AQA Specification focus:

‘The difference between debt and equity.’

Debt and equity finance are two fundamental ways in which firms raise funds. Understanding their differences is essential for analysing financial decisions, risks, and long-term impacts.

Debt Finance

Debt finance refers to funds borrowed by a firm that must be repaid with interest over a fixed period. It allows companies to secure capital without surrendering ownership.

Key Characteristics of Debt Finance

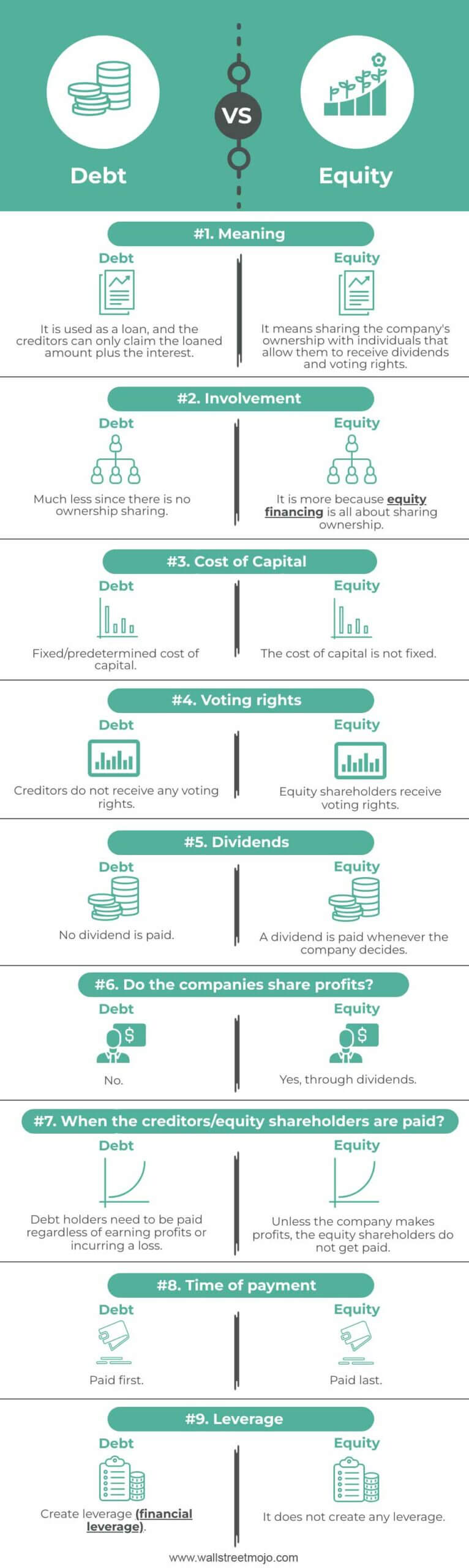

Fixed obligation: The firm must repay both principal and interest regardless of performance.

Time-limited: Debt typically has a maturity date, after which repayment is required.

No ownership dilution: Lenders do not gain voting rights or control over company decisions.

Priority in liquidation: Creditors are paid before equity holders if the firm becomes insolvent.

Debt Finance: Borrowed funds that a company is legally obligated to repay, usually with interest, within a specified timeframe.

Debt finance can take the form of:

Bank loans – negotiated borrowing directly from financial institutions.

Corporate bonds – long-term debt instruments sold to investors with a fixed coupon payment.

Overdrafts – short-term borrowing facilities with flexible repayment.

Equity Finance

Equity finance involves raising capital by selling shares of ownership in a company. This provides funds without the obligation of repayment, but ownership is diluted.

Key Characteristics of Equity Finance

Permanent capital: Equity does not require repayment at maturity.

Ownership and control: Shareholders gain voting rights and may influence strategic decisions.

Dividends not guaranteed: Payments to shareholders depend on profitability and board decisions.

Residual claim: Equity holders are paid last in liquidation, after debt obligations.

Equity Finance: Funds raised by issuing shares, giving investors ownership rights and potential dividends, without a fixed obligation of repayment.

Equity finance typically includes:

Ordinary shares – standard equity shares with variable dividends.

Preference shares – shares with fixed dividends but limited voting rights.

Retained earnings – profits reinvested into the business rather than distributed.

Comparing Debt and Equity

Cost of Finance

Debt is usually cheaper in the short term because interest payments are tax-deductible.

Equity is more expensive as shareholders require higher returns to compensate for risk.

Risk Profile

Debt increases financial risk since repayments are obligatory even during downturns.

This infographic contrasts debt and equity financing, highlighting key differences such as ownership rights, repayment obligations, and associated risks, providing a visual summary of the concepts discussed. Source

Equity spreads risk across shareholders, as dividends are flexible and non-obligatory.

Control and Ownership

Debt holders have no say in how the firm is run.

Equity holders gain ownership rights, influencing corporate governance and decision-making.

Repayment Structure

Debt has a set repayment schedule with interest.

Equity does not require repayment, offering flexibility but with long-term cost implications.

Advantages of Debt Finance

Interest is tax-deductible, lowering effective borrowing costs.

No dilution of control, enabling original owners to maintain strategic authority.

Provides predictability in repayment terms.

Disadvantages of Debt Finance

Increases financial leverage, making firms vulnerable in economic downturns.

Cash flow pressure due to fixed repayments.

Excessive borrowing can reduce credit ratings, raising future borrowing costs.

Advantages of Equity Finance

No fixed repayment obligations, easing cash flow management.

Greater ability to raise large amounts of capital, especially for expansion.

Attracts investors who bring expertise and connections.

Disadvantages of Equity Finance

Leads to ownership dilution and potential loss of control.

Dividends are not tax-deductible, increasing effective costs.

Shareholders may demand higher returns, raising the firm’s cost of capital.

Strategic Considerations for Firms

Stage of Business Development

Start-ups often rely on equity as they lack collateral for loans.

Established firms may favour debt for tax efficiency and control preservation.

Market Conditions

Low interest rates encourage debt financing due to cheaper borrowing costs.

High market confidence supports equity financing through successful share issuance.

Risk Appetite

Risk-averse firms may prefer equity, as it avoids compulsory repayments.

Firms seeking rapid growth may use debt, leveraging predictable costs to expand quickly.

Debt-Equity Balance

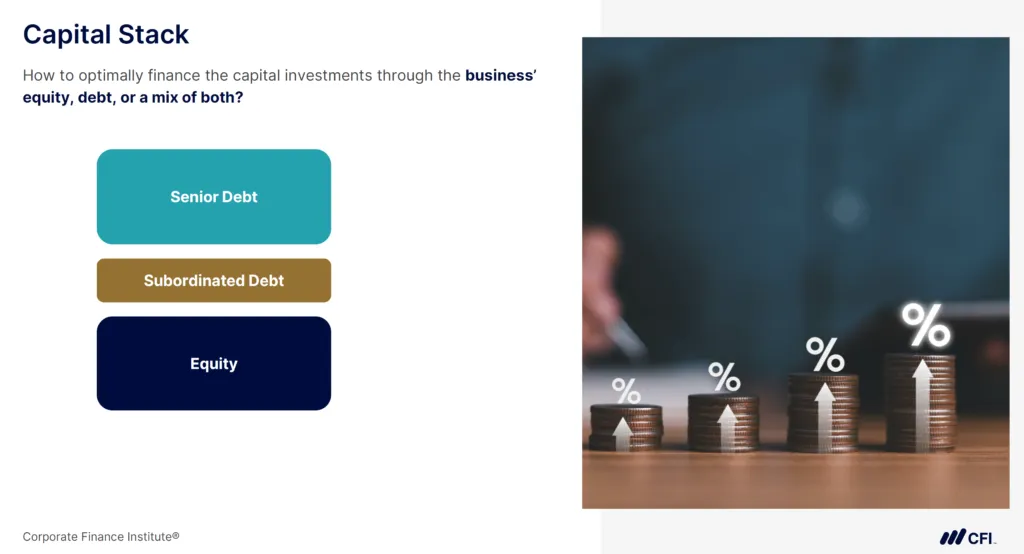

A firm’s capital structure (the mix of debt and equity) is critical for long-term financial stability. Striking the right balance involves trade-offs:

Too much debt risks insolvency.

Too much equity dilutes ownership and raises costs.

This diagram depicts the capital structure hierarchy, categorizing debt and equity financing into senior debt, subordinated debt, and equity, each with varying levels of risk and return. Source

Capital Structure: The proportion of debt and equity a firm uses to finance its operations and growth.

In practice, firms aim for an optimal capital structure that minimises the cost of capital while maintaining flexibility and security.

FAQ

Businesses often prefer debt because interest payments are tax-deductible, reducing the overall cost of borrowing.

Debt also allows owners to retain full control, as lenders do not gain voting rights. This can be especially important for firms where founders wish to maintain strategic authority.

If interest rates are low, debt can also be cheaper than raising equity, which requires giving up future profits through dividends.

Investors in debt (such as bonds) seek stability and predictable income through fixed interest payments. They value lower risk and priority in repayment.

Equity investors, however, accept higher risk in exchange for potentially higher returns through dividends and capital gains. They also value ownership rights and influence over company decisions.

Excessive reliance on equity can dilute ownership, reducing the influence of original shareholders.

It may also increase the cost of capital, as equity investors often demand higher returns than lenders.

Finally, issuing more shares can reduce earnings per share (EPS), potentially making the company less attractive to future investors.

Short-term debt increases repayment pressure and can strain cash flow if revenues fluctuate.

Long-term debt spreads repayments over time, reducing immediate pressure but increasing overall interest costs.

A firm’s ability to balance short-term and long-term debt commitments is key to managing liquidity and stability.

Yes, firms often use a mix known as a balanced capital structure.

Benefits include:

Reduced risk of insolvency compared to using only debt.

Avoiding excessive ownership dilution compared to only equity.

Greater flexibility to adapt to changing market conditions.

This balance aims to minimise the overall cost of capital while maintaining stability and control.

Practice Questions

Define the term equity finance. (2 marks)

1 mark for stating that equity finance involves raising funds by issuing shares.

1 mark for explaining that it gives investors ownership rights or potential dividends.

Explain two differences between debt finance and equity finance. (6 marks)

Award up to 3 marks per difference:

Identification of a valid difference (1 mark).

Explanation of that difference (1 mark).

Application of how this affects firms/investors (1 mark).

Indicative points:

Debt finance requires fixed repayments with interest, whereas equity does not require repayment but dividends may be paid.

Debt does not dilute ownership, while equity gives shareholders voting rights.

Debt holders are prioritised in insolvency, whereas equity holders are residual claimants.