AQA Specification focus:

‘The effect of changes in injections and withdrawals on national income.’

Introduction

Injections and withdrawals play a crucial role in determining the level of national income. Shifts in their balance directly influence economic performance, growth, and equilibrium stability.

Understanding Injections and Withdrawals

Injections

Injections are additions of spending into the circular flow of income from outside the domestic household–firm relationship. These increase aggregate demand and stimulate production.

Government spending on goods, services, and welfare programmes

Investment by firms in capital goods

Exports, since foreign demand for domestic products brings in new income

Injections: Exogenous additions to the circular flow of income, including investment, government expenditure, and exports.

Withdrawals

Withdrawals (also called leakages) represent income that leaves the circular flow, reducing demand for domestically produced goods and services.

Saving by households in financial institutions

Taxes collected by the government

Imports, which redirect domestic spending towards foreign goods

Withdrawals: Exogenous reductions from the circular flow of income, including savings, taxes, and imports.

Equilibrium and Disequilibrium

The Role of Balance

Equilibrium national income occurs when total injections equal total withdrawals. At this point, planned spending matches output, and the economy operates at a sustainable level.

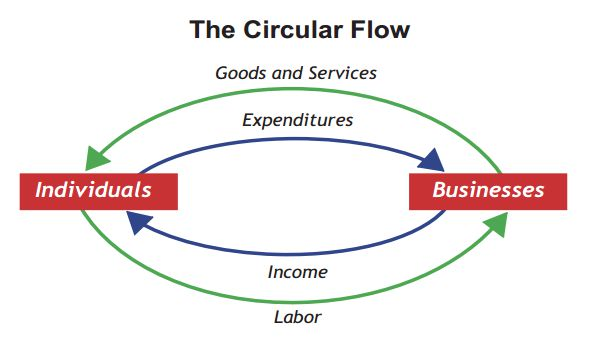

This diagram depicts the fundamental circular flow of income, showing the continuous movement of money between households and firms. It serves as a basis for understanding how injections and withdrawals affect national income. Source

Equilibrium Condition: Injections (J) = Withdrawals (W)

J = I + G + X

I = Investment

G = Government spending

X = Exports

W = S + T + M

S = Savings

T = Taxes

M = Imports

If injections exceed withdrawals, the economy expands. If withdrawals exceed injections, output contracts.

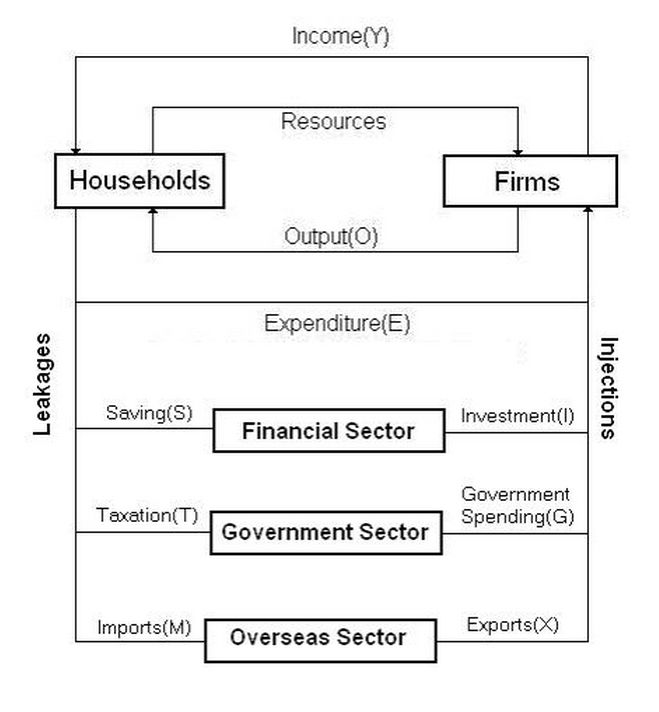

The five-sector circular flow model illustrates the complex interactions between different economic agents. It shows how changes in injections and withdrawals can lead to economic expansion or contraction. Source

Disequilibrium Effects

Excess injections: National income rises as firms increase output to meet rising demand.

Excess withdrawals: National income falls as spending weakens and production declines.

Impact of Changes in Injections

Increase in Injections

When injections grow (e.g., increased government investment in infrastructure):

Firms face greater demand, leading to higher output.

Employment rises as production expands.

Household incomes grow, feeding back into further consumption.

Decrease in Injections

If injections fall (e.g., reduced business investment):

Aggregate demand weakens.

Firms cut back production, lowering employment.

National income contracts, possibly triggering recessionary pressures.

Impact of Changes in Withdrawals

Increase in Withdrawals

Greater withdrawals (e.g., higher taxes or rising imports):

Domestic demand falls as households and firms reduce spending.

Lower demand causes contraction in output.

National income decreases, potentially increasing unemployment.

Decrease in Withdrawals

Reduced withdrawals (e.g., tax cuts or lower household savings):

Consumption increases, boosting aggregate demand.

Firms respond by raising output and employing more resources.

National income expands, supporting economic growth.

Interaction Between Injections and Withdrawals

Multiplier Effects

A small rise in injections or reduction in withdrawals can generate a larger increase in national income through the multiplier process, as higher incomes fuel more spending.

Dynamic Adjustments

Short-term: Output adjusts faster than prices, so changes affect real national income significantly.

Long-term: Persistent imbalances may alter inflation, trade positions, and government policy responses.

Application in Economic Context

Policy Implications

Governments and central banks monitor injections and withdrawals closely because they guide policy:

Expansionary fiscal policy (raising government spending or cutting taxes) increases injections and reduces withdrawals.

Contractionary fiscal policy (raising taxes or cutting spending) increases withdrawals and reduces injections.

Global Influences

External shocks — such as a surge in export demand or global financial crises — shift injections and withdrawals, influencing national income beyond domestic policy control.

Key Points Recap in List Form

Injections: Investment, government spending, exports.

Withdrawals: Saving, taxes, imports.

Equilibrium: Achieved when injections = withdrawals.

National income rises when injections > withdrawals.

National income falls when withdrawals > injections.

Multiplier effect magnifies changes.

Policy and global factors strongly influence outcomes.

FAQ

Short-term fluctuations often arise when injections or withdrawals change unexpectedly. For instance, a sudden rise in investment can temporarily boost national income, while higher savings or taxation can reduce spending power.

These imbalances can lead to growth spurts or slowdowns before the economy readjusts to a new equilibrium where injections equal withdrawals again.

Imports are treated as withdrawals because money spent on foreign goods leaves the domestic economy. This reduces demand for domestically produced goods and services.

As a result, while households may enjoy more choice, the direct impact is a reduction in domestic output and employment unless matched by equivalent export earnings.

Governments use fiscal policy tools to influence injections and withdrawals:

Increasing government spending (injection) during downturns.

Cutting taxes to reduce withdrawals and boost consumption.

Raising taxes or cutting spending in booms to reduce inflationary pressures.

Such policies aim to stabilise national income by keeping injections and withdrawals in balance.

Yes. For example, poorly targeted government spending may increase demand but create inefficiencies, waste, or inflation.

Similarly, excessive foreign investment could lead to future profit outflows, reducing long-term income retention within the domestic economy.

While savings reduce immediate spending, they provide funds for banks to lend to businesses. This can stimulate future investment, turning today’s withdrawal into tomorrow’s injection.

In economies with well-functioning financial markets, this process supports sustainable long-term growth by financing productive capital expenditure.

Practice Questions

Define the term injections in the context of the circular flow of income. (2 marks)

1 mark for identifying that injections are additions to spending in the circular flow of income.

1 mark for stating examples such as investment, government spending, or exports.

Explain how an increase in withdrawals can affect the level of national income. (6 marks)

Up to 2 marks for identifying what withdrawals are (savings, taxes, imports) and that they represent leakages from the circular flow.

Up to 2 marks for explaining that an increase in withdrawals reduces aggregate demand, leading to lower output.

Up to 2 marks for linking this to the effect on national income, such as reduced employment and possible contraction in economic growth.