AQA Specification focus:

‘Real national income as an indicator of economic performance.’

National income plays a central role in macroeconomics, serving as a key measure of economic performance, policy success, and living standards within domestic and international contexts.

National Income as an Economic Indicator

Understanding National Income

National income refers to the total value of goods and services produced within an economy over a period, usually measured annually. It is commonly calculated using real GDP, which adjusts for changes in the price level.

National Income: The total value of income earned by residents of a country, usually measured as real GDP, reflecting overall economic performance.

National income provides policymakers and analysts with a broad overview of whether an economy is growing, stagnating, or contracting.

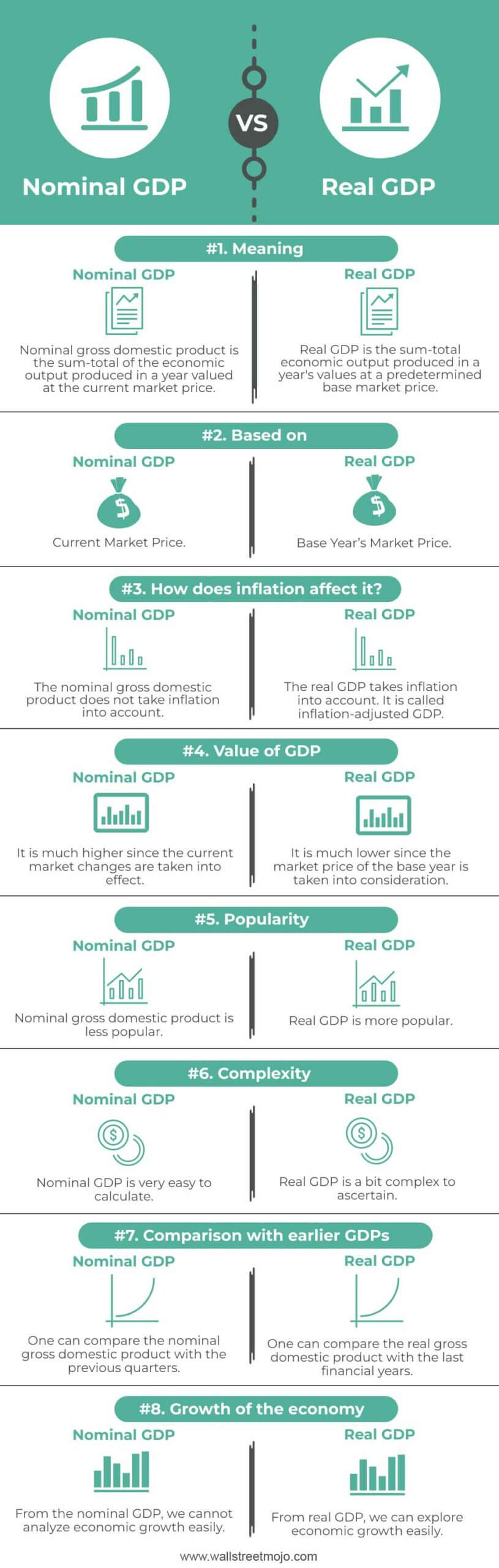

This chart compares nominal and real GDP, demonstrating how inflation can inflate nominal GDP figures, while real GDP offers a more accurate reflection of economic growth by adjusting for price changes. Source

Nominal vs Real National Income

When using national income as an indicator, it is important to distinguish between nominal income (measured at current prices) and real income (adjusted for inflation). Real income provides a clearer picture of changes in output and performance because it removes the distortion of price changes.

Real National Income: National income adjusted for inflation, showing the true level of economic output.

A rise in nominal income may simply reflect inflation, whereas an increase in real income demonstrates genuine economic growth.

National Income as a Measure of Economic Performance

National income is widely used as an indicator of performance because it reveals trends in production and consumption. Key applications include:

Assessing economic growth: Rising real national income signals expansion, while falling income indicates contraction or recession.

Comparing living standards: Higher income levels are often linked with better access to goods, services, and welfare.

Evaluating policy effectiveness: Fiscal and monetary policies are often judged by their impact on national income.

International comparisons: Real national income per capita enables comparisons between countries at different stages of development.

Limitations of National Income as an Indicator

While widely used, national income as a performance measure has notable limitations:

Non-market activity: It excludes unpaid work such as household labour or volunteer activity.

Distribution of income: Rising national income does not necessarily mean all citizens benefit equally.

Negative externalities: Growth may coincide with environmental damage or resource depletion.

Informal economy: In some economies, large informal sectors are not fully recorded.

These limitations highlight the importance of complementing national income with other indicators, such as the Human Development Index (HDI).

Real National Income and Full Employment

National income also provides insight into whether an economy is achieving full employment income, where resources are used efficiently without significant unemployment.

Full Employment Income: The level of national income at which all available resources, including labour, are fully employed without inflationary pressure.

Monitoring real national income relative to this benchmark helps policymakers assess whether the economy is underperforming or overheating.

Using National Income for Policy and Planning

Government Policy Applications

Governments rely heavily on national income data when designing and evaluating policies:

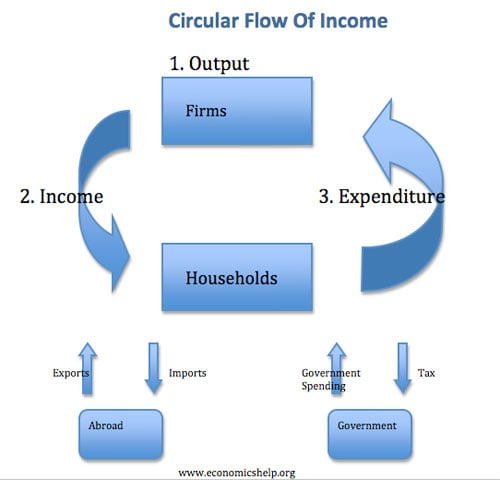

Fiscal Policy: Adjusting government spending and taxation to influence income levels.

Monetary Policy: Managing interest rates and money supply to stabilise growth.

Trade Policy: Understanding the role of exports and imports in sustaining income.

Business and Investment Decisions

Firms also monitor national income trends:

Higher real income often indicates stronger consumer demand.

Declining income may signal reduced profitability, discouraging investment.

Alternative Measures of Performance

Although real national income remains central, economists often combine it with alternative indicators for a fuller picture:

GDP per capita: Provides insight into average living standards.

Growth rate of real GDP: Highlights the pace of economic expansion.

Productivity measures: Focus on efficiency and competitiveness.

Wellbeing indicators: Include health, education, and environmental sustainability.

This multi-indicator approach avoids overreliance on a single measure and supports better-informed economic decisions.

National Income and International Comparisons

National income data enables cross-country analysis by comparing relative performance:

Economic growth differentials: Helps identify successful policies and development strategies.

Living standards: Using real national income per capita shows disparities in wealth and opportunity.

Global policy coordination: International bodies such as the IMF and World Bank use income data to design aid and support programmes.

However, exchange rate fluctuations and differences in data collection methods can complicate such comparisons.

The circular flow of income model depicts the continuous movement of money, goods, and services between households and firms, forming the basis of national income accounting. Source

Key Points for Students

Real national income is a primary indicator of economic performance.

Distinguishing between real and nominal income is essential.

National income measures growth and living standards but has limitations such as ignoring inequality and environmental impacts.

It is used by governments, businesses, and international organisations to inform decisions.

Complementary indicators are often necessary for a complete view of economic wellbeing.

FAQ

Real national income accounts for inflation, ensuring that measured growth reflects actual increases in goods and services. GDP growth rates can be misleading if they rise purely due to higher prices.

In contrast, real national income shows whether an economy is genuinely producing more, making it a more reliable indicator of performance and living standards.

Governments use real national income data to adjust fiscal and monetary policies.

If real income falls, policies may shift towards stimulating demand through spending or tax cuts.

If real income grows too quickly, governments may tighten monetary policy to prevent inflationary pressures.

Thus, real income guides decisions on stabilising growth and maintaining employment.

A rise in real national income does not always mean individuals are better off. If population growth outpaces income growth, living standards may stagnate or even decline.

Therefore, economists often use real national income per capita to measure changes in average living standards across the population.

Real national income reflects the economy’s capacity to produce goods and services, which directly influences labour demand.

Rising real income often leads to job creation, reducing unemployment.

Falling real income can signal contraction, leading to redundancies and higher unemployment.

Employment trends are therefore closely tied to movements in national income.

Comparisons are complicated by:

Differences in data collection methods.

Exchange rate fluctuations affecting measurement.

Variations in informal economic activity.

Differences in living costs and social welfare provisions.

To address these issues, economists often use purchasing power parity (PPP) adjusted figures to compare real national income across countries.

Practice Questions

Explain the difference between nominal national income and real national income. (2 marks)

1 mark for identifying that nominal national income is measured at current market prices without adjustment for inflation.

1 mark for identifying that real national income is adjusted for inflation and therefore reflects actual output changes.

Using examples, explain why real national income is considered a better indicator of economic performance than nominal national income. (6 marks)

Up to 2 marks for defining or explaining real national income (e.g., adjusted for inflation, shows true changes in output).

Up to 2 marks for defining or explaining nominal national income (e.g., measured at current prices, includes inflationary effects).

Up to 2 marks for analysis with examples, such as:

If nominal income rises due to high inflation, it may not reflect improved living standards.

Real income growth indicates an actual increase in goods and services produced.

Example: A 5% rise in nominal income alongside 5% inflation shows no real growth.

Maximum 6 marks awarded for clear definitions and relevant analysis with appropriate examples.