AQA Specification focus:

‘Students should be able to use AD and AS analysis to help them explain macroeconomic problems and issues.’

Aggregate demand (AD) and aggregate supply (AS) analysis provides a powerful framework for understanding real-world macroeconomic issues, enabling students to connect theory to contemporary economic challenges.

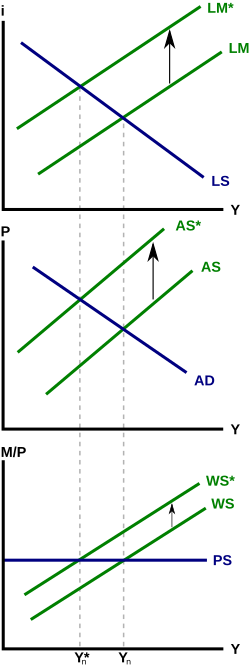

The AD/AS model demonstrates the interaction between aggregate demand and aggregate supply in determining the equilibrium output and price level in an economy. Shifts in these curves can result from changes in factors like consumer confidence, government spending, or production costs, leading to various macroeconomic outcomes. Source

Using AD/AS to Analyse Real Issues

The AD/AS model shows how the total demand for goods and services (AD) interacts with the productive capacity of the economy (AS). It helps economists and policymakers analyse inflation, unemployment, growth, and trade imbalances.

Demand-Side Issues

Demand-side issues occur when fluctuations in aggregate demand drive changes in output, employment, and prices. These include:

Recession: A sharp fall in consumption, investment, or net exports shifts AD leftwards, reducing output and increasing unemployment.

Inflationary pressure: Excessive government spending or credit growth may shift AD rightwards, causing demand-pull inflation.

Demand-pull inflation: Inflation caused by an increase in aggregate demand when the economy is close to or at full employment.

One way to visualise this is through rightward or leftward shifts of the AD curve on an AD/AS diagram, which show the pressure on price levels and output.

Supply-Side Issues

Supply-side issues occur when aggregate supply is disrupted, shifting the SRAS or LRAS curve. These are often linked to production costs, resource availability, or structural changes.

Cost-push inflation: Rising oil prices, raw material shortages, or higher wage demands can shift SRAS leftward, increasing the price level while reducing output.

Productivity growth: Improvements in technology or workforce skills can shift LRAS rightward, boosting potential output without causing inflation.

Cost-push inflation: Inflation caused by rising production costs that reduce aggregate supply.

Employment and Output

The AD/AS framework allows us to understand employment fluctuations.

If AD is below full employment output, there is a negative output gap and higher unemployment.

If AD exceeds long-run productive capacity, a positive output gap emerges, generating inflationary pressure.

Output gap: The difference between actual output and potential output in an economy.

These gaps help explain why governments pursue stabilisation policies, such as fiscal expansion during recessions or monetary tightening during inflationary periods.

International and Global Issues

AD/AS analysis also applies to global shocks. For example:

A global financial crisis reduces investment and confidence, shifting AD leftward.

A global commodity price spike, such as oil, shifts SRAS leftward, creating stagflation — rising prices and falling output.

Currency depreciation increases export demand (raising AD) but also raises import costs (reducing SRAS).

Policy Applications

Governments and central banks rely on AD/AS analysis when crafting macroeconomic policy.

Demand-side policies: Fiscal stimulus (higher government spending, tax cuts) or monetary easing (lower interest rates, quantitative easing) aim to boost AD.

Supply-side policies: Deregulation, education investment, infrastructure improvements, or incentives for innovation aim to shift LRAS rightward.

These policies are often combined to manage both short-term cycles and long-term growth prospects.

Real-World Examples of AD/AS Application

2008 Global Financial Crisis: Collapse in credit and investment shifted AD sharply leftward, leading to recessions across developed economies. Expansionary monetary and fiscal policies were used to shift AD back.

COVID-19 Pandemic: Both AD and AS were affected. Lockdowns reduced consumption and investment (AD fall), while supply chain disruptions constrained SRAS. Policy responses targeted both sides of the economy.

Energy Price Shocks: Rising oil and gas prices in the 1970s and again in the 2020s shifted SRAS leftward, fuelling cost-push inflation.

These cases show the flexibility of the AD/AS framework for diagnosing complex macroeconomic problems.

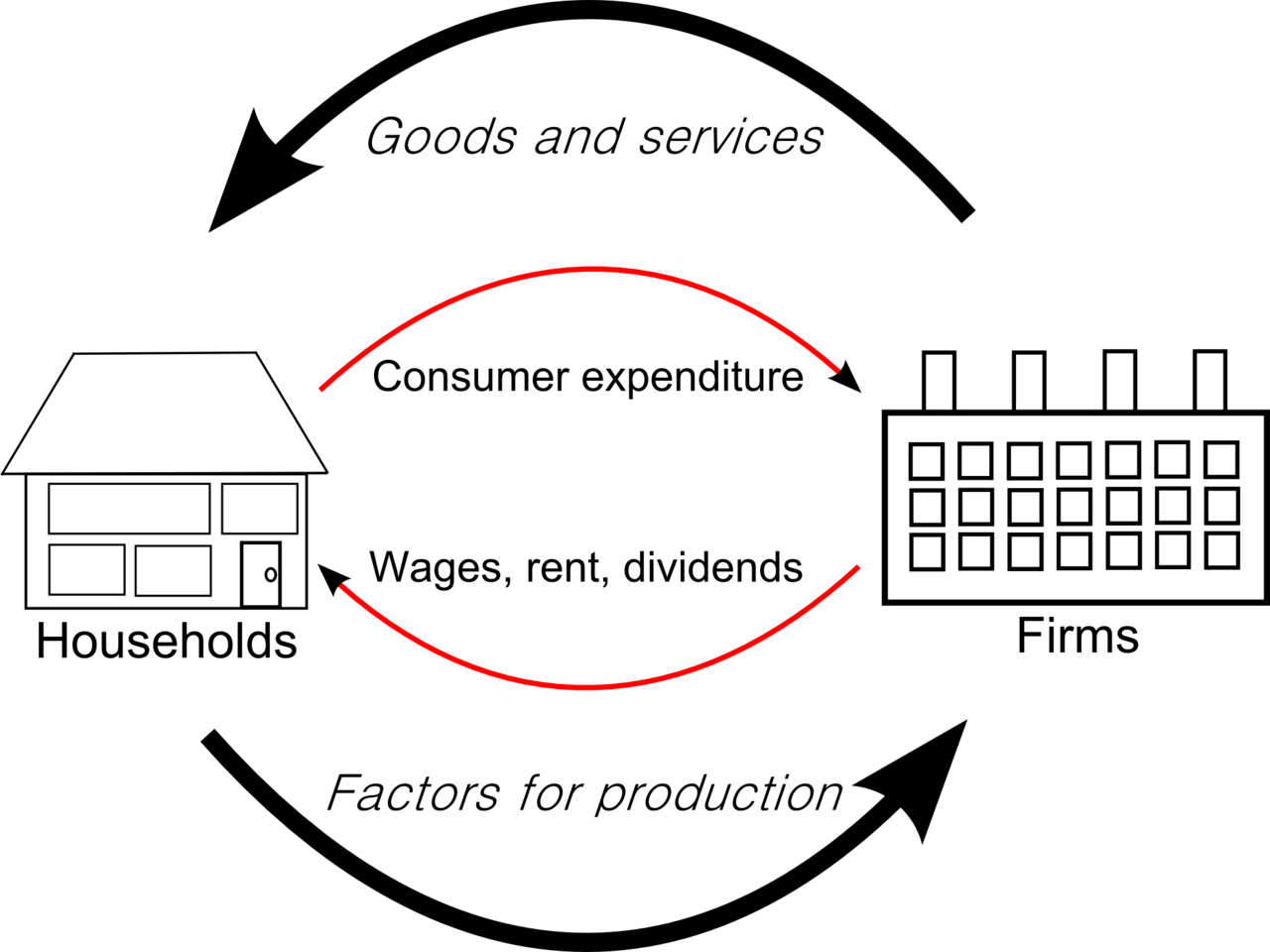

The circular flow of income diagram illustrates the continuous movement of money among different sectors of the economy, highlighting the interdependencies that influence aggregate demand and supply. This model is foundational for understanding how economic activities in one sector can impact others, thereby affecting overall economic performance. Source

Key Points for Students

When applying AD/AS to real issues, students should focus on:

Identifying the initial shock (e.g., demand fall, cost rise).

Determining which curve shifts (AD, SRAS, or LRAS).

Assessing the impact on output, employment, and inflation.

Considering the role of government or central bank intervention.

This structured approach ensures answers remain clear, logical, and aligned with the specification.

FAQ

Stagflation occurs when high inflation and high unemployment exist simultaneously. Using AD/AS analysis, this is shown by a leftward shift in short-run aggregate supply (SRAS).

Higher costs, such as oil price rises, reduce output while pushing up prices. This creates the unusual combination of falling GDP and rising inflation, which cannot be explained by demand-side shifts alone.

The AD/AS model helps visualise how different policies affect the economy.

Demand-side policies shift AD (e.g., government spending, interest rate changes).

Supply-side policies shift LRAS or SRAS (e.g., education, tax incentives, deregulation).

This framework enables policymakers to consider trade-offs such as inflation versus growth, or short-term stimulus versus long-term capacity building.

Yes. In the short run, shocks such as wage rises or tax changes typically shift SRAS.

In the long run, factors like technology, labour productivity, and capital investment shift LRAS.

By distinguishing between SRAS and LRAS shifts, AD/AS diagrams reveal why some policies produce temporary effects while others alter long-term potential output.

A depreciation of the exchange rate can affect both sides of the model.

Exports become cheaper, increasing AD.

Imports become more expensive, raising input costs and shifting SRAS leftward.

The combined impact depends on which effect dominates: stronger demand boosting growth, or higher costs generating inflationary pressure.

While useful, the AD/AS model has limitations.

It simplifies complex interactions in the economy.

Curve shifts are often difficult to measure precisely.

Real-world economies face multiple shocks simultaneously, not isolated shifts.

Thus, while it offers a clear framework for analysis, outcomes may differ in practice due to global interdependence, expectations, and unpredictable behaviours.

Practice Questions

Explain what is meant by cost-push inflation using the AD/AS framework. (2 marks)

1 mark for identifying that cost-push inflation occurs when rising production costs cause a leftward shift in the short-run aggregate supply (SRAS).

1 mark for linking this to higher prices (inflation) and reduced output.

Using an AD/AS diagram, analyse how a fall in consumer confidence could affect output and employment in the economy. (6 marks)

Up to 2 marks for correctly explaining that lower consumer confidence reduces consumption, shifting AD leftwards.

Up to 2 marks for explaining the effect on output (fall in equilibrium output).

Up to 1 mark for explaining the effect on employment (higher unemployment due to reduced output).

Up to 1 mark for clear application of AD/AS analysis to the context (e.g., reference to diagram shifts or linking to a negative output gap).