AQA Specification focus:

‘The difference between the money market, the capital market and the foreign exchange market.’

Introduction

Financial markets play a central role in allocating funds, enabling borrowing, investment, and international trade. Understanding money markets, capital markets, and foreign exchange markets is essential for A-Level Economics.

The Money Market

Definition and Scope

The money market is the part of the financial system where short-term borrowing and lending take place, usually for periods of less than one year.

Money Market: A financial market dealing in short-term debt instruments, such as Treasury bills, certificates of deposit, and commercial paper.

It is used by governments, financial institutions, and large corporations to manage short-term funding needs and cash flow.

Main Features of the Money Market

Maturity: Instruments are short-term, typically less than one year.

Instruments: Treasury bills, repurchase agreements, commercial paper.

Participants: Central banks, commercial banks, corporations, and governments.

Purpose: Provides liquidity and financing for working capital.

Importance in the Economy

The money market ensures:

Liquidity for businesses and governments.

A mechanism for the central bank to influence interest rates.

Stability in short-term financing and cash management.

The Capital Market

Definition and Scope

The capital market is where long-term funds are raised through the buying and selling of financial instruments with maturities greater than one year.

Capital Market: A financial market for raising long-term finance through instruments such as shares and bonds.

It is vital for economic growth, as it allows firms and governments to finance investment projects.

Types of Capital Market

Primary market: Where new securities are issued (e.g., initial public offerings of shares).

Secondary market: Where existing securities are traded between investors (e.g., stock exchanges).

Instruments in the Capital Market

Equity: Shares that provide ownership rights in a company.

Debt: Bonds and debentures, representing loans to firms or governments.

Role in Economic Development

Mobilises savings into productive investment.

Encourages entrepreneurship through access to long-term finance.

Provides investment opportunities for individuals and institutions.

Allows price discovery through trading of securities.

The Foreign Exchange Market

Definition and Scope

The foreign exchange market (Forex) is the global marketplace where currencies are bought and sold, determining exchange rates.

Foreign Exchange Market: A financial market for trading national currencies, facilitating international trade, investment, and capital flows.

It operates 24 hours a day, with decentralised trading through banks, brokers, and electronic platforms.

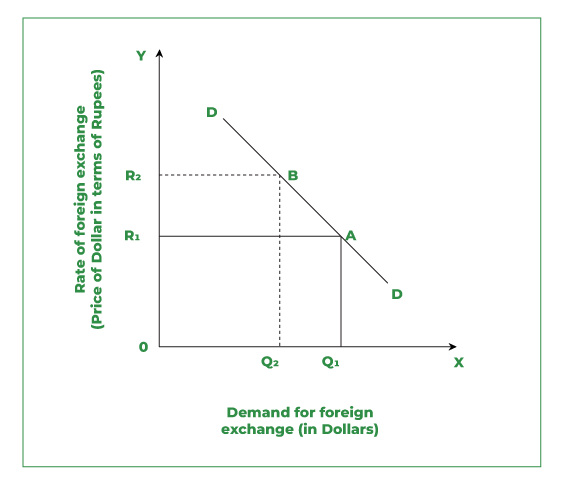

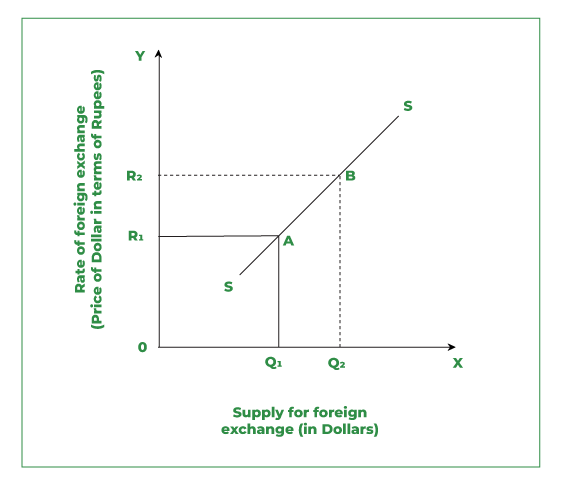

This diagram shows how the exchange rate is determined by the supply and demand for a particular currency in the foreign exchange market. The equilibrium point sets the current spot rate. (Extra detail: includes shifts in curves not covered elsewhere in the notes, but core supply/demand structure matches syllabus.) Source

Functions of the Foreign Exchange Market

Currency conversion: Allows firms and individuals to exchange one currency for another.

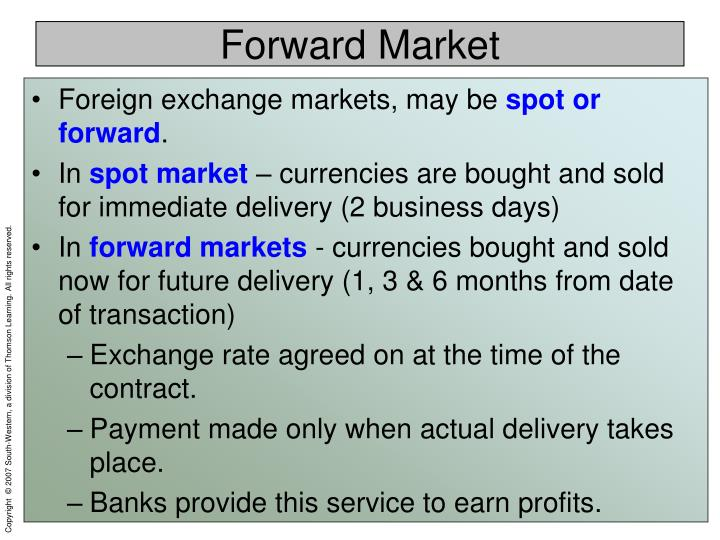

Hedging: Reduces risk of exchange rate fluctuations through forward contracts and derivatives.

Speculation: Traders seek profit from movements in exchange rates.

Arbitrage: Exploiting price differences in different markets.

Importance in Global Trade

Facilitates international trade by enabling settlement in different currencies.

Influences the competitiveness of exports and imports.

Transmits monetary policy through its impact on the exchange rate and aggregate demand.

This slide defines and contrasts the spot market and forward market within foreign exchange, showing immediate vs future currency delivery. (Extra content: mentions specific settlement timings and arbitrage, which go slightly beyond the very basics required.) Source

Key Differences Between the Markets

Distinction by Time Horizon

Money market: Short-term finance (under one year).

Capital market: Long-term finance (over one year).

Foreign exchange market: Currency transactions, both short- and long-term, depending on purpose.

Distinction by Instruments

Money market: Treasury bills, certificates of deposit, commercial paper.

Capital market: Shares, corporate bonds, government bonds.

Foreign exchange market: Currencies and currency derivatives (forwards, futures, options).

Distinction by Purpose

Money market: Ensures liquidity and cash flow management.

Capital market: Supports investment, growth, and development.

Foreign exchange market: Facilitates international trade and global capital flows.

Interaction Between the Markets

Although distinct, the three markets are interconnected:

Central banks use the money market to set interest rates, which influence capital markets and exchange rates.

Capital markets attract foreign investors, leading to currency flows in the foreign exchange market.

Foreign exchange fluctuations impact demand for domestic bonds and shares, linking currency movements with capital markets.

These interdependencies mean that shocks in one market often spread to others, creating potential risks but also opportunities for investors and policymakers.

FAQ

The money market deals in short-term, highly liquid instruments. These include Treasury bills issued by governments, commercial paper from corporations, and certificates of deposit offered by banks.

These instruments are generally considered low risk and provide a way for institutions to manage short-term funding needs efficiently.

In the primary capital market, new securities are issued directly by companies or governments to raise funds, such as through an initial public offering (IPO).

In the secondary capital market, existing securities are bought and sold between investors on platforms such as stock exchanges. No new capital is raised here, but it provides liquidity and price discovery.

Unlike stock exchanges, the foreign exchange market has no single physical location.

It operates through a global network of banks, brokers, and electronic trading platforms. This allows 24-hour trading, with activity moving across time zones from Asia to Europe to North America.

When a central bank increases interest rates, borrowing costs rise. This reduces demand for short-term funds in the money market and increases the return on deposits.

Conversely, lower interest rates make borrowing cheaper, boosting demand for money market instruments and lowering the incentive to hold idle cash.

The main risk is exchange rate volatility, where sudden changes in rates can cause significant financial losses.

Other risks include:

Counterparty risk, where one party fails to meet its obligations.

Liquidity risk, if trading in a particular currency becomes restricted.

Political and economic risk, where events affect confidence in a currency.

Practice Questions

Define the difference between the money market and the capital market. (2 marks)

1 mark for identifying that the money market deals with short-term borrowing and lending (less than one year).

1 mark for identifying that the capital market deals with long-term finance (greater than one year).

Explain the role of the foreign exchange market in facilitating international trade and investment. (6 marks)

Up to 2 marks for explaining that the foreign exchange market allows currency conversion, enabling businesses and individuals to trade across borders.

Up to 2 marks for explaining that it provides a mechanism for hedging against exchange rate risk through instruments such as forward contracts.

Up to 2 marks for explaining that it influences the competitiveness of exports and imports, affecting demand for goods and services.

Maximum 6 marks: Award marks for clear, relevant points with accurate use of terminology. Answers do not need to cover all aspects to gain full marks if depth is shown.