AQA Specification focus:

‘The difference between nominal and real income.’

Understanding the distinction between nominal and real income is essential in A-Level Economics. It highlights how inflation influences the usefulness of income as an indicator of performance.

Nominal vs Real Income: An Overview

Nominal and real income are central concepts in measuring economic performance and living standards. While they are related, they capture very different economic realities.

Nominal Income

Nominal income refers to the total money earned by households, firms, or the economy measured at current prices, without adjusting for inflation.

Nominal Income: The total income received in money terms during a given period, unadjusted for changes in the price level.

Nominal figures are important because they are the amounts directly received and spent. However, on their own they can be misleading if used to judge economic well-being.

Real Income

Real income adjusts nominal income to take account of changes in the general price level. This reflects the actual purchasing power of income.

Real Income: Nominal income adjusted for inflation, showing the amount of goods and services that can actually be purchased.

By focusing on real rather than nominal income, economists can better understand changes in living standards over time.

The Importance of Inflation

Inflation plays a decisive role in distinguishing nominal and real income. Even if nominal income rises, real income may remain the same or even fall if prices rise faster.

If nominal income rises by 5% but inflation is also 5%, then real income remains unchanged.

If inflation exceeds nominal growth, real income falls.

If nominal growth exceeds inflation, real income rises.

This adjustment allows economists to measure whether people are genuinely better or worse off.

Equation for Real Income

Real Income = Nominal Income ÷ Price Index × 100

Nominal Income = Income in current money terms

Price Index = A measure of the average price level (e.g., Consumer Price Index, CPI)

This formula ensures that nominal income figures are standardised for inflation, enabling more accurate analysis of economic performance.

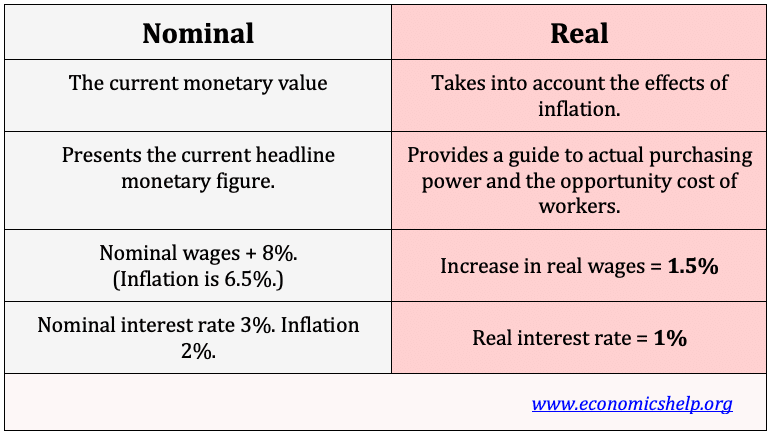

This table contrasts nominal and real values, highlighting how inflation affects purchasing power. It underscores the necessity of adjusting for inflation to accurately assess economic well-being. Source

Real National Income as an Indicator of Performance

The AQA specification highlights real national income as an indicator of economic performance. This means real income is not only useful at the household or individual level but also for the economy as a whole.

Why Real National Income Matters

Reflects living standards: Real income changes show whether households can buy more or fewer goods and services.

Informs policy: Governments and central banks track real income trends when setting fiscal and monetary policy.

International comparisons: Real income allows meaningful comparisons between countries by stripping out differences in inflation rates.

Business decisions: Firms use real income data to forecast demand and adjust production.

Without real adjustments, nominal figures could suggest growth where in fact people are worse off due to rising prices.

Applications of Nominal vs Real Income

Understanding these concepts enables students to apply them to real-world economic issues. Some key applications include:

Household Level

Wage negotiations: Workers push for wage rises that at least match inflation to preserve real income.

Living standards: Real household income shows whether people’s day-to-day purchasing power is rising.

Government Level

Taxation and benefits: Policymakers often index benefits and pensions to inflation to protect real incomes.

Economic growth measurement: GDP figures are reported in both nominal and real terms, with real GDP being the more meaningful indicator of performance.

International Economics

Exchange rate comparisons: Real income is important when comparing across borders, as nominal measures alone can distort comparisons due to differing inflation rates.

Global shocks: Oil price surges or financial crises often reduce real incomes worldwide, despite nominal values being unchanged.

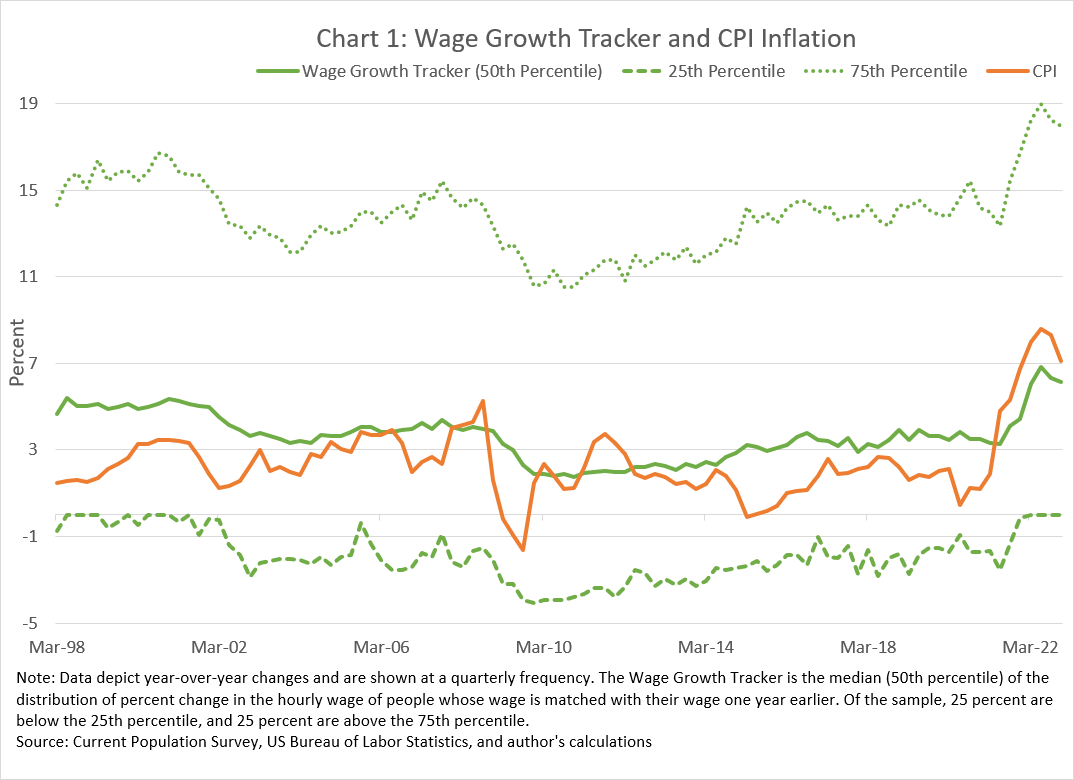

This chart demonstrates how real wage growth can be negative when inflation outpaces nominal wage increases, emphasizing the importance of considering real income for assessing living standards. Source

Limitations of Using Real Income Alone

While real income is crucial, it has limitations as an economic indicator. Economists must consider:

Distributional issues: Average real income may rise while inequality worsens.

Non-market factors: Changes in quality of life (e.g., leisure, health outcomes) are not fully captured.

Measurement problems: The choice of price index (CPI vs RPI) can alter real income figures.

Short-run distortions: Temporary price shocks may misrepresent long-term income trends.

Therefore, real income must be interpreted alongside other indicators for a complete picture.

Key Takeaways for AQA Students

Nominal income is measured in current money terms, unadjusted for inflation.

Real income adjusts for inflation and measures purchasing power.

Real national income is a central indicator of economic performance, showing whether an economy is genuinely growing in terms of output and living standards.

Inflation is the crucial factor in distinguishing between the two, and the real vs nominal distinction underpins most macroeconomic analysis.

FAQ

Nominal income rises may suggest households are better off, but without considering inflation this can be deceptive. If prices increase faster than income, purchasing power falls.

For example, a 3% wage rise with 4% inflation means households can afford fewer goods and services despite higher money income.

The choice of price index, such as the Consumer Price Index (CPI) or the Retail Price Index (RPI), changes the estimate of real income.

CPI excludes housing costs such as mortgage interest.

RPI includes them, often making inflation appear higher.

This means real income calculations may vary depending on the index used.

Workers and trade unions often argue for pay rises in line with inflation to protect real incomes.

If nominal pay increases lag behind inflation, living standards decline. Real income provides the benchmark for whether a pay settlement actually maintains or improves purchasing power.

Governments frequently use real income as a measure when uprating pensions, benefits, or tax thresholds.

By linking these to inflation, the aim is to maintain beneficiaries’ purchasing power, ensuring living standards are not eroded by rising prices.

Sustained growth in real income usually reflects rising productivity, greater output, and improved living standards.

Falling real incomes may indicate inflationary pressures, weak wage growth, or economic stagnation, signalling potential problems for demand, growth, and social stability.

Practice Questions

Define the difference between nominal income and real income. (2 marks)

1 mark for correctly identifying nominal income as income measured in current money terms, unadjusted for inflation.

1 mark for correctly identifying real income as nominal income adjusted for inflation, showing purchasing power.

Explain why real national income is a more reliable indicator of economic performance than nominal national income. (6 marks)

Up to 2 marks for identifying that nominal income does not account for inflation, while real income does.

Up to 2 marks for explaining that real income reflects actual purchasing power and living standards, whereas nominal income may give a misleading impression if inflation is high.

Up to 2 marks for further development, such as noting that policymakers and economists rely on real measures for comparing economic performance over time or between countries.

(Max 6 marks: allow development marks for clear explanation and application of economic reasoning.)