AQA Specification focus:

‘The role of financial markets in the wider economy.’

Financial markets are essential in connecting savers and borrowers, enabling investment, supporting government finance, and facilitating international trade. Their functions sustain growth and economic stability.

The Purpose of Financial Markets

Financial markets provide mechanisms through which money and capital flow between economic agents. They allocate resources, distribute risk, and ensure liquidity across the economy.

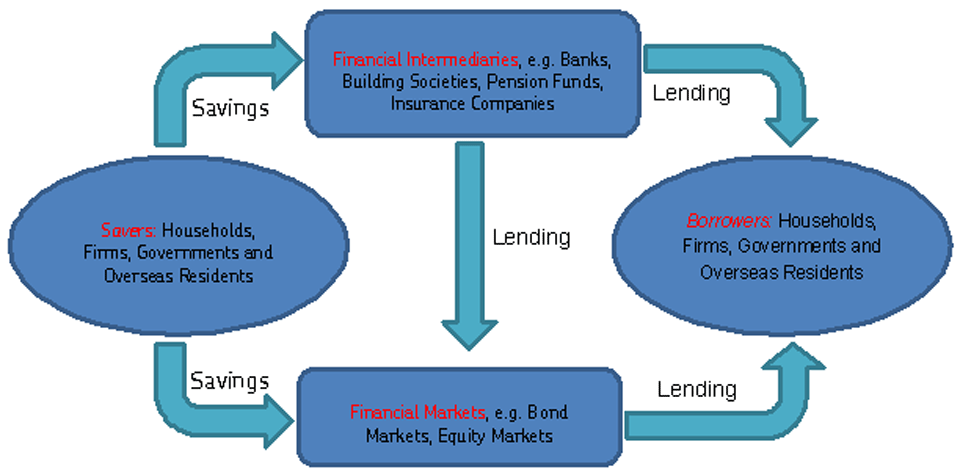

This diagram depicts the flow of funds between savers and borrowers through financial intermediaries, illustrating the core function of financial markets in resource allocation. Source

Core Functions

Facilitating borrowing and lending: Linking surplus units (savers) with deficit units (borrowers).

Providing liquidity: Allowing individuals and firms to convert assets into cash when needed.

Price discovery: Enabling prices for financial assets to be determined by supply and demand.

Risk management: Through diversification, derivatives, and insurance-related products.

Supporting government policy: By offering avenues for government borrowing and implementing monetary policy.

This graphic highlights the seven essential functions of financial markets, emphasizing their role in facilitating economic growth and stability. Source

Resource Allocation and Investment

Financial markets play a critical role in directing funds toward productive investments that promote long-term growth.

Capital Allocation

Firms raise funds by issuing shares or bonds.

Investors decide where to place capital based on risk and return.

Markets channel resources to the most efficient and profitable uses.

Capital Market: A financial market where long-term debt and equity instruments are traded to provide capital for investment.

Markets thereby help improve productivity by rewarding innovation and efficiency.

Liquidity and Asset Management

Liquidity is vital for both firms and households, ensuring assets can be sold quickly without significant loss in value.

Importance of Liquidity

Enables investors to adjust portfolios rapidly.

Encourages greater participation in markets.

Prevents cash shortages in firms and banks.

Liquidity: The ease with which an asset can be converted into cash without loss of value.

Without sufficient liquidity, firms and individuals might hesitate to engage in investment or saving.

Price Discovery and Information Role

Financial markets gather information from millions of buyers and sellers, helping to set prices that reflect true asset value.

Mechanisms of Price Discovery

Stock markets indicate the value of firms.

Bond markets reflect government and corporate creditworthiness.

Foreign exchange markets determine currency values relative to each other.

This transparency guides decision-making for firms, households, and policymakers.

Risk Sharing and Diversification

Financial markets allow risk to be spread across participants, reducing the burden on any single agent.

Risk Management Tools

Equity finance spreads ownership risk among shareholders.

Insurance markets provide protection against specific risks.

Derivatives such as options and futures allow hedging against fluctuations in interest rates, exchange rates, and commodity prices.

Diversification: The practice of spreading investments across assets to reduce exposure to risk from any single source.

This encourages more investment by lowering uncertainty.

Role in Government Finance

Governments rely on financial markets to raise funds for spending and investment projects.

Government Bonds

Issued to finance budget deficits and infrastructure.

Bought by individuals, firms, banks, and foreign investors.

Bond yields reflect investor confidence in government stability.

The efficiency of government borrowing impacts fiscal policy and economic growth.

Support for Monetary Policy

Central banks interact with financial markets to influence macroeconomic objectives.

Monetary Policy Instruments

Bank rate changes affect borrowing costs and savings returns.

Quantitative easing alters demand for bonds, influencing yields.

Open market operations adjust liquidity in the banking system.

Financial markets are therefore central to achieving inflation targets and stabilising the business cycle.

International Trade and Foreign Exchange

Global financial markets facilitate cross-border transactions and trade.

Functions of Foreign Exchange Markets

Convert currencies for trade and investment.

Provide hedging instruments against currency volatility.

Influence a nation’s competitiveness through exchange rate movements.

Foreign Exchange Market (Forex): A global marketplace for trading national currencies, determining exchange rates through supply and demand.

Efficient forex markets enable international business to operate smoothly.

Stability and Confidence

Financial markets underpin confidence in the economic system. Stability ensures trust, while volatility can undermine growth and investment.

Maintaining Stability

Regulation prevents systemic risks and ensures fair practice.

Transparency encourages investor participation.

Crisis management by central banks restores order in turbulent times.

Confidence in financial markets sustains investment, consumption, and economic resilience.

FAQ

If financial markets fail, credit becomes scarce and borrowing costs rise, which can reduce business investment and household spending.

A lack of liquidity discourages saving and investment, while volatility can undermine confidence. This may lead to economic slowdown, unemployment, and reduced growth.

Households use financial markets to save and invest, influencing how they balance risk and return.

Access to liquid assets allows households to plan for emergencies.

Investment opportunities provide long-term returns such as pensions.

Market conditions, like interest rates, affect borrowing decisions on mortgages or loans.

Information efficiency ensures that prices of financial assets reflect all available data.

When prices are accurate, investors and firms can make better decisions, reducing misallocation of resources. Inefficient markets may lead to bubbles or crashes, destabilising the wider economy.

Financial markets provide capital for firms to fund research, development, and expansion.

Start-ups often depend on equity finance, while established firms issue bonds or shares. By channelling funds into new projects, markets foster technological progress and productivity growth.

Global financial markets affect exchange rates, investment flows, and borrowing costs in the UK.

Foreign investment into UK firms raises capital availability.

Exchange rate movements influence trade competitiveness.

International confidence impacts bond yields, shaping government borrowing costs.

Practice Questions

State two roles of financial markets in the wider economy. (2 marks)

1 mark for each correct role stated, up to a maximum of 2 marks.

Acceptable answers include:

Facilitating borrowing and lending.

Providing liquidity.

Enabling price discovery.

Allowing risk management.

Supporting government finance.

Explain how financial markets help to allocate resources efficiently in the economy. (6 marks)

Level 1 (1–2 marks): Basic awareness of financial markets with limited explanation. For example, “Financial markets move money around the economy.”

Level 2 (3–4 marks): Clear explanation of how financial markets channel funds from savers to borrowers and how this supports investment. For example, “Financial markets direct savings into investment by firms through shares or bonds, allowing firms to finance growth.”

Level 3 (5–6 marks): Developed explanation with reference to efficiency in allocation, risk-return considerations, and potential economic outcomes. For example, “Financial markets allocate resources efficiently by directing funds to the most profitable and productive investments. Investors choose based on risk and return, meaning firms with stronger prospects gain more finance. This ensures scarce resources are used in ways that maximise output and long-term economic growth.”

Maximum: 6 marks.