AQA Specification focus:

‘The factors considered by the MPC when setting the bank rate.’

Introduction

The Monetary Policy Committee (MPC) must carefully evaluate a wide range of economic indicators when setting the Bank Rate, aiming to achieve government-set monetary policy objectives.

The Role of the MPC

The MPC of the Bank of England is tasked with setting monetary policy to achieve the government’s targets, primarily price stability (meeting the inflation target) and supporting broader economic objectives such as sustainable growth and employment. When deciding on changes to the Bank Rate, the MPC balances multiple factors that influence aggregate demand, inflation, and the wider economy.

Key Factors Considered by the MPC

1. Inflation

The central focus is the inflation rate, particularly the Consumer Prices Index (CPI).

The government sets an official inflation target, usually at 2% CPI.

The MPC examines whether current and forecasted inflation is above or below target and adjusts policy accordingly.

Inflation: A sustained rise in the general price level of goods and services in an economy over time.

Monitoring inflation expectations is also crucial, as if businesses and households expect higher inflation, they may adjust wages and prices, creating a self-fulfilling cycle.

2. Economic Growth and Output Gap

The MPC considers the state of aggregate demand relative to aggregate supply.

A positive output gap (demand exceeding capacity) may cause inflationary pressures.

A negative output gap (unused capacity) may require stimulus through lower interest rates.

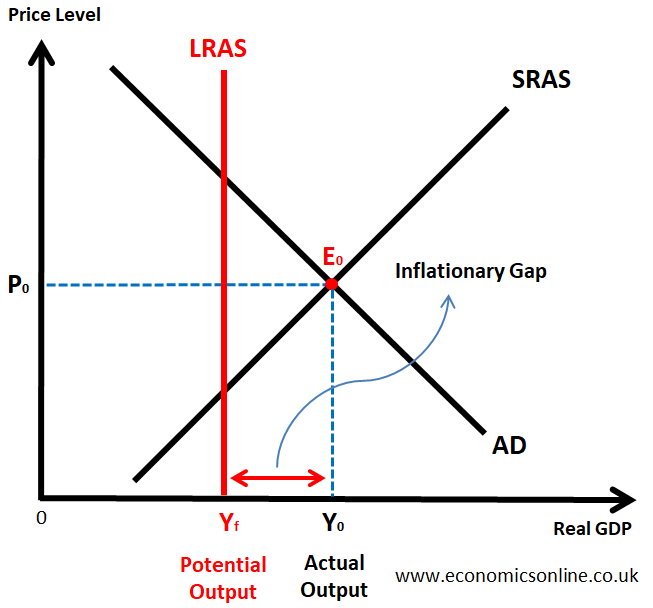

The diagram illustrates an inflationary gap, where the economy's actual output exceeds its potential output, leading to upward pressure on the price level. Source

Output Gap: The difference between an economy’s actual output and its potential output at full capacity.

This helps the MPC judge whether monetary policy should tighten or loosen.

3. Unemployment and Labour Market Conditions

Levels of employment and unemployment provide insight into the economy’s spare capacity.

Low unemployment may drive wage inflation as firms compete for workers.

High unemployment may signal weak demand, requiring looser monetary policy.

4. Exchange Rates

The MPC assesses how the exchange rate affects inflation and demand:

A stronger pound lowers import prices, reducing inflation, but can hurt exports and growth.

A weaker pound boosts exports and demand but raises import prices, potentially increasing inflation.

5. Global Economic Conditions

The UK economy is highly integrated into the global system.

Events such as global recessions, commodity price shocks, or changes in trading partner growth affect demand, inflation, and interest rate decisions.

For example, rising global oil prices increase inflationary pressures in the UK.

6. Financial Market Conditions

Stability in financial markets affects borrowing costs and credit availability.

The MPC considers how changes in bank lending, bond yields, or investor confidence influence the transmission of monetary policy.

7. Household and Business Confidence

Surveys of consumer and business sentiment guide the MPC in judging future spending and investment trends.

Falling confidence may reduce aggregate demand, requiring supportive policy.

Rising confidence could increase demand and risk inflationary pressures.

8. Fiscal Policy Stance

The MPC considers the interaction between monetary policy and fiscal policy.

For instance, expansionary government spending may boost demand, potentially requiring tighter monetary policy.

Conversely, austerity measures may necessitate looser monetary policy to support growth.

9. Supply-Side Shocks

Unexpected events can alter inflation and growth.

Examples include natural disasters, supply chain disruptions, or geopolitical tensions.

The MPC assesses whether shocks are temporary or long-term before adjusting interest rates.

The Transmission of Policy Decisions

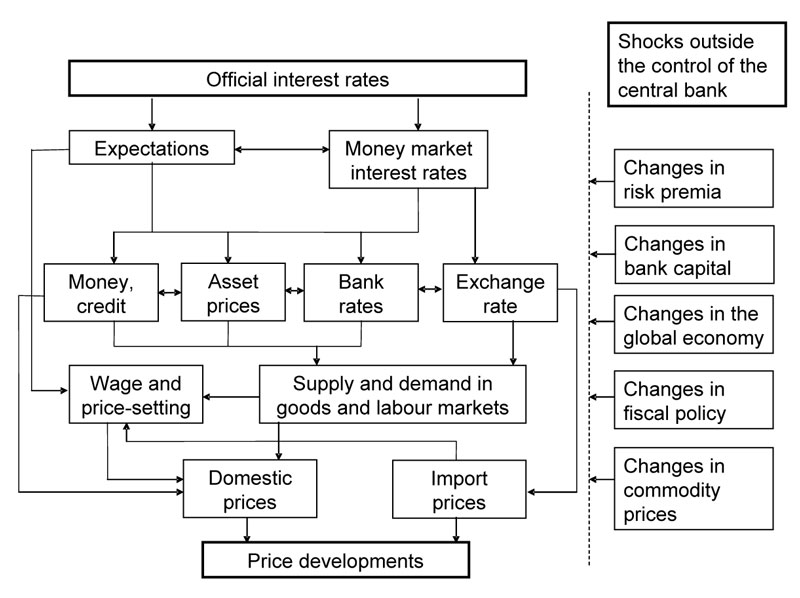

The MPC’s decisions work through the monetary policy transmission mechanism, where changes in the Bank Rate influence:

Borrowing costs for households and firms

Savings returns and consumption

Exchange rates, affecting trade competitiveness

Asset prices, influencing wealth effects

This diagram depicts the monetary policy transmission mechanism, showing how adjustments in the Bank Rate influence economic variables such as market interest rates, asset prices, and exchange rates, ultimately affecting aggregate demand and inflation. Source

This complex web of effects means the MPC must carefully balance short-term trade-offs with long-term stability.

Balancing Conflicting Objectives

The MPC often faces conflicts between objectives:

Lowering interest rates may support growth and employment but risk higher inflation.

Raising rates may stabilise inflation but risk slowing growth.

External shocks may complicate these trade-offs further.

Thus, setting the Bank Rate is not a mechanical exercise but requires judgement, forecasting, and balancing risks in uncertain conditions.

FAQ

Actual inflation shows current price level changes, but expectations influence future behaviour. If households and firms believe inflation will rise, they may demand higher wages or increase prices in advance.

This can make inflation more persistent, so the MPC closely monitors surveys, financial market signals, and consumer sentiment to judge how expectations may shape future inflationary pressures.

Changes in global commodity prices, such as oil or food, directly impact UK inflation through import costs.

Rising commodity prices increase costs for businesses and households, pushing inflation higher.

Falling commodity prices reduce cost pressures but may signal weaker global demand.

The MPC must decide if these shocks are temporary or if they require a policy response.

Temporary shocks, like a one-off rise in oil prices, may not justify a change in interest rates as their effects fade.

Long-term shocks, such as sustained supply chain disruptions, risk embedding inflation. In these cases, the MPC may raise rates to prevent wage-price spirals and loss of credibility in its inflation target.

The MPC looks not only at unemployment levels but also at:

Underemployment (people working fewer hours than desired)

Labour force participation rates

Wage growth trends

These provide a clearer picture of spare capacity in the labour market and the likelihood of wage-driven inflationary pressure.

Financial markets signal expectations about future economic conditions. The MPC examines:

Bond yields, which reflect long-term interest rate expectations

Sterling exchange rates, influencing import prices and export competitiveness

Credit conditions, showing how easily households and firms can borrow

These indicators help the MPC judge how changes in the Bank Rate will be transmitted through the economy.

Practice Questions

Identify two factors the Monetary Policy Committee (MPC) considers when deciding the Bank Rate. (2 marks)

Award 1 mark for each correct factor identified (maximum 2 marks).

Accept any of the following:

Current inflation rate (CPI) and inflation expectations

Output gap (positive or negative)

Levels of unemployment/labour market conditions

Exchange rate movements

Global economic conditions

Fiscal policy stance

Household and business confidence

Financial market conditions

Supply-side shocks

Explain how the MPC might use information about the output gap and unemployment levels when setting the Bank Rate. (6 marks)

Up to 2 marks for identifying how the output gap influences MPC decisions (e.g., positive output gap may lead to raising rates to curb inflation; negative output gap may lead to lowering rates to stimulate demand).

Up to 2 marks for explaining how unemployment affects decisions (e.g., low unemployment may create wage inflation pressures; high unemployment may require lower rates to boost demand).

Up to 2 marks for linking to the Bank Rate and monetary policy objectives (e.g., raising or lowering rates to stabilise inflation and support economic growth).

Maximum 6 marks.

Responses should show clear application to MPC decision-making rather than just definitions. Development of analysis and clear economic reasoning are required for higher marks.