AQA Specification focus:

‘The circular flow of income concept, the equation income = output = expenditure, and of the concepts of equilibrium and full employment income.’

The circular flow of income illustrates how money, goods, and services move between households and firms, helping economists understand equilibrium, national income, and full employment income.

The Circular Flow of Income

At the centre of macroeconomic analysis lies the circular flow of income, which explains how money and resources circulate between the main economic agents.

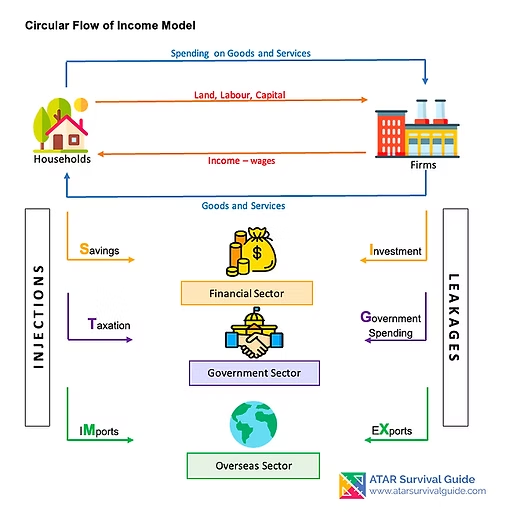

This diagram depicts the four-sector circular flow of income, showing the interdependence between households, firms, government, and the foreign sector. It highlights the flow of income and expenditure, demonstrating the equality of income, output, and expenditure in an economy. Source

Households and Firms

Households provide factors of production (land, labour, capital, enterprise) to firms.

In return, they receive factor incomes such as wages, rent, interest, and profit.

Households then spend this income on goods and services produced by firms, creating continuous flows of income and expenditure.

Equality of Measures: Income = Output = Expenditure

A fundamental principle of macroeconomics is that national income, national output, and national expenditure are equal.

National Income: The total income earned by households in an economy from providing factors of production.

National Output: The total value of goods and services produced within an economy.

National Expenditure: The total spending on goods and services in an economy.

Circular Flow Identity: Income = Output = Expenditure

Income = Wages, rent, interest, profit

Output = Goods and services produced

Expenditure = Household, government, and investment spending

This equality arises because every unit of output produced generates income for households, which is then spent on goods and services. Leakage from the flow (e.g., saving) or additional injections (e.g., investment) are considered separately.

Equilibrium in the Circular Flow

Equilibrium occurs when planned injections (e.g., investment, government spending, exports) are equal to planned withdrawals (e.g., savings, taxation, imports). At this point, there is no pressure for national income to change.

If injections exceed withdrawals, national income tends to rise.

If withdrawals exceed injections, national income tends to fall.

Equilibrium National Income: The level of income where planned injections equal planned withdrawals, and the circular flow remains stable.

Full Employment Income

Economists distinguish between equilibrium national income and full employment income.

This diagram represents the full employment equilibrium in an economy, where the aggregate demand curve intersects both the short-run and long-run aggregate supply curves. It illustrates the level of output where all resources are fully employed, corresponding to the full employment income level. Source

Full employment income is the level of output achieved when all available resources are employed efficiently.

The economy may reach equilibrium at a point below full employment, meaning some resources remain unused (unemployment).

Full Employment Income: The level of national income corresponding to maximum sustainable output when all factors of production are fully utilised.

This distinction is crucial for policy-making: equilibrium does not always guarantee full utilisation of resources.

Key Relationships in the Circular Flow

The Flow of Payments

Firms → Households: Wages, rent, interest, and profit for factor services.

Households → Firms: Expenditure on goods and services.

Interdependence of Income, Output, and Expenditure

Every pound spent on goods is income for a factor owner.

Every unit of output sold corresponds to an equal value of income and expenditure.

Importance for Economic Analysis

Allows policymakers to measure gross domestic product (GDP) using three methods:

Income method (summing factor incomes)

Output method (summing goods and services produced)

Expenditure method (summing spending on final goods)

Dynamic Adjustments in the Flow

When changes occur within the circular flow, equilibrium may shift. For example:

An increase in investment raises expenditure, stimulating higher output and income.

A rise in savings reduces expenditure, leading to falling output and income unless offset by injections.

These dynamics help explain short-run fluctuations in national income and highlight the role of government and external trade in stabilising economies.

Why the Circular Flow Model Matters

The circular flow is not just a visual model; it underpins key macroeconomic principles:

It demonstrates the interdependence of households and firms.

It explains why income = output = expenditure, a central identity in national accounting.

It highlights the role of equilibrium in determining the stability of national income.

It distinguishes between equilibrium income and full employment income, a core theme in debates over government intervention.

FAQ

The simplest model assumes only two sectors: households and firms. It ignores government, the financial sector, and international trade.

It also assumes that households spend all their income on goods and services, and that firms distribute all revenue as factor payments. These simplifications allow focus on the fundamental equality of income, output, and expenditure.

Equilibrium occurs when injections equal withdrawals, but this balance can be reached at a level of output below full employment.

This situation happens if aggregate demand is too low to utilise all resources. As a result, unemployment or underemployment may persist despite equilibrium being achieved.

The model underpins three methods of calculating GDP:

Output method: adds up the value of goods and services.

Income method: sums factor incomes like wages, rent, and profit.

Expenditure method: totals spending on final goods and services.

Because income, output, and expenditure are equal in the model, all three should produce the same GDP figure.

If injections exceed withdrawals, income rises, creating economic expansion.

If withdrawals exceed injections, income falls, leading to contraction.

This imbalance explains why economies may experience fluctuations in growth, even without changes in productive capacity.

Full employment income indicates the maximum sustainable level of national output.

If equilibrium lies below this level, governments may use demand management policies such as fiscal or monetary stimulus. These aim to raise spending and move equilibrium closer to full employment.

Practice Questions

Define the term equilibrium national income. (2 marks)

1 mark for identifying equilibrium national income as the level of income where planned injections equal planned withdrawals.

1 mark for stating that, at this point, there is no tendency for national income to change.

Using the circular flow of income model, explain why national income, national output, and national expenditure are always equal. (6 marks)

1 mark for stating that every unit of output generates an equivalent value of income.

1 mark for stating that the income received is then used for expenditure on goods and services.

1 mark for explaining that expenditure leads to further output, maintaining the flow.

1 mark for clearly linking output, income, and expenditure as three different measures of the same economic activity.

Up to 2 additional marks for a clear, logical explanation showing the continuous nature of the circular flow and why these measures are equal in theory.