AQA Specification focus:

‘That monetary policy involves the central bank taking action to influence interest rates, the supply of money and credit and the exchange rate.’

Monetary policy is a key tool used by central banks to influence economic activity, controlling demand, stabilising prices, and supporting employment through various financial mechanisms.

What Monetary Policy Involves

Monetary policy is the process through which a central bank (in the UK, the Bank of England) takes action to influence economic conditions. According to the specification, monetary policy involves changing interest rates, the money supply, the availability of credit, and the exchange rate to meet economic objectives. These actions are critical in managing the business cycle, ensuring inflation control, and supporting long-term economic growth.

The Central Bank’s Tools of Monetary Policy

Central banks have several key tools they can employ to influence the economy:

Interest rates: Adjusting the Bank Rate, which influences borrowing and lending costs across the economy.

Money supply: Regulating the quantity of money and credit available.

Exchange rate policy: Affecting the value of the domestic currency in relation to others, influencing exports and imports.

Each of these mechanisms alters aggregate demand (AD) and can help stabilise or stimulate the economy, depending on the prevailing circumstances.

Interest Rates

Interest rates are the primary lever used in monetary policy. By raising or lowering the Bank Rate, the central bank can alter the cost of borrowing and the reward for saving.

Interest Rate: The percentage charged by a lender for borrowing money or paid to a saver for holding money in a deposit.

Higher interest rates reduce borrowing, encourage saving, and typically lower aggregate demand.

Lower interest rates encourage borrowing, discourage saving, and increase aggregate demand.

These changes influence consumption, investment, and overall economic activity.

Money and Credit Supply

The central bank also influences the supply of money and the accessibility of credit within the economy. This can be achieved through mechanisms such as open market operations, where the central bank buys or sells government securities, influencing liquidity in the banking system.

Money Supply: The total quantity of money circulating in an economy, including cash, deposits, and other liquid assets.

By expanding or contracting the money supply, the central bank can encourage or restrain economic activity. More credit availability leads to greater business and consumer spending, while restrictions slow the pace of growth.

The Exchange Rate

The exchange rate represents the value of one currency relative to another. Central banks may intervene to influence this rate directly or indirectly.

Exchange Rate: The price of one currency in terms of another.

A stronger currency makes exports more expensive and imports cheaper, reducing net exports and aggregate demand.

A weaker currency boosts export competitiveness but makes imports more costly, increasing aggregate demand.

Exchange rate changes feed into inflation, growth, and the balance of payments.

The Transmission Mechanism of Monetary Policy

The effects of monetary policy do not act instantly.

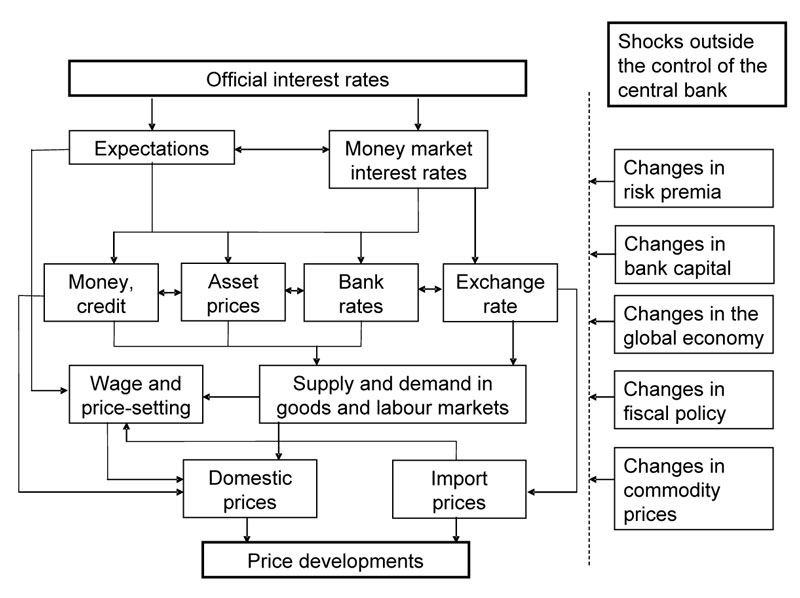

This diagram outlines the transmission mechanism of monetary policy, showing how changes in official interest rates can influence money market interest rates, asset prices, exchange rates, and ultimately aggregate demand and inflation. Source

Instead, they work through the transmission mechanism, which describes how changes in interest rates and money supply influence the broader economy:

Policy action: Central bank adjusts interest rates or money supply.

Market reaction: Commercial banks change their lending behaviour; consumers and businesses respond.

Spending and investment: Consumption and investment adjust due to altered borrowing and saving incentives.

Aggregate demand: National demand rises or falls.

Inflation and output: Economic growth, employment, and price levels are influenced.

This sequence highlights the indirect but powerful role monetary policy plays in shaping economic outcomes.

This diagram illustrates the channels of monetary policy transmission, including the saving and investment channel, cash flow channel, asset price channel, exchange rate channel, and expectations channel, each impacting economic activity and inflation. Source

Objectives of Monetary Policy

The government sets monetary policy objectives, which the central bank aims to achieve using these tools. Typical objectives include:

Price stability: Keeping inflation low and stable.

Economic growth: Supporting sustainable increases in output.

Employment: Promoting high levels of employment.

External stability: Ensuring a manageable balance of payments position.

By influencing interest rates, the supply of money and credit, and the exchange rate, monetary policy aligns short-term decisions with long-term economic stability.

Limitations of Monetary Policy

While monetary policy is essential, it has limitations:

Time lags: Policy changes take months or years to fully impact the economy.

Uncertainty: The effect on investment and consumption can vary depending on confidence.

Global factors: Exchange rates and capital flows may be influenced by international conditions outside the control of the domestic central bank.

Liquidity trap: When interest rates are near zero, lowering them further may not stimulate borrowing or spending.

Summary of Key Elements

To recap, monetary policy involves the central bank using its tools to:

Adjust interest rates to influence borrowing and spending.

Control the supply of money and credit to manage liquidity.

Influence the exchange rate to affect trade flows.

These mechanisms work through the transmission mechanism, ultimately impacting aggregate demand, inflation, employment, and growth.

FAQ

Expansionary monetary policy involves lowering interest rates or increasing money supply to boost spending and investment, raising aggregate demand.

Contractionary monetary policy does the opposite: raising interest rates or restricting credit to reduce inflationary pressures and slow demand.

In deep recessions, even very low interest rates may not encourage borrowing or spending. This situation is known as a liquidity trap.

Low consumer and business confidence can also reduce the effectiveness of cheaper credit, limiting the impact on aggregate demand.

Expectations about future inflation, interest rates, and economic conditions affect how households and firms respond.

If people expect inflation to rise, they may spend more now, boosting aggregate demand.

If confidence is low, even expansionary policy may not lead to greater spending.

Globalisation increases the importance of exchange rates.

A weaker currency may not boost exports if global demand is weak.

Cheaper imports can limit inflation despite domestic monetary tightening.

This reduces a central bank’s control compared to a more closed economy.

Forward guidance is when the central bank communicates future policy intentions.

It shapes expectations by signalling how long interest rates will remain low or when tightening might occur.

This can influence behaviour immediately, as households and businesses adjust spending and investment based on anticipated changes.

Practice Questions

Define monetary policy. (2 marks)

1 mark for identifying that monetary policy is the use of interest rates, money supply, credit, and/or exchange rates.

1 mark for stating that it is used by the central bank to influence economic activity (e.g., inflation, growth, employment).

Explain how changes in the exchange rate can affect aggregate demand in the UK economy. (6 marks)

Up to 2 marks for defining exchange rate (the price of one currency in terms of another).

1 mark for identifying that a fall in the exchange rate makes exports more competitive and imports more expensive.

1 mark for identifying that a rise in the exchange rate makes exports less competitive and imports cheaper.

Up to 2 marks for explaining the impact on net exports and aggregate demand (e.g., a weaker pound increases AD through higher net exports, while a stronger pound reduces AD).

Maximum 6 marks overall.