AQA Specification focus:

‘Students should also understand how global economic events can affect the domestic economy.’

Global events significantly influence domestic economies by affecting trade, financial flows, confidence, and overall economic activity. Understanding these linkages is vital for effective macroeconomic analysis.

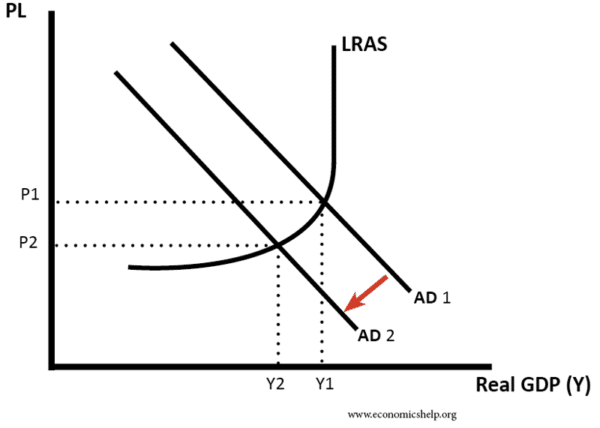

This diagram depicts the Aggregate Demand and Aggregate Supply model, showing how shifts in AD and AS curves can lead to changes in the equilibrium output and price level. Such shifts can occur due to global economic events, affecting domestic economic conditions. Source

Global Events and Their Transmission Channels

Trade Links

Global economic events often affect exports and imports directly. For instance:

A global recession reduces demand for a nation’s exports, leading to lower aggregate demand (AD).

A global boom increases export demand, boosting domestic output.

Disruptions such as natural disasters or pandemics can constrain supply chains, raising costs and reducing output.

Aggregate Demand (AD): The total demand for goods and services in an economy at a given overall price level and in a given period.

Changes in trade links demonstrate how international conditions can shift the AD curve, influencing growth and employment domestically.

Financial Markets

Global events impact financial markets through capital flows, interest rates, and investor confidence:

A global financial crisis can reduce foreign investment, restrict credit availability, and weaken domestic spending.

International interest rate changes, such as a rise in US rates, can strengthen the US dollar and weaken other currencies, increasing import costs elsewhere.

Global uncertainty often leads to "safe-haven" capital movements, influencing domestic exchange rates and bond yields.

Commodity Prices

Domestic economies dependent on commodities are highly exposed to global events:

A global oil price spike increases production costs, shifting short-run aggregate supply (SRAS) leftwards and creating inflationary pressure.

A fall in global commodity demand depresses export earnings in resource-dependent countries.

Short-Run Aggregate Supply (SRAS): The total output an economy’s producers are willing and able to supply at a given overall price level in the short run.

This relationship shows how external shocks can drive inflation and affect competitiveness.

Specific Types of Global Events

Global Recessions and Booms

Recessions abroad reduce export demand, depress domestic AD, and can lead to higher unemployment.

Global growth periods often enhance export performance, improve investment prospects, and raise confidence.

Financial Crises

Events such as the 2008 Global Financial Crisis illustrate how banking failures abroad can affect domestic economies through tighter credit, reduced liquidity, and weakened business confidence.

Pandemics and Health Crises

Health emergencies like COVID-19 demonstrate:

Sudden contraction of AD due to reduced consumption and investment.

Severe supply-side disruption from closed factories and global logistics breakdowns.

Government responses such as fiscal stimulus and monetary easing influencing the domestic recovery path.

Geopolitical Events

Wars, sanctions, and political instability alter domestic economies through:

Increased uncertainty and lower investment.

Disruption of trade routes and energy supplies.

Government reallocation of resources towards defence spending.

Climate-Related Events

Natural disasters abroad can disrupt raw material supply chains, raising costs for domestic producers.

Global agreements on carbon reduction can change domestic industrial structures and investment flows.

Exchange Rates and Global Events

Global events frequently affect exchange rates, which in turn influence the domestic economy:

If global investors lose confidence, capital outflows weaken a currency, making imports more expensive and potentially fuelling inflation.

Conversely, a stronger domestic currency due to global demand for safe assets can harm export competitiveness.

Net Exports (NX) = Exports (X) – Imports (M)

X = Value of goods/services sold abroad (£)

M = Value of goods/services bought from abroad (£)

NX = Net impact of trade on AD

This relationship highlights the role of trade balances as a transmission channel between global events and domestic income.

Demand-Side vs Supply-Side Impacts

Global events can affect both sides of the economy:

Demand-side effects: Global slowdowns reduce export demand, foreign investment, and consumer confidence.

Supply-side effects: Global cost shocks (oil, raw materials) raise input costs, shifting SRAS.

Understanding whether the shock is demand-side or supply-side helps policymakers respond effectively.

Policy Responses to Global Events

Governments and central banks often react to global events to stabilise the domestic economy:

Fiscal policy: Increased government spending or tax cuts can offset weaker AD caused by global recessions.

Monetary policy: Lower interest rates or quantitative easing can boost liquidity and stimulate spending.

Trade policy: Diversification of export markets or trade agreements can reduce vulnerability to specific global shocks.

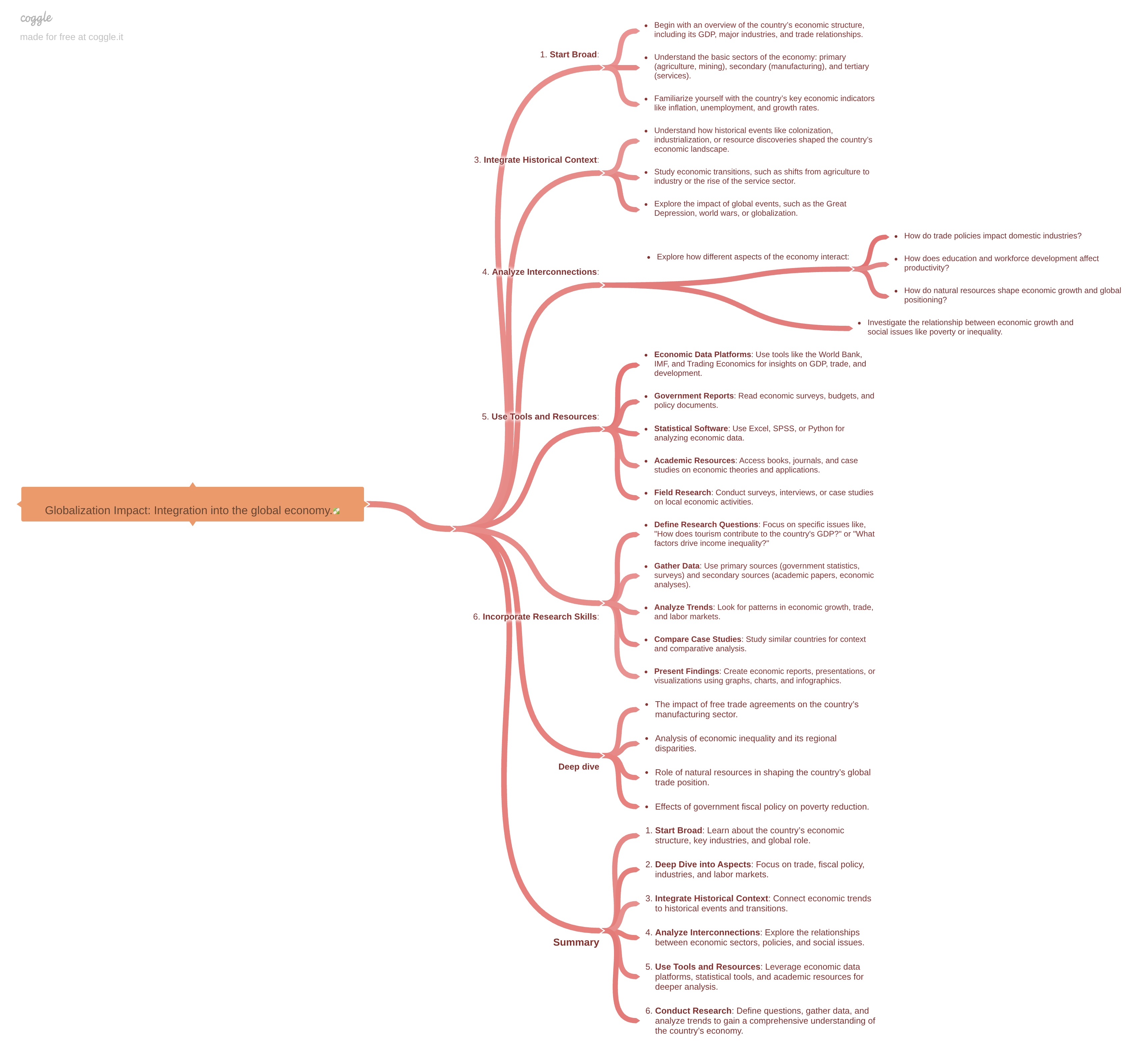

The Importance of Interdependence

Modern economies are highly interdependent, meaning no domestic economy is fully insulated from global events. Policy choices therefore must consider external conditions as well as internal stability.

This illustration showcases the positive and negative effects of globalization on economic growth, emphasizing how interconnectedness can lead to both opportunities and challenges for domestic economies. Source

FAQ

Global recessions often create uncertainty, making households cautious about spending and businesses reluctant to invest. This fall in confidence can reduce domestic aggregate demand even if income levels remain stable.

Businesses may delay expansion plans, while consumers may increase savings to protect against potential job losses, amplifying the impact of global downturns on the domestic economy.

Small open economies typically rely heavily on exports and imports, meaning global shifts in demand and prices quickly affect them.

Export-dependent economies suffer disproportionately from reduced global demand.

Exchange rate volatility has a larger impact on domestic inflation and competitiveness.

Dependence on a narrow range of trading partners increases vulnerability to regional shocks.

Global financial crises spread through interconnected capital markets. Domestic banks may face liquidity shortages if overseas lenders withdraw funds.

Falling global asset values can also reduce the value of banks’ holdings, weakening balance sheets. This reduces credit availability domestically, tightening borrowing conditions for households and firms.

When global supply chains are disrupted, firms may face higher costs and delays in obtaining key inputs.

Rising input costs increase inflationary pressure, shifting SRAS left.

Shortages of intermediate goods limit domestic production capacity.

Firms may pass on costs to consumers, reducing real disposable incomes and dampening demand.

For net exporters, rising commodity prices increase export revenues, boosting aggregate demand and improving trade balances.

For net importers, the opposite occurs: higher import costs worsen trade deficits, reduce AD, and create inflationary pressures.

The overall effect depends on whether a country imports or exports more of the affected commodity, highlighting the asymmetry of global shocks.

Practice Questions

Explain one way in which a global recession can affect a country’s domestic aggregate demand. (2 marks)

1 mark for identifying a valid channel, e.g. fall in exports.

1 mark for explaining the impact on domestic AD, e.g. reduced foreign demand for goods lowers exports, decreasing AD.

Discuss how a sharp increase in global oil prices might affect both aggregate demand and aggregate supply in the domestic economy. (6 marks)

Up to 2 marks for clear explanation of how higher oil prices increase import costs, potentially worsening the trade balance and reducing net exports, lowering AD.

Up to 2 marks for explaining the effect on SRAS, e.g. higher production costs shift SRAS leftwards, causing higher inflation and lower output.

1 mark for reference to the interdependence of global and domestic economies or recognition of both demand and supply-side effects together.

1 mark for using appropriate terminology such as “aggregate demand”, “aggregate supply”, “inflationary pressure”, or “net exports”.