AQA Specification focus:

‘Students are not expected to have a detailed knowledge of the construction of national income accounts.’

This subsubtopic clarifies that while students must understand how national income statistics are used, they are not required to master the complex process of account construction.

National Income Accounting: The Context

National income accounting is a branch of economics concerned with measuring the overall economic activity of a country. It involves compiling data on income, output, and expenditure to give a coherent picture of the economy. These measures are vital for comparing performance across time and between countries. However, the actual construction of national accounts involves highly technical processes carried out by statistical agencies, requiring sophisticated surveys, sampling techniques, and adjustments.

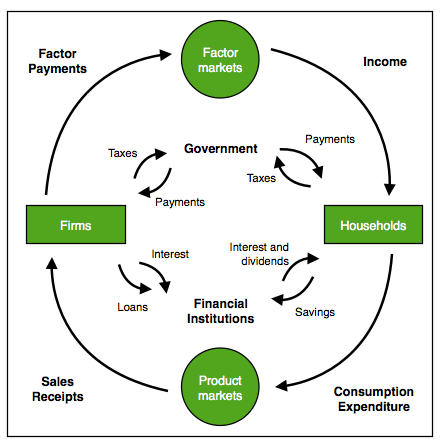

This diagram depicts the basic two-sector circular flow of income model, highlighting the exchange of goods and services between households and firms. It serves as a foundational representation, emphasising the flow of income and expenditure in an economy. Source

The AQA specification explicitly notes that students are not expected to have detailed knowledge of this construction, but rather should understand what the accounts represent and why they matter in the study of macroeconomics.

Why Construction Details Are Excluded

Complexity of Methodology

Building national accounts requires:

Gathering data from millions of households and firms.

Adjusting for informal or unrecorded activity.

Avoiding double-counting, ensuring output is measured only once.

Applying statistical corrections, such as seasonal adjustments.

This process is highly complex and not suitable for A-Level study, where the focus is on understanding economic concepts rather than mastering statistical techniques.

Role of Statistical Bodies

In the UK, national income accounts are compiled by the Office for National Statistics (ONS). Internationally, organisations such as the IMF and World Bank provide guidelines through frameworks like the System of National Accounts (SNA). These bodies employ professional statisticians and economists who apply standardised procedures to maintain accuracy and comparability.

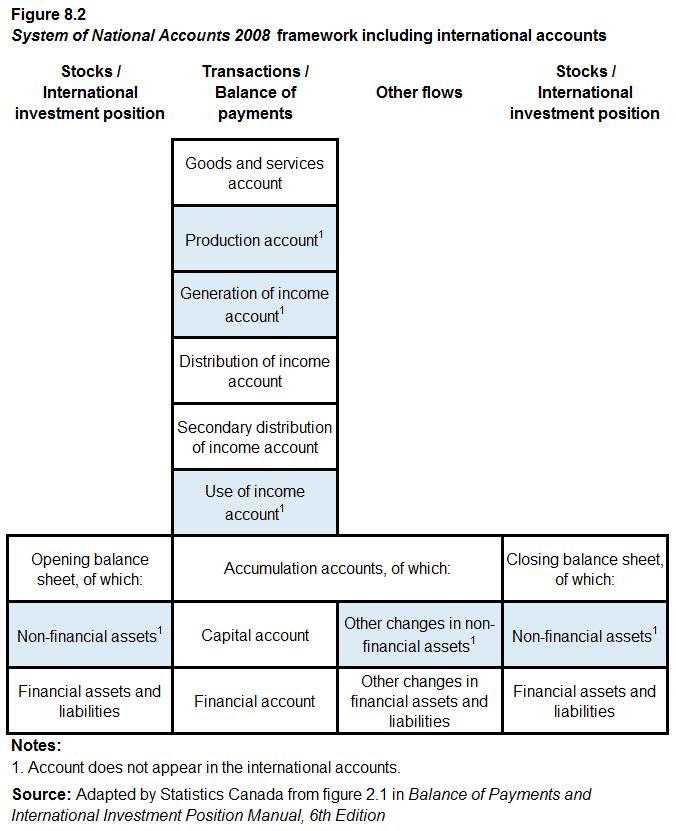

This flowchart outlines the components of the System of National Accounts (SNA), showcasing how national income statistics are structured. It provides a high-level overview suitable for understanding the framework without delving into detailed methodologies. Source

What Students Should Focus On

Although detailed construction is excluded, students need to understand the key principles underlying national income measurement:

Income = Output = Expenditure: This equation forms the basis of the circular flow of income.

Equilibrium occurs when injections into the economy equal withdrawals.

Full employment income represents the level of output achieved when all available resources are used efficiently.

These concepts can be understood without delving into how raw data is collected and transformed into final figures.

Issues with National Income Statistics

Why Awareness Matters

Even without construction knowledge, it is important to recognise the limitations of national income accounts as indicators of performance:

Some economic activity (e.g. household labour, informal trade) goes unrecorded.

Measuring the shadow economy or illegal activity is very difficult.

Errors and omissions may occur despite advanced statistical methods.

Differences Between Countries

Different countries may use slightly varied accounting standards or face difficulties in collecting accurate data, particularly in developing economies. This limits the comparability of statistics across borders.

National Accounts and Policy Use

Policy Relevance

National accounts are critical for:

Monitoring economic growth (GDP trends).

Assessing inflation-adjusted changes through real income measures.

Guiding fiscal and monetary policy decisions.

Comparing performance with other economies.

Student Understanding

Students should focus on how governments use national income statistics to judge economic performance, rather than on how statisticians gather and refine the data.

Key Takeaways for Students

No detailed construction: You are not expected to learn data collection, statistical adjustments, or the technical compilation of accounts.

Focus on interpretation: Understand what national income represents and how it links to macroeconomic performance.

Recognise limitations: Be aware that data may be imperfect, especially across countries or in capturing informal activity.

Supporting Definitions

National Income: The total value of all goods and services produced in an economy over a given period, measured as income, output, or expenditure.

National income accounts provide the framework through which this value is tracked. But for A-Level study, emphasis lies in using the data rather than constructing it.

System of National Accounts (SNA): An international standard framework developed by bodies like the UN and IMF for compiling and presenting national income statistics.

Students should be aware of the existence of such frameworks but do not need to study their technical details.

Linking Back to the Specification

The AQA specification ensures that students gain a functional understanding of national income statistics without being overwhelmed by statistical detail. You should:

Understand what the data means.

Be able to apply the data to economic analysis.

Recognise that construction details are beyond the scope of the course.

FAQ

The process of constructing national income accounts involves complex data collection, statistical sampling, and adjustments that are beyond the scope of A-Level.

The focus for AQA students is on interpreting what national income figures represent and applying them in macroeconomic analysis, rather than replicating the methods used by professional statisticians.

In the UK, the Office for National Statistics (ONS) is responsible for compiling and publishing national income accounts.

They collect data from businesses, households, government agencies, and trade statistics to build a coherent set of national accounts, ensuring compliance with international standards such as the System of National Accounts (SNA).

Adjustments are necessary to ensure accuracy and avoid distortions. These include:

Seasonal adjustments to account for regular patterns in activity.

Removing double counting when goods are used as intermediate inputs.

Estimating the value of informal or unrecorded economic activity where possible.

These adjustments highlight why detailed knowledge of construction is not required at A-Level.

Limitations highlight the fact that national income data is not perfect.

Recognising issues such as the exclusion of household labour, the difficulty of measuring the shadow economy, and variations across countries helps students critically evaluate how reliable GDP is as a measure of performance.

The System of National Accounts (SNA) provides a standardised framework for all countries to follow.

This reduces discrepancies in how income, output, and expenditure are measured, making cross-country comparisons more meaningful.

Without such frameworks, economic data would be inconsistent and much harder to use for international analysis.

Practice Questions

Explain why AQA students are not required to have a detailed knowledge of how national income accounts are constructed. (2 marks)

1 mark for stating that construction involves highly technical statistical processes or adjustments.

1 mark for stating that A-Level study focuses on interpreting and using national income data, not producing it.

Discuss two limitations of national income statistics that students should be aware of, even without knowledge of their detailed construction. (6 marks)

Up to 3 marks per limitation explained (maximum 6).

1 mark for identifying a relevant limitation (e.g. unrecorded activity such as household labour, shadow economy, or cross-country comparability issues).

1 mark for explaining why this limitation arises.

1 mark for explaining the impact on measuring economic performance (e.g. GDP figures may underestimate true economic activity, making comparisons less reliable).

Maximum of 6 marks available (2 valid limitations discussed fully).