AQA Specification focus:

‘Students should know the terms coupon and maturity in relation to government bonds and be able to calculate the yield on a government bond.’

Introduction

Government bonds are a vital financial instrument that help governments raise funds and investors earn returns. Understanding coupon, maturity, and yield is crucial for AQA Economics.

Bonds in Context

A government bond is a debt security issued by the government to borrow money from investors. These bonds promise fixed payments over time and repayment of the principal at maturity.

Investors buy bonds for stable returns, while governments use them to fund expenditure without immediate tax increases.

Coupon

The coupon is the fixed annual interest payment paid to the bondholder, usually expressed as a percentage of the bond’s face (nominal) value.

Coupon: The annual interest payment on a bond, usually expressed as a percentage of its face value.

For example, a £1,000 bond with a 5% coupon pays £50 annually.

Coupons are typically paid semi-annually or annually.

The coupon remains fixed for the life of the bond, but its value to investors changes depending on market interest rates.

Maturity

The maturity of a bond is the date at which the principal (the original amount borrowed) is repaid to the investor.

Maturity: The date on which the principal amount of the bond is repaid and the bond ceases to exist.

Key features:

Bonds may be short-term (less than 5 years), medium-term (5–10 years), or long-term (over 10 years).

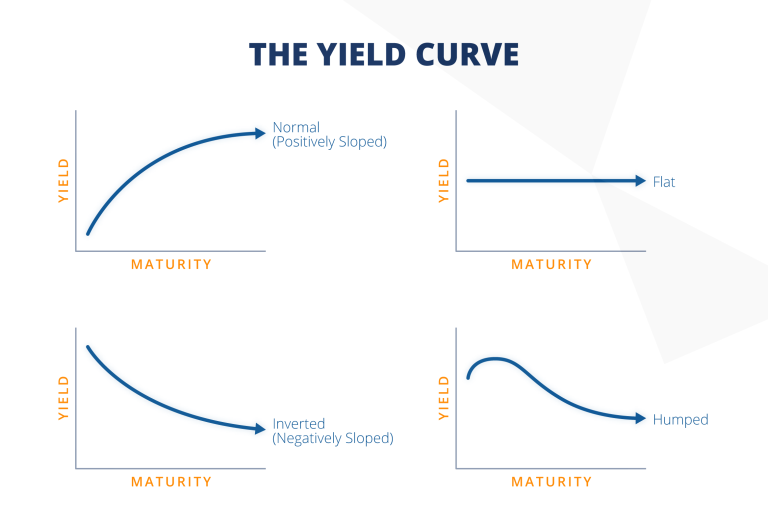

The longer the maturity, the greater the risk of interest rate fluctuations affecting the bond’s market value.

Investors prefer shorter maturities in uncertain times, while governments often issue long-term bonds to spread repayment obligations.

Yield

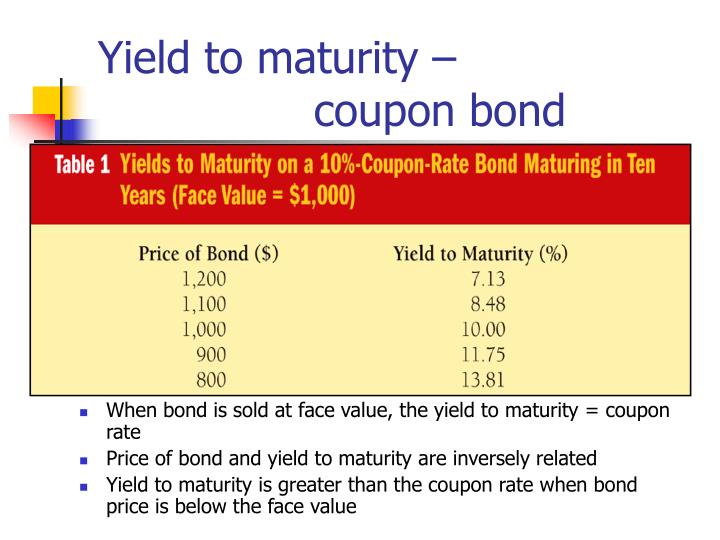

The yield measures the effective return an investor receives from a bond, taking into account its coupon payments and the price paid for the bond. Yield is expressed as a percentage.

Yield: The effective annual return on a bond, calculated by dividing the annual coupon payment by the bond’s current market price.

Bond Yield (Y) = (Coupon Payment ÷ Current Market Price) × 100

Coupon Payment = Fixed annual interest paid (£)

Current Market Price = Price at which the bond is traded (£)

For example, if a bond with a £50 coupon is trading at £1,000, the yield is 5%. If the bond price falls to £800, the yield rises to 6.25%. This shows why yield is influenced by bond prices.

This formula demonstrates how to calculate the Yield to Maturity (YTM) for a coupon bond, considering price, coupon payments, and time to maturity. Source

Relationship Between Coupon, Maturity and Yield

These three factors interact in determining the attractiveness of bonds:

Coupon sets the nominal income stream.

Maturity determines how long the investor must wait for repayment of the principal.

Yield reflects the actual return, which may be higher or lower than the coupon rate depending on the bond’s current price in the market.

Bonds with longer maturities are generally more sensitive to interest rate changes. If market interest rates rise, existing bonds with lower coupons become less attractive, reducing their price and raising their yield.

The Government Bond Yield Curve illustrates the typical upward slope, indicating that longer-term bonds generally offer higher yields due to increased time and risk factors. Source

Why Yield Matters

Yield provides a standardised measure for comparing bonds of different prices and maturities. Investors focus on yield to:

Compare government bonds with corporate bonds, equities, or savings accounts.

Assess risk and expected return.

Anticipate central bank policy changes, as yields often rise when markets expect higher interest rates.

Government Bonds in Monetary Policy

Government bond yields are closely linked to central bank actions:

When the Bank of England lowers interest rates, existing bonds with higher coupons become more valuable, pushing their market price up and yield down.

Conversely, higher base rates cause bond prices to fall and yields to rise.

This interaction ensures bonds play a critical role in the transmission mechanism of monetary policy, influencing borrowing costs and investment decisions across the economy.

Key Takeaways for AQA

Know the terms coupon and maturity in relation to government bonds.

Be able to calculate yield using the provided formula.

Understand how coupon, maturity, and yield interact in financial markets.

Recognise how these factors link to broader macroeconomic policy and investor decisions.

FAQ

The coupon rate is influenced by prevailing interest rates at the time of issue. If market interest rates are high, new bonds must offer higher coupons to attract buyers.

Other factors include the government’s credit rating and inflation expectations. A higher risk of inflation or default means investors demand a higher coupon.

Short-term bonds reduce the risk of interest rate changes eroding value. If rates rise, investors can reinvest sooner at higher returns.

They also offer greater liquidity, making them attractive in uncertain economic conditions.

Longer maturities are more sensitive to interest rate changes because fixed coupon payments are locked in for longer.

This means price fluctuations are greater for long-term bonds than for short-term ones, a concept known as duration risk.

Nominal yield is simply the bond’s coupon rate, expressed as a percentage of its face value.

Current yield measures the coupon as a percentage of the bond’s market price, giving a more accurate reflection of actual return.

Issuing bonds spreads the cost of government spending over time, avoiding sudden tax rises.

It also allows governments to finance large projects quickly, while giving investors a relatively safe asset to purchase.

Practice Questions

Define the term "coupon" in relation to a government bond. (2 marks)

1 mark for stating that the coupon is the fixed annual interest payment on a bond.

1 additional mark for mentioning that it is expressed as a percentage of the bond’s face (nominal) value.

Explain the relationship between bond prices and yields, using an example to illustrate your answer. (6 marks)

1 mark for recognising that yield is calculated by dividing the coupon by the current market price of the bond.

1 mark for identifying that when bond prices fall, yields rise.

1 mark for identifying that when bond prices rise, yields fall.

1 mark for explaining why this inverse relationship occurs (e.g., fixed coupon becomes more or less attractive depending on the market price).

1 mark for including a relevant example showing a change in bond price leading to a change in yield.

1 additional mark for explaining the significance of this relationship to investors (e.g., in assessing returns compared to alternative investments or changing interest rates).