AP Syllabus focus:

‘More organized methods of international trade, including joint-stock companies, drove economic change in Europe and the Americas.’

Joint-stock companies revolutionized early modern trade by pooling capital, reducing individual risk, and enabling unprecedented overseas investment that reshaped European economies and facilitated expansive colonial ventures across the Atlantic world.

Joint-Stock Companies in the Context of Atlantic Expansion

Joint-stock companies emerged during the late 16th and early 17th centuries as Europe’s commercial landscape shifted from feudal economic structures toward more dynamic and profit-driven systems. These developments aligned with rising demand for overseas goods, intensified imperial competition, and improved maritime capabilities. By allowing numerous investors to purchase shares in a commercial venture, these companies created mechanisms for large-scale financial mobilization unmatched in earlier trading models.

Joint-Stock Company: A business enterprise in which investors purchase shares and collectively fund a venture, with profits and losses distributed according to the proportion of shares owned.

These firms played a central role in enabling European states to expand their economic presence and establish lasting footholds in the Americas.

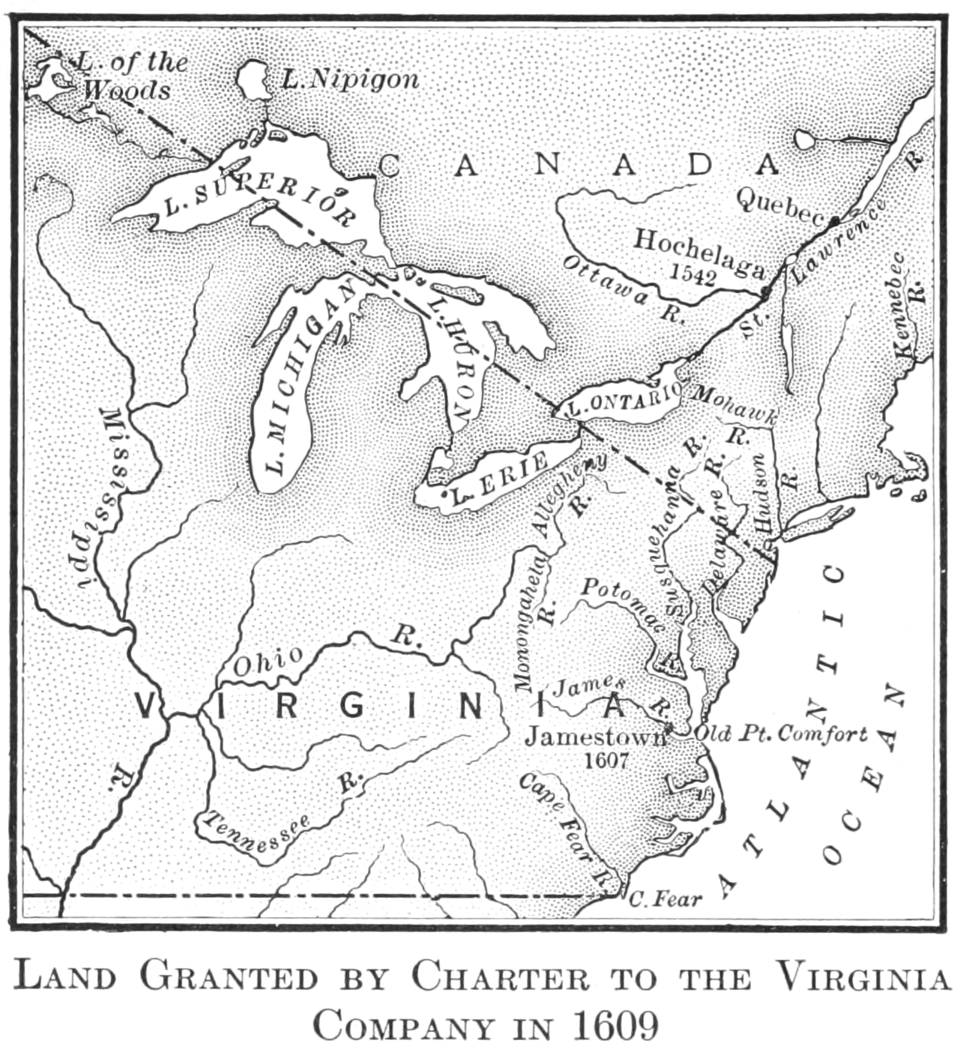

This map depicts the territory granted to the Virginia Company by its 1609 charter, illustrating how corporate investment translated into legally defined colonial claims. It visually reinforces the relationship between joint-stock companies and English colonization. The map includes more geographic detail than required by the syllabus but remains directly relevant to Period 1 content. Source.

Organized Trade and the Shift Toward Capitalist Economic Systems

The rise of joint-stock companies reflected increasing European reliance on organized, large-scale trade networks. Unlike earlier forms of merchant activity, which were constrained by personal capital and localized markets, these companies thrived on expansive international exchange. Their operations demonstrated emerging capitalist principles, including investment for profit, risk diversification, and market expansion.

Key Features of Organized International Trade

• Capital Pooling enabled enterprises to raise vast funds for ships, crews, supplies, and prolonged voyages.

• Limited Liability reduced individual investor risk, encouraging broader participation in overseas commerce.

• Permanent Corporate Structure allowed companies to outlive individual investors and sustain long-term projects.

• State Charters granted monopolies over specific trade regions, reinforcing national competition for global influence.

These characteristics allowed joint-stock companies to coordinate complex transatlantic ventures. They also contributed to Europe’s transition toward economic systems grounded in profit motives rather than hereditary landholding.

Major Joint-Stock Companies and Their Transatlantic Influence

Early examples, such as the Muscovy Company and the Dutch East India Company, pioneered the model, but the most consequential for North American history was the Virginia Company of London. Chartered by James I in 1606, the Virginia Company financed the establishment of Jamestown, the first permanent English settlement in North America.

State Charter: A formal document in which a monarch or government grants special rights, privileges, or monopolies to a company to conduct trade or colonization.

The Virginia Company’s role in founding Jamestown illustrates how corporate interests shaped early colonial development. Shareholders sought profits from commodities such as gold, timber, and later tobacco. This drive for economic gain influenced interactions with Indigenous peoples, labor strategies, and settlement patterns in the Chesapeake region.

A range of similar companies operated across the Atlantic world, each pursuing wealth through trade or colonization. Although differing in structure and scope, these corporations collectively facilitated the expansion of European commercial influence into the Americas.

Economic Change Driven by Corporate Trade Models

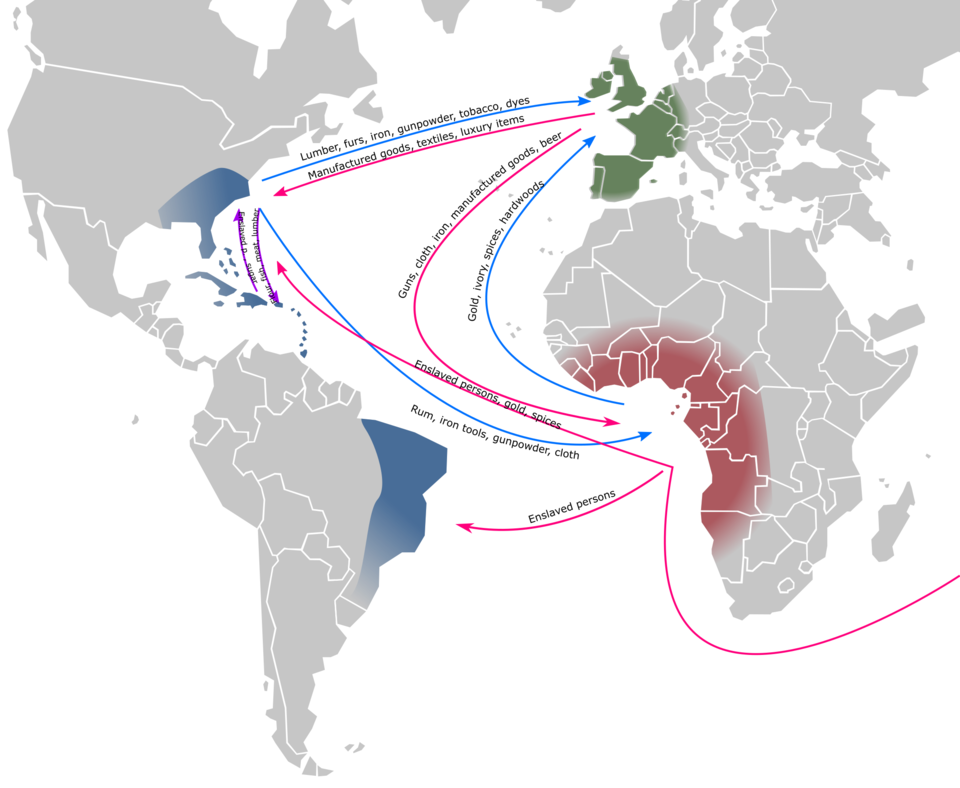

Joint-stock companies were instrumental in creating economic systems that linked Europe, Africa, and the Americas through sustained commercial exchange.

This map illustrates the major trade routes connecting Europe, Africa, and the Americas, emphasizing the structured commercial circuits that underpinned early Atlantic economies. It reinforces how organized trade networks, often supported by joint-stock investment, shaped economic systems. Some routes extend beyond Period 1, but the overall structure aligns closely with the subsubtopic. Source.

Economic Impacts in Europe

• Growth of financial markets, as investors bought and sold company shares.

• Expansion of merchant classes, who gained wealth through dividends and speculation.

• Shift toward capitalist economic organization, reducing reliance on feudal land-based wealth.

• Increased tax revenue for monarchies from corporate profits, strengthening centralized states.

Economic Impacts in the Americas

• Establishment of plantations and extractive industries to generate profits for investors.

• Demand for coerced labor systems, including indentured servitude and later African slavery, to sustain profitable production.

• Growth of port cities and trade routes, integrating colonial economies into broader Atlantic markets.

• Commercialization of land and resources, altering Indigenous land use and political relationships.

These forces reveal how corporate investment strategies shaped the economic foundations of European colonies and influenced long-term regional development, from plantation systems to Atlantic commerce.

Organized Trade as a Mechanism of Empire

Joint-stock companies contributed directly to the creation and maintenance of European empires. Their pursuit of profit aligned with state ambitions for territorial expansion, national prestige, and access to global markets. Companies often acted as quasi-governmental entities, exercising political and military authority in addition to commercial power.

Corporate and State Collaboration

• Companies received exclusive trading rights that advanced national interests.

• States provided military support to protect commercial investments.

• Corporate ventures established permanent settlements, creating footholds for further imperial growth.

Through these interconnected roles, joint-stock companies became essential to the organized international trade networks that transformed economic systems in Europe and reshaped societies across the Americas, firmly embedding commerce within the structure of empire-building during the early modern Atlantic world.

FAQ

Joint-stock companies operated as permanent corporate bodies, whereas medieval partnerships typically dissolved after a single voyage or transaction.

They also introduced transferable shares, allowing investors to join or leave without dissolving the enterprise.

• Medieval partnerships relied on the personal capital of a small group of merchants.

• Joint-stock companies, by contrast, enabled hundreds of investors to contribute, creating far larger pools of capital.

• This structure supported long-term colonial projects rather than short-term trading ventures.

Chartering companies allowed monarchs to extend their influence overseas without assuming financial risk.

Kings and queens could claim new territories, enhance national prestige, and benefit from taxes or a share of profits while avoiding the cost of outfitting fleets.

Charters also ensured royal oversight:

• The crown dictated trading rights.

• Companies acted in ways that aligned with national policy.

• This created a hybrid public–private system ideal for early imperial competition.

Investors ranged from wealthy merchants to members of the gentry and even minor nobles seeking new sources of income.

Many were attracted by the possibility of high returns at a time when traditional land-based wealth held limited prospects for growth.

Common investor groups included:

• London merchants experienced in Mediterranean and Baltic trade.

• Urban professionals such as lawyers and craftsmen.

• Elite patrons who lent political credibility to ventures.

This broad investor base made colonial enterprises more financially stable.

Risk was distributed through the sale of shares. No single investor bore the full cost of a failed voyage.

Companies also diversified risk through multiple strategies:

• Outfitting several ships at a time, reducing dependence on the success of a single mission.

• Maintaining reserves of capital to absorb losses.

• Using insured shipping, which became increasingly common in major ports like London and Amsterdam.

These mechanisms made long-distance ventures more appealing and economically viable.

Many companies acted as de facto governments in the early phases of colonisation, especially before royal control was formally established.

The Virginia Company, for example, developed rules for land distribution, labour expectations, and religious conduct within the colony.

Joint-stock companies influenced governance by:

• Creating councils or assemblies to manage colonial affairs.

• Establishing legal codes that blended commercial goals with social regulation.

• Controlling migration by selecting who could settle in their territories.

These practices shaped early political structures that later colonial administrations inherited.

Practice Questions

Question 1 (1–3 marks)

Explain one way in which joint-stock companies contributed to European expansion in the Americas during the period 1491–1607.

Question 1 (1–3 marks)

• 1 mark for identifying a valid contribution (e.g., joint-stock companies provided financial capital for expeditions).

• 1 mark for describing how this contribution functioned (e.g., pooling investor funds reduced individual risk).

• 1 mark for linking the contribution directly to European expansion in the Americas (e.g., financing the Virginia Company’s establishment of Jamestown).

Maximum: 3 marks.

Question 2 (4–6 marks)

Evaluate the extent to which the development of joint-stock companies transformed European economic activity in the Atlantic world during the period 1491–1607. In your answer, consider both their immediate impact and their wider significance.

Question 2 (4–6 marks)

• 1–2 marks for describing relevant features of joint-stock companies (e.g., shared investment, state charters, risk reduction).

• 1–2 marks for explaining their immediate impact on European economic activity (e.g., enabling large-scale overseas ventures, supporting colonisation efforts).

• 1–2 marks for analysing their wider significance (e.g., contribution to the rise of capitalism, expansion of transatlantic trade networks, growth of merchant classes).

Answers that demonstrate analytical depth or provide well-integrated examples may receive marks at the top of the band.

Maximum: 6 marks.