AQA Specification focus:

‘The monetary policy transmission mechanism, including the relationship between changes in interest rates and the exchange rate.’

Introduction

The monetary policy transmission mechanism explains how changes in interest rates set by the central bank influence spending, investment, exchange rates, and overall economic activity within an economy.

Understanding the Transmission Mechanism

At its core, the transmission mechanism links monetary policy decisions (primarily interest rate changes) to changes in aggregate demand (AD) and ultimately the government’s macroeconomic objectives, such as inflation control, growth, and employment.

Monetary Policy Transmission Mechanism: The process through which changes in central bank interest rates affect aggregate demand, output, employment, inflation, and other macroeconomic variables.

The process is complex because it influences multiple channels simultaneously, with time lags between changes in interest rates and their full impact on the economy.

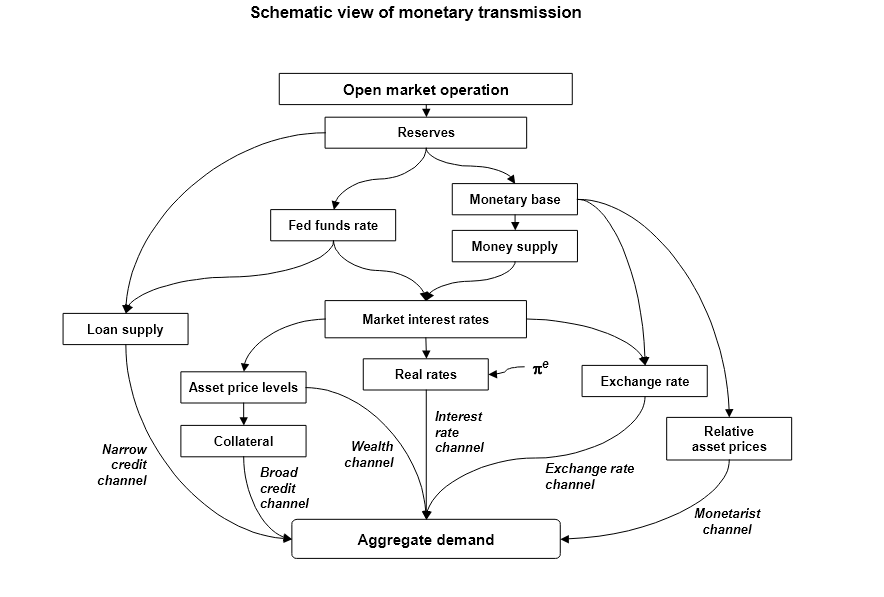

This diagram outlines the steps through which changes in central bank policy rates affect aggregate demand and macroeconomic variables. It highlights the interconnectedness of interest rates, asset prices, exchange rates, and overall economic activity. Source

Key Channels of Transmission

Interest Rate Channel

When the central bank changes its policy rate (e.g. the Bank of England’s Bank Rate):

Lower interest rates make borrowing cheaper, increasing household and firm spending and investment.

Higher interest rates raise borrowing costs, discouraging consumption and investment, while encouraging saving.

This affects AD directly through consumption and investment decisions.

Asset Price Channel

Changes in interest rates also influence the prices of assets such as shares and bonds:

Lower interest rates boost asset values, increasing household wealth and confidence, leading to more consumption.

Higher rates reduce asset prices, lowering wealth effects and spending.

Exchange Rate Channel

Interest rates affect the exchange rate through capital flows:

A cut in UK interest rates makes UK assets less attractive to foreign investors, leading to capital outflows and a weaker pound sterling.

A weaker pound boosts exports (cheaper to foreigners) and reduces imports (more expensive for domestic buyers), raising net exports and AD.

Conversely, higher interest rates strengthen the pound, reducing net exports and AD.

Credit Availability Channel

Lower interest rates can encourage banks to lend more by improving credit demand and reducing default risks. This increases access to finance for firms and households.

By contrast, higher interest rates may tighten credit conditions, making borrowing harder.

Time Lags in the Transmission Mechanism

The effects of monetary policy are not immediate:

It can take up to 18–24 months for interest rate changes to have their full impact on inflation and output.

Short-term uncertainty can occur because other economic shocks may offset the intended policy effect.

Time Lag: The period between a change in monetary policy (e.g. interest rates) and the observable impact on economic activity or inflation.

This delay complicates policymaking because decisions must anticipate future economic conditions.

Sequence of the Transmission Process

The mechanism works through several linked steps:

Step 1: The central bank changes the policy rate (Bank Rate).

Step 2: Commercial banks adjust lending and saving rates.

Step 3: Borrowing and saving behaviour of households and firms changes.

Step 4: Asset prices and wealth are influenced.

Step 5: Exchange rates adjust due to shifts in capital flows.

Step 6: Aggregate demand responds through changes in consumption, investment, and net exports.

Step 7: Output, employment, and inflation move toward or away from policy objectives.

This chain shows how a single decision can ripple through multiple parts of the economy.

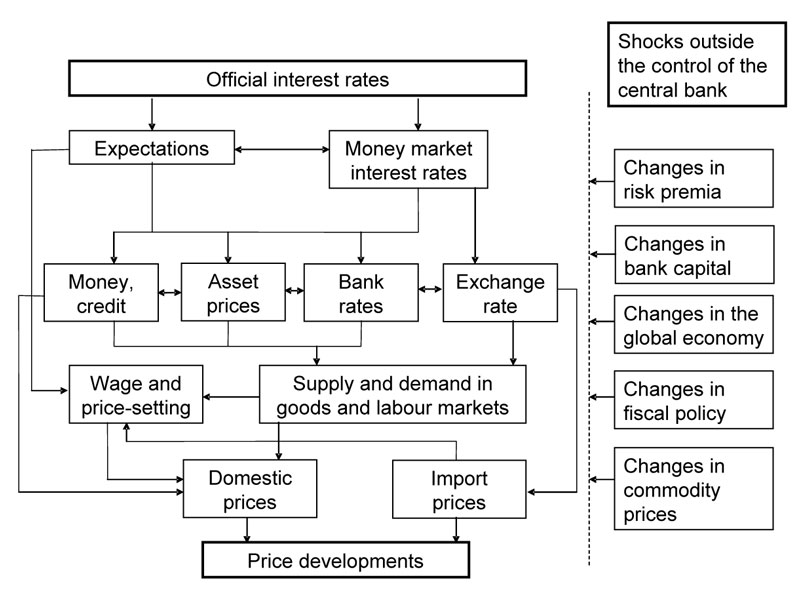

This diagram from the European Central Bank demonstrates the pathways through which changes in official interest rates affect economic variables such as bank rates, exchange rates, and domestic demand. It emphasizes the interconnectedness of monetary policy and economic outcomes. Source

The Relationship Between Interest Rates and Exchange Rates

The interest rate–exchange rate link is a crucial part of the transmission mechanism.

When UK interest rates fall relative to foreign rates, international investors move funds abroad to seek higher returns.

This selling of sterling reduces demand for the pound, causing depreciation.

Depreciation makes UK exports more competitive and imports more costly, boosting AD.

EQUATION

—-----------------------------------------------------------------

Exchange Rate (ER) = Price of one currency in terms of another

Depreciation: Fall in ER value → Exports ↑, Imports ↓ → Net Exports ↑

Appreciation: Rise in ER value → Exports ↓, Imports ↑ → Net Exports ↓

—-----------------------------------------------------------------

This exchange rate channel is often stronger in open economies with significant international trade, such as the UK.

Inflation Targeting and Policy Objectives

The ultimate aim of using the transmission mechanism is to meet the government’s macroeconomic objectives, especially the inflation target (currently 2% CPI in the UK).

If inflation is forecast to rise above target, the MPC may raise interest rates, strengthening the exchange rate and dampening AD.

If inflation is below target, rates may be lowered, weakening the exchange rate and stimulating AD.

Limitations of the Transmission Mechanism

While powerful, the mechanism faces constraints:

Global factors: International interest rate changes and global trade flows can reduce its effectiveness.

Uncertainty: Households and firms may not respond predictably to changes in rates.

Liquidity traps: In very low interest rate environments, monetary policy becomes less effective.

These limitations mean policymakers often use a mix of tools, including unconventional policies such as quantitative easing, to complement the traditional transmission mechanism.

FAQ

Indirect effects occur when changes in interest rates influence behaviour not through immediate borrowing or saving decisions, but through secondary factors such as expectations and confidence.

For example, lower rates may signal that the central bank is supporting growth, boosting business optimism and investment plans. Conversely, higher rates may indicate concern about inflation, leading households to cut back spending even before borrowing costs rise significantly.

Open economies are heavily reliant on trade and capital flows, so changes in interest rates quickly affect exchange rates and international competitiveness.

A cut in interest rates tends to cause depreciation, immediately altering import and export prices.

This amplifies the impact on aggregate demand compared with a more closed economy, where domestic spending is the primary driver of growth.

Expectations shape how strongly households react to policy changes.

If consumers believe lower interest rates will persist, they may feel confident to take out mortgages or loans. If they think cuts are temporary, they may delay decisions. Similarly, expectations of future inflation can weaken the impact of interest rate changes, as households may spend early to avoid higher future prices.

Exchange rates are influenced by global financial markets, not just domestic interest rates.

Political events, investor sentiment, or foreign central bank policies can offset the expected impact of UK rate changes.

As a result, a cut in UK rates may not always cause depreciation if foreign investors still see sterling as a safe haven.

Banks act as intermediaries between central bank policy and the real economy.

When interest rates fall, banks decide how much of the reduction to pass on through lending rates.

If banks are risk-averse or repairing balance sheets, they may restrict lending despite low rates, weakening the transmission effect.

In contrast, healthy banks can magnify the policy impact by actively expanding credit availability.

Practice Questions

Define the term "monetary policy transmission mechanism". (2 marks)

1 mark for identifying it as the process through which changes in interest rates affect the economy.

1 mark for mentioning at least one macroeconomic variable affected, e.g. aggregate demand, output, employment, inflation.

Explain how a fall in the Bank of England’s policy rate can affect the exchange rate and aggregate demand through the monetary policy transmission mechanism. (6 marks)

1 mark for recognising that lower interest rates reduce the return on UK assets, leading to capital outflows.

1 mark for stating that capital outflows cause a depreciation of the pound.

1 mark for explaining that a weaker pound makes UK exports more competitive.

1 mark for explaining that imports become more expensive, reducing demand for imports.

1 mark for linking this to an increase in net exports.

1 mark for linking higher net exports to an increase in aggregate demand.