AQA Specification focus:

‘Definitions of the money supply and the distinction between narrow money and broad money.’

The concept of the money supply is central to understanding how economies function. Economists divide it into different measures, most notably narrow money and broad money.

Understanding the Money Supply

The money supply refers to the total stock of money circulating in an economy at a given time. It includes various forms of money that can be classified depending on their liquidity and accessibility.

Money Supply: The total amount of monetary assets available in an economy at a specific time, including cash, deposits, and other liquid financial assets.

The definition matters because policymakers, such as the Bank of England, monitor different measures of money supply to assess inflationary pressures, financial stability, and economic growth.

Narrow Money

Narrow money is the most liquid form of money, consisting of money that can be used immediately for transactions. It represents the medium of exchange function of money.

Narrow Money: The part of the money supply made up of cash in circulation and easily accessible deposits such as current accounts.

Narrow money excludes less liquid financial assets like savings accounts or time deposits because these are not readily available for day-to-day spending.

Components of Narrow Money

Physical currency (notes and coins in circulation).

Demand deposits in banks, mainly current accounts that can be withdrawn on demand without penalty.

This category aligns closely with the definition of money as an immediate means of exchange. Economists often label narrow money as M0 or M1, depending on the system used.

Broad Money

Broad money extends beyond the highly liquid forms of narrow money. It includes assets that can be converted into cash relatively easily but are not immediately available for transactions.

Broad Money: A wider measure of the money supply that includes narrow money as well as less liquid financial assets such as savings deposits and time deposits.

While not instantly spendable, broad money provides a fuller picture of the total purchasing power within an economy.

Components of Broad Money

Narrow money (cash and demand deposits).

Time deposits (accounts with withdrawal restrictions or penalties).

Savings accounts with notice requirements.

Money market instruments held by households and firms.

This measure is usually labelled M3 or M4 in official statistics, with M4 commonly used in the UK.

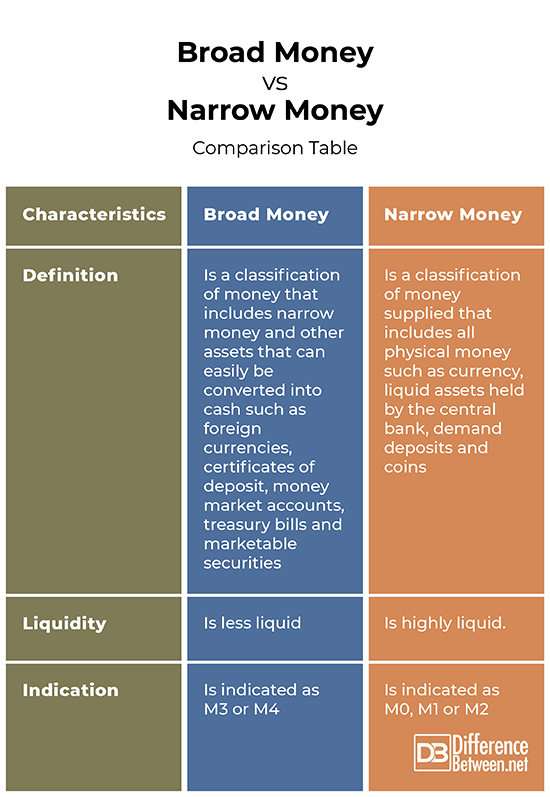

Comparing Narrow and Broad Money

The distinction between narrow and broad money lies in liquidity and accessibility.

Liquidity: Narrow money is highly liquid; broad money includes assets that require time or effort to convert into spendable cash.

Policy Use: Narrow money helps central banks monitor transaction levels, while broad money is more useful for understanding long-term credit growth and inflationary potential.

Scope: Broad money encompasses a larger set of financial assets, giving a more comprehensive view of the economy’s monetary environment.

By distinguishing between the two, economists can analyse short-term spending behaviour as well as long-term economic trends.

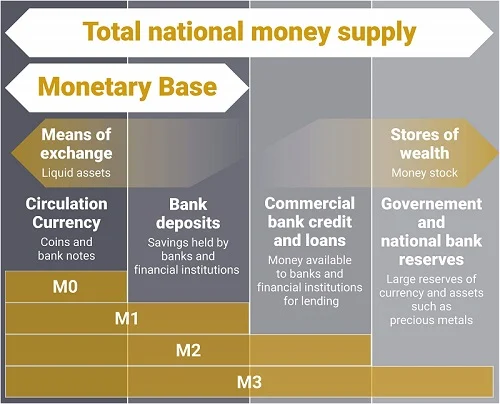

This diagram delineates the hierarchy of money supply measures, from M0 (most liquid) to M4 (least liquid), highlighting the increasing inclusivity of each measure. Note: The diagram includes M4, which is beyond the AQA specification’s focus on M0 to M3. Source

Importance of Money Supply Measures in Policy

Central banks such as the Bank of England consider money supply measures when making decisions about monetary policy. Changes in the money supply can influence:

Aggregate demand (AD): More money in circulation increases spending and investment.

Inflation: Excessive growth in the money supply risks demand-pull inflation.

Interest rates: Narrow money interacts directly with short-term rates, while broad money reflects longer-term financial conditions.

Financial stability: Monitoring broad money helps detect risks of unsustainable credit expansion.

The Role of Narrow and Broad Money in Economic Analysis

Narrow Money as a Transaction Indicator

Because narrow money covers cash and current accounts, it is closely tied to consumer spending patterns. An increase in narrow money typically indicates greater liquidity for immediate consumption.

Broad Money as a Credit and Savings Indicator

Broad money provides insights into the availability of funds for investment and lending. For example, rising savings deposits within broad money may signal lower consumption but higher potential for investment.

Why the Distinction Matters

Understanding narrow and broad money is vital because:

It highlights the different roles money plays: medium of exchange vs store of value.

It allows central banks to tailor their policies based on whether they want to influence short-term liquidity or long-term financial conditions.

It provides economists with different lenses through which to assess economic health.

Bullet points help clarify the significance:

Narrow money = reflects transaction capability.

Broad money = reflects overall purchasing power.

Both are essential to understanding inflation, interest rates, and financial stability.

Measuring Money Supply in the UK

In the UK context:

M0: Notes and coins in circulation.

M1: Cash plus demand deposits.

M4: A widely used measure of broad money, including bank and building society deposits and other near-money instruments.

By monitoring both M1 and M4, the Bank of England can gauge not only how much money is available for immediate transactions but also the depth of financial assets influencing the wider economy.

These distinctions ensure policymakers can strike a balance between fostering growth and controlling inflationary pressures, aligning directly with the AQA specification requirement to understand definitions of the money supply and the distinction between narrow money and broad money.

This infographic illustrates the UK's monetary aggregates, detailing the components of M0, M1, M2, and M3, and their relationships. Note: The infographic includes M3, which is beyond the AQA specification's focus on M0 to M2. Source

FAQ

Economists distinguish between narrow and broad money to capture different aspects of economic activity. Narrow money reflects day-to-day liquidity and spending, while broad money includes savings and credit that affect long-term investment and inflationary trends.

Using both measures allows central banks to monitor immediate consumer behaviour as well as underlying financial stability. Relying on a single measure would obscure these important differences.

Narrow money influences decisions on short-term interest rates because it reflects immediate liquidity available to households and firms.

Broad money, by contrast, informs longer-term policies aimed at managing inflation, credit growth, and financial stability.

Narrow money = tool for demand management.

Broad money = guide for assessing wider risks in the financial system.

No. While the basic principles of liquidity and accessibility apply globally, countries adopt different labels and classifications.

For example:

The UK commonly uses M0 (narrowest) and M4 (broadest).

The United States uses M1 and M2.

This makes international comparisons difficult, but central banks adapt definitions to suit their own financial systems.

Technological changes, such as mobile banking and instant payments, blur the distinction between liquid and less liquid assets.

Funds in savings accounts, which once required notice, may now be transferred instantly, shifting them closer to narrow money. Central banks must update classifications to reflect how easily funds can be used for transactions in practice.

Broad money includes credit and savings that expand the overall purchasing power of the economy. When broad money grows rapidly, it signals more funds available for spending and investment, which can fuel inflation.

Narrow money, while important, is less strongly connected to long-term inflationary pressures because it focuses only on immediate liquidity.

Practice Questions

Define narrow money and give one example of what it includes. (2 marks)

1 mark for a correct definition: Narrow money is the most liquid form of the money supply, consisting of cash and deposits readily available for transactions.

1 mark for a correct example: e.g., notes and coins in circulation, or current account deposits.

Explain the difference between narrow money and broad money, and discuss why both measures are useful for economic analysis. (6 marks)

Up to 2 marks for explaining narrow money (definition and characteristics such as high liquidity, immediate use for transactions).

Up to 2 marks for explaining broad money (definition and inclusion of less liquid assets such as savings deposits and time deposits).

Up to 2 marks for explaining why both are useful (narrow money shows short-term spending power and liquidity, broad money shows overall credit, savings, and purchasing power).

Maximum 6 marks.