AQA Specification focus:

‘How changes in the exchange rate affect aggregate demand and the various macroeconomic policy objectives.’

Introduction

Exchange rates significantly influence aggregate demand (AD) by affecting trade flows, investment, and inflation, thereby shaping the government’s wider macroeconomic objectives of growth, employment, and stability.

Understanding Exchange Rates and Aggregate Demand

What is the Exchange Rate?

The exchange rate is the price of one currency in terms of another. It indicates how much domestic currency is needed to purchase a unit of foreign currency.

Exchange Rate: The value of one currency expressed in terms of another, determining the relative price of domestic and foreign goods and services.

Exchange rates can be determined by supply and demand in foreign exchange markets (floating systems), fixed by governments, or managed within a band (managed floats).

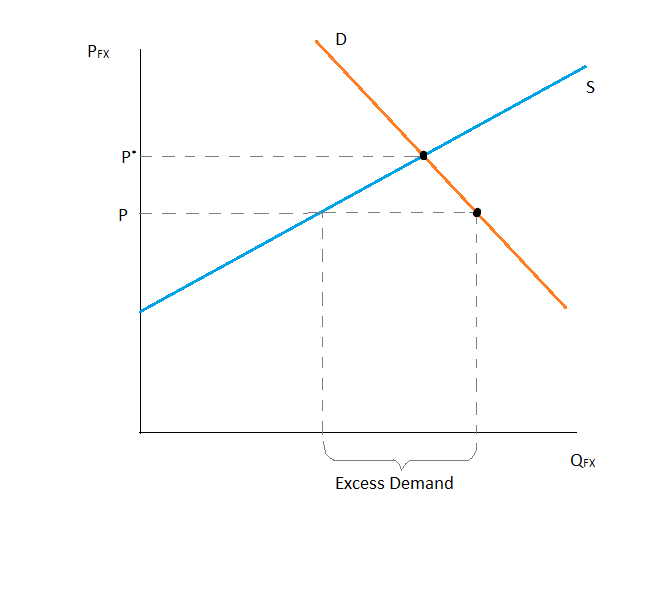

This diagram illustrates the demand and supply dynamics in the foreign exchange market, showing how changes in these forces can lead to fluctuations in the exchange rate, affecting a country's trade balance and aggregate demand. Source

Components of Aggregate Demand (AD)

Aggregate demand is the total demand for goods and services in an economy at a given overall price level. It is expressed as:

Aggregate Demand (AD) = C + I + G + (X – M)

C = Consumption

I = Investment

G = Government spending

X = Exports

M = Imports

Changes in the exchange rate primarily affect the (X – M) component, altering the competitiveness of exports and imports.

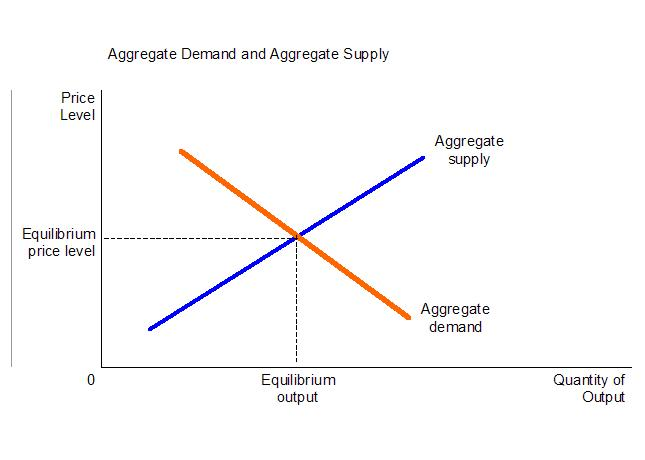

This diagram depicts the intersection of aggregate demand and aggregate supply curves, demonstrating equilibrium output and price level in an economy. It is fundamental for analysing shifts in AD due to exchange rate changes. Source

Exchange Rate Depreciation and Aggregate Demand

Depreciation Effects

A depreciation of the domestic currency (fall in exchange rate value) makes exports cheaper and imports more expensive.

Exports rise: Foreign consumers find domestic goods more affordable.

Imports fall: Domestic consumers switch from expensive imports to local substitutes.

Net exports (X – M) increase, leading to higher AD.

This process is most effective if:

Price elasticity of demand for exports and imports is high (Marshall–Lerner condition).

Domestic industries can increase output to meet higher demand.

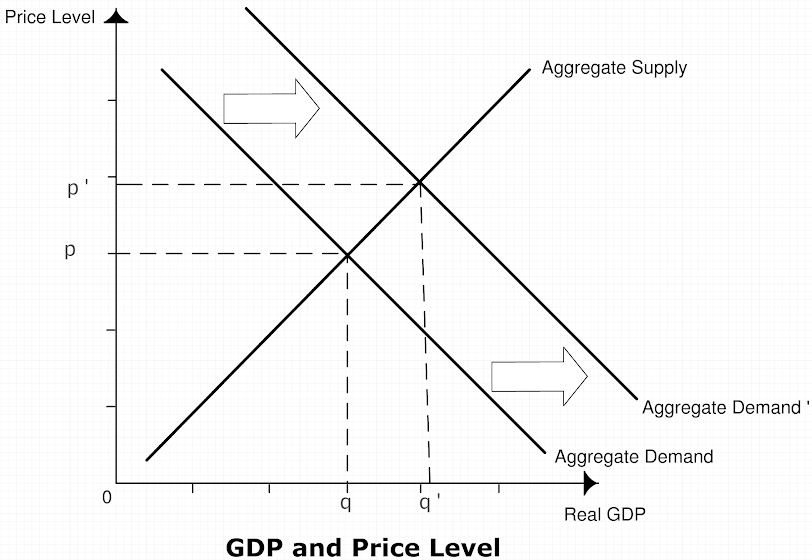

This graph shows the outward shift of the aggregate demand curve, representing an increase in GDP resulting from factors like a depreciation of the exchange rate that boosts net exports. Source

Potential Downsides

Higher import costs raise imported inflation (e.g., oil, raw materials).

Living standards may fall if imported consumer goods become more expensive.

Balance of payments may not improve immediately due to the J-curve effect, where trade deficits worsen before improving.

Exchange Rate Appreciation and Aggregate Demand

Appreciation Effects

An appreciation (rise in the value of domestic currency) has the opposite impact:

Exports fall: Domestic goods become more expensive abroad.

Imports rise: Foreign goods become relatively cheaper.

Net exports (X – M) decrease, reducing AD.

Potential Benefits

Lower import prices can reduce cost-push inflation.

Firms importing capital goods may face lower production costs.

Consumers benefit from cheaper imported goods, raising real incomes.

Exchange Rates and Macroeconomic Policy Objectives

Economic Growth

Depreciation stimulates growth by raising AD through net exports.

Appreciation may dampen growth if exports decline significantly.

Inflation Control

Depreciation risks higher inflation due to rising import prices and stronger demand.

Appreciation helps control inflation by lowering import prices and easing demand pressures.

Employment

Depreciation boosts employment in export and import-competing industries.

Appreciation may raise unemployment in industries exposed to foreign competition.

Balance of Payments Stability

Depreciation improves the current account balance if the Marshall–Lerner condition holds and the J-curve effect subsides.

Appreciation can worsen trade deficits, harming external stability.

Government Objectives

Governments often pursue a balance of growth, inflation, employment, and external stability. Exchange rate changes create trade-offs:

Pursuing low inflation via a stronger currency may hinder growth and jobs.

Encouraging growth through depreciation risks inflationary pressures.

The Transmission Mechanism of Exchange Rates

Step-by-Step Process

Exchange rate change (appreciation or depreciation).

Relative price change between domestic and foreign goods.

Impact on exports and imports (demand for X rises/falls; demand for M falls/rises).

Change in net trade balance (X – M).

Shift in aggregate demand curve (AD increases or decreases).

Macroeconomic consequences: Growth, inflation, employment, external balance.

Interactions with Monetary Policy

Exchange rates also affect AD indirectly through interest rates and capital flows:

Higher interest rates → currency appreciation → reduced AD.

Lower interest rates → currency depreciation → boosted AD.

Short-Term vs Long-Term Impacts

Short-term: Exchange rate movements may be volatile, with immediate effects on inflation and consumer spending.

Medium-term: AD adjusts as businesses expand or contract output in response to competitiveness.

Long-term: Persistent misalignments can lead to structural changes in the economy, such as deindustrialisation or export-led growth.

Key Points for Students

Depreciation → stronger AD, higher inflation, better current account (eventually).

Appreciation → weaker AD, lower inflation, worse current account.

Effects depend on elasticities of demand, supply-side capacity, and global conditions.

Governments must balance competing policy objectives when exchange rates shift.

FAQ

The Marshall–Lerner condition states that for depreciation to improve the current account, the sum of the price elasticities of demand for exports and imports must be greater than one.

If demand for exports and imports is inelastic, a weaker currency may initially worsen the current account, as higher import costs outweigh gains from increased exports. Over time, elasticity tends to rise as consumers adjust spending patterns.

The J-curve effect describes how, following depreciation, the trade balance may worsen before it improves.

In the short term, contracts and habits mean import spending remains high while export volumes do not adjust immediately.

Over time, as imports fall and exports rise, the trade balance strengthens, causing the curve to resemble a “J” shape.

An appreciation makes imports cheaper. This includes raw materials, intermediate goods, and energy resources like oil.

Lower import prices reduce firms’ costs of production, easing upward pressure on domestic prices. Consumers also benefit from cheaper imported goods, further helping to limit inflation.

Depreciation increases the competitiveness of domestic exports, which can encourage firms to invest in expanding production capacity.

Appreciation may discourage investment in export sectors, but could encourage spending in import-dependent industries due to cheaper capital goods.

Several factors influence the scale of impact:

Elasticity of demand for exports and imports.

Availability of domestic substitutes for imports.

The degree of spare capacity in the economy.

Global economic conditions affecting demand for exports.

A high degree of elasticity and spare capacity generally make the impact on aggregate demand more significant.

Practice Questions

Define the term exchange rate. (2 marks)

1 mark for identifying that it is the price/value of one currency in terms of another.

1 mark for stating that it determines how much of one currency is needed to buy another or for linking it to trade in goods and services.

Explain how a depreciation of the exchange rate could affect a country’s aggregate demand and one macroeconomic policy objective. (6 marks)

Up to 2 marks for explaining that depreciation makes exports cheaper and imports more expensive, improving net exports (X – M).

Up to 2 marks for linking this to an outward shift in aggregate demand (AD) as net exports increase.

Up to 2 marks for linking AD change to a macroeconomic policy objective, e.g.:

Economic growth (higher output).

Employment (more jobs in export industries).

Inflation (higher due to imported inflation).

Award full marks if the answer shows a clear chain of reasoning from depreciation → net exports → AD → impact on chosen objective.