AQA Specification focus:

‘The difference between injections and withdrawals into the circular flow of income.’

Introduction

The circular flow of income highlights how money moves within an economy. Injections and withdrawals are crucial concepts, explaining how economic activity expands or contracts.

The Circular Flow of Income Framework

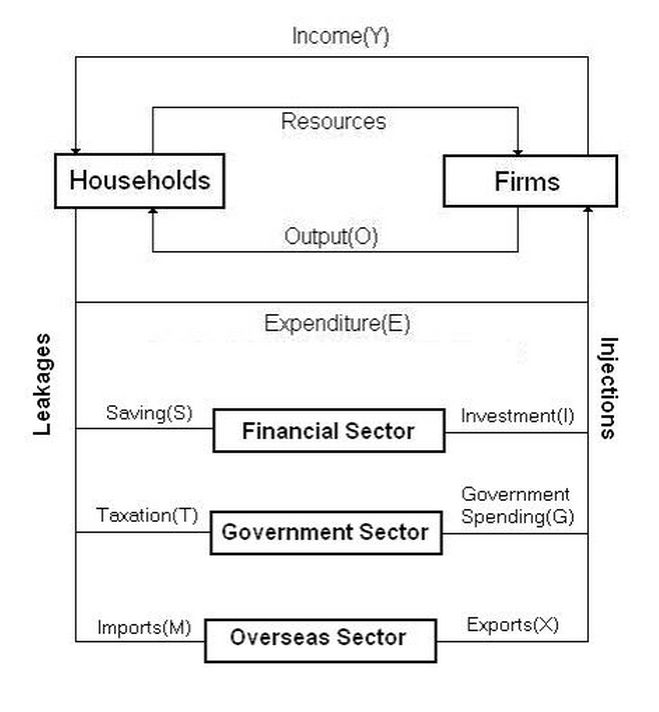

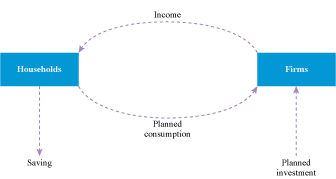

The circular flow of income is a model illustrating how income, output, and expenditure move between households and firms. It shows how resources, goods, services, and money circulate. In a simple closed economy without government or foreign trade, households provide factors of production (labour, land, capital, enterprise) and receive income, which they then spend on goods and services produced by firms.

The Five-Sector Circular Flow of Income Model illustrates the interactions between households, firms, government, financial institutions, and the foreign sector. Injections such as investment, government spending, and exports, along with withdrawals like savings, taxes, and imports, are clearly shown, demonstrating their impact on national income. Source

In reality, modern economies are more complex, involving injections and withdrawals that influence the overall level of national income.

Injections into the Circular Flow

Injections are flows of money that enter the economy, boosting aggregate demand and expanding the level of national income.

Injections: Additions of spending to the circular flow of income, originating from investment, government spending, and exports.

The three main forms of injections are:

Investment (I): Spending by firms on capital goods (e.g., machinery, buildings, technology) that increases productive capacity.

Government Spending (G): Expenditure by the state on goods and services such as healthcare, education, and infrastructure.

Exports (X): Revenue from the sale of domestically produced goods and services to foreign buyers, bringing money into the domestic economy.

Injections act as external drivers of economic growth by stimulating demand and potentially leading to a multiplier effect.

Withdrawals from the Circular Flow

Withdrawals, also called leakages, represent flows of money leaving the circular flow, reducing aggregate demand and potentially contracting national income.

Withdrawals: Reductions of spending from the circular flow of income, including savings, taxes, and imports.

The three main forms of withdrawals are:

Savings (S): Income not spent on consumption but stored in financial institutions, reducing immediate demand for goods and services.

Taxes (T): Compulsory payments to the government that reduce households’ disposable income and firms’ retained profits.

Imports (M): Expenditure on goods and services produced abroad, transferring money out of the domestic economy.

Withdrawals reduce the spending power available within the domestic circular flow, potentially dampening economic activity.

The Circular Flow of Income with Investment and Saving diagram emphasizes the roles of investment and saving in the economy. Investment is depicted as an injection, stimulating economic activity, while saving is shown as a withdrawal, potentially reducing aggregate demand. Source

Balancing Injections and Withdrawals

The interaction between injections and withdrawals determines whether national income rises, falls, or remains stable.

National Income Equilibrium Condition: Injections (I + G + X) = Withdrawals (S + T + M)

I = Investment (spending by firms on capital goods)

G = Government spending (on goods and services)

X = Exports (foreign demand for domestic goods/services)

S = Savings (unspent income)

T = Taxes (government revenue collection)

M = Imports (domestic spending on foreign goods/services)

If Injections > Withdrawals, national income increases because more money enters the economy than leaves it.

If Withdrawals > Injections, national income decreases as more money exits the flow.

If Injections = Withdrawals, the economy is in equilibrium, with national income stable at its current level.

The Role of Equilibrium in National Income

Equilibrium is a central concept in macroeconomics. It occurs when the planned injections into the economy equal the planned withdrawals. At this point:

Output produced by firms equals expenditure by households and other agents.

Income generated matches the spending required to maintain current production.

National income is stable, with no tendency to expand or contract.

This balance explains why economies can stabilise at different levels of output, not necessarily at full employment.

Full Employment and Equilibrium

Full employment income occurs when the economy operates at its maximum sustainable capacity, utilising resources efficiently without generating inflationary pressure. However, equilibrium can exist at a lower level of national income, where resources are underutilised.

This is known as an output gap, where injections and withdrawals balance but unemployment or idle capacity remains. Policymakers often respond with fiscal or monetary measures to increase injections and reduce withdrawals, aiming to raise national income toward the full employment level.

Key Insights for Students

Injections (I, G, X) expand economic activity by adding new spending.

Withdrawals (S, T, M) reduce economic activity by diverting spending away from domestic production.

National income equilibrium is reached when I + G + X = S + T + M.

Equilibrium does not guarantee full employment — economies may settle at lower levels of output.

Understanding injections and withdrawals is therefore essential for analysing how economies grow, stagnate, or shrink.

FAQ

Financial institutions act as intermediaries between savings and investment. When households save, money is withdrawn from the circular flow. Banks and other institutions can recycle these funds back as injections by lending to firms for investment or to consumers for spending.

This intermediation helps to ensure that savings do not remain idle but are used to support economic activity.

Although imports involve domestic spending, the money flows abroad to foreign producers rather than remaining in the domestic economy.

This means income is generated overseas rather than supporting domestic firms or employment. Imports therefore reduce the demand for domestically produced goods and services, which makes them a leakage from the circular flow.

Higher taxation reduces disposable income for households and retained profits for firms, leading to lower consumption and investment. This increases withdrawals.

Conversely, tax cuts allow households to spend more and firms to invest more, reducing withdrawals and potentially boosting injections if government spending also rises.

Yes. If withdrawals match injections at a low level of national income, the economy is in equilibrium but not at full capacity.

This creates an output gap, where resources such as labour are underutilised. Policymakers often use fiscal or monetary measures to shift the balance by increasing injections or reducing withdrawals.

Injections depend on factors that can fluctuate significantly, such as:

Investment: influenced by interest rates, business confidence, and expected returns.

Government spending: affected by fiscal policy decisions and budgetary constraints.

Exports: shaped by global demand, exchange rates, and competitiveness.

These variations mean injections may not provide a steady stimulus to national income, leading to periods of economic expansion and contraction.

Practice Questions

Define what is meant by an injection into the circular flow of income. (2 marks)

1 mark for identifying that an injection is an addition of spending into the circular flow of income.

1 mark for providing an example (investment, government spending, or exports).

Explain, using the circular flow of income model, how an increase in government spending can affect national income when withdrawals remain unchanged. (6 marks)

1 mark for recognising that government spending is an injection.

1 mark for identifying that injections increase aggregate demand.

1 mark for stating that when injections exceed withdrawals, national income rises.

1 mark for explaining that increased demand encourages firms to raise output.

1 mark for noting that this generates additional income for households.

1 mark for clear reference to equilibrium adjustment (national income rises until injections equal withdrawals again).