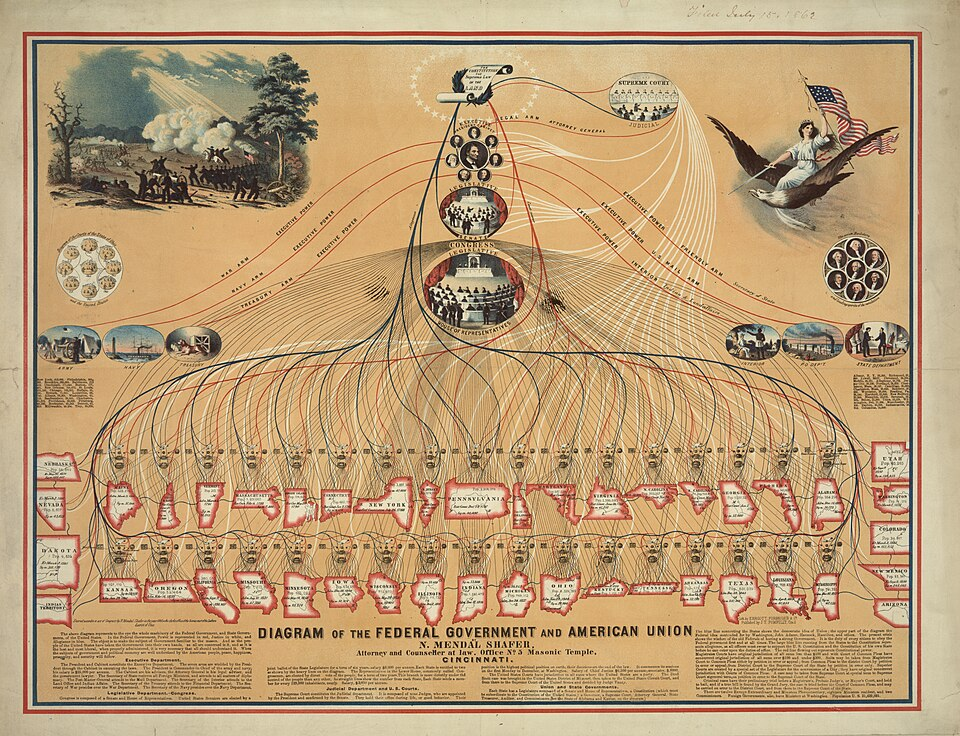

Historical organizational chart of the U.S. federal government that explicitly labels the Executive, Legislative, and Judicial branches and shows executive departments under the President. As a contrast tool, it helps students see the kind of administrative hierarchy and chain of command that the Articles-era national government lacked. The chart’s structure makes “implementation capacity” visible as an organizational design feature, not just a theoretical concept. Source

Executive branch: the part of government responsible for enforcing laws, administering public policy, and managing day-to-day operations of the state.

Without an executive, Congress lacked tools that modern governments use to ensure compliance, such as a nationwide enforcement bureaucracy, clear chains of command, and routine administration.

What “Enforcement” Requires (and What Congress Lacked)

Effective enforcement typically depends on:

Administrative capacity: offices, officials, and procedures to apply laws consistently

Command authority: the ability to direct action rather than merely recommend it

Accountability structures: a single office (or small set of offices) identifiable to voters and other officials

Implementation power: the ability to supervise execution and respond quickly to noncompliance

Under the Articles, Congress could pass resolutions, but execution depended heavily on state cooperation, which varied with local interests and political incentives.

Taxation as the Central Test of Enforcement Power

A major consequence of having no executive was the inability to reliably secure national revenue. Congress could identify collective needs (debt payments, basic operations, common defence) but had weak practical means to obtain funds.

Requisitions vs. Taxation Authority

The Articles did not grant Congress robust taxation authority over individuals. Instead, Congress relied on state payments.

Requisition: a request by the national government that states supply money or resources, typically according to an assigned quota, without direct federal collection from individuals.

Because requisitions were not direct taxes, compliance depended on each state legislature choosing to raise and remit funds. Even when states agreed in principle, they often delayed, reduced payments, or prioritised their own fiscal needs.

Why Tax Collection Needs an Executive

Tax systems are not just laws on paper; they require:

Assessment (determining what is owed)

Collection (gathering payments on time)

Enforcement (penalties for nonpayment, consistent procedures)

Recordkeeping (auditing, receipts, anti-fraud controls)

Without an executive branch, there was no national-level structure to administer these tasks. Congress had limited capacity to monitor state compliance, no routine mechanism to compel payment, and few credible consequences when states failed to contribute.

Effects on National Authority

The lack of executive enforcement weakened the national government in ways that reinforced one another.

Legitimacy and Compliance

When a government cannot ensure its decisions are carried out, it faces an authority problem:

States may treat national policy as optional

National commitments (like paying debts) become unreliable

Foreign and domestic actors may doubt the government’s credibility

This undermines the perception that the national government is the final decision-maker in national matters, encouraging states to behave as near-sovereign entities rather than components of a unified system.

Policy Implementation Becomes Fragmented

Even when Congress reached agreement, implementation could differ widely because each state:

interpreted requests through its own political priorities

responded on different timelines

attached conditions or refused participation

With no executive to coordinate implementation, national policy lacked uniformity, creating practical inequality across states and reducing the effectiveness of any shared national programme.

Revenue Limits the Scope of Government

The inability to raise revenue is more than a budgeting inconvenience; it sets the ceiling on what a government can actually do.

Operational Consequences of Unreliable Revenue

When Congress could not count on stable funds, it struggled to:

maintain basic administrative functions

meet financial obligations consistently

plan beyond short-term, state-by-state bargaining

In practice, this forced Congress into a reactive posture, frequently negotiating for resources rather than governing through predictable institutions.

Incentives for States to Underpay

State leaders had reasons to resist requisitions:

keeping taxes low at home could be politically popular

states could “free ride” if others contributed more

local economic pressures often took priority over national requests

Because there was no executive enforcement mechanism, these incentives were not balanced by credible national penalties, making underpayment a rational political choice for many states.

Why This Weakness Mattered for Constitutional Change

The Articles demonstrated a structural lesson: a national government cannot function effectively if it can only ask states to comply. The absence of an executive meant Congress lacked a central instrument for enforcing laws, including taxation, which weakened national authority and constrained revenue—the lifeblood of governing.

FAQ

Yes, Congress could appoint committees and some officials, but they lacked independent authority and permanence.

They were not a separate branch with broad power to administer laws across states, so implementation still depended on state governments.

Many Americans associated centralised taxation with British abuses.

State leaders also feared losing fiscal control, since taxation affects local economies and political accountability.

It could produce unequal burdens:

compliant states effectively paid more

noncompliant states benefited without equivalent contribution

This undermined trust and cooperation among states.

Common features include:

designated tax collectors and supervisors

standardised procedures and deadlines

auditing and reporting systems

penalties and appeals processes

These make revenue predictable and compliance more uniform.

Without dependable revenue, a government cannot consistently fund policies or institutions.

Revenue capacity signals real governing power because it enables planning, enforcement, and fulfilment of commitments over time.

Practice Questions

Question 1 (1–3 marks) Explain one reason why the absence of an executive branch under the Articles of Confederation made it difficult to collect national revenue.

1 mark: Identifies that Congress lacked an executive/enforcement apparatus.

1 mark: Explains that Congress relied on state compliance (e.g., requisitions) rather than direct collection.

1 mark: Connects this to inconsistent/insufficient revenue because states could delay, reduce, or refuse payments.

Question 2 (4–6 marks) Using your knowledge of the Articles of Confederation, analyse how the lack of an executive branch weakened national authority, with specific reference to enforcing laws and taxation.

1 mark: States that there was no executive to implement/enforce congressional decisions.

1 mark: Explains that enforcement depended on state cooperation, making national policy uneven or optional in practice.

1 mark: Describes reliance on requisitions rather than direct federal taxation of individuals.

1 mark: Explains why requisitions were ineffective (states could ignore, delay, or underpay without credible penalties).

1 mark: Links weak revenue to reduced national capacity (e.g., inability to meet obligations or run operations reliably).

1 mark: Provides clear analytical linkage showing how enforcement and revenue limits together reduced legitimacy/credibility of national authority.