AQA Specification focus:

‘How the Bank of England can influence the growth of the money supply.’

The ability of the Bank of England to influence money supply growth is central to modern macroeconomic policy. Through various instruments, it can manage inflation, stabilise financial markets, and support economic growth.

Understanding Money Supply Growth

The money supply refers to the total quantity of money circulating in an economy at a given time. Its growth rate matters because it can affect aggregate demand, inflation, and exchange rates.

Money Supply: The total stock of money in circulation in an economy, including cash, deposits, and other highly liquid assets.

The Bank of England does not directly control the entire money supply but can influence its growth through monetary policy instruments that affect credit creation, lending, and liquidity conditions.

Main Tools of Influence

1. The Bank Rate

The Bank Rate is the official interest rate set by the Monetary Policy Committee (MPC). Changes to this rate influence borrowing, lending, and credit creation.

A higher Bank Rate makes borrowing more expensive, discouraging lending and slowing money supply growth.

A lower Bank Rate encourages borrowing and lending, boosting credit expansion and accelerating money supply growth.

2. Open Market Operations

The Bank of England conducts open market operations by buying or selling government securities.

Buying bonds injects liquidity into the system, raising commercial banks’ reserves and supporting credit expansion.

Selling bonds withdraws liquidity, reducing banks’ ability to lend and slowing money supply growth.

3. Quantitative Easing (QE)

Quantitative easing is used when interest rates are already low. The Bank purchases government or corporate bonds, directly expanding the monetary base.

This increases the reserves of commercial banks, encouraging them to lend.

It lowers long-term interest rates, boosting borrowing and investment.

Quantitative Easing (QE): A monetary policy where a central bank purchases financial assets to increase money supply and stimulate the economy when interest rates are near zero.

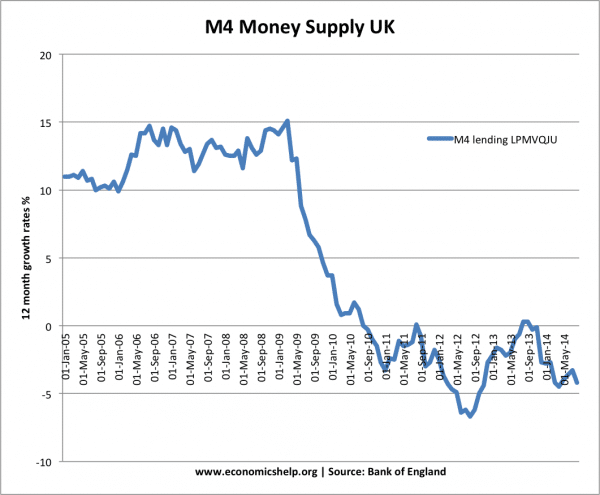

This chart depicts the UK's M4 money supply alongside inflation rates, emphasising the impact of quantitative easing on money supply expansion. Despite increased supply, inflation remained subdued. Source

4. Reserve Requirements and Capital Ratios

Although rarely adjusted in the UK compared to other economies, reserve requirements can influence money supply.

Higher reserve requirements limit banks’ ability to lend, reducing money supply growth.

Lower requirements allow greater lending, expanding money supply growth.

Similarly, capital ratios can indirectly affect the extent of credit creation by banks, influencing the overall supply of money.

5. Forward Guidance

The Bank of England also uses forward guidance to influence expectations. By signalling its future policy intentions, it affects borrowing, saving, and lending behaviour.

Promises of low rates for an extended period encourage firms and households to borrow, increasing money supply growth.

Indications of tighter policy discourage borrowing, dampening credit expansion.

Interaction with Commercial Banks

Credit Creation Process

Commercial banks play a vital role in determining the growth of money supply through credit creation. While the central bank controls the monetary base, most of the money supply comes from commercial bank lending.

The Bank of England provides liquidity through its policy tools.

Banks then decide how much to lend, which directly influences money supply growth.

Confidence, risk appetite, and regulatory requirements all shape this process.

Importance of the Transmission Mechanism

Changes in central bank policy work through the monetary policy transmission mechanism, where:

Adjustments in interest rates affect borrowing costs.

Borrowing costs affect consumption and investment.

These shifts influence credit growth and, ultimately, money supply growth.

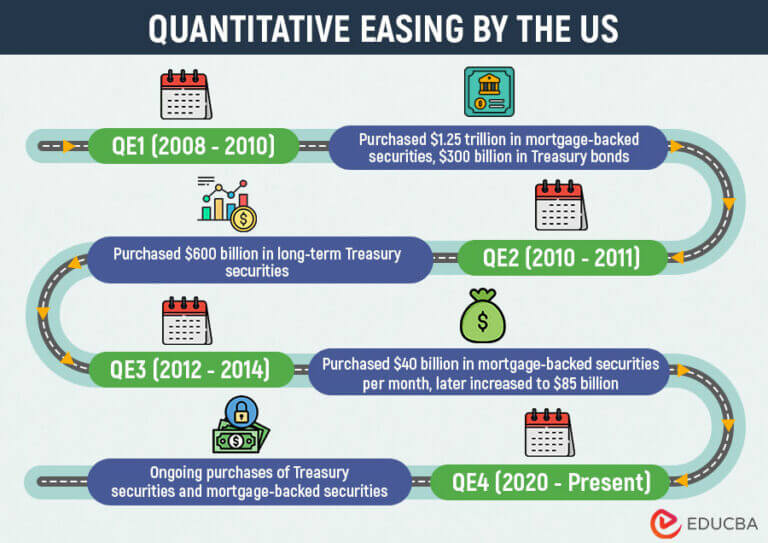

This flowchart outlines the steps of quantitative easing, from asset purchase by the central bank to increased reserves and lending. It demonstrates how QE stimulates money supply growth. Source

Controlling Inflation and Growth

The Bank of England must balance stimulating growth and controlling inflation.

Excessive money supply growth can fuel demand-pull inflation, weakening the currency and reducing purchasing power.

Too little growth may restrict economic activity, causing unemployment and recession.

This balance highlights the importance of carefully calibrated interventions by the Bank of England.

Constraints on Influence

While the Bank of England has multiple tools, its influence is not absolute:

Global financial flows can affect liquidity independently of domestic policy.

Commercial banks’ willingness to lend depends on confidence, not just reserves.

Household and business demand for credit may be weak during downturns, limiting policy effectiveness.

Key Points for Students

The Bank of England influences, but does not directly control, money supply growth.

Instruments include the Bank Rate, open market operations, QE, reserve requirements, and forward guidance.

Effectiveness depends on commercial banks, confidence, and wider economic conditions.

FAQ

When the money supply expands rapidly, households and firms often have greater access to credit and liquidity.

This additional liquidity can increase demand for financial assets such as shares and property. As demand rises, asset prices may inflate beyond their underlying value, raising the risk of speculative bubbles.

Conversely, a slowdown in money supply growth can reduce demand for these assets, potentially leading to falling prices.

Even though QE boosts commercial bank reserves, banks may choose not to lend if economic conditions are weak.

Key reasons include:

Low business and consumer confidence.

High levels of existing debt making borrowers reluctant.

Stricter regulatory requirements, such as higher capital ratios.

As a result, QE can raise bank liquidity without necessarily translating into rapid money supply growth.

The Bank cannot force commercial banks to lend or households to borrow.

Its policies may be constrained by:

International capital flows influencing liquidity.

Uncertainty in financial markets affecting risk-taking.

Global shocks such as oil price rises or financial crises.

These factors mean the Bank’s influence is significant but not absolute.

If households and firms expect inflation to rise, they may increase borrowing before prices rise further.

This behaviour can accelerate credit creation, boosting money supply growth. However, if inflation expectations are low or negative (deflationary), borrowing may slow as people delay spending, reducing money supply growth.

An expansion in the money supply often leads to lower interest rates.

Lower rates can reduce foreign demand for sterling, weakening the exchange rate. This depreciation may increase export competitiveness but raise import costs.

A weaker exchange rate can then influence inflation and spending patterns, creating indirect effects on future money supply growth.

Practice Questions

Define the term quantitative easing and explain briefly how it can influence money supply growth. (2 marks)

1 mark for correct definition of quantitative easing:

Quantitative easing is when the central bank purchases financial assets (e.g., government bonds) to inject liquidity into the economy.1 mark for stating how it influences money supply growth:

It increases commercial banks’ reserves, encouraging them to lend more and expand the money supply.

Explain how the Bank of England can influence the growth of the money supply using both interest rates and forward guidance. (6 marks)

Up to 2 marks for explaining the effect of interest rates:

Lowering the Bank Rate makes borrowing cheaper, encouraging lending and money supply growth; raising it has the opposite effect.Up to 2 marks for explaining the role of forward guidance:

Forward guidance shapes expectations. Promises of low rates for longer encourage borrowing, raising money supply; signalling higher rates discourages borrowing.Up to 2 marks for application/clarity of link to money supply growth:

Clear explanation of how these policies affect credit creation and lending behaviour, influencing the growth of the money supply.